Geico Commercial Insurance 2024 offers a comprehensive suite of insurance solutions designed to safeguard businesses of all sizes. Whether you’re a small startup or a large corporation, Geico provides tailored coverage that addresses the unique risks your industry faces.

Make sure your holiday plans are covered with Holiday Insurance 2024. This type of insurance can protect you from unexpected events that might disrupt your trip, ensuring your vacation goes smoothly.

From general liability and property insurance to workers’ compensation and auto coverage, Geico ensures your business is protected against unforeseen circumstances.

The Hartford Insurance Company is known for its reliable coverage and excellent customer service. The Hartford Insurance Company 2024 offers a range of products, including auto, home, and business insurance.

Geico’s commitment to customer satisfaction is evident in their competitive pricing, efficient claims processing, and dedicated customer support. They understand the challenges businesses face and strive to provide seamless and personalized insurance experiences.

If you’re looking for travel insurance, consider Blue Cross Travel Insurance 2024. They offer a variety of plans to suit different needs, so you can find the right coverage for your trip.

Geico Commercial Insurance Overview

Geico, a renowned name in the insurance industry, has expanded its offerings to cater to the unique needs of businesses with Geico Commercial Insurance. This comprehensive suite of insurance products provides businesses of all sizes with the protection they need to thrive in today’s competitive landscape.

Insurance doesn’t have to break the bank. Cheap Insurance 2024 can help you find affordable coverage for your needs, without sacrificing quality.

Geico Commercial Insurance is designed to safeguard businesses from a range of potential risks, offering peace of mind and financial stability.

AAA is a trusted name in insurance, and Aaa Insurance 2024 offers a range of products to meet your needs. From auto to home insurance, they can help you protect what matters most.

Key Features and Benefits of Geico Commercial Insurance

Geico Commercial Insurance boasts several key features and benefits that make it an attractive option for businesses:

- Comprehensive Coverage Options:Geico offers a wide range of coverage options to meet the specific needs of various industries and business types. This includes general liability, property, workers’ compensation, and auto insurance, ensuring businesses are protected against a broad spectrum of risks.

Keeping your smile healthy is important, and Blue Cross Dental Insurance 2024 can help you do just that. Their plans provide coverage for a wide range of dental procedures, so you can feel confident about your oral health.

- Competitive Pricing:Geico is known for its competitive pricing structure, making its commercial insurance products accessible to businesses of all sizes. Geico strives to provide value for money while ensuring adequate coverage for its policyholders.

- Exceptional Customer Service:Geico prides itself on providing excellent customer service. Its team of dedicated professionals is available to answer questions, address concerns, and guide businesses through the insurance process, ensuring a smooth and positive experience.

- Digital Convenience:Geico offers a user-friendly online platform and mobile app, allowing businesses to manage their policies, access information, and file claims conveniently from anywhere, anytime.

- Financial Stability:Geico is a financially sound company with a strong track record of paying claims promptly and fairly. This financial stability provides businesses with the assurance that they will be protected in the event of a covered loss.

Industries and Businesses that Benefit from Geico Commercial Insurance, Geico Commercial Insurance 2024

Geico Commercial Insurance is tailored to meet the diverse needs of various industries and businesses. Some examples of businesses that could benefit from Geico’s offerings include:

- Small and Medium-Sized Enterprises (SMEs):Geico provides comprehensive coverage options and competitive pricing, making it an ideal choice for SMEs looking for affordable and effective insurance solutions.

- Retail Businesses:Geico offers coverage for property damage, liability claims, and employee injuries, providing essential protection for retail businesses against various risks.

- Construction Companies:Geico’s commercial insurance policies cater to the specific risks faced by construction companies, including liability for injuries on work sites, property damage, and workers’ compensation.

- Manufacturing Companies:Geico provides comprehensive coverage for manufacturing companies, including product liability, property damage, and business interruption insurance.

- Professional Services Firms:Geico offers professional liability insurance, also known as errors and omissions (E&O) insurance, to protect professional service firms from claims arising from negligence or mistakes.

Types of Coverage Available

Geico Commercial Insurance offers a comprehensive range of coverage options to address the diverse needs of businesses. Here are some of the key types of coverage available:

- General Liability Insurance:This coverage protects businesses from claims arising from bodily injury, property damage, and advertising injury caused by their operations or products. It is essential for businesses that interact with the public or have customers on their premises.

- Property Insurance:This coverage provides financial protection for a business’s physical assets, such as buildings, equipment, inventory, and furniture, against damage or loss caused by fire, theft, vandalism, or natural disasters.

