How much can I contribute to a Roth IRA in 2024 if I am over 50? If you’re over 50, you have the opportunity to contribute more to your Roth IRA than younger individuals. This extra contribution room, known as a “catch-up contribution,” allows you to build your retirement savings even faster.

This article explores the specifics of Roth IRA contributions for those over 50, including the increased contribution limit, the benefits of contributing, and factors to consider when making your decision.

The ability to contribute more to your Roth IRA after age 50 can significantly impact your retirement savings. Not only can you build your nest egg faster, but you can also potentially reduce your taxable income in the present.

This can be a valuable strategy, especially for those in higher tax brackets or who anticipate being in a higher tax bracket in retirement. However, before you make any decisions, it’s essential to consider your individual financial circumstances and goals.

Roth IRA Contribution Limits for 2024

For 2024, the Roth IRA offers a tax-advantaged way to save for retirement. You can contribute after-tax dollars to a Roth IRA and potentially withdraw your earnings tax-free in retirement. Here’s a breakdown of the contribution limits and other important considerations.

Contribution Limits for 2024

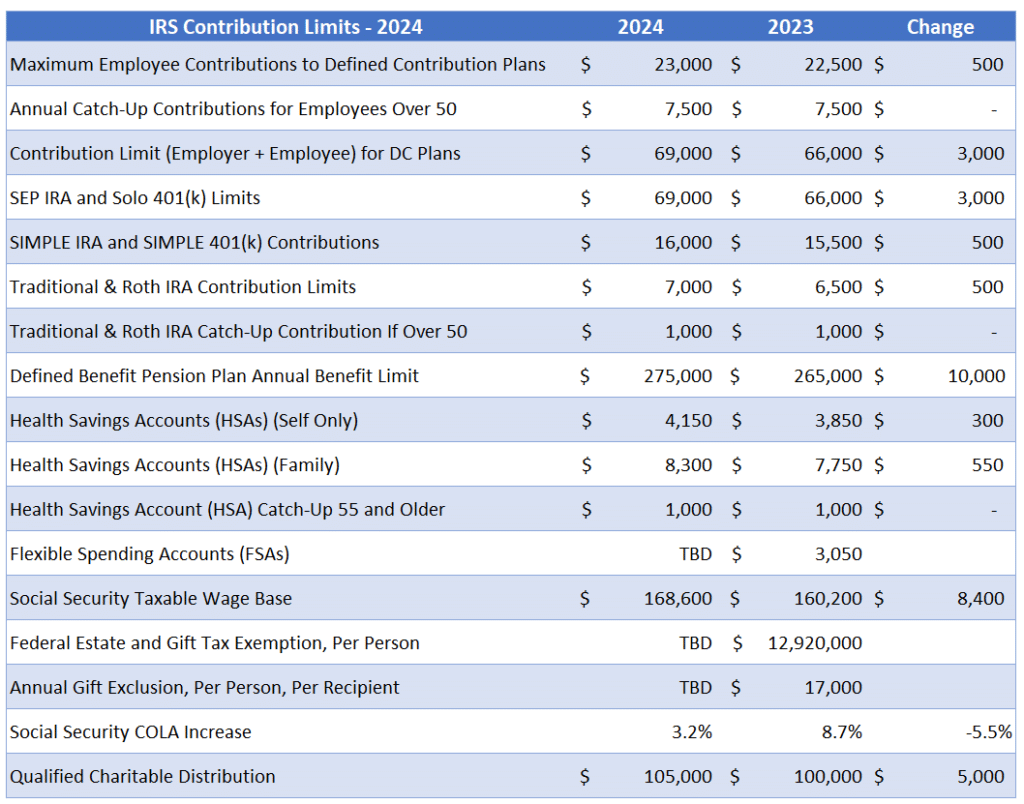

The maximum amount you can contribute to a Roth IRA in 2024 depends on your age.

- Individuals under 50:The maximum contribution limit for individuals under 50 in 2024 is $6,500.

- Individuals 50 and over:Individuals 50 and over can contribute an additional $1,000, bringing the total contribution limit to $7,500.

Comparison with Traditional IRA Contribution Limits

The contribution limit for traditional IRAs is the same as for Roth IRAs in 2024. This means that individuals under 50 can contribute up to $6,500, while individuals 50 and over can contribute up to $7,500. However, the tax treatment of contributions and withdrawals differs significantly between the two types of IRAs.

If you’re a freelancer, you might need to file for a tax extension. Find out about the extension deadline for freelancers in October 2024: Tax extension deadline October 2024 for freelancers.

Income Limits for Roth IRA Contributions

It’s important to note that Roth IRA contributions are subject to income limitations. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA or may be subject to a reduced contribution limit.

Tax brackets can change from year to year, and 2024 is no exception. To see how the brackets have shifted compared to 2023, you can check out this article: Tax bracket changes for 2024 vs 2023.

- Single Filers:For 2024, if your MAGI is $153,000 or higher, you cannot contribute to a Roth IRA. The contribution limit is gradually phased out between $144,000 and $153,000.

