Global Inflation Trends and Their Impact in November 2024 present a complex economic landscape, marked by a surge in prices across various sectors. The world grapples with the repercussions of rising inflation, impacting everything from energy costs to food prices, while businesses navigate challenges and consumers adjust their spending habits.

This analysis explores the factors driving global inflation, examines its impact on key sectors, and delves into regional differences. We also investigate the monetary policy responses of major central banks and discuss the potential implications for economic growth. Understanding these trends is crucial for navigating the evolving economic environment.

Obtain recommendations related to Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 that can assist you today.

Global Inflation Trends in November 2024: Global Inflation Trends And Their Impact In November 2024

Inflation continues to be a major concern for economies worldwide, with November 2024 marking a critical juncture in understanding its trajectory and impact. While some economies have seen a moderation in inflation rates, others are still grappling with persistent price pressures.

Browse the multiple elements of The Impact of Inflation on Economic Growth in November 2024 to gain a more broad understanding.

This article delves into the global inflation landscape, examining key trends, sector-specific impacts, regional variations, and policy responses.

Global Inflation Overview in November 2024, Global Inflation Trends and Their Impact in November 2024

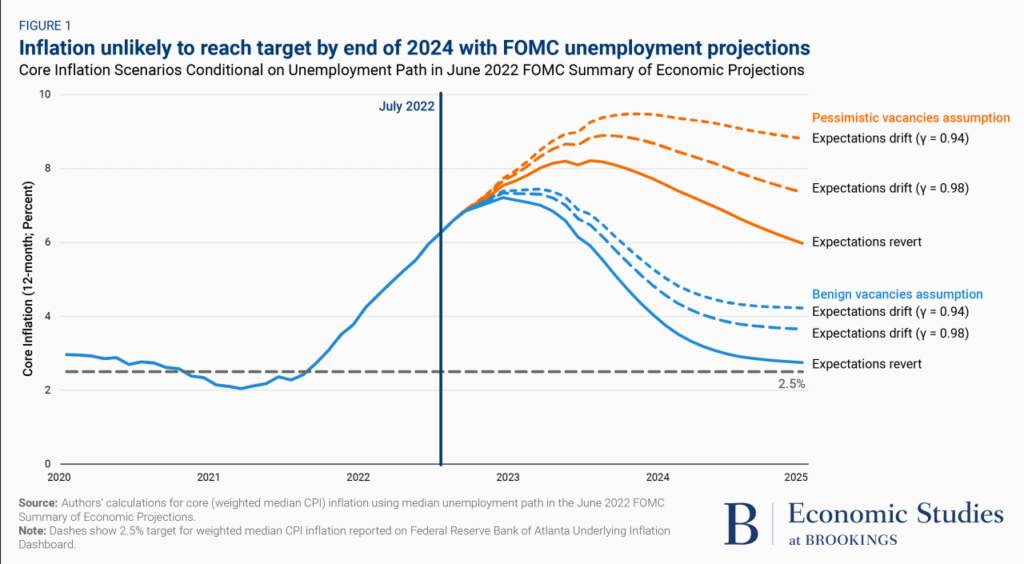

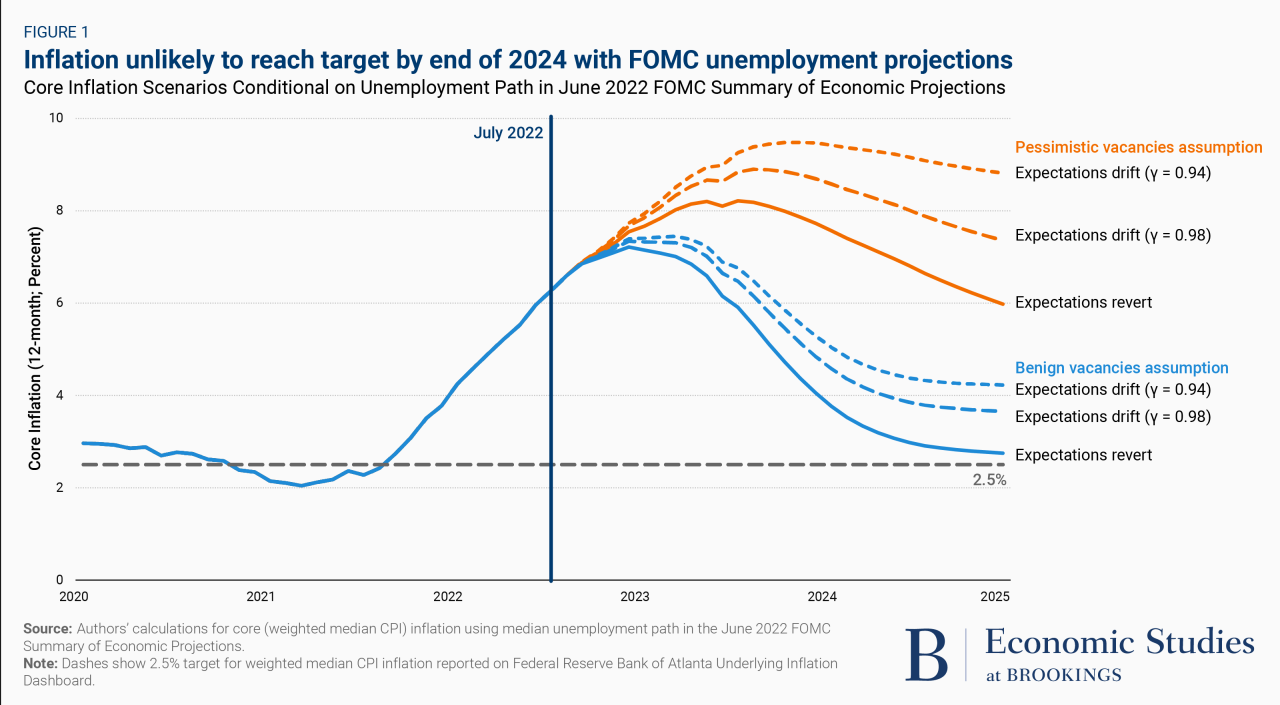

Global inflation in November 2024 presents a mixed picture. While some major economies, like the United States and the Eurozone, have witnessed a decline in inflation rates from their peak levels, the overall trend remains elevated in many parts of the world.

Explore the different advantages of CPI Calculation in Different Countries: A Comparison with November 2024 Data that can change the way you view this issue.

This persistent inflation is driven by a complex interplay of factors, including supply chain disruptions, geopolitical tensions, and robust demand.

- The US inflation rate in November 2024 is projected to be around 3.5%, down from its peak of 4.2% in early 2024. This decline is attributed to easing supply chain bottlenecks and a moderation in energy prices.

- The Eurozone, on the other hand, is still experiencing higher inflation rates, with an estimated 4.0% in November 2024. The ongoing war in Ukraine continues to impact energy prices and contribute to inflationary pressures in the region.

- Emerging market economies, particularly in Asia and Latin America, are facing significant inflationary pressures, driven by rising food and commodity prices. For instance, India’s inflation rate is projected to be around 6.0% in November 2024, reflecting the impact of high food prices.