- Workers’ Compensation Insurance:This coverage is required by law in most states and provides benefits to employees who are injured or become ill while on the job. It covers medical expenses, lost wages, and disability benefits.

- Auto Insurance:This coverage protects businesses from financial losses arising from accidents involving company vehicles. It includes liability coverage, collision coverage, and comprehensive coverage, providing comprehensive protection for business vehicles.

- Commercial Umbrella Insurance:This coverage provides additional liability protection beyond the limits of underlying insurance policies, offering an extra layer of security for businesses facing significant financial risks.

- Business Interruption Insurance:This coverage provides financial support to businesses that experience a loss of income due to a covered event, such as a fire or natural disaster, helping them to recover and continue operations.

- Professional Liability Insurance:Also known as errors and omissions (E&O) insurance, this coverage protects businesses that provide professional services, such as accountants, lawyers, and consultants, from claims arising from negligence or mistakes.

Geico’s Target Audience for Commercial Insurance

Geico’s target audience for commercial insurance encompasses businesses of all sizes and industries that prioritize comprehensive protection, competitive pricing, and exceptional customer service. Geico aims to cater to businesses that are seeking a reliable and trustworthy insurance partner to safeguard their operations and financial well-being.

Dental care is important for everyone, and Medicare Dental Plans 2024 can help you access affordable coverage. They offer a variety of plans to choose from, so you can find the one that’s right for you.

Ideal Customer Profile

Geico’s ideal customer profile for commercial insurance includes:

- Businesses with a strong commitment to safety and risk management:Geico values businesses that prioritize safety and implement robust risk management practices, as this often translates into lower insurance premiums.

- Businesses seeking long-term partnerships with their insurance providers:Geico aims to build lasting relationships with its commercial insurance customers, providing consistent and reliable support over the long term.

- Businesses that value digital convenience and efficiency:Geico’s online platform and mobile app cater to businesses that prefer managing their insurance policies and accessing information digitally.

- Businesses that are looking for competitive pricing and value for money:Geico strives to provide affordable and effective insurance solutions, ensuring businesses receive the coverage they need without breaking the bank.

Needs and Challenges of Geico’s Target Businesses

Businesses in Geico’s target audience face various challenges, including:

- Managing risk and liability:Businesses operate in complex environments and face numerous risks, including liability claims, property damage, and employee injuries. They need insurance solutions that provide adequate protection against these risks.

- Controlling costs and maximizing profitability:Businesses constantly seek ways to reduce costs and increase profitability. They need insurance solutions that offer competitive pricing and value for money without compromising coverage.

- Staying compliant with regulations:Businesses must comply with various regulations, including those related to workers’ compensation, environmental protection, and data privacy. They need insurance solutions that help them navigate these complexities.

- Responding to evolving business needs:Businesses operate in dynamic environments and must adapt to changing conditions. They need insurance solutions that are flexible and adaptable to meet their evolving needs.

How Geico Addresses Business Challenges

Geico’s commercial insurance offerings address these challenges by:

- Providing comprehensive coverage options:Geico offers a wide range of coverage options to protect businesses against a variety of risks, including general liability, property damage, workers’ compensation, and auto insurance.

- Offering competitive pricing and value for money:Geico strives to provide affordable and effective insurance solutions, ensuring businesses receive the coverage they need without breaking the bank.

- Providing expert guidance and support:Geico’s team of dedicated professionals is available to answer questions, address concerns, and guide businesses through the insurance process, ensuring a smooth and positive experience.

- Offering digital convenience and efficiency:Geico’s online platform and mobile app allow businesses to manage their policies, access information, and file claims conveniently from anywhere, anytime.

Competitive Landscape for Geico Commercial Insurance: Geico Commercial Insurance 2024

The commercial insurance market is highly competitive, with several major players vying for market share. Geico faces competition from established insurance companies like State Farm, Liberty Mutual, and Travelers, as well as newer entrants like online insurance platforms. Understanding the competitive landscape is crucial for Geico to effectively position its offerings and attract customers.

Life can throw curveballs, and Short Term Disability Insurance 2024 can provide financial support during a temporary disability. It can help you cover expenses while you focus on recovery.

