Fixed Rate Mortgage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. A fixed-rate mortgage provides borrowers with a predictable monthly payment for the life of the loan, offering a sense of financial security and stability.

Looking for a peer-to-peer lending platform? Prosper Loans offers a unique way to borrow and lend money, connecting investors with borrowers directly. This platform can be a great option for borrowers with good credit who are looking for competitive rates.

This type of mortgage is a cornerstone of the housing market, offering a predictable path to homeownership for millions.

Building your credit score can be a challenge, but a credit builder loan can help you achieve your financial goals. These loans are designed to help you establish a positive credit history, making it easier to qualify for future loans with better interest rates.

This comprehensive guide explores the intricacies of fixed-rate mortgages, from their fundamental concepts to the factors influencing interest rates. We’ll delve into how these mortgages work, comparing them to other loan types and outlining the process of obtaining one.

Need a loan but don’t know where to start? Loan Places can connect you with lenders who offer a wide range of loan options. Whether you need a personal loan, home loan, or something else, Loan Places makes it easy to find the right lender for your needs.

Ultimately, we’ll equip you with the knowledge to make informed decisions about your home financing.

Looking for a loan to finance your dream pool? Pool loans can help you turn your backyard oasis into reality. They offer flexible terms and competitive rates, making it easier than ever to enjoy the benefits of a sparkling pool.

Ending Remarks: Fixed Rate Mortgage

Understanding fixed-rate mortgages is crucial for anyone navigating the complex world of homeownership. By grasping the fundamentals, comparing options, and considering key factors, you can confidently make informed decisions that align with your financial goals. Whether you’re a first-time buyer or a seasoned homeowner, this guide provides valuable insights into the intricacies of fixed-rate mortgages, empowering you to secure a future of stability and financial peace.

Need money fast? Fast loans can provide quick access to funds, but it’s important to be aware of the potential downsides, such as high interest rates and short repayment terms. Before taking out a fast loan, carefully consider your financial situation and explore other options.

