Formula Annuity Certain 2024: In the ever-evolving world of finance, understanding different investment options is crucial. Formula annuity certain, a structured financial product, provides a predictable stream of income for a defined period, making it an attractive option for those seeking financial security and stability.

Annuity products are used in a variety of ways, from retirement planning to estate planning. Annuity Is Used In 2024 can help you learn more about how annuities can be used to meet your specific financial goals.

This comprehensive guide explores the fundamentals of formula annuity certain, its calculations, applications, and considerations for 2024.

Formula annuity certain offers a unique approach to managing your finances. It provides a guaranteed stream of payments for a specific duration, offering a sense of security and peace of mind. Unlike traditional annuities, formula annuity certain utilizes a specific formula to determine the payment amount, ensuring transparency and predictability.

Annuity contracts are a popular financial tool for retirement planning, and if you’re considering an annuity, you’ll want to know how to calculate the cash flows. Calculating Annuity Cash Flows 2024 will help you understand the different types of annuities, the factors that influence their cash flows, and how to estimate your future income stream.

Formula Annuity Certain: Definition and Basics: Formula Annuity Certain 2024

Annuity certain, also known as a fixed-term annuity, is a type of financial product that provides a series of regular payments for a predetermined period of time. This period can be a specific number of years or until a certain date.

The payments are guaranteed and do not depend on the longevity of the recipient. This makes it a reliable and predictable income stream for individuals seeking financial security.

If you’re looking for a way to secure your retirement income, an annuity can be a good option. 7 Annuity Return 2024 can help you explore the different types of annuities available and their potential returns.

Definition and Key Characteristics, Formula Annuity Certain 2024

A formula annuity certain is a type of annuity that pays a fixed amount of money at regular intervals for a specific period of time. The payments are guaranteed and do not depend on the longevity of the recipient. The value of the annuity is determined by the amount of the payments, the frequency of the payments, the interest rate, and the length of the annuity period.

Annuity ownership can be shared with another person, offering flexibility and benefits. Annuity Joint Ownership 2024 can help you explore the different types of joint ownership and their implications.

Difference from Other Annuities

Formula annuity certains differ from other types of annuities in several ways. Unlike variable annuities, whose payments fluctuate based on the performance of underlying investments, formula annuity certains provide a fixed and predictable income stream. Similarly, they differ from life annuities, which continue payments until the death of the recipient, while formula annuity certains have a predetermined duration.

Factors Determining Value

The value of a formula annuity certain is determined by several factors, including:

- Payment Amount:The larger the payment amount, the higher the value of the annuity.

- Payment Frequency:More frequent payments generally lead to a higher annuity value.

- Interest Rate:Higher interest rates result in a higher annuity value.

- Annuity Period:A longer annuity period generally leads to a higher value.

Calculation and Formula

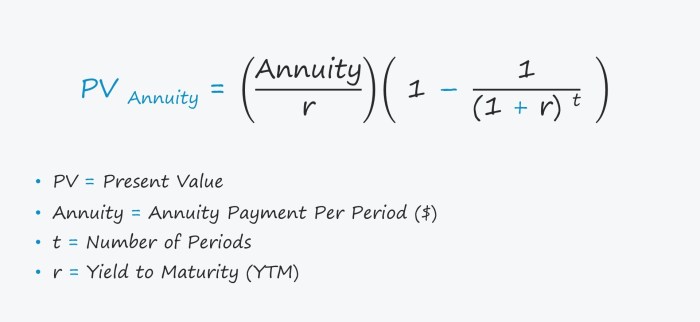

The present value of a formula annuity certain is calculated using a formula that takes into account the payment amount, the frequency of payments, the interest rate, and the length of the annuity period.

If you’re considering an annuity, you might want to know how much you can expect to receive. Annuity 70000 2024 can help you understand how to estimate your annuity payments.

Formula for Present Value

PV = PMT- [1 – (1 + i)^-n] / i

Many people dream of winning the lottery and securing their financial future. An annuity can help you manage those winnings effectively. Annuity Jackpot 2024 can help you understand how annuities can work for lottery winners.

Where:

- PV = Present value of the annuity

- PMT = Payment amount per period

- i = Interest rate per period

- n = Number of periods

Step-by-Step Calculation

- Determine the payment amount (PMT), the interest rate (i), and the number of periods (n).

- Calculate the present value factor using the formula: [1

(1 + i)^-n] / i.

- Multiply the payment amount (PMT) by the present value factor to obtain the present value (PV) of the annuity.

Example Calculation

Suppose you want to calculate the present value of a formula annuity certain that pays $1,000 per month for 10 years at an interest rate of 5% per year compounded monthly. In this case:

- PMT = $1,000

- i = 0.05 / 12 = 0.0041667 (monthly interest rate)

- n = 10 years – 12 months/year = 120 months

Using the formula, the present value of the annuity is:

PV = $1,000- [1 – (1 + 0.0041667)^-120] / 0.0041667 = $95,072.85

Therefore, the present value of this formula annuity certain is $95,072.85.