Comparison with Major Competitors

Geico’s commercial insurance offerings are comparable to those of its major competitors in terms of coverage options and pricing. However, Geico differentiates itself through its focus on customer service, digital convenience, and financial stability. Here’s a table comparing Geico’s commercial insurance offerings with those of its major competitors:

| Feature | Geico | State Farm | Liberty Mutual | Travelers |

|---|---|---|---|---|

| Coverage Options | Comprehensive | Comprehensive | Comprehensive | Comprehensive |

| Pricing | Competitive | Competitive | Competitive | Competitive |

| Customer Service | Excellent | Good | Good | Good |

| Digital Convenience | Excellent | Good | Good | Good |

| Financial Stability | Strong | Strong | Strong | Strong |

Strengths and Weaknesses

Geico’s commercial insurance offerings have several strengths, including:

- Competitive pricing:Geico is known for its competitive pricing structure, making its commercial insurance products accessible to businesses of all sizes.

- Exceptional customer service:Geico prides itself on providing excellent customer service, with a dedicated team available to answer questions, address concerns, and guide businesses through the insurance process.

- Digital convenience:Geico offers a user-friendly online platform and mobile app, allowing businesses to manage their policies, access information, and file claims conveniently from anywhere, anytime.

- Strong financial stability:Geico is a financially sound company with a strong track record of paying claims promptly and fairly, providing businesses with the assurance that they will be protected in the event of a covered loss.

However, Geico also faces some challenges in the competitive landscape, including:

- Limited brand recognition in the commercial insurance market:Geico is primarily known for its personal auto insurance, and its brand recognition in the commercial insurance market is still developing.

- Lack of a comprehensive network of independent agents:Geico primarily relies on its direct sales model, which can limit its reach compared to competitors with extensive agent networks.

Geico Commercial Insurance Pricing and Policies

Geico’s pricing structure for commercial insurance is designed to be competitive and transparent, taking into account various factors that influence risk and coverage. The company aims to provide businesses with affordable and effective insurance solutions while ensuring adequate protection.

United Health Care is a major player in the healthcare industry, and United Health Care Medicare 2024 offers a variety of plans to meet the needs of seniors. They provide comprehensive coverage for medical expenses and can help you navigate the Medicare system.

Pricing Structure

Geico’s pricing for commercial insurance is based on a combination of factors, including:

- Industry:Different industries face varying levels of risk, which are reflected in insurance premiums. For example, construction companies typically have higher premiums than retail businesses due to the inherent risks associated with their operations.

- Business size:Larger businesses typically have higher premiums than smaller businesses due to their increased exposure to potential losses.

- Risk factors:Several factors can influence the risk associated with a business, such as its safety record, the types of equipment it uses, and the nature of its operations. These risk factors are considered when determining insurance premiums.

- Coverage options:The specific coverage options selected by a business will also influence the cost of its insurance policy. More comprehensive coverage typically results in higher premiums.

- Deductibles:A deductible is the amount a business pays out of pocket before its insurance policy kicks in. Choosing a higher deductible can result in lower premiums.

Policy Features

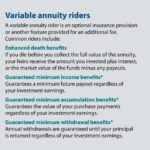

Geico’s commercial insurance policies offer various features that can impact coverage and costs, including:

- Waiver of subrogation:This feature prevents Geico from seeking reimbursement from a business for claims paid out, even if the business is partially responsible for the loss.

- Additional insured endorsements:These endorsements can add additional parties to a policy, such as contractors or vendors, providing them with liability coverage.

- Loss control services:Geico offers loss control services to help businesses identify and mitigate potential risks, which can lead to lower premiums.

- Claims handling services:Geico provides efficient and timely claims handling services, ensuring businesses receive prompt support during the claims process.

Examples of Specific Policy Features

Here are some examples of specific policy features and their impact on coverage and costs:

- Business interruption insurance:This coverage provides financial support to businesses that experience a loss of income due to a covered event, such as a fire or natural disaster. It can help businesses to recover and continue operations during a disruption.

- Product liability insurance:This coverage protects businesses from claims arising from injuries or damages caused by their products. It is essential for businesses that manufacture or sell products.

- Cyber liability insurance:This coverage protects businesses from financial losses arising from cyberattacks, data breaches, and other cyber risks. It can help businesses to recover from cyber incidents and mitigate the impact on their operations.

Customer Experience with Geico Commercial Insurance

Customer experience is a crucial aspect of any insurance offering, and Geico Commercial Insurance strives to provide a positive and seamless experience for its policyholders. The company’s focus on customer service, digital convenience, and efficient claims handling has garnered positive feedback from many businesses.

Starting a business? Business Insurance For Llc 2024 is essential for protecting your assets and mitigating risk. It can help you navigate the challenges of running a business with confidence.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the experiences of businesses with Geico Commercial Insurance. Here are some common themes that emerge from customer feedback:

- Positive customer service:Many customers praise Geico’s customer service representatives for their responsiveness, helpfulness, and professionalism. They appreciate the ability to easily contact Geico and receive prompt assistance with their insurance needs.