General Inquiries

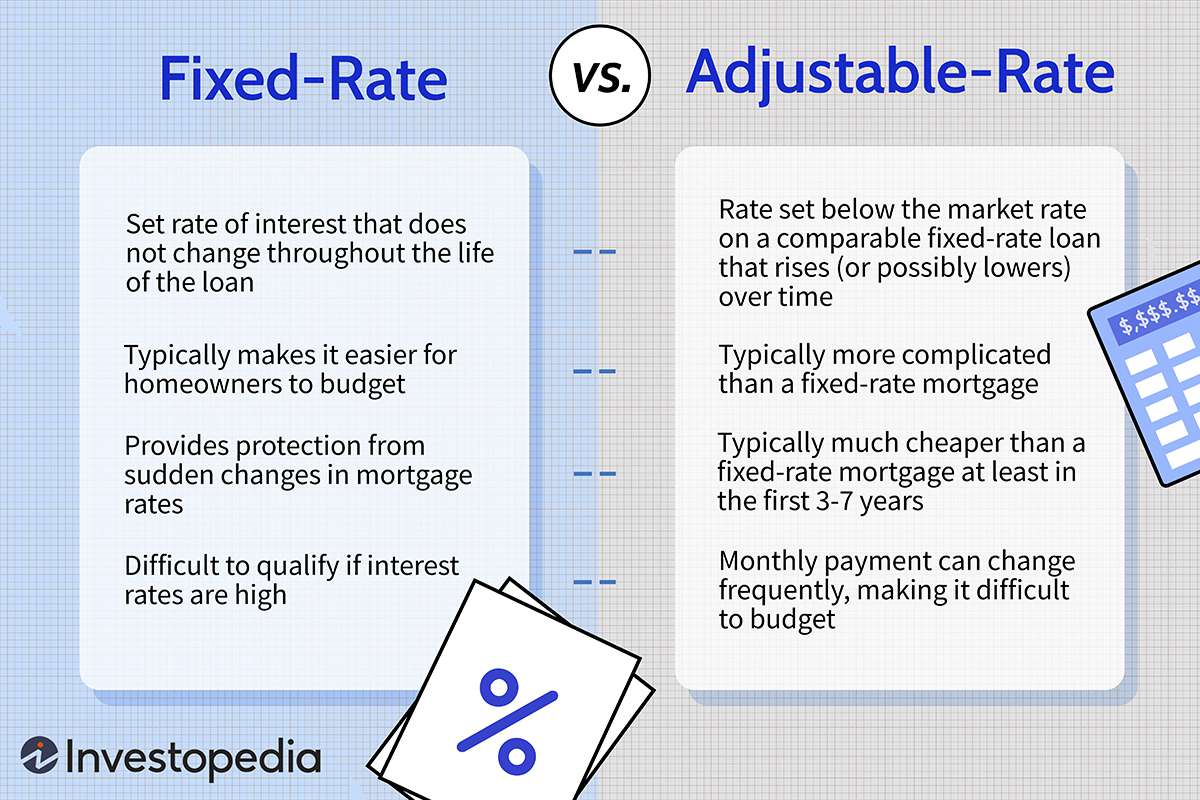

What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage (ARM)?

Considering a second mortgage? Second mortgage rates can vary widely, so it’s important to shop around and compare options before making a decision. Understanding the terms and conditions of these loans is crucial to ensure you’re making the best choice for your financial situation.

A fixed-rate mortgage has an interest rate that remains the same for the entire loan term, while an ARM’s interest rate can adjust periodically based on market conditions.

For small businesses looking for financing, an SBA 7(a) loan can provide the financial support needed to grow and thrive. These loans offer favorable terms and are backed by the Small Business Administration, making them a great option for entrepreneurs.

How do I qualify for a fixed-rate mortgage?

Lenders consider factors like your credit score, income, debt-to-income ratio, and down payment amount when assessing your eligibility for a fixed-rate mortgage.

What are some of the closing costs associated with a fixed-rate mortgage?

Closing costs can include origination fees, appraisal fees, title insurance, and other expenses related to the mortgage process.

Can I refinance my fixed-rate mortgage?

If you’re a PNC Bank customer and need a home equity line of credit, a PNC HELOC might be the perfect solution. These loans offer flexible repayment options and can be used for various purposes, from home improvements to debt consolidation.

Yes, you can refinance your fixed-rate mortgage to potentially lower your interest rate or change the loan term. However, refinancing involves additional costs and may not always be beneficial.

What are some tips for negotiating a lower interest rate on a fixed-rate mortgage?

Shop around for quotes from multiple lenders, improve your credit score, and consider making a larger down payment to potentially negotiate a lower interest rate.

Finding a local lender can be convenient, especially if you prefer face-to-face interactions. Loan companies near me can help you locate lenders in your area, making it easier to discuss your loan options in person.

A second mortgage can be a good option for homeowners who need extra cash, but it’s essential to understand the risks involved. These loans can come with higher interest rates and could potentially put your home at risk if you can’t make payments.

Want to find the best personal loan for your needs? Best personal loans can help you compare different lenders and interest rates to find the most suitable option. These loans offer flexible terms and can be used for various purposes, from debt consolidation to home improvements.

In a pinch and need cash quickly? A cash advance online can provide immediate funds, but these loans often come with high interest rates and fees. It’s crucial to use these loans responsibly and only as a last resort.

For eligible veterans and active military personnel, a VA home loan can offer significant benefits, such as no down payment requirement and competitive interest rates. These loans are designed to help veterans achieve the dream of homeownership.

Need a loan but don’t know where to start? Get A Loan can help you navigate the loan application process and connect you with lenders who offer a wide range of loan options.

Discover offers a variety of financial products, including Discover Loans. These loans can be a good option for borrowers with good credit who are looking for competitive rates and flexible terms.