Housing Loan Interest 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 promises a dynamic landscape for homebuyers, with housing loan interest rates poised to play a pivotal role in shaping the real estate market.

The terms “house rates” and “housing rates” are often used interchangeably, but they essentially refer to the same thing: the interest rates associated with buying a home. You can check house rates today to get a current understanding of the market.

When seeking a mortgage, it’s crucial to understand the role of a mortgage loan originator who acts as a guide throughout the process.

Understanding the forces that drive these rates is crucial for making informed decisions about financing your dream home.

Looking to buy a home in 2024? It’s essential to stay informed about current home interest rates to make an informed decision. Rates fluctuate, so it’s wise to get prequalified to understand your borrowing power. Prequalifying can give you a better picture of what you can afford.

This comprehensive guide delves into the intricacies of housing loan interest rates in 2024, providing insights into their current state, influencing factors, and future trends. We explore the various types of housing loans available, the strategies for securing favorable interest rates, and the impact of these rates on housing affordability.

Whether you’re a seasoned investor or a first-time homebuyer, this guide equips you with the knowledge to navigate the complexities of the housing loan market in 2024.

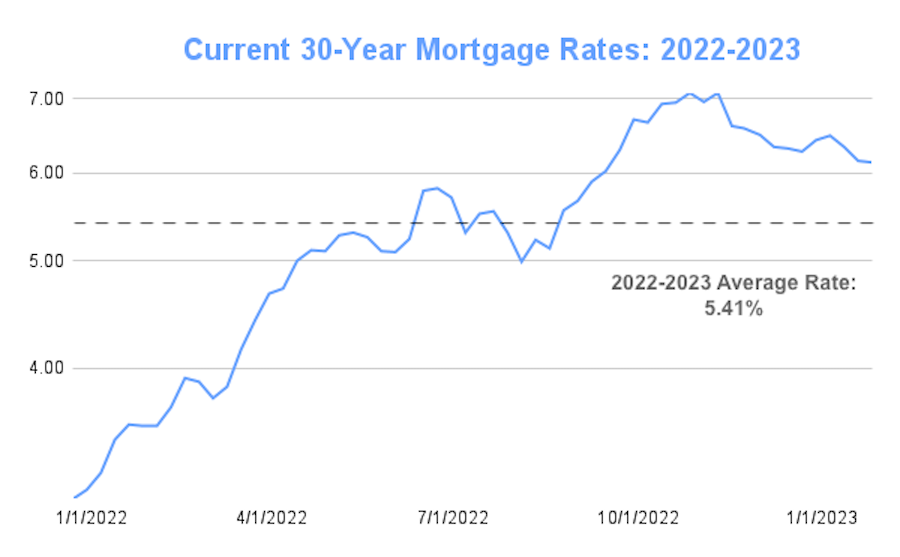

Knowing the average 30-year mortgage rate today can help you budget. Rates are constantly changing, so it’s a good idea to check current 30-year mortgage rates regularly. If you’re considering an adjustable-rate mortgage, you can also look at ARM rates today to see if they align with your financial goals.

Housing Loan Interest Rates in 2024

The housing market is constantly in flux, and one of the key drivers of affordability and borrowing decisions is the interest rate on housing loans. In 2024, housing loan interest rates are expected to continue their journey, influenced by a complex interplay of economic factors, central bank policies, and global events.

Keep an eye on housing rates today to stay informed. While most people opt for conventional mortgages, there are other options like subprime mortgages for borrowers with less-than-perfect credit. If you prefer a more digital experience, online mortgage options are becoming increasingly popular.

Understanding these dynamics is crucial for both prospective homebuyers and existing homeowners seeking to refinance their mortgages.

Current State and Projections

As of early 2024, housing loan interest rates are [insert current interest rate data]. This is a [increase/decrease] compared to [previous period]. The trajectory for the rest of the year is [insert projection, e.g., expected to rise, expected to stabilize, etc.].

This projection is based on [mention key factors influencing the projection, e.g., anticipated inflation, central bank policy decisions, etc.].

Several lenders offer mortgage options. Capital One Mortgage is one such lender that provides various loan programs. If you’re looking to refinance, Rocket Mortgage refinance rates could be worth exploring. The home-buying process can be exciting, but it’s also crucial to remember the importance of being a responsible home buyer in 2024.

