Group Immediate Annuity – Group Immediate Annuities offer a unique and often overlooked path to retirement income security. This type of annuity, purchased collectively by a group of individuals, provides a guaranteed stream of income for life, starting immediately. Unlike individual immediate annuities, group annuities leverage the collective purchasing power of a group, potentially leading to more favorable rates and greater financial stability.

Annuity joint and survivor options provide a guaranteed income stream for both spouses, even after one passes away. Annuity Joint And Survivor 2024 explains the benefits and considerations of this type of annuity.

Group Immediate Annuities are particularly attractive for employers seeking to offer valuable retirement benefits to their workforce. By providing access to a guaranteed income stream, these annuities can help employees feel more confident about their financial future during retirement, ultimately contributing to higher employee morale and retention.

Variable annuities offer potential growth but also come with risks. Is A Variable Annuity A Good Investment 2024 helps you weigh the pros and cons of variable annuities and determine if they are suitable for your investment strategy.

What is a Group Immediate Annuity?

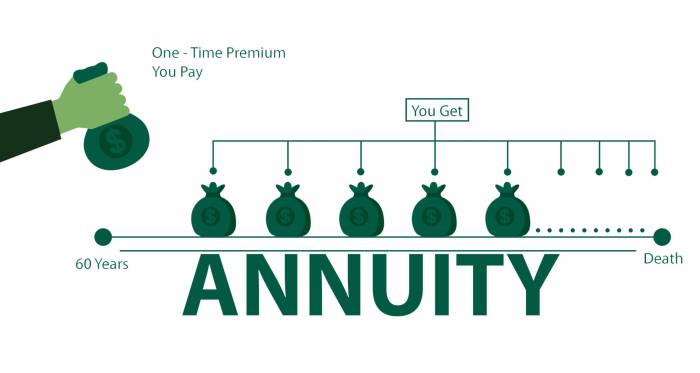

A Group Immediate Annuity is a type of retirement income product that provides a guaranteed stream of income payments for life, starting immediately after purchase. It’s often offered as an option within employer-sponsored retirement plans, allowing employees to convert a portion of their retirement savings into a guaranteed income stream.

The “J Calculation” is a method used in HVAC (Heating, Ventilation, and Air Conditioning) systems. J Calculation Hvac 2024 explains the process and its significance in ensuring efficient and effective HVAC operation.

Key Features of Group Immediate Annuities

Group Immediate Annuities are characterized by several key features:

- Guaranteed Income for Life:The annuity contract ensures regular income payments for the annuitant’s lifetime, regardless of how long they live. This provides financial security and predictability in retirement.

- Immediate Payment:Payments begin immediately after the annuity is purchased, providing a reliable source of income from the start of retirement.

- Fixed or Variable Payment Options:Annuitants can choose between fixed payments, which remain consistent throughout the contract, or variable payments, which fluctuate based on the performance of underlying investments.

- Tax-Deferred Growth:The income earned on the annuity grows tax-deferred, meaning taxes are only paid when income is withdrawn in retirement.

Comparison with Individual Immediate Annuities

While both Group and Individual Immediate Annuities offer guaranteed income for life, they differ in several ways:

- Availability:Group Immediate Annuities are typically available through employer-sponsored retirement plans, while individual annuities are purchased directly from insurance companies.

- Pricing:Group annuities often offer lower premiums compared to individual annuities due to economies of scale and administrative efficiencies.

- Flexibility:Individual annuities provide greater flexibility in terms of payment options and investment choices, while group annuities often have more standardized features.

Real-World Examples of Group Immediate Annuities

Group Immediate Annuities are commonly used in various scenarios:

- Large Corporations:Companies with large employee bases may offer group annuities as part of their retirement benefits package, providing employees with a guaranteed income stream alongside other retirement savings options.

- Government Agencies:Public sector employers often offer group annuities to their employees, ensuring a stable income stream during retirement.

- Union-Negotiated Benefits:Labor unions may negotiate group annuity contracts as part of collective bargaining agreements, providing members with a guaranteed income stream upon retirement.

Benefits of Group Immediate Annuities

Group Immediate Annuities offer a range of advantages for both individuals and employers.

The “4 Annuity” is a specific type of annuity that offers a fixed rate of return. 4 Annuity 2024 provides insights into the features and potential advantages of this particular annuity option.

Benefits for Individuals

Group Immediate Annuities provide individuals with several key benefits:

- Guaranteed Income:The most significant benefit is the guarantee of regular income payments for life, eliminating the risk of outliving retirement savings.

- Financial Security:A predictable income stream provides peace of mind and financial stability during retirement, allowing individuals to plan for future expenses with confidence.

- Tax Advantages:The tax-deferred growth of annuity income allows individuals to accumulate wealth more efficiently, paying taxes only when income is withdrawn in retirement.

- Simplified Retirement Planning:Group Immediate Annuities simplify retirement planning by providing a reliable income source, reducing the need for complex investment strategies.

Benefits for Employers

Offering Group Immediate Annuities as part of their retirement plan benefits employers by:

- Employee Retention:Attractive retirement benefits, such as group annuities, can improve employee satisfaction and reduce turnover rates.

