Fixed Annuity In IRA 2024: A Comprehensive Guide offers a detailed exploration of fixed annuities and their potential within Individual Retirement Accounts (IRAs). This guide delves into the fundamentals of fixed annuities, their unique features, and the advantages and disadvantages of incorporating them into your IRA investment strategy.

An annuity is essentially a series of equal payments made over a specific period. This article provides a clear definition of an annuity: Annuity Is A Series Of Equal Payments 2024.

From understanding the basics of fixed annuities to exploring the nuances of tax implications and investment options, this guide provides a comprehensive overview of this investment vehicle, equipping you with the knowledge to make informed decisions about your retirement savings.

Annuity certain, a type of annuity with a fixed payment period, is a common topic in financial planning. This article explores the concept of annuity certain in more detail: Is Annuity Certain 2024.

Fixed Annuity Basics

A fixed annuity is a type of insurance contract that provides a guaranteed stream of income payments for a specific period, typically for life. These annuities are known for their stability and predictability, offering a reliable source of income in retirement.

Annuity is a financial tool that can be beneficial in certain situations, but it’s important to understand the potential drawbacks. This article discusses the pros and cons of annuities: Annuity Is Good Or Bad 2024.

Key Features and Benefits

- Guaranteed Interest Rates:Fixed annuities offer a fixed interest rate for the duration of the contract, providing predictable income payments. This can be beneficial in periods of market volatility, as the returns are not subject to fluctuations.

- Principal Protection:The principal amount invested in a fixed annuity is generally protected from market losses. This means that even if interest rates decline, you are guaranteed to receive your initial investment back, along with accumulated interest.

Potential Risks

- Lower Returns:Fixed annuities typically offer lower returns compared to other investments like stocks or bonds, especially in periods of strong market growth.

- Inflation Risk:The fixed interest rate may not keep pace with inflation, eroding the purchasing power of your income payments over time.

- Early Withdrawal Penalties:Most fixed annuities impose penalties if you withdraw funds before a certain period, typically 10 years.

IRA and Fixed Annuities

Fixed annuities can be a valuable addition to an IRA (Individual Retirement Account), offering tax-advantaged growth and income in retirement.

Android WebView 202 has undergone significant API changes, offering developers new ways to interact with web content. For a comprehensive understanding of these changes, explore this article: Android WebView 202 API changes.

Tax Implications

- Tax-Deferred Growth:Interest earned on a fixed annuity within an IRA grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement.

- Tax-Free Withdrawals:When you withdraw funds from a traditional IRA, the distributions are taxed as ordinary income. However, withdrawals from a Roth IRA are generally tax-free.

Advantages and Disadvantages

- Advantages:

- Tax-deferred growth and potentially tax-free withdrawals.

- Guaranteed income stream in retirement.

- Principal protection from market losses.

- Disadvantages:

- Lower returns compared to other IRA investments.

- Potential for inflation risk.

- Early withdrawal penalties.

Fixed Annuity Features and Options

Fixed annuities offer a variety of features and options that can be tailored to meet individual needs and financial goals.

Annuity is also known as a series of regular payments, a concept that’s crucial for understanding financial planning. Read this article for a comprehensive explanation of annuity: Annuity Is Also Known As 2024.

Common Features

- Guaranteed Minimum Interest Rates:These rates ensure a minimum return on your investment, providing a safety net against interest rate fluctuations.

- Death Benefits:Some fixed annuities offer death benefits, which guarantee a payout to your beneficiaries upon your death. This can provide financial security for your loved ones.

- Living Benefits:These features provide additional income or protection in specific situations, such as chronic illness or long-term care.