Before you commit to an annuity, it’s essential to ask the right questions. Annuity Questions 2024 can help you get the information you need to make an informed decision.

Applications and Uses

Formula annuity certains have a wide range of applications in various financial scenarios. They are commonly used for:

Retirement Planning

Formula annuity certains are a popular choice for retirement planning, as they provide a guaranteed stream of income during retirement. They can help individuals ensure they have enough money to cover their living expenses in their later years.

An annuity certain is a type of annuity that provides guaranteed payments for a specific period. Annuity Certain Is An Example Of 2024 can help you understand the concept of an annuity certain and its applications.

Estate Planning

Formula annuity certains can be used in estate planning to provide a steady income stream for beneficiaries after the death of the annuitant. This can help ensure that loved ones are financially secure and can maintain their standard of living.

Business Transactions

Formula annuity certains can be used in business transactions, such as settling lawsuits or funding employee benefits. They provide a predictable and reliable way to make payments over a specific period.

Annuity products can provide a stream of income for a specific period. 4 Annuity 2024 can help you understand the different types of annuities and their potential durations.

Benefits of Using Formula Annuity Certain

Using a formula annuity certain offers several benefits, including:

- Guaranteed Income:Payments are guaranteed for the entire duration of the annuity, providing financial security.

- Predictability:Payments are fixed and predictable, making it easier to budget and plan for the future.

- Flexibility:Formula annuity certains can be tailored to meet specific needs, such as choosing the payment amount, frequency, and duration.

Comparison with Other Financial Instruments

Formula annuity certains offer a different approach to income generation compared to other financial instruments. Unlike stocks or bonds, which carry market risk, formula annuity certains provide a guaranteed income stream. However, they typically offer lower returns than other investments, especially in a rising market.

Role in Financial Planning and Investment Strategies

Formula annuity certains can play a valuable role in financial planning and investment strategies. They can be used to supplement other income sources, provide a safety net for retirement, or generate a steady stream of income for specific purposes. However, it is important to consider the potential risks and trade-offs before investing in a formula annuity certain.

To determine the future value of your annuity payments, you’ll need to know the number of periods. Annuity Number Of Periods Calculator 2024 can help you calculate the number of periods for your annuity.

Types and Variations

Formula annuity certains come in various types, each with unique features and characteristics. These types can be categorized based on the payment structure, interest rate, and other factors.

Dreaming of a comfortable retirement? An annuity could help you achieve that goal. Annuity 2 Million 2024 can help you explore how annuities can help you grow your retirement savings to $2 million or more.

Types of Formula Annuity Certain

- Fixed Annuity:This type of annuity offers a fixed interest rate and payment amount for the entire duration of the annuity. It provides a predictable income stream but may not keep pace with inflation.

- Variable Annuity:This type of annuity offers a variable interest rate and payment amount based on the performance of underlying investments. It has the potential for higher returns but also carries higher risk.

- Indexed Annuity:This type of annuity offers a fixed interest rate but also provides potential for growth based on the performance of a specific index, such as the S&P 500. It offers a balance between stability and potential growth.

Differences and Suitability

The suitability of each type of formula annuity certain depends on individual needs and risk tolerance. Fixed annuities are suitable for those seeking guaranteed income and stability, while variable annuities may be more attractive for those seeking higher returns but willing to accept higher risk.

Calculating the future value of your annuity can be complex, but online tools can help. Annuity Calculator Bankrate 2024 can provide you with a convenient way to estimate your annuity’s future value.

Indexed annuities offer a balance between the two.

Examples of Formula Annuity Certain Products

Various financial institutions offer formula annuity certain products, including:

- Immediate Annuities:These annuities begin paying out immediately after purchase.

- Deferred Annuities:These annuities start paying out at a later date, allowing for accumulation of interest before payments begin.

- Single Premium Annuities:These annuities are purchased with a single lump sum payment.

- Flexible Premium Annuities:These annuities allow for periodic contributions, offering flexibility in funding.

Advantages and Disadvantages

Each type of formula annuity certain has its advantages and disadvantages. It is important to carefully consider these factors before making a decision.

Before purchasing an annuity, it’s crucial to carefully review the contract. Annuity Contract Is 2024 can help you understand the key elements of an annuity contract.

| Type | Advantages | Disadvantages |

|---|---|---|

| Fixed Annuity | Guaranteed income, stability, predictable payments | Lower returns, may not keep pace with inflation |

| Variable Annuity | Potential for higher returns, market participation | Higher risk, fluctuating payments |

| Indexed Annuity | Potential for growth, protection from inflation | Lower returns than variable annuities, limited upside potential |

Considerations and Risks

When evaluating a formula annuity certain, it is crucial to consider several factors and potential risks.

Your 401(k) plan might offer annuity options, and it’s important to understand how these work. Annuity 401k Plan 2024 can help you understand the benefits and drawbacks of annuities in your 401(k) plan.

