Home Refinance 2024 presents a unique opportunity for homeowners to potentially lower their monthly payments, access home equity, or even shorten their mortgage term. With interest rates fluctuating and the housing market in constant motion, understanding the ins and outs of refinancing is crucial for making informed financial decisions.

If you’re a veteran or active-duty military member, staying informed about Current Va Mortgage Rates 2024 is essential for securing the best possible loan terms.

This guide explores the various refinance options available, including rate-and-term, cash-out, and streamline refinance, outlining their benefits, drawbacks, and eligibility requirements. It also delves into factors influencing refinance decisions, such as current interest rates, credit score, loan-to-value ratio, and closing costs.

Home Refinancing in 2024: A Guide for Homeowners

The housing market in 2024 is a landscape of shifting tides. Interest rates have fluctuated, and while home prices may not be soaring like they were in recent years, they still remain relatively high. This dynamic environment presents a unique opportunity for homeowners to consider refinancing their mortgages.

Refinancing your home loan can potentially save you money on interest payments and shorten your loan term. Check out Refinance Home Loan 2024 options to see if it’s right for you.

Refinancing can offer a path to lower monthly payments, access to home equity, or a chance to switch to a more favorable loan term.

A Cash Out Refinance 2024 can be a great way to access your home equity for a variety of purposes, such as home improvements, debt consolidation, or even a down payment on another property.

However, before diving into the refinance pool, it’s crucial to weigh the potential benefits against the associated costs and risks. This guide will equip you with the knowledge to make an informed decision about whether refinancing is the right move for you in 2024.

Understanding Refinance Options

Refinancing your mortgage essentially means replacing your existing loan with a new one. This can be advantageous if current interest rates are lower than your original loan rate, allowing you to potentially save on monthly payments. There are various types of refinance options available, each with its own set of advantages and disadvantages:

- Rate-and-Term Refinance:This is the most common type of refinance. It allows you to lower your interest rate and/or shorten the term of your loan. This can result in lower monthly payments and a quicker payoff of your mortgage.

- Cash-Out Refinance:This option allows you to borrow more money than your current loan balance, giving you access to a portion of your home equity. You can use the cash for various purposes, such as home improvements, debt consolidation, or even investment.

FHA loans offer more flexible requirements than conventional loans, making them a popular choice for first-time homebuyers and borrowers with less-than-perfect credit. Learn more about Fha Loans 2024 to see if they’re right for you.

However, it increases your overall loan amount and could lead to higher monthly payments.

- Streamline Refinance:This option is designed for borrowers with existing loans backed by Fannie Mae or Freddie Mac. It simplifies the refinance process by requiring less documentation and often involves lower closing costs. However, it typically only allows you to lower your interest rate, not shorten your loan term.

A second mortgage can be a valuable financial tool, but it’s important to understand the associated risks. Check out 2nd Mortgage Rates 2024 and compare them to other financing options.

Factors Influencing Refinance Decisions, Home Refinance 2024

Several factors play a crucial role in determining whether refinancing makes sense for you. Understanding these factors will help you make a well-informed decision.

Securing a Mortgage Loan 2024 is a significant step towards homeownership. Understanding the different types of loans and interest rates available can help you make the best choice for your financial situation.