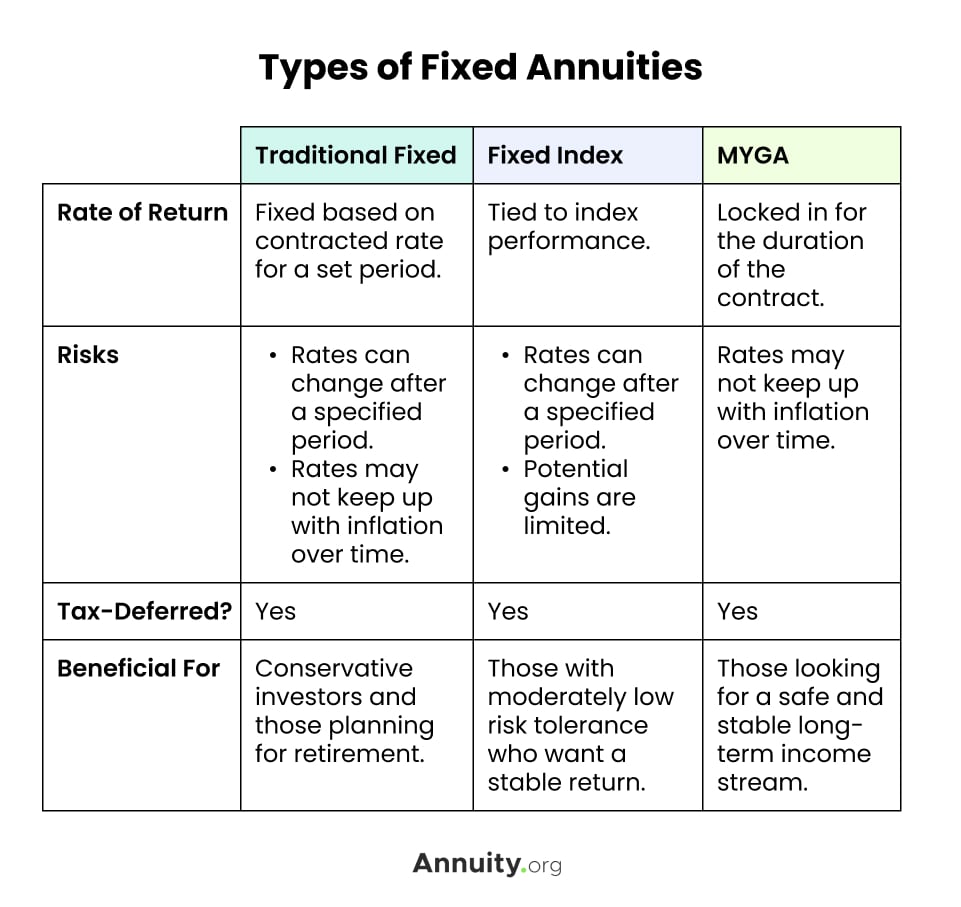

Types of Fixed Annuities

- Single Premium Fixed Annuities (SPFA):These annuities require a lump sum payment upfront, typically for a longer term, and offer higher interest rates.

- Flexible Premium Fixed Annuities (FPFA):These annuities allow you to make regular contributions over time, offering more flexibility in your investment strategy.

- Indexed Fixed Annuities (IFA):These annuities link their returns to the performance of a specific index, such as the S&P 500, while still providing principal protection.

Factors to Consider, Fixed Annuity In Ira 2024

- Investment Goals:Determine your primary financial objectives, such as retirement income, income protection, or estate planning.

- Risk Tolerance:Assess your comfort level with market volatility and potential losses. Fixed annuities offer a lower risk profile compared to other investments.

- Time Horizon:Consider how long you plan to hold the annuity, as the duration of the contract can impact returns and penalties.

Fixed Annuities vs. Other IRA Investments: Fixed Annuity In Ira 2024

Fixed annuities are just one investment option within an IRA. It’s essential to compare them with other popular investment types to determine the most suitable strategy for your individual circumstances.

Google Tasks 2024 offers a variety of features that are particularly helpful for entrepreneurs. This article highlights how Google Tasks can be used effectively for entrepreneurial endeavors: Google Tasks 2024: Google Tasks for Entrepreneurs.

Comparison with Stocks, Bonds, and Mutual Funds

| Investment Type | Advantages | Disadvantages |

|---|---|---|

| Fixed Annuities | Guaranteed interest rates, principal protection, tax-deferred growth. | Lower returns compared to other investments, potential inflation risk, early withdrawal penalties. |

| Stocks | Potential for high returns, diversification opportunities. | Volatility and potential for losses, requires active management. |

| Bonds | Lower risk than stocks, potential for income generation. | Lower returns than stocks, interest rate risk. |

| Mutual Funds | Diversification, professional management, access to a wide range of investment options. | Fees, potential for losses, market risk. |

Choosing the Right Investment Strategy

- Financial Goals:Your investment strategy should align with your specific financial objectives, such as retirement income, wealth accumulation, or estate planning.

- Risk Tolerance:Your comfort level with market fluctuations should influence your investment choices. Fixed annuities offer a lower risk profile, while stocks and other growth-oriented investments carry higher risk.

- Time Horizon:The duration of your investment horizon plays a significant role. Longer time horizons allow for greater potential growth, while shorter horizons may favor lower-risk investments.

Considerations for 2024

The fixed annuity market is constantly evolving, influenced by factors such as interest rate changes, economic conditions, and regulatory updates.

Annuity is a common topic in financial planning, often appearing in multiple-choice questions (MCQ). This article delves into the concept of annuity and its relevance in MCQs: Annuity Is A Mcq 2024.

Impact of Current Market Conditions

- Interest Rate Environment:Rising interest rates can impact fixed annuity returns, as providers may offer lower interest rates to compensate for the higher cost of borrowing.

- Inflation:High inflation can erode the purchasing power of fixed income investments, including fixed annuities.

Potential Impact of Interest Rate Changes

- Rising Interest Rates:Higher interest rates may lead to lower returns on new fixed annuity contracts, as providers adjust their rates to reflect the higher cost of borrowing.

- Falling Interest Rates:Lower interest rates may benefit existing fixed annuity holders, as their guaranteed rates may remain higher than new contracts.

New Regulations and Changes

- Regulatory Updates:The insurance industry is subject to ongoing regulatory changes, which may impact the features and availability of fixed annuities.

