How is NIIT Calculated? Tax Rates, Deductions, and Credits: Navigating the intricate world of Indian income tax, the NIIT (Notional Income Tax) stands as a significant element, impacting the financial planning of individuals and businesses alike. Understanding how NIIT is calculated, the applicable tax rates, deductions, and credits, is crucial for maximizing tax efficiency and minimizing liability.

This comprehensive guide delves into the intricacies of NIIT, providing clarity and insight into its role in the Indian tax system.

NIIT, a tax levied on income earned from specified investments, primarily focuses on those exceeding a certain threshold. The calculation of NIIT involves a complex interplay of factors, including income, deductions, and credits, each contributing to the final tax liability.

This guide provides a detailed breakdown of these components, offering practical insights and real-world examples to illustrate the calculation process.

Calculating NIIT

The NIIT (Notional Income Tax) is levied on individuals who earn income from investments exceeding a certain threshold. It is a surcharge on the income tax payable by an individual, and is calculated based on the income earned from investments.

Calculating NIIT

To calculate NIIT, you need to understand the following:* Income from investments:This includes income from sources like equity shares, mutual funds, and bonds.

Navigating the world of investments can be tricky, especially with the Net Investment Income Tax lurking in the shadows. Don’t get caught off guard! This comprehensive guide on understanding the Net Investment Income Tax in 2024 will equip you with the knowledge you need to make informed decisions.

Exempt income

Certain income sources are exempt from NIIT, such as income from savings bank accounts, fixed deposits, and post office schemes.

Income slab

Green finance and sustainable investing are on everyone’s lips these days. The DealBook Summit 2024 is the place to be for insights into this growing trend. Want to know how to invest responsibly? Learn more about green finance and sustainable investing at the summit.

The NIIT rate depends on the total income from investments, which is categorized into different income slabs.

Corporate social responsibility is more than just a buzzword; it’s a real force for good. The DealBook Summit 2024 showcases companies that are making a difference. Want to learn from the best? Check out this article on case studies in corporate social responsibility at the summit.

NIIT rate

Climate change is a serious issue, but businesses are stepping up to the plate. The DealBook Summit 2024 delves into the role of businesses in tackling this global challenge. Want to know how companies are making a difference? Learn more about the role of business in combating climate change at the summit.

Each income slab has a corresponding NIIT rate.The formula for calculating NIIT is:

NIIT = (Income from investments

Taxes are a part of life, but sometimes they can be confusing. The Net Investment Income Tax is one such beast. If you’re looking for a comprehensive guide to this tax, look no further than this article on understanding the Net Investment Income Tax in 2024.

It’ll clear up all your questions and help you avoid any nasty surprises.