Impact of Inflation on Key Sectors

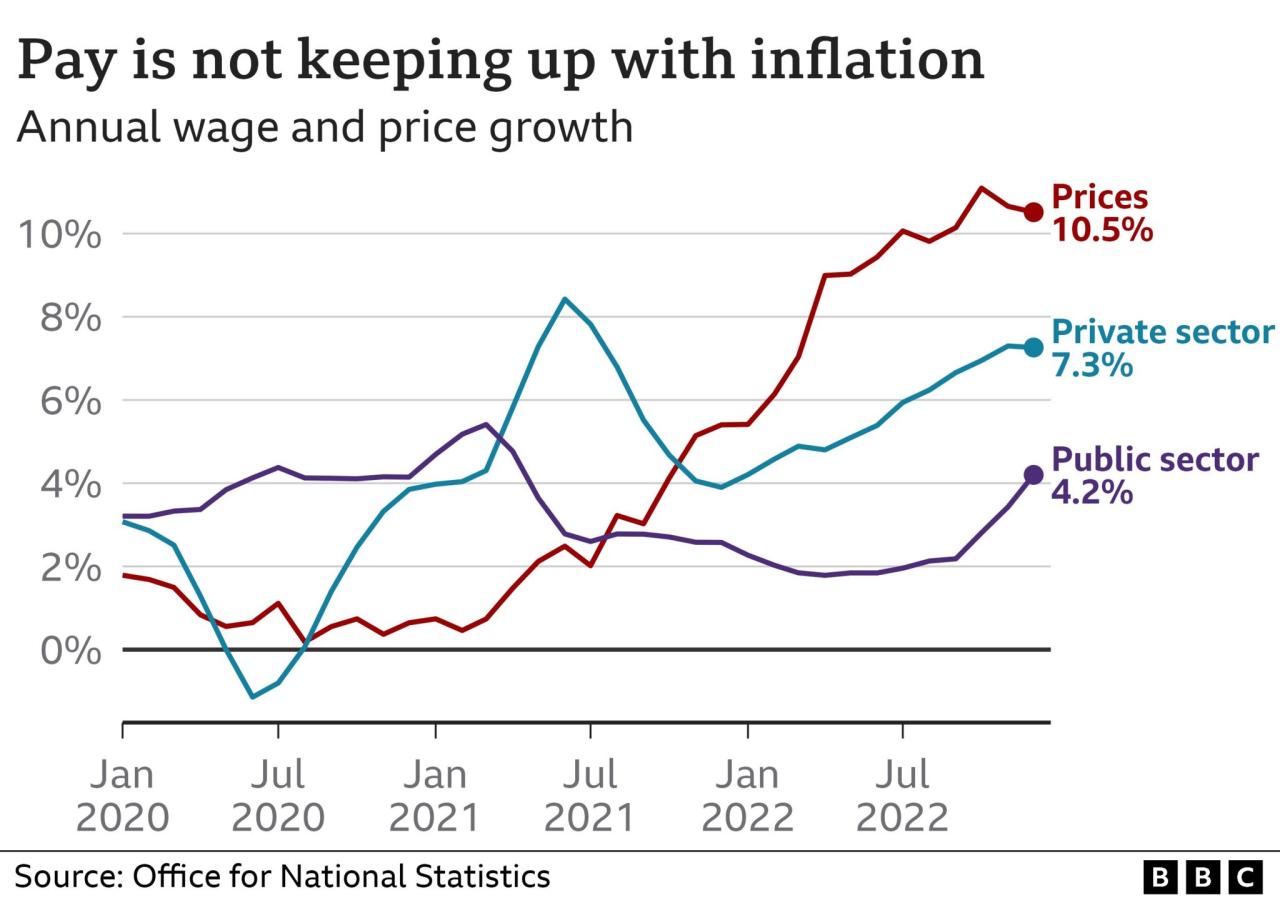

Inflation is having a profound impact on various sectors, leading to increased costs and challenges for businesses and consumers alike.

- Energy:The energy sector has been heavily impacted by inflation, with rising oil and gas prices driving up costs for businesses and households. This has led to increased transportation costs, higher electricity bills, and a surge in demand for alternative energy sources.

Obtain access to CPI and Transportation Costs in November 2024 to private resources that are additional.

- Food:Inflation has pushed up food prices globally, particularly for essential commodities like wheat, rice, and vegetable oils. This has resulted in increased food insecurity, particularly in developing countries, and has forced consumers to adjust their spending patterns.

- Housing:The housing sector has also experienced significant inflationary pressures, with rising construction costs, mortgage rates, and rental prices. This has made it more difficult for individuals and families to afford housing, leading to a decline in housing affordability and increased homelessness.