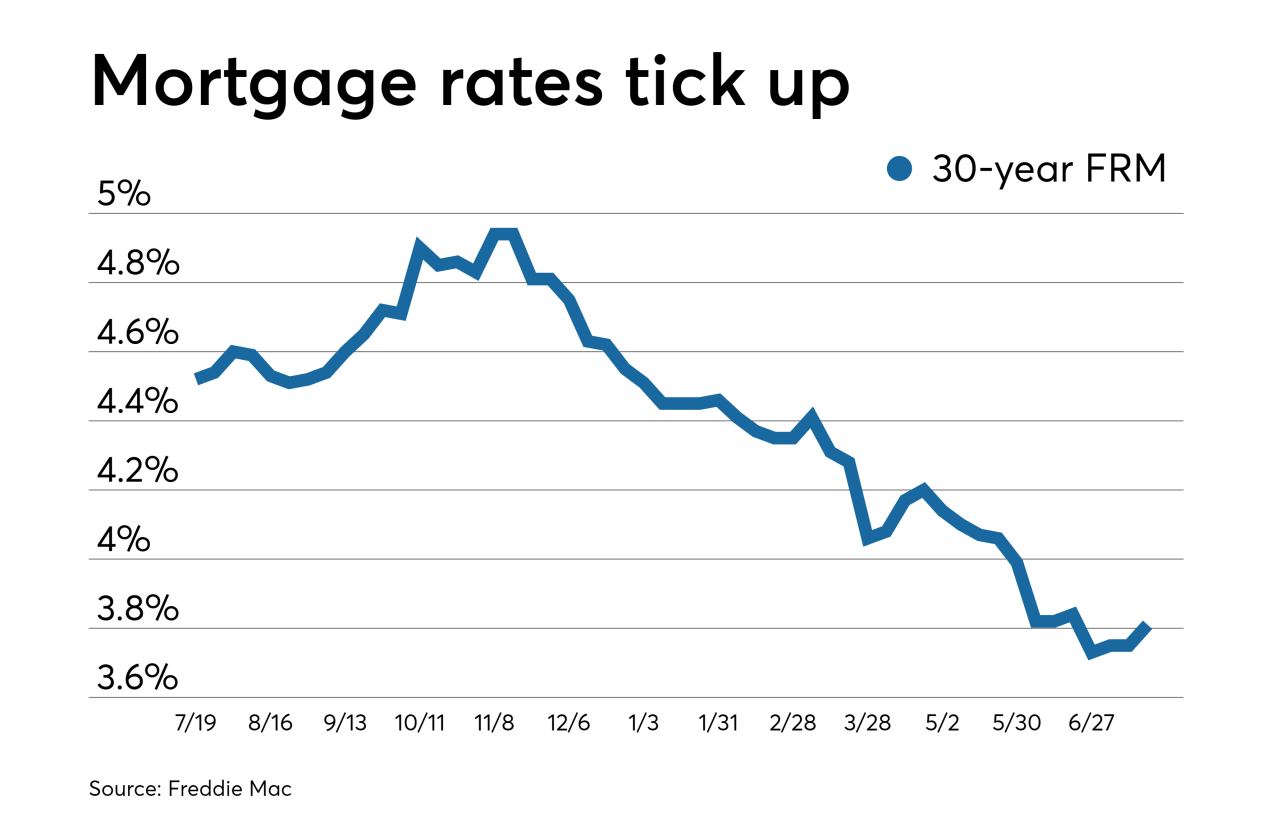

- Current Interest Rate Environment:The current interest rate environment is a key driver of refinance decisions. If interest rates have fallen significantly since you took out your original loan, refinancing could result in substantial savings on your monthly payments. However, if rates are high or have recently risen, refinancing might not be financially beneficial.

- Credit Score and Loan-to-Value Ratio:Your credit score and loan-to-value (LTV) ratio are critical factors influencing refinance eligibility and the interest rate you qualify for. A higher credit score generally leads to better interest rates, while a lower LTV ratio (meaning you have more equity in your home) can also improve your chances of securing favorable terms.

Bank of America is a major lender offering a range of mortgage products. Check out their Bank Of America Mortgage Rates 2024 to compare them to other lenders.

- Closing Costs and Other Fees:Refinancing involves closing costs, which can include appraisal fees, title insurance, and lender fees. These costs can add up, so it’s essential to factor them into your calculations to determine if the long-term savings from refinancing outweigh the upfront expenses.

Refinance Process and Considerations

The refinance process typically involves several steps, from application to closing. Understanding this process will help you navigate it smoothly and efficiently.

A Mortgage Broker 2024 can be a valuable asset in your home financing journey. They can shop around for the best rates and terms, saving you time and effort in the process.

- Application:Begin by applying for a refinance loan with a reputable mortgage lender. Provide the necessary documentation, including your financial information, property details, and credit history.