Exempt income) x NIIT rate

NIIT Rates and Income Slabs

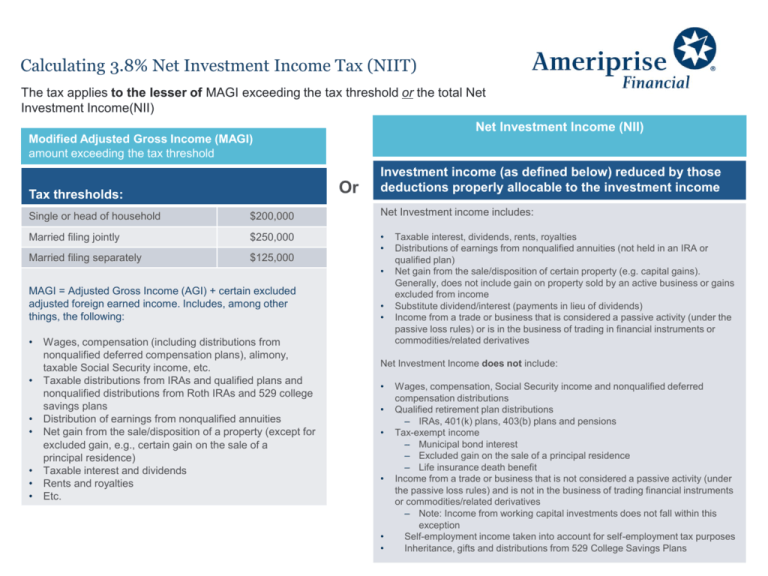

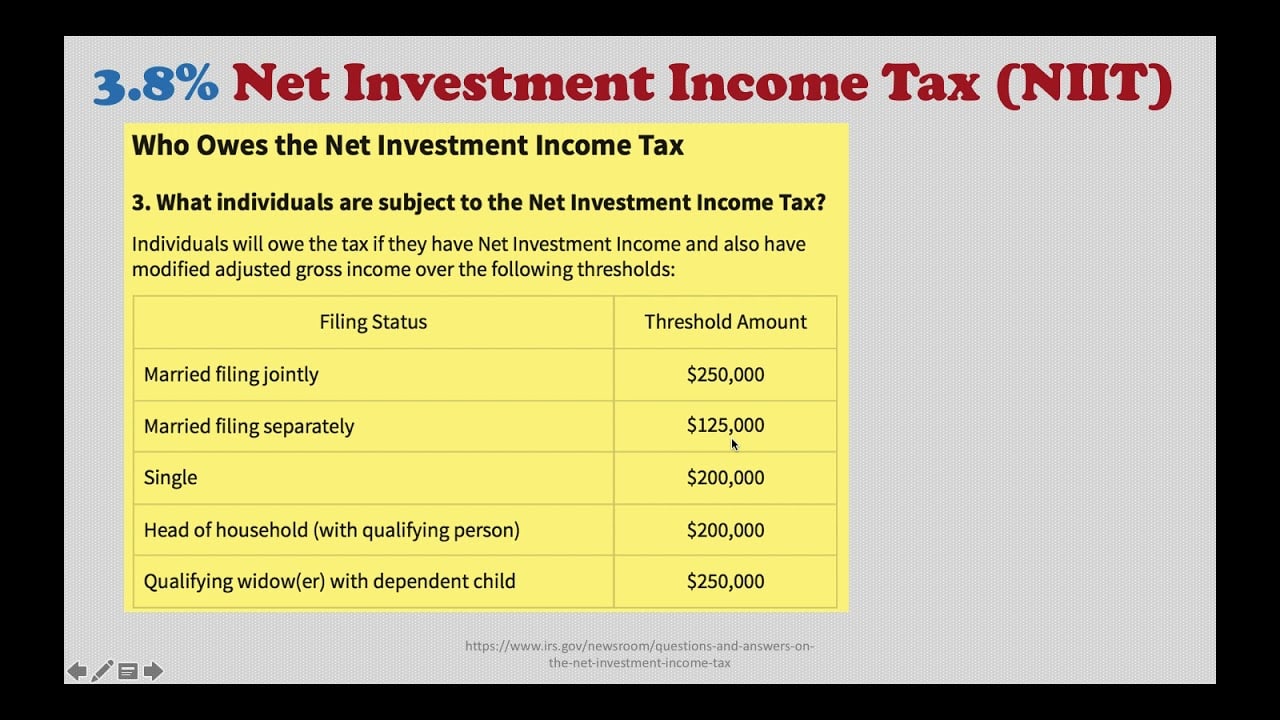

The following table shows the different NIIT rates and their corresponding income slabs:

| Income Slab | NIIT Rate |

|---|---|

| Up to ₹2,50,000 | 0% |

| ₹2,50,001 to ₹5,00,000 | 15% |

| ₹5,00,001 and above | 25% |

For example, let’s say an individual earns ₹4,00,000 from investments, with no exempt income. Their NIIT would be calculated as follows:

NIIT = (₹4,00,000

₹0) x 15% = ₹60,000

ESG performance is all the rage, but how do you measure it? There are standards and frameworks galore! Get the lowdown on measuring ESG performance in this insightful article.

This means they would have to pay ₹60,000 as NIIT on their investment income.

Want to make a difference while making money? Investing for impact is the way to go. Discover how to generate financial returns while contributing to social good in this article on investing for impact. It’s a win-win situation for everyone!

NIIT Calculation: A Real-World Example: How Is NIIT Calculated? Tax Rates, Deductions, And Credits

To illustrate how NIIT is calculated, let’s consider a fictional scenario involving a hypothetical individual named Sarah. This example will showcase the calculation of NIIT using her income, deductions, and tax credits.

Sarah’s Income, Deductions, and Tax Credits, How is NIIT Calculated? Tax Rates, Deductions, and Credits

Sarah’s income for the financial year is ₹15,00,000. She has a few deductions, including a home loan interest deduction of ₹2,00,000, a contribution to her 80C investment of ₹1,50,000, and a medical insurance premium deduction of ₹50,000. Additionally, she has a tax credit of ₹10,000 for her investment in solar panels.

Calculating NIIT

To calculate NIIT, we need to first determine Sarah’s taxable income.

Taxable Income = Total Income

The DealBook Summit 2024 is a hotbed of ideas, especially when it comes to stakeholder engagement. Want to know how to keep everyone happy, from your employees to your investors? Check out this article on the importance of stakeholder engagement at the summit, and you’ll be a pro in no time!

Deductions

Therefore, Sarah’s taxable income is:

₹15,00,000

- ₹2,00,000

- ₹1,50,000

- ₹50,000 = ₹11,00,000

Next, we need to calculate her income tax liability.

Income Tax Liability = Taxable Income

Applicable Tax Rate

Assuming Sarah’s income tax liability is ₹1,50,000 after applying the applicable tax rates and considering the tax credit of ₹10,000, we can now calculate her NIIT.

NIIT = Income Tax Liability

- (15% of (Total Income

- ₹2,50,000))

In Sarah’s case, her NIIT would be:

₹1,50,000

- (15% of (₹15,00,000

- ₹2,50,000)) = ₹1,50,000

- (15% of ₹12,50,000) = ₹1,50,000

- ₹1,87,500 =

- ₹37,500

However, NIIT cannot be negative. Therefore, Sarah’s NIIT payable would be ₹0.

Last Point

Navigating the complex landscape of NIIT requires a thorough understanding of its calculation, applicable tax rates, deductions, and credits. By carefully analyzing income, leveraging available deductions, and utilizing relevant tax credits, individuals and businesses can optimize their tax position.

Remember, seeking professional advice from a qualified tax consultant can provide personalized guidance and ensure that your tax planning aligns with your specific financial goals and circumstances.

FAQ Overview

What is the significance of NIIT in the Indian tax system?

NIIT is designed to ensure that income from certain investments is taxed at a minimum rate, preventing individuals and businesses from avoiding tax obligations by holding investments that generate income but are not subject to regular income tax. It promotes a more equitable distribution of tax burden.

Can I claim deductions on my income before calculating NIIT?

Yes, deductions are applicable before calculating NIIT. Deductions reduce your taxable income, thereby potentially lowering your NIIT liability. Familiarize yourself with the various deductions available to maximize your savings.

Are there specific tax credits applicable for NIIT?

While specific tax credits for NIIT may not exist, you can utilize general tax credits available in India to reduce your overall tax liability, which can indirectly impact your NIIT burden. Consult tax regulations for available credits.