Key Factors to Consider

- Interest Rates:Higher interest rates generally lead to higher annuity values. However, interest rates can fluctuate, potentially impacting the value of the annuity.

- Fees and Expenses:Formula annuity certains often come with fees and expenses, which can impact the overall returns. It is important to compare different products and understand the fee structure.

- Inflation:Inflation can erode the purchasing power of annuity payments over time. It is important to consider how inflation will impact the value of the annuity.

- Liquidity:Formula annuity certains are generally illiquid, meaning it can be difficult to access the funds before the annuity period ends.

Potential Risks

Investing in a formula annuity certain involves certain risks, including:

- Interest Rate Risk:If interest rates rise after purchasing an annuity, the value of the annuity may decline.

- Inflation Risk:Inflation can erode the purchasing power of annuity payments over time.

- Credit Risk:The financial stability of the issuing company can impact the payment of annuity benefits.

- Liquidity Risk:It can be difficult to access funds from an annuity before the annuity period ends.

Risk Mitigation Strategies

To mitigate these risks, consider the following strategies:

- Diversify Investments:Do not put all your eggs in one basket. Consider diversifying your investments across different asset classes, including stocks, bonds, and real estate.

- Choose a Reputable Issuer:Select an annuity from a financially sound and reputable company with a strong track record.

- Understand the Fee Structure:Carefully review the fees and expenses associated with the annuity before making a decision.

- Consider Inflation Protection:Look for annuities that offer inflation protection to help preserve the purchasing power of your payments.

Choosing the Right Annuity

Choosing the right formula annuity certain depends on individual needs, goals, and risk tolerance. It is essential to consult with a financial advisor to determine the best option for your specific circumstances.

2024 Trends and Outlook

The demand for formula annuity certains is expected to remain strong in 2024, driven by several factors.

There are different types of annuities, and one common type is an annuity due. Annuity Due Is 2024 can help you understand the specifics of an annuity due and its potential benefits.

Current Trends and Outlook

The rising interest rates and economic uncertainty have made fixed-income products, including formula annuity certains, more attractive to investors seeking stability and guaranteed income. This trend is likely to continue in 2024, as investors seek to protect their assets and generate reliable income streams.

Impact of Market Conditions

The current market conditions, characterized by rising inflation and interest rates, have increased the demand for formula annuity certains. These products offer a safe haven for investors seeking to preserve their capital and generate predictable income. This trend is likely to persist in 2024, as market volatility and economic uncertainty continue.

Future Developments and Innovations

The formula annuity certain market is constantly evolving, with new products and innovations emerging to meet changing investor needs. In 2024, we can expect to see more innovative products with features such as:

- Inflation Protection:Annuities with features that help protect against inflation, such as index-linked payments or cost-of-living adjustments.

- Flexibility:Annuities with more flexibility in terms of payment options, withdrawal options, and investment choices.

- Technology Integration:Annuities with enhanced digital capabilities, such as online account management, mobile apps, and personalized financial planning tools.

Factors Influencing Growth and Adoption

Several factors will influence the growth and adoption of formula annuity certains in 2024, including:

- Interest Rate Environment:Rising interest rates are likely to make formula annuity certains more attractive, driving demand for these products.

- Economic Uncertainty:Economic uncertainty and market volatility can increase investor demand for guaranteed income streams, boosting the popularity of formula annuity certains.

- Demographics:The aging population is a key driver of demand for retirement income products, including formula annuity certains.

- Financial Literacy:Increased financial literacy and awareness of the benefits of formula annuity certains can lead to higher adoption rates.

Final Wrap-Up

In conclusion, formula annuity certain presents a compelling financial tool for individuals seeking a consistent income stream with a predictable payout structure. As we move forward in 2024, understanding the intricacies of this financial instrument, its applications, and potential risks is crucial for making informed financial decisions.

By carefully considering your financial goals, risk tolerance, and market conditions, you can determine if formula annuity certain aligns with your investment strategy and helps you achieve your desired financial outcomes.

General Inquiries

What are the main advantages of a formula annuity certain?

Formula annuity certain offers several advantages, including guaranteed income payments for a specified period, predictable cash flow, and potential tax benefits. It can be a valuable tool for retirement planning, income generation, and estate planning.

Are there any risks associated with formula annuity certain?

While formula annuity certain provides predictable income, it does come with certain risks. The value of the annuity may be affected by interest rate fluctuations, inflation, and the financial stability of the issuing company. It’s important to thoroughly research and understand these potential risks before investing.

How does a formula annuity certain differ from a traditional annuity?

Traditional annuities offer a variety of payment options, including fixed, variable, and indexed. Formula annuity certain, on the other hand, uses a specific formula to determine the payment amount, ensuring a more predictable and transparent income stream.

What are some factors to consider when choosing a formula annuity certain?

When choosing a formula annuity certain, consider factors such as the length of the payout period, the interest rate, the issuing company’s financial stability, and the tax implications. It’s also important to assess your individual financial goals, risk tolerance, and investment strategy.