- Married Filing Jointly:For 2024, if your MAGI is $228,000 or higher, you cannot contribute to a Roth IRA. The contribution limit is gradually phased out between $218,000 and $228,000.

Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several tax advantages that can significantly benefit your financial well-being, particularly in retirement.

Independent contractors often need to fill out a W9 form. If you’re an independent contractor, you can find information about the W9 form for October 2024 here: W9 Form October 2024 for independent contractors.

Tax-Free Withdrawals in Retirement

The most significant benefit of a Roth IRA is the potential for tax-free withdrawals in retirement. When you withdraw money from a Roth IRA after age 59 1/2, it is considered tax-free, meaning you won’t have to pay any federal income tax on your withdrawals.

The IRS offers a variety of resources to help you navigate the tax filing process. Check out this article to find out what resources are available for the October 2024 tax deadline: IRS resources for the October 2024 tax deadline.

This can save you a substantial amount of money in taxes, especially if your tax bracket is higher in retirement.

If you’re a part-time worker, you might be wondering about the 401k contribution limits for 2024. You can find out more about those limits by checking out this article: 401k contribution limits for 2024 for part-time workers.

Reducing Taxable Income

Roth IRA contributions are made with after-tax dollars, which means they can help reduce your taxable income in the year you contribute. This can be particularly beneficial if you are in a high tax bracket, as it can lower your overall tax liability.

As you approach retirement, it’s important to understand how taxes will impact your income. A tax calculator can help you estimate your tax liability, and there’s one specifically designed for retirees in October 2024: Tax calculator for retirees in October 2024.

Benefits of Having a Roth IRA in Retirement Planning

A Roth IRA can be a valuable tool for retirement planning for several reasons:

- Tax-Free Growth:Your Roth IRA investments grow tax-free, meaning you won’t have to pay taxes on any investment gains. This can lead to a larger nest egg in retirement.

- Flexibility:Roth IRAs offer flexibility in retirement, as you can withdraw your contributions at any time without penalties or taxes. This can be helpful if you need access to funds before retirement.

- Inheritance:Roth IRA assets can be passed on to beneficiaries tax-free, making them a valuable inheritance tool.

Factors to Consider When Contributing to a Roth IRA

Deciding whether to contribute to a Roth IRA involves several factors, including your income level, age, and retirement goals. You also need to consider the potential impact of future tax rate changes and your overall financial circumstances.

Potential Tax Rate Changes

It’s essential to consider the potential impact of future tax rate changes on your Roth IRA contributions. Since Roth IRA withdrawals are tax-free in retirement, contributing to a Roth IRA may be advantageous if you anticipate being in a higher tax bracket in retirement.

If you’re self-employed, you might be interested in learning about the IRA contribution limits for solo 401k plans in 2024. This article provides the information you need: Ira contribution limits for solo 401k in 2024.

If you believe your tax rate will be higher in retirement, contributing to a Roth IRA can help you avoid paying taxes on your retirement savings.

For instance, if you are currently in a lower tax bracket and expect to be in a higher tax bracket in retirement, contributing to a Roth IRA may be a wise decision. However, if you expect to be in a lower tax bracket in retirement, a traditional IRA might be more advantageous.

Understanding Individual Financial Circumstances

It’s crucial to evaluate your individual financial circumstances before deciding whether to contribute to a Roth IRA. Factors to consider include your current income, expenses, debt levels, and other financial goals.

Trusts also need to file a W9 form. You can find information about the W9 form for trusts in October 2024 in this article: W9 Form October 2024 for trusts.

You should assess your overall financial picture before committing to a Roth IRA.

Wondering about the maximum amount you can contribute to your 401k in 2024? This article provides the answer: What is the 401k contribution limit for 2024.

For example, if you have high-interest debt, it might be more prudent to prioritize paying down that debt before contributing to a Roth IRA. Similarly, if you have other financial goals, such as buying a house or paying for your children’s education, you may need to prioritize those goals before contributing to a Roth IRA.

If you’re filing as a single filer, you’ll want to know the tax brackets for 2024. This article provides the details: Tax brackets for single filers in 2024.

Comparing Roth IRA and Traditional IRA

The following table Artikels the benefits and drawbacks of contributing to a Roth IRA versus a traditional IRA:

| Factor | Roth IRA | Traditional IRA |

|---|---|---|

| Contributions | Made with after-tax dollars | Made with pre-tax dollars |

| Tax Treatment | Withdrawals in retirement are tax-free | Withdrawals in retirement are taxed |

| Tax Deduction | Not tax-deductible | Tax-deductible |

| Income Limits | There are income limits for contributing to a Roth IRA | No income limits for contributing to a traditional IRA |

It’s essential to weigh the benefits and drawbacks of each type of IRA carefully before making a decision.

If you owe money and the October 2024 tax deadline is looming, you might be wondering if you can get an extension. Find out more in this article: Can I get an extension on my taxes if I owe money in October 2024.

Steps to Contribute to a Roth IRA: How Much Can I Contribute To A Roth IRA In 2024 If I Am Over 50

Contributing to a Roth IRA is a straightforward process that involves opening an account, making contributions, and choosing investment options. Here’s a step-by-step guide to help you get started.