- Loan Approval:Once your application is reviewed, the lender will assess your creditworthiness and determine if you qualify for a refinance loan. You’ll receive a loan approval with the terms and conditions.

- Property Appraisal:The lender will typically require an appraisal of your home to determine its current market value. This helps ensure that the loan amount is commensurate with the property’s worth.

- Closing:Once all the necessary steps are completed, you’ll attend the closing ceremony, where you’ll sign the final loan documents and receive the proceeds from your refinance loan.

Refinance Strategies for 2024

Here are some strategies to help you navigate the refinance process effectively in 2024:

| Refinance Scenario | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| Current Loan | 4.5% | 30 years | $2,000 | $240,000 |

| Refinance Option 1 (Lower Rate) | 3.75% | 30 years | $1,800 | $200,000 |

| Refinance Option 2 (Shorter Term) | 4.25% | 20 years | $2,200 | $150,000 |

This table illustrates two potential refinance scenarios based on current market conditions. Scenario 1 shows a lower interest rate, resulting in lower monthly payments and reduced total interest paid. Scenario 2 demonstrates a shorter loan term, leading to higher monthly payments but a faster payoff of the mortgage.

For homeowners over the age of 62, a Aag Reverse Mortgage 2024 can provide a steady stream of income. This type of loan allows you to convert your home equity into cash, providing financial security in retirement.

It’s essential to compare different refinance options to determine which best aligns with your financial goals.

Finding a Mortgage Broker Near Me 2024 can be as simple as a quick online search. Local brokers often have a deep understanding of the market and can provide personalized guidance.

Alternatives to Refinancing

If refinancing isn’t the right fit for you, several other options can help you lower your mortgage payments or access home equity.

Whether you’re a first-time buyer or looking to refinance, understanding the basics of Mortgage 2024 options is crucial. From fixed-rate to adjustable-rate mortgages, there’s a loan type for every borrower.

- Home Equity Loans:A home equity loan provides a lump sum of cash secured by your home equity. You’ll receive the money upfront and repay it over a fixed period with a fixed interest rate.

- Home Equity Lines of Credit (HELOCs):A HELOC is a revolving line of credit secured by your home equity. You can borrow money as needed up to a certain limit and repay it over a specific period with a variable interest rate.

- Debt Consolidation:This involves taking out a new loan to pay off existing debts, such as credit cards or personal loans. This can help simplify your finances and potentially lower your monthly payments.

Outcome Summary

Refinancing your home in 2024 can be a strategic move, but it’s essential to carefully weigh the potential benefits against the risks. By understanding the different refinance options, assessing your financial situation, and navigating the process effectively, you can make an informed decision that aligns with your long-term financial goals.

Navigating the home buying process can be overwhelming, but it doesn’t have to be. Home Buyers 2024 resources can provide valuable guidance and support, making your journey smoother.

Remember, seeking advice from a reputable mortgage lender can provide valuable insights and guidance throughout your refinance journey.

Staying on top of Mortgage Interest Rates Today 2024 is crucial when making major financial decisions. Whether you’re buying, refinancing, or simply planning for the future, understanding current rates can help you make informed choices.

Questions Often Asked: Home Refinance 2024

What is the current average interest rate for a refinance?

Current refinance rates fluctuate daily. It’s best to check with a mortgage lender for the most up-to-date information.

How long does the refinance process typically take?

The refinance process can take anywhere from 30 to 60 days, depending on factors like loan type, lender, and documentation.

What are the tax implications of refinancing?

If you’re looking to access your home equity for a major purchase or to consolidate debt, a Best Home Equity Line Of Credit 2024 can be a great option. These lines of credit offer flexible borrowing with low interest rates, making them a smart choice for homeowners.

Refinancing may impact your tax deductions, especially if you are refinancing into a new loan with a different interest rate. Consult with a tax professional for personalized advice.

For veterans and active-duty military personnel seeking to purchase a home, a Va Home Loan 2024 offers unique benefits like no down payment requirements and competitive interest rates. It’s a valuable resource for those who have served our country.