How Homeownership Affects Stimulus Check Eligibility in Ohio sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide delves into the intricacies of Ohio’s stimulus check program, specifically examining how homeownership status influences eligibility and potential benefits.

Find out further about the benefits of Special Circumstances and Stimulus Check Eligibility in Ohio (e.g., Disabilities, Recently Unemployed) that can provide significant benefits.

We’ll explore the interplay between property taxes, mortgage payments, and the eligibility criteria, shedding light on the unique considerations for homeowners.

This exploration will navigate the complexities of Ohio’s stimulus check program, revealing how homeownership status can impact eligibility and potential benefits. From analyzing the role of property taxes and mortgage payments to understanding the application process for homeowners, this guide provides a comprehensive overview of this critical topic.

Ohio Stimulus Check Eligibility Overview

Ohio has implemented various stimulus programs to assist residents facing financial hardship. These programs, often referred to as stimulus checks, offer financial aid to eligible individuals and families. To determine eligibility for these stimulus checks, Ohio uses a set of criteria that considers factors such as income levels and residency status.

This article will delve into the specifics of Ohio stimulus check eligibility, with a particular focus on how homeownership affects the process.

Eligibility Requirements for Ohio Stimulus Checks

To be eligible for Ohio stimulus checks, individuals must meet certain criteria. These requirements are designed to ensure that the aid reaches those who need it most. The primary factors influencing eligibility include:

- Income Level:Ohio stimulus checks are often targeted towards low- and middle-income households. Specific income thresholds vary depending on the program and the number of dependents in the household.

- Residency Status:To qualify for Ohio stimulus checks, individuals must be legal residents of the state. This generally means they must have established a permanent address in Ohio and have lived there for a specific period.

Ohio offers different types of stimulus checks, each with its own eligibility criteria. Some common types include:

- Direct Payments:These are one-time payments sent directly to eligible individuals or families. They may be targeted towards specific demographics, such as low-income families or seniors.

- Tax Credits:These are tax deductions that reduce the amount of taxes owed. Homeowners may be eligible for specific tax credits related to property taxes or mortgage interest.

- Financial Assistance Programs:Ohio offers various financial assistance programs, such as rental assistance or utility assistance, which can help individuals and families cover essential expenses. Eligibility for these programs is typically based on income and other factors.

Homeownership and Stimulus Check Eligibility

Homeownership can influence eligibility for Ohio stimulus checks in several ways. While owning a home doesn’t automatically disqualify you from receiving stimulus aid, certain factors related to homeownership can impact your eligibility and the amount of assistance you receive.

Property Taxes and Stimulus Check Eligibility, How Homeownership Affects Stimulus Check Eligibility in Ohio

Property taxes are a significant expense for homeowners, and Ohio offers various deductions and credits related to property taxes. These tax benefits can reduce the amount of taxes owed, potentially increasing the amount of stimulus aid received.

Explore the different advantages of Impact of Filing Status on Ohio Stimulus Check Qualification that can change the way you view this issue.

| Property Tax Payment | Stimulus Check Amount |

|---|---|

| $1,000 or less | $100 |

| $1,001 to $2,000 | $200 |

| $2,001 to $3,000 | $300 |

This table illustrates a hypothetical example of how property tax payments might influence stimulus check amounts. The actual relationship between property taxes and stimulus checks can vary depending on the specific program and the individual’s financial situation.

Mortgage Payments and Stimulus Check Eligibility

Mortgage payments are another significant expense for homeowners. Ohio doesn’t have specific provisions directly linking mortgage payments to stimulus check eligibility. However, mortgage interest deductions and other tax benefits related to homeownership can impact your overall tax liability, potentially affecting the amount of stimulus aid you receive.

Do not overlook the opportunity to discover more about the subject of How Previous Stimulus Payments Affect Eligibility in Ohio.

