Geico Insurance Company 2024 stands as a prominent player in the auto insurance landscape, navigating a dynamic market with its established brand and innovative offerings. This analysis delves into Geico’s current market position, examining its pricing strategies, brand perception, and customer satisfaction levels.

Finding the right insurance can be a complex process, but it’s crucial for protecting your assets and well-being. Insurance 2024 can help you explore various insurance options and find the best fit for your needs.

We’ll explore its core auto insurance products, digital platforms, and recent developments, all within the context of a competitive industry marked by emerging technologies and shifting consumer demands.

The report further examines Geico’s financial performance, including revenue, profitability, and underwriting results. We’ll analyze the factors influencing its financial performance, such as claims costs and investment returns, and compare its financial standing with key competitors. Finally, we’ll discuss the key challenges and opportunities facing Geico in the coming years, considering the potential impact of regulatory changes and technological advancements on its future growth and market share.

Traveling internationally? Make sure you’re covered with the right health insurance. International Health Insurance 2024 provides comprehensive coverage for your health needs while you’re abroad.

Geico’s Current Market Position

Geico, a subsidiary of Berkshire Hathaway, has consistently been a major player in the US auto insurance market. To understand Geico’s current standing, we need to analyze its market share, pricing strategies, brand perception, and customer satisfaction levels.

Market Share and Pricing

As of 2024, Geico holds a significant market share in the auto insurance industry, consistently ranking among the top providers. Geico’s pricing strategies are known for their competitive nature, often offering lower premiums compared to its competitors. This approach has contributed to its success in attracting a large customer base.

Planning a trip? Don’t forget to secure travel insurance! Travel Insurance Online 2024 makes it easy to compare and purchase insurance online, ensuring you’re covered for your journey.

Brand Perception and Customer Satisfaction

Geico has cultivated a strong brand image through its memorable advertising campaigns and focus on customer service. The company is generally perceived as a reliable and trustworthy insurer. Customer satisfaction surveys consistently rank Geico highly, indicating a positive experience for policyholders.

AAA is known for its reliable services, and their home insurance offerings are no exception. Aaa Home Insurance 2024 provides comprehensive coverage and peace of mind for your home.

Key Products and Services

Geico’s core business revolves around auto insurance, but the company has expanded its offerings to include other insurance lines, such as homeowners, renters, and motorcycle insurance. Furthermore, Geico has developed digital platforms and mobile applications to enhance policy management for its customers.

Auto Insurance Products

- Liability Coverage:Covers damages to others’ property or injuries caused by an insured driver.

- Collision Coverage:Covers damages to the insured vehicle in an accident, regardless of fault.

- Comprehensive Coverage:Covers damages to the insured vehicle from non-collision events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage:Protects the insured driver if they are involved in an accident with a driver who lacks or has insufficient insurance.

- Personal Injury Protection (PIP):Covers medical expenses and lost wages for the insured driver and passengers in an accident.

Other Insurance Lines

Geico offers a range of insurance products beyond auto insurance, including:

- Homeowners Insurance:Protects homeowners against damage to their property and liability claims.

- Renters Insurance:Provides coverage for renters’ personal belongings and liability protection.

- Motorcycle Insurance:Covers damages to the insured motorcycle and liability protection for the rider.

Digital Platforms and Mobile Applications

Geico’s digital platforms and mobile applications allow customers to manage their policies online, make payments, file claims, and access policy documents. These features provide convenience and efficiency for policyholders.

Recent Developments and Initiatives

In recent years, Geico has implemented changes in its business model and product offerings to adapt to the evolving insurance landscape. The company has also embraced emerging industry trends like telematics and usage-based insurance.

Business Model and Product Offerings

Geico has continuously refined its business model by investing in technology and automation to streamline operations and improve customer service. The company has also introduced new products and services to cater to the changing needs of its customer base.

For example, Geico has expanded its offerings to include specialized coverage for electric vehicles.

Protecting yourself and your loved ones from critical illnesses is essential. Critical Illness Insurance 2024 provides financial support in case of a serious health event, giving you peace of mind and financial security.

Telematics and Usage-Based Insurance

Geico has embraced telematics, a technology that uses data from vehicles to assess driving behavior and offer personalized insurance rates. This approach allows customers with safer driving habits to potentially benefit from lower premiums. Geico’s adoption of telematics aligns with the industry trend of using data to personalize insurance pricing.

Protecting your home is a top priority, and finding the right insurance policy is crucial. With House Insurance 2024 , you can explore different coverage options and find the best fit for your property.

Marketing Campaigns and Initiatives

Geico is known for its memorable and humorous advertising campaigns, which have played a significant role in building brand awareness and attracting customers. The company continues to invest in innovative marketing initiatives to reach new audiences and maintain its brand visibility.

:

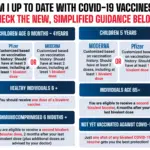

Navigating the world of health insurance can be overwhelming, especially with all the new plans and options available. Luckily, there are resources like Health Insurance Plans 2024 that can help you find the right coverage for your needs and budget.

In 2024, Geico launched a new digital marketing campaign targeting younger demographics through social media and streaming platforms.

Comprehensive insurance provides extensive coverage for various aspects of your life. Comprehensive Insurance 2024 can help you find a policy that meets your specific needs and provides maximum protection.

Competitive Landscape

The auto insurance market is highly competitive, with Geico facing strong competition from established players like State Farm, Progressive, and Allstate. To maintain its competitive advantage, Geico has implemented strategies that focus on pricing, customer service, and technological innovation.

Motorbike enthusiasts need the right insurance for their beloved rides. Motorbike Insurance 2024 offers specialized coverage options for your motorcycle, ensuring you’re protected on the road.