- Enhanced Employee Financial Security:Providing a guaranteed income stream helps employees feel more secure in retirement, leading to increased productivity and focus on their work.

- Reduced Administrative Costs:Group annuities streamline retirement planning for both employers and employees, simplifying administrative processes and reducing costs.

Tax Implications

The tax implications of Group Immediate Annuities vary depending on the specific contract terms and the individual’s tax situation. However, in general, the income earned on the annuity grows tax-deferred, and taxes are only paid when income is withdrawn in retirement.

Many people wonder if an annuity is considered insurance. Is Annuity Insurance 2024 provides a clear explanation of the nature of annuities and how they differ from traditional insurance products.

This contrasts with other retirement options, such as traditional IRAs or 401(k) plans, where contributions may be tax-deductible but withdrawals are taxed as ordinary income.

One of the key benefits of annuities is the guaranteed income they provide. Is Annuity Income 2024 discusses the tax implications of annuity income and how it can be used for retirement planning.

Impact on Financial Security in Retirement

Group Immediate Annuities can significantly enhance financial security in retirement by providing a guaranteed income stream that cannot be depleted. This helps individuals cover essential expenses, maintain their lifestyle, and avoid the risk of outliving their retirement savings. The predictability of income payments also allows individuals to plan for future expenses and make informed financial decisions.

To better understand how immediate annuities work, it’s helpful to use a calculator. Immediate Annuity Calculator provides a resource for exploring the calculations involved in these types of annuities.

How Group Immediate Annuities Work

Purchasing a Group Immediate Annuity involves a straightforward process, typically facilitated through an employer-sponsored retirement plan.

Purchasing a Group Immediate Annuity

The process of purchasing a Group Immediate Annuity generally involves the following steps:

- Eligibility:Individuals must meet eligibility requirements set by the employer and the annuity provider.

- Contribution:Employees contribute a portion of their retirement savings to the annuity program, either as a lump sum or through regular contributions.

- Annuity Contract:The annuity provider issues a contract outlining the terms of the annuity, including payment options, interest rates, and other relevant details.

- Income Payments:Upon retirement, the annuitant receives regular income payments, either as a fixed amount or based on a variable investment strategy.

Payment Options

Group Immediate Annuities offer a range of payment options to suit different individual needs and preferences:

- Fixed Payments:Provide a guaranteed, consistent income stream throughout the contract period, offering predictability and stability.

- Variable Payments:Offer the potential for higher income payments, but also involve greater risk as payments fluctuate based on the performance of underlying investments.

- Lump Sum Payments:Allow annuitants to receive a portion of their annuity benefits as a single lump sum payment, providing flexibility for immediate financial needs.

Common Group Immediate Annuity Payout Options

| Payout Option | Description | Advantages | Disadvantages |

|---|---|---|---|

| Fixed Annuity | Provides a guaranteed, consistent income stream for life. | Predictable income, guaranteed payments, no investment risk. | Lower potential for growth, limited flexibility. |

| Variable Annuity | Offers the potential for higher income payments, but payments fluctuate based on the performance of underlying investments. | Potential for higher returns, greater flexibility. | Higher risk, payments are not guaranteed. |

| Lump Sum | Allows annuitants to receive a portion of their annuity benefits as a single lump sum payment. | Flexibility for immediate financial needs, potential for investment growth. | Risk of depleting funds quickly, may not provide guaranteed income for life. |

Role of Insurance Companies

Insurance companies play a crucial role in Group Immediate Annuity programs by providing the financial guarantees and administrative support necessary to ensure the long-term sustainability of the program. They manage the investment assets underlying the annuities and ensure that income payments are made promptly and reliably.

Immediate annuities offer a guaranteed stream of income starting right away. Immediate Annuity Payments Begin provides a comprehensive overview of these annuities and how they can provide financial security during retirement.

Considerations for Group Immediate Annuities

When considering a Group Immediate Annuity, it’s essential to carefully evaluate several factors to ensure it aligns with your individual circumstances and financial goals.

Factors to Consider

Key factors to consider when choosing a Group Immediate Annuity include:

- Your Retirement Income Needs:Determine how much income you’ll need in retirement and whether a guaranteed income stream from an annuity is sufficient to cover your expenses.

- Risk Tolerance:Consider your comfort level with investment risk. Fixed annuities offer guaranteed payments, while variable annuities involve potential for higher returns but also greater risk.

- Payment Options:Evaluate the different payment options available and choose the one that best suits your financial needs and preferences.

- Fees and Expenses:Compare the fees and expenses associated with different annuity programs to ensure you’re getting a competitive rate of return.

Risks Associated with Group Immediate Annuities

While Group Immediate Annuities offer significant benefits, there are also some potential risks to consider:

- Inflation Risk:Fixed annuities provide a guaranteed income stream, but the purchasing power of that income may decline over time due to inflation.

- Interest Rate Risk:Fixed annuities typically have a fixed interest rate, which may be lower than prevailing market rates. If interest rates rise, the annuity’s rate of return may become less attractive.

- Investment Risk:Variable annuities involve investment risk, as payments are tied to the performance of underlying investments. If those investments perform poorly, income payments may be lower than expected.