- Market Trends:The fixed annuity market is dynamic, with new products and features emerging regularly.

Fixed Annuity Strategies

Fixed annuities can be incorporated into a diversified investment portfolio within an IRA to achieve specific financial goals.

Deciding between an annuity and drawdown can be a challenging choice. This article compares the two options to help you make an informed decision: Is Annuity Better Than Drawdown 2024.

Sample Portfolio Allocation

A sample portfolio allocation strategy for an IRA might include a combination of fixed annuities, stocks, and bonds, with the specific allocation depending on individual risk tolerance, time horizon, and financial goals. For example, a conservative investor with a long-term horizon might allocate 20% of their IRA to a fixed annuity, 40% to stocks, and 40% to bonds.

The Snapdragon 2024 processor is making waves in the tech world with its impressive AI and machine learning capabilities. Check out this article for a deep dive into the Snapdragon 2024’s AI prowess: Snapdragon 2024 AI and machine learning capabilities.

This allocation provides a balance between income generation, growth potential, and risk mitigation.

Android WebView 202 is packed with new features, offering developers greater flexibility and control over web content. Discover the latest features in this article: Android WebView 202 new features.

Rationale and Potential Benefits

- Income Generation:The fixed annuity component provides a guaranteed stream of income in retirement, providing financial security and predictable cash flow.

- Growth Potential:The stock and bond components offer the potential for long-term capital appreciation, helping to keep pace with inflation and grow wealth over time.

- Risk Mitigation:The fixed annuity component acts as a ballast, protecting the portfolio from market losses and providing a safety net for income during retirement.

Potential Risks and Limitations

- Lower Returns:The fixed annuity component may limit overall portfolio returns, especially in periods of strong market growth.

- Inflation Risk:The fixed interest rate on the annuity may not keep pace with inflation, eroding the purchasing power of income payments.

- Early Withdrawal Penalties:Withdrawing funds from the annuity before a certain period may result in penalties.

Case Studies

| Case Study | Investment Goals | Risk Tolerance | Outcome | Factors Contributing to Success/Failure |

|---|---|---|---|---|

| John, age 65, retired teacher | Guaranteed income stream, preserve principal | Low | Successful | Fixed annuity provided predictable income, principal was protected. |

| Mary, age 55, entrepreneur | Growth potential, long-term wealth accumulation | High | Mixed | Stock investments generated strong returns, but also experienced some losses. Fixed annuity provided a safety net. |

| David, age 45, corporate executive | Retirement planning, tax-advantaged growth | Moderate | Successful | Diversified portfolio with a fixed annuity component helped to achieve long-term financial goals. |

Summary

In conclusion, Fixed Annuities can offer a valuable addition to your IRA investment strategy, providing guaranteed interest rates and principal protection. However, it is essential to carefully consider the potential risks and limitations associated with these investments, including limited growth potential and potential surrender charges.

Annuity certain, a type of annuity with a fixed payment period, is a great example of how financial planning can provide peace of mind. You can learn more about annuity certain in this article: Annuity Certain Is An Example Of 2024.

Ultimately, the decision of whether or not to include a fixed annuity in your IRA portfolio should be based on your individual financial goals, risk tolerance, and long-term investment objectives.

Top FAQs

What are the potential downsides of fixed annuities in an IRA?

While fixed annuities offer guaranteed interest rates and principal protection, they may also have limitations, such as limited growth potential compared to other investments, potential surrender charges if you withdraw funds early, and the possibility of interest rates declining over time.

A common question about annuities is whether the death benefit is taxable. This article delves into the tax implications of annuity death benefits: Is Annuity Death Benefit Taxable 2024.

How do fixed annuities affect my IRA withdrawals?

Withdrawals from a fixed annuity within an IRA are generally subject to the same tax rules as other IRA distributions. This means that withdrawals before age 59 1/2 are typically subject to taxes and a 10% penalty.

Google Tasks 2024 is a popular task management app, but how does it stack up against its competitors? This article provides a detailed comparison of Google Tasks with other task management apps: Google Tasks 2024: Comparison to Other Task Management Apps.

Are there any fees associated with fixed annuities in an IRA?

Yes, fixed annuities may have various fees, including annual fees, surrender charges, and administrative fees. It’s crucial to carefully review the fee structure of any fixed annuity before making a decision.

Annuity is a financial product often used to provide a steady stream of income during retirement. This article explains the primary use of annuities: An Annuity Is Primarily Used To Provide 2024.

How do I choose the right fixed annuity for my IRA?

Selecting the right fixed annuity depends on your individual needs and goals. Consider factors such as guaranteed interest rates, surrender charges, death benefits, living benefits, and the financial stability of the insurance company issuing the annuity.

The Snapdragon 2024 boasts impressive 5G connectivity, delivering lightning-fast speeds and seamless mobile experiences. Learn more about the Snapdragon 2024’s 5G capabilities here: Snapdragon 2024 5G connectivity.