If you’re working with government agencies, you might need to fill out a W9 form. You can find information about the W9 form for October 2024 in this article: W9 Form October 2024 for government agencies.

Opening a Roth IRA Account

To begin contributing to a Roth IRA, you’ll need to open an account with a financial institution that offers them. You can choose from a variety of options, including banks, credit unions, brokerage firms, and mutual fund companies. Here are some reputable financial institutions that offer Roth IRA accounts:

- Fidelity Investments

- Vanguard

- Schwab

- TIAA

- Charles Schwab

Making Contributions to a Roth IRA

Once you have a Roth IRA account, you can start making contributions. The contribution limit for 2024 is $7,500 for individuals under 50 and $8,000 for individuals over 50. You can contribute up to the limit each year, or you can choose to contribute less.

Want to know the maximum amount you can contribute to your 401k in 2024? This article provides the answer: What is the maximum 401k contribution for 2024.

Contributions to a Roth IRA are made with after-tax dollars, which means you won’t owe taxes on the money you withdraw in retirement.

The October 2024 tax deadline is approaching, so it’s a good time to start thinking about tax preparation. This article offers some helpful tips to get you started: Tax preparation tips for the October 2024 deadline.

Investment Options Available Within a Roth IRA

Within your Roth IRA, you have the flexibility to invest in a variety of options, including:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Individual Stocks

- Bonds

- Annuities

Additional Considerations for Roth IRA Contributions

There are several other important factors to consider when deciding whether to contribute to a Roth IRA, beyond the basic contribution limits and potential benefits. These factors can significantly influence your overall financial strategy and tax implications.

401k contribution limits for 2024 can vary based on your age. To find out what the limits are for your age group, check out this helpful article: What are the 401k contribution limits for 2024 for different ages.

Roth IRA Conversions

A Roth IRA conversion involves transferring money from a traditional IRA or 401(k) to a Roth IRA. This can be a valuable strategy for individuals who expect to be in a higher tax bracket in retirement than they are currently.

By converting funds to a Roth IRA, you pay taxes on the conversion amount upfront, but your withdrawals in retirement will be tax-free. However, it’s important to understand the potential tax implications of Roth IRA conversions.

The amount you convert will be taxed as ordinary income in the year of the conversion.

This means you’ll need to factor in your current tax bracket and potential future tax bracket when deciding whether to convert.

Early Withdrawals from a Roth IRA

While Roth IRA withdrawals in retirement are tax-free, there are specific rules for early withdrawals.

Withdrawals made before age 59 1/2 are generally subject to a 10% penalty, as well as income tax, unless they qualify for an exception.

Exceptions include withdrawals for first-time home purchases, qualified education expenses, or certain medical expenses. It’s crucial to be aware of these rules and exceptions to avoid unexpected tax consequences.

Maximizing Roth IRA Contributions Over Time

One of the key benefits of a Roth IRA is its potential for tax-free growth over time. To maximize this potential, it’s essential to contribute regularly and consistently.

Consider making automatic contributions from your paycheck to ensure you’re contributing the maximum amount each year.

This approach helps to establish a habit of saving and ensures you don’t miss out on potential growth.

Importance of Regular Contributions for Long-Term Financial Growth, How much can I contribute to a Roth IRA in 2024 if I am over 50

Regular contributions to a Roth IRA, even small amounts, can have a significant impact on your long-term financial well-being. The power of compound interest can work wonders over time, especially when combined with tax-free growth.

For example, a $5,000 annual contribution starting at age 30 and earning an average annual return of 7% could grow to over $500,000 by age 65, all tax-free.

This illustrates the importance of starting early and contributing regularly to maximize your Roth IRA’s potential.

Closure

Contributing to a Roth IRA, especially with the added flexibility of catch-up contributions for those over 50, can be a smart move for your retirement planning. It offers the potential for tax-free growth and withdrawals, which can be a significant advantage.

However, remember to carefully assess your individual financial situation, including income level, age, and retirement goals, before making any decisions. Seek guidance from a financial advisor if needed to ensure you are making the most informed choices for your future.

Questions Often Asked

What is the difference between a Roth IRA and a traditional IRA?

A Roth IRA allows for tax-free withdrawals in retirement, while a traditional IRA offers tax deductions on contributions but taxes on withdrawals. The best choice depends on your individual tax situation and projected future tax rates.

Are there any income limitations for contributing to a Roth IRA?

Yes, there are modified adjusted gross income (MAGI) limits for contributing to a Roth IRA. If your MAGI exceeds these limits, you may not be able to contribute or your contributions may be limited. The limits are adjusted annually, so it’s essential to check the current guidelines.

Can I contribute to both a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, as long as you don’t exceed the annual contribution limits for each type of account.

What happens if I withdraw money from my Roth IRA before age 59 1/2?

Withdrawals from a Roth IRA before age 59 1/2 are generally subject to taxes and penalties unless they meet certain exceptions, such as for first-time home purchases, medical expenses, or educational expenses.