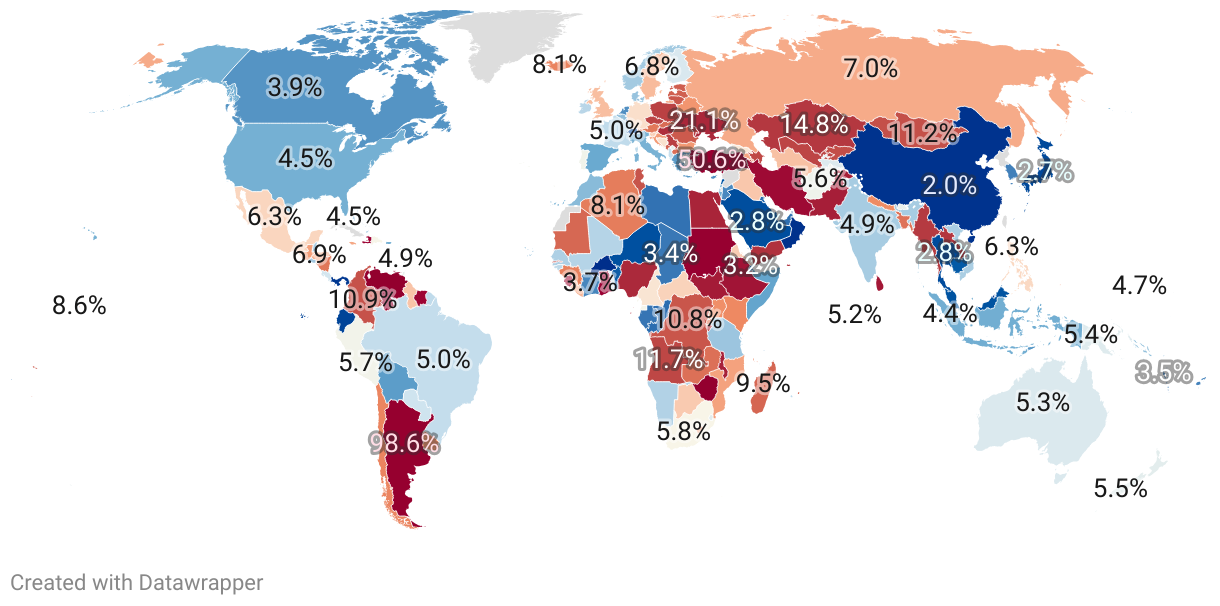

Regional Inflation Trends and Comparisons

Inflation rates vary considerably across different regions of the world, reflecting the unique economic and geopolitical circumstances of each region.

In this topic, you find that The CPI and the Environment in November 2024 is very useful.

- North America:Inflation in North America has moderated in recent months, with the US and Canada experiencing a decline in inflation rates. This is partly attributed to easing supply chain bottlenecks and a slowdown in consumer demand.

- Europe:The Eurozone continues to grapple with high inflation, driven by the ongoing war in Ukraine and its impact on energy prices. The region is also facing challenges from high energy dependence on Russia and supply chain disruptions.

- Asia:Inflation rates in Asia are generally higher than in North America and Europe, driven by rising food and commodity prices, as well as strong domestic demand. China, for example, has seen a recent uptick in inflation due to increased demand for consumer goods.

In this topic, you find that CPI and Social Inequality in November 2024 is very useful.

Monetary Policy Responses to Inflation

Central banks around the world have been actively responding to inflationary pressures by implementing monetary policy measures aimed at controlling inflation.

Do not overlook explore the latest data about CPI and the Changing Consumer Landscape in November 2024.

- Interest Rate Hikes:Many central banks have raised interest rates to curb inflation. This strategy aims to slow down economic activity by making borrowing more expensive, thereby reducing consumer spending and business investment.

- Quantitative Tightening:Some central banks have also implemented quantitative tightening measures, which involve reducing the amount of money in circulation by selling government bonds. This helps to control inflation by reducing the supply of money and lowering demand.

Inflation’s Impact on Economic Growth

Inflation can have a significant impact on economic growth by affecting business investment, consumer spending, and overall economic activity.

Investigate the pros of accepting Challenges in CPI Measurement for November 2024 in your business strategies.

- Business Investment:High inflation can discourage businesses from investing, as it makes it more difficult to predict future costs and returns. This can lead to a slowdown in economic growth.

- Consumer Spending:Inflation erodes purchasing power, leading to a decline in consumer spending. As prices rise, consumers have less money to spend on goods and services, which can dampen economic activity.

- Economic Slowdown:If inflation remains persistently high, it can lead to an economic slowdown or even a recession. This is because high inflation can create uncertainty and instability in the economy, making it difficult for businesses to plan and invest.

Strategies for Managing Inflation

Both businesses and individuals can implement strategies to mitigate the impact of inflation.

- Price Monitoring:Businesses should closely monitor price trends in their industry and adjust their pricing strategies accordingly. This will help them maintain profitability in an inflationary environment.

- Cost Control:Businesses need to focus on cost control measures to offset rising input costs. This may involve negotiating better deals with suppliers, improving operational efficiency, and reducing waste.

- Financial Planning:Individuals should focus on financial planning to protect their savings and investments from the effects of inflation. This may involve investing in assets that can hedge against inflation, such as real estate or gold.

Last Point

As we conclude our exploration of global inflation trends in November 2024, it becomes clear that the economic landscape remains dynamic and unpredictable. Managing inflation effectively requires a multifaceted approach, encompassing proactive monetary policy, strategic business adjustments, and informed consumer decisions.

Learn about more about the process of Decoding the November 2024 CPI: Key Terms and Concepts in the field.

By understanding the underlying forces at play, we can better navigate the challenges and opportunities presented by this global phenomenon.

General Inquiries

What are the main factors contributing to global inflation in November 2024?

Global inflation in November 2024 is driven by a combination of factors, including supply chain disruptions, increased energy prices, and strong consumer demand.

How is inflation impacting consumer behavior?

Rising inflation is prompting consumers to adjust their spending habits, prioritizing essential goods and services while potentially delaying discretionary purchases.

What are the potential risks associated with high inflation?

Examine how The CPI Basket of Goods and Services in November 2024: What’s Included? can boost performance in your area.

High inflation can erode purchasing power, lead to economic uncertainty, and potentially trigger a recession or economic slowdown.