Suitability for Different Individuals

Group Immediate Annuities can be a suitable retirement income option for a wide range of individuals, but they are particularly well-suited for:

- Individuals seeking guaranteed income:Group Immediate Annuities provide a reliable income stream that cannot be depleted, offering peace of mind and financial security.

- Risk-averse individuals:Fixed annuities offer guaranteed payments, minimizing investment risk and providing predictability.

- Individuals with long life expectancies:The lifetime income guarantee of annuities ensures income for as long as the annuitant lives, protecting against the risk of outliving their savings.

Impact of Market Fluctuations

Market fluctuations can impact Group Immediate Annuities, particularly variable annuities. If the underlying investments perform poorly, income payments may be lower than expected. However, fixed annuities offer protection against market volatility, as payments are guaranteed regardless of market conditions.

Calculator.net is a popular online resource for various financial calculations, including annuities. To explore their annuity tools and get a better understanding of how they work, visit Calculator.Net Annuity 2024. This article will guide you through their platform and its functionalities.

Group Immediate Annuities in Different Scenarios

Group Immediate Annuities can be incorporated into various retirement planning scenarios to address different financial goals and circumstances.

Choosing the right variable annuity is crucial for maximizing your retirement income. What Is The Best Variable Annuity 2024 explores factors to consider when selecting a variable annuity, helping you make the best decision for your financial needs.

Early Retirement Planning

Group Immediate Annuities can be a valuable tool for individuals planning to retire early. By converting a portion of their retirement savings into a guaranteed income stream, they can reduce their reliance on other income sources and provide financial stability during their early retirement years.

Understanding the concept of contingent annuities is important when considering these financial instruments. Annuity Contingent Is 2024 delves into the specifics of contingent annuities, providing valuable insights for your financial planning.

Specific Financial Goals

Group Immediate Annuities can be used to achieve specific financial goals in retirement, such as:

- Covering Essential Expenses:The guaranteed income stream from an annuity can provide a reliable source of income to cover essential expenses such as housing, healthcare, and utilities.

- Maintaining Lifestyle:Annuity payments can help individuals maintain their desired lifestyle in retirement by providing a steady stream of income for discretionary spending.

- Leaving a Legacy:Some annuities offer death benefits that can be passed on to beneficiaries, providing a financial legacy for loved ones.

Supplementing Other Retirement Income Sources

Group Immediate Annuities can be used to supplement other retirement income sources, such as Social Security, pensions, or savings accounts. By providing a guaranteed income stream, annuities can help ensure a more secure and predictable retirement income.

If you’re in Nigeria and need a tool to calculate annuity payments, you can find one online. Annuity Calculator Nigeria 2024 provides information about annuity calculators specifically designed for the Nigerian market.

Hypothetical Case Study, Group Immediate Annuity

Consider a hypothetical scenario where an individual is approaching retirement and has a significant amount of retirement savings. They are concerned about outliving their savings and desire a guaranteed income stream to cover essential expenses. They decide to purchase a Group Immediate Annuity, converting a portion of their savings into a fixed income stream for life.

This provides them with peace of mind, knowing that they have a reliable source of income to cover their expenses in retirement, regardless of market fluctuations or longevity.

Final Wrap-Up

Group Immediate Annuities present a compelling retirement income solution, especially for those seeking guaranteed income and peace of mind. By carefully considering the benefits, drawbacks, and individual circumstances, potential annuitants can determine if this option aligns with their retirement planning goals.

Whether you are an individual seeking to secure your financial future or an employer seeking to offer valuable benefits, exploring the possibilities of Group Immediate Annuities is a worthwhile endeavor.

If you’re looking to understand the intricacies of calculating annuity due in 2024, check out this informative article on Calculating Annuity Due 2024. It provides a comprehensive breakdown of the process, helping you make informed decisions about your financial future.

Top FAQs: Group Immediate Annuity

What are the tax implications of Group Immediate Annuities?

Planning for retirement? Variable annuities can be a good option, but there are age requirements to consider. Variable Annuity Age Requirements 2024 outlines the eligibility criteria for these investments, ensuring you’re aware of the specifics before making any decisions.

The tax treatment of Group Immediate Annuities depends on the specific type of annuity and the individual’s circumstances. Generally, the premiums paid for the annuity are not tax-deductible, but the income received from the annuity is taxed as ordinary income.

How do Group Immediate Annuities compare to other retirement savings options?

Inflation can significantly impact the value of your investments over time, including variable annuities. To learn more about how inflation affects these financial instruments, check out Variable Annuity Inflation 2024. This resource will help you understand the potential risks and strategies for mitigating them.

Group Immediate Annuities offer a guaranteed income stream, unlike traditional retirement savings accounts like 401(k)s or IRAs, which provide potential growth but no guaranteed income. They are a suitable option for those seeking a guaranteed income stream and a more conservative approach to retirement planning.

What are the potential risks associated with Group Immediate Annuities?

The primary risk associated with Group Immediate Annuities is the potential for lower interest rates, which can impact the amount of income received. Additionally, the financial stability of the insurance company issuing the annuity is also a factor to consider.