For example, homeowners with a mortgage may be eligible for a larger stimulus check due to the tax deductions they can claim. Conversely, homeowners without a mortgage might not be eligible for certain tax benefits, potentially leading to a smaller stimulus check amount.

Homeownership and Stimulus Check Applications

The application process for Ohio stimulus checks can vary depending on the program. However, homeowners should be prepared to provide certain documentation to support their eligibility. This documentation may include:

- Proof of Residency:This can include a driver’s license, utility bills, or other documents that show your current address in Ohio.

- Income Verification:This may include pay stubs, tax returns, or other documents that demonstrate your income level.

- Property Tax Information:If you’re claiming deductions or credits related to property taxes, you’ll need to provide documentation of your property tax payments.

- Mortgage Information:If you have a mortgage, you may need to provide information about your mortgage payments and interest rates.

Homeownership and Stimulus Check Disbursement: How Homeownership Affects Stimulus Check Eligibility In Ohio

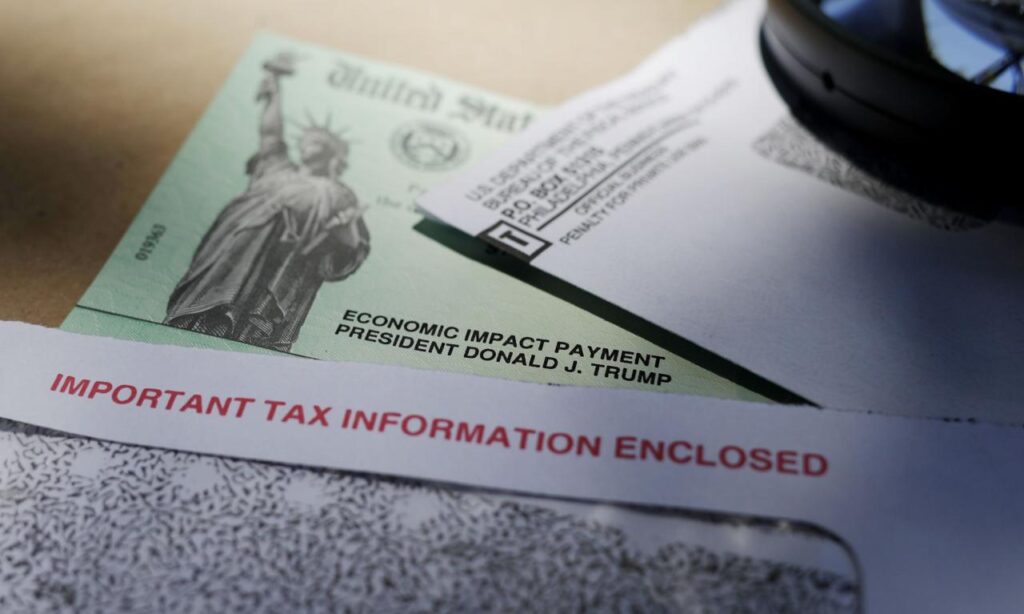

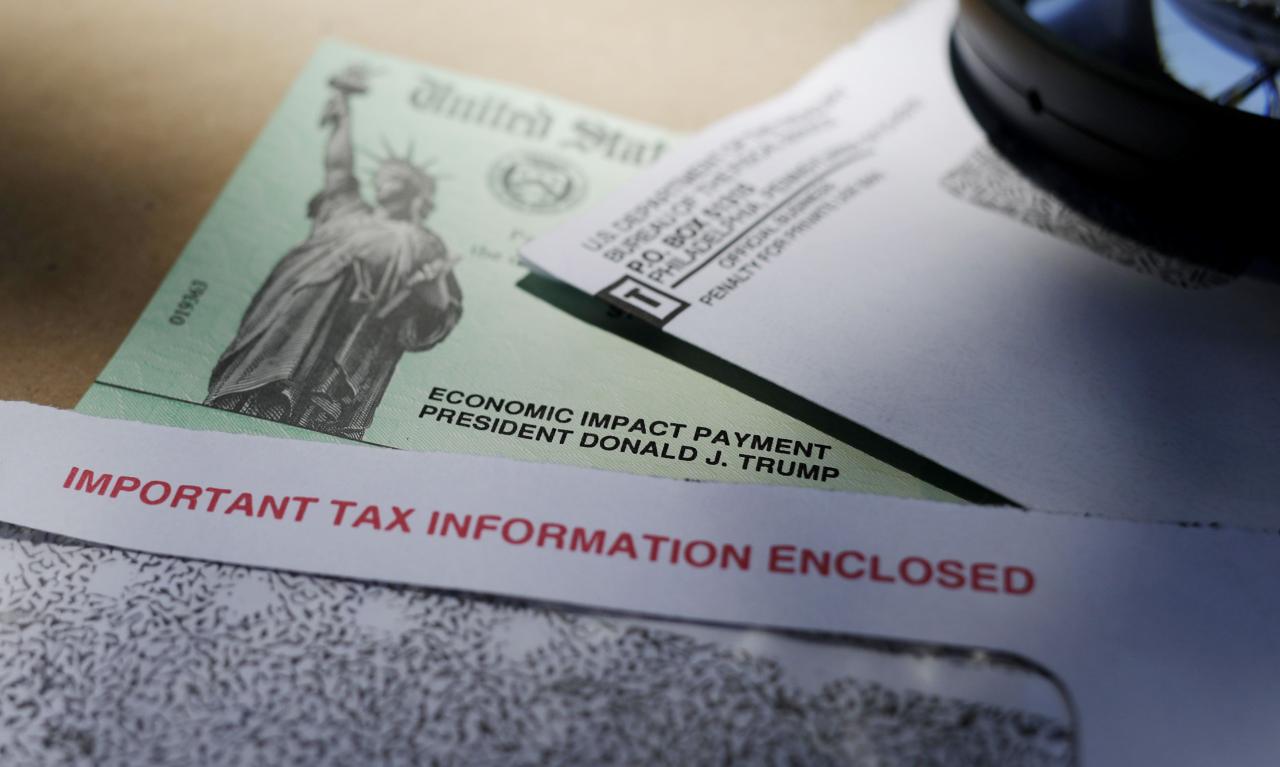

Ohio stimulus checks can be disbursed through various methods, including direct deposit, mail, or debit card. The specific method used will depend on the program and the individual’s preference.

| Disbursement Method | Timeline |

|---|---|

| Direct Deposit | 1-2 weeks |

| 2-4 weeks | |

| Debit Card | 3-5 weeks |

