Fixed Rate 2024: In a year marked by economic uncertainty, understanding the intricacies of fixed-rate mortgages is crucial for both current and prospective homeowners. This guide delves into the factors shaping the fixed-rate mortgage landscape in 2024, providing insights into current trends, economic influences, and considerations for homebuyers.

Wells Fargo is a major lender, and you can find information about their current mortgage rates for 2024 on their website.

From analyzing the impact of inflation and interest rate hikes to exploring the role of the Federal Reserve and emerging market trends, we’ll examine the dynamics that influence fixed-rate mortgages. We’ll also provide a practical guide for homebuyers, equipping them with the knowledge and tools to navigate the complexities of securing a fixed-rate mortgage in today’s market.

For those with less-than-perfect credit, low-doc home loans in 2024 might be an option. However, it’s essential to carefully consider the terms and conditions before making a decision.

Summary: Fixed Rate 2024

As we conclude our exploration of Fixed Rate 2024, it’s evident that the mortgage landscape is constantly evolving. By staying informed about economic factors, market trends, and the considerations for homebuyers, individuals can make informed decisions regarding their mortgage options.

Getting pre-approved for a mortgage in 2024 can be a wise move. It shows sellers that you’re a serious buyer and can strengthen your offer in a competitive market.

Understanding the dynamics of fixed-rate mortgages in 2024 empowers both current and prospective homeowners to navigate the housing market with confidence.

If you’re considering a commercial property, working with a commercial mortgage broker in 2024 can be invaluable. These professionals have expertise in navigating the complex world of commercial lending.

Essential Questionnaire

What are the benefits of a fixed-rate mortgage?

A 40-year mortgage in 2024 might seem like a long commitment, but it can offer lower monthly payments, which could be beneficial for some borrowers.

Fixed-rate mortgages offer the security of a predictable monthly payment for the duration of the loan term, shielding you from fluctuating interest rates.

Carrington Mortgage Services is a well-known lender, and you can find information about their offerings for 2024 on their website, Carrington Mortgage Services 2024.

How do I know if a fixed-rate mortgage is right for me?

If you’re looking to buy a home in 2023 or 2024, it’s important to stay informed about mortgage rates. These rates can fluctuate frequently, so it’s essential to keep track of the current market trends.

Consider your financial goals, risk tolerance, and the anticipated length of your homeownership. If you prefer predictable payments and want to avoid the potential for higher interest rates, a fixed-rate mortgage might be a good fit.

Choosing a 30-year mortgage in 2024 might be a good option for those seeking lower monthly payments, but it’s crucial to consider the overall cost of the loan over the long term.

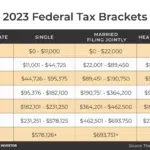

What factors influence the interest rate on a fixed-rate mortgage?

Getting a house loan in 2024 might seem daunting, but with the right information and preparation, you can navigate the process smoothly. Understanding the different loan options available and the factors that influence interest rates can help you secure a favorable deal.

Interest rates are influenced by economic factors such as inflation, the Federal Reserve’s monetary policy, and overall market conditions.

A 15-year mortgage in 2024 offers a shorter repayment period, which can result in lower interest costs over the life of the loan.

If you’re looking to purchase a high-value property, you might need a jumbo mortgage in 2024. These loans have different requirements and rates compared to traditional mortgages.

An interest-only mortgage in 2024 can be an option for those who want lower initial payments, but it’s important to understand that you’ll need to pay off the principal at the end of the loan term.

Keeping an eye on the average mortgage rate in 2024 can provide valuable insight into the current market conditions.

Home equity can be a valuable asset, and understanding the options available for 2024, such as Point Home Equity , can help you make informed financial decisions.

Finding the right mortgage can be a challenging task, but using a mortgage finder in 2024 can simplify the process by comparing rates and terms from different lenders.