- Digital convenience:Customers appreciate the convenience of managing their policies and accessing information online or through the mobile app. They find the platform user-friendly and efficient.

- Competitive pricing:Many customers highlight Geico’s competitive pricing structure as a major advantage, allowing them to obtain comprehensive coverage without breaking the bank.

- Efficient claims handling:Customers generally report positive experiences with Geico’s claims handling process, with claims being processed promptly and fairly.

Pros and Cons of Geico Commercial Insurance

Here’s a table summarizing the pros and cons of Geico’s commercial insurance offerings from a customer perspective:

| Pros | Cons |

|---|---|

| Competitive pricing | Limited brand recognition in the commercial insurance market |

| Exceptional customer service | Lack of a comprehensive network of independent agents |

| Digital convenience | |

| Efficient claims handling | |

| Strong financial stability |

Geico’s Approach to Commercial Insurance Claims

Geico is committed to providing a smooth and efficient claims process for its commercial insurance policyholders. The company understands that claims can be stressful for businesses, and it strives to minimize the impact of a loss by handling claims promptly and fairly.

Your home is your sanctuary, and Allianz Home Insurance 2024 can help you protect it. They offer a range of coverage options to suit different needs, so you can rest assured knowing your home is secure.

Claims Process

Geico’s claims process for commercial insurance policies is designed to be straightforward and user-friendly. Here’s a general overview of the process:

- Report the claim:Businesses can report claims online, through the mobile app, or by phone.

- Gather information:Geico will request information about the claim, such as the date and time of the incident, the nature of the loss, and any relevant documentation.

- Investigate the claim:Geico will investigate the claim to determine the cause of the loss, the extent of the damage, and the validity of the claim.

- Process the claim:Once the investigation is complete, Geico will process the claim and issue a payment to the business for the covered losses.

Commitment to Timely and Efficient Claim Resolution

Geico is committed to resolving claims promptly and efficiently. The company has dedicated claims adjusters who are trained to handle commercial insurance claims effectively. Geico also uses technology to streamline the claims process, making it faster and more convenient for businesses.

Finding the right insurance agent can be a daunting task, but Insurance Agent 2024 can help you find the perfect match for your needs. They have a network of qualified agents who can provide personalized advice and guidance.

Support During the Claims Process

Geico provides businesses with support during the claims process, including:

- 24/7 claims reporting:Businesses can report claims at any time, day or night.

- Dedicated claims adjusters:Businesses are assigned dedicated claims adjusters who are responsible for handling their claim from start to finish.

- Regular updates:Businesses receive regular updates on the status of their claim.

- Access to resources:Geico provides businesses with access to resources, such as legal assistance and repair services, to help them recover from a loss.

Closure

Geico Commercial Insurance 2024 stands out as a reliable and comprehensive solution for businesses seeking peace of mind. With a wide range of coverage options, competitive pricing, and exceptional customer service, Geico empowers businesses to focus on growth and success knowing they are well-protected.

As the insurance landscape evolves, Geico remains at the forefront, adapting to emerging trends and providing innovative solutions to meet the evolving needs of businesses.

Planning a cruise? Don’t forget about Cruise Travel Insurance 2024. This type of insurance can protect you from unexpected events that might disrupt your trip, giving you peace of mind on the high seas.

Popular Questions

What types of businesses can benefit from Geico Commercial Insurance?

Geico Commercial Insurance caters to a wide range of businesses, including retail stores, restaurants, construction companies, healthcare providers, and more. They offer customized coverage options to meet the specific needs of each industry.

How does Geico determine commercial insurance premiums?

Geico’s pricing structure for commercial insurance takes into account various factors, such as the business’s industry, size, location, and risk profile. They also consider factors like the type of coverage needed and the amount of coverage requested.

What are the key benefits of choosing Geico Commercial Insurance?

Key benefits of Geico Commercial Insurance include comprehensive coverage options, competitive pricing, efficient claims processing, dedicated customer support, and a commitment to innovation in the insurance industry.

Finding affordable dental coverage can be a challenge, but Cheap Dental Insurance 2024 can help you find the right plan for your needs. They offer a variety of plans at competitive prices, so you can get the care you need without breaking the bank.

Hitting the slopes? Don’t forget about Ski Insurance 2024. This type of insurance can protect you from injuries or accidents that might occur while you’re enjoying the winter wonderland.