The timeline for receiving stimulus checks can vary depending on the disbursement method and the specific program. Homeowners should carefully review the information provided by the Ohio government to understand the expected timeframe for receiving their stimulus checks.

Closing Notes

Understanding how homeownership affects stimulus check eligibility in Ohio is crucial for maximizing potential benefits. By navigating the complexities of property taxes, mortgage payments, and application procedures, homeowners can confidently pursue the financial assistance they deserve. This guide serves as a valuable resource, empowering individuals to make informed decisions and secure their rightful share of stimulus benefits.

Examine how How to Determine Your New York Stimulus Check Eligibility Online can boost performance in your area.

FAQ Resource

What are the general eligibility requirements for Ohio stimulus checks?

Eligibility for Ohio stimulus checks is based on factors like income level, residency status, and other specific criteria. These requirements may vary depending on the type of stimulus program.

Can I still qualify for stimulus checks if I have a mortgage?

Do not overlook the opportunity to discover more about the subject of Can Immigrants Receive Stimulus Checks in New York?.

Yes, homeowners with mortgages can still be eligible for stimulus checks. However, the amount of the stimulus check may be influenced by factors such as mortgage payments and property taxes.

What documents do I need to apply for stimulus checks as a homeowner?

Required documentation for homeowners applying for stimulus checks may include proof of residency, income verification, and property tax information. Specific requirements may vary depending on the stimulus program.