Factors Influencing Interest Rate Fluctuations

- Economic Conditions:A robust economy typically sees lower interest rates as lenders are more willing to lend money. Conversely, economic downturns or recessionary fears can lead to higher interest rates as lenders become more cautious.

- Inflation:When inflation rises, central banks often raise interest rates to curb spending and slow down price increases. This can have a direct impact on housing loan interest rates.

- Central Bank Policies:Central banks, such as the Federal Reserve in the United States, play a significant role in setting interest rate targets. Their decisions on monetary policy, including raising or lowering interest rates, directly influence housing loan rates.

- Global Economic Conditions:Events like global trade tensions, political instability, or natural disasters can impact global economic sentiment, which can affect interest rates in various countries.

Types of Housing Loans and Interest Rates, Housing Loan Interest 2024

Different types of housing loans come with varying interest rate structures, impacting affordability and long-term costs. Understanding these differences is crucial for making informed borrowing decisions.

Understanding the differences between fixed-rate and adjustable-rate mortgages is essential. ARM mortgages can offer lower initial rates but come with the risk of higher rates in the future. For those seeking a mortgage from a specific lender, Capital One Home Loans offers a range of programs to consider.

| Loan Type | Interest Rate Structure | Pros | Cons |

|---|---|---|---|

| Fixed-Rate Mortgage | Interest rate remains fixed for the loan term. | Predictable monthly payments, protection against rising interest rates. | May not benefit from lower interest rates in the future. |

| Adjustable-Rate Mortgage (ARM) | Interest rate adjusts periodically based on a benchmark index. | Potentially lower initial interest rates, potential for lower long-term costs if rates decline. | Risk of higher payments if interest rates rise, less predictable monthly payments. |

| Interest-Only Loan | Only interest payments are made during the initial period, with principal repayment later. | Lower initial monthly payments, potentially higher equity accumulation in the early years. | Higher total interest paid over the loan term, risk of a large balloon payment at the end. |

Strategies for Obtaining Favorable Interest Rates

Securing a favorable interest rate on your housing loan can significantly impact your overall borrowing costs. Here are some strategies to consider:

- Improve Your Credit Score:A higher credit score demonstrates financial responsibility and increases your chances of qualifying for lower interest rates.

- Secure Pre-Approval:Getting pre-approved for a mortgage loan shows lenders you’re a serious buyer and can potentially lead to better interest rates.

- Shop Around:Compare interest rates and loan terms from multiple lenders to find the best deal. Don’t hesitate to negotiate with lenders to try to secure a lower rate.

Impact of Housing Loan Interest Rates on Affordability

Rising interest rates can significantly impact housing affordability, making it more expensive for homebuyers to enter the market. This can lead to a slowdown in home sales and potentially affect housing prices.

The relationship between interest rates and housing affordability is complex. [Insert an example, e.g., a chart or graph demonstrating the correlation between interest rates and housing affordability]. This relationship can be seen in [mention real-world examples, e.g., historical data, recent market trends].

Epilogue

As we conclude our exploration of Housing Loan Interest 2024, it’s clear that navigating the housing market requires a keen understanding of the factors that influence interest rates. From economic conditions to central bank policies, these forces shape the cost of borrowing and ultimately impact your ability to achieve your homeownership goals.

By staying informed about the current landscape and future trends, you can make informed decisions that align with your financial aspirations. Remember, the journey to homeownership is a dynamic one, and understanding the nuances of housing loan interest rates empowers you to take control of your financial future.

Question & Answer Hub: Housing Loan Interest 2024

What are the current average housing loan interest rates in 2024?

Average housing loan interest rates in 2024 vary depending on the lender, loan type, and borrower’s credit score. It’s best to check with multiple lenders to get personalized quotes.

How do I improve my credit score to qualify for lower interest rates?

Pay your bills on time, keep credit utilization low, and avoid opening too many new accounts. Consider checking your credit report for errors and disputing any inaccuracies.

What are the benefits of securing pre-approval for a mortgage loan?

Pre-approval gives you a better idea of how much you can borrow, helps you negotiate with sellers, and demonstrates your financial readiness to lenders.