Strengths and Weaknesses

Geico’s strengths include its competitive pricing, strong brand recognition, and commitment to customer service. However, the company faces challenges in areas like its limited product offerings compared to some competitors and the potential for increased claims costs in a volatile economic environment.

Hitting the slopes this winter? Make sure you’re protected with the right insurance. Ski Insurance 2024 provides coverage for your skiing adventures, giving you peace of mind on the mountain.

Strategies for Maintaining Competitive Advantage

Geico’s strategies for maintaining its competitive advantage include:

- Competitive Pricing:Geico continues to focus on offering competitive premiums to attract customers.

- Customer Service Excellence:The company prioritizes providing exceptional customer service to foster loyalty.

- Technological Innovation:Geico invests in technology to enhance its operations, improve customer experiences, and stay ahead of the competition.

Impact of Emerging Insurance Technology Companies

The emergence of insurance technology companies (InsurTechs) is transforming the industry, bringing new approaches to insurance distribution, pricing, and claims processing. While InsurTechs may pose a potential challenge to established players like Geico, they also offer opportunities for collaboration and innovation.

If you have multiple vehicles, finding the right insurance policy can be tricky. Multi Car Insurance 2024 offers convenient options for insuring your fleet, ensuring you’re covered for all your vehicles.

Financial Performance

Geico’s financial performance is a key indicator of its overall health and success. To assess Geico’s financial standing, we need to analyze its revenue, profitability, and underwriting results. It is important to consider factors like claims costs and investment returns that influence Geico’s financial performance.

Revenue, Profitability, and Underwriting Results

Geico’s revenue has grown steadily in recent years, driven by increased policy sales and premium growth. The company has consistently maintained profitability, demonstrating its ability to manage expenses and generate positive returns. Geico’s underwriting results, which measure its profitability from insurance operations, have been generally favorable, indicating efficient claims management and pricing strategies.

Planning a holiday getaway? Don’t break the bank on insurance! Cheap Holiday Insurance 2024 offers affordable options that still provide essential coverage for your trip.

Factors Influencing Financial Performance

Several factors influence Geico’s financial performance, including:

- Claims Costs:The frequency and severity of claims have a significant impact on Geico’s profitability. Higher claims costs can reduce underwriting profits.

- Investment Returns:Geico’s investment portfolio generates returns that contribute to overall profitability. Fluctuations in the financial markets can affect investment returns.

- Competition:Intense competition in the auto insurance market can pressure Geico to lower premiums, potentially impacting profitability.

Comparison with Competitors

Geico’s financial performance compares favorably with its major competitors in terms of revenue growth, profitability, and underwriting results. The company’s strong financial position reflects its efficient operations and competitive strategies.

An IUL policy can be a valuable tool for financial planning and retirement savings. Iul Policy 2024 provides information and resources to help you understand the benefits and features of this type of insurance.

Future Outlook

The future of Geico will be shaped by a range of factors, including regulatory changes, technological advancements, and evolving consumer preferences. The company faces both challenges and opportunities in the coming years.

Maintaining good health is essential, and having the right medical insurance plan can make a big difference. Medical Insurance Plans 2024 can help you compare different plans and find the best coverage for your healthcare needs.

Challenges and Opportunities, Geico Insurance Company 2024

Key challenges facing Geico include:

- Increased Competition:The auto insurance market is becoming increasingly competitive, with the entry of new players and the growth of InsurTechs.

- Rising Claims Costs:Factors like inflation and vehicle repair costs can drive up claims expenses, potentially impacting profitability.

- Regulatory Changes:Changes in insurance regulations can affect Geico’s operations and pricing strategies.

Opportunities for Geico include:

- Growth in the Insurance Market:The overall insurance market is expected to continue growing, providing opportunities for Geico to expand its customer base.

- Technological Advancements:New technologies like artificial intelligence and blockchain can enhance Geico’s operations, improve customer experiences, and create new revenue streams.

- Emerging Insurance Products:The demand for new insurance products, such as coverage for autonomous vehicles and cyber risks, presents opportunities for Geico to expand its offerings.

Impact of Regulatory Changes and Technological Advancements

Regulatory changes, such as those related to data privacy and cybersecurity, can impact Geico’s operations. Technological advancements, such as the development of autonomous vehicles, will require Geico to adapt its products and services to meet the evolving needs of its customers.

Predictions for Future Growth and Market Share

Geico is expected to continue its growth trajectory in the coming years, driven by its strong brand, competitive pricing, and commitment to customer service. The company’s investments in technology and its ability to adapt to industry changes will be key to maintaining its market share and achieving further success.

Ultimate Conclusion: Geico Insurance Company 2024

In conclusion, Geico Insurance Company 2024 faces both challenges and opportunities in the ever-evolving insurance market. Its ability to adapt to changing consumer preferences, embrace technological advancements, and maintain a strong competitive edge will be crucial for its future success.

By carefully navigating these factors, Geico can solidify its position as a leading provider of insurance solutions and continue to thrive in the years to come.

FAQ Corner

What are Geico’s key strengths in the market?

Traveling the world is an exciting adventure, but it’s important to be prepared for unexpected events. Cheap Travel Insurance 2024 provides you with peace of mind, ensuring you’re covered in case of emergencies or travel disruptions.

Geico’s strengths include its strong brand recognition, competitive pricing, and efficient digital platforms.

How does Geico compare to its competitors in terms of customer satisfaction?

Geico consistently ranks highly in customer satisfaction surveys, known for its responsive customer service and user-friendly online tools.

What are some of the emerging technologies impacting the insurance industry?

Emerging technologies such as telematics, artificial intelligence, and blockchain are transforming the insurance landscape, enabling personalized pricing, fraud detection, and automated claims processing.