First Health Insurance 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 marks a pivotal moment in the evolution of health insurance, driven by a confluence of factors that are reshaping the industry landscape.

Looking for health insurance in 2024? Day Insurance offers a range of plans to suit your needs, whether you’re looking for individual coverage or family coverage.

This comprehensive guide will delve into the key trends, considerations, and financial aspects of first health insurance, providing valuable insights for individuals seeking to navigate this evolving market.

Protecting your business is crucial. D&O Insurance can help shield your company from liability claims.

From the rise of telehealth and personalized medicine to the changing demographics and technological advancements, the first health insurance market is experiencing a dynamic transformation. Understanding these forces is crucial for individuals making informed decisions about their health coverage. This guide will equip readers with the knowledge and tools necessary to choose the right plan, manage their healthcare expenses, and maximize the value of their first health insurance coverage.

Renters insurance is essential for protecting your belongings. Liberty Mutual Renters Insurance offers competitive rates and reliable coverage.

The Rise of First Health Insurance in 2024

The first health insurance market is experiencing a significant surge in 2024, driven by a confluence of factors that are making health coverage increasingly essential for individuals. This surge is fueled by a combination of demographic shifts, technological advancements, and evolving healthcare needs.

Looking for moped insurance? Moped Insurance can help you find the right policy for your needs.

Key Factors Driving Growth

Several key factors are propelling the growth of the first health insurance market in 2024. These include:

- Growing Awareness of Healthcare Costs:Individuals are becoming increasingly aware of the rising costs associated with healthcare, leading them to seek financial protection through health insurance.

- Shifting Demographics:An aging population, with its associated health concerns, is driving up demand for health insurance. Additionally, a growing number of young adults are entering the workforce and seeking coverage.

- Technological Advancements:Technological innovations, such as telehealth and personalized medicine, are making healthcare more accessible and affordable, increasing the value proposition of health insurance.

- Government Initiatives:Government policies and initiatives aimed at promoting health insurance coverage are also playing a role in driving market growth.

Changing Demographics and Demand

The changing demographics of the population are having a significant impact on the demand for first health insurance. As the population ages, the incidence of chronic diseases increases, leading to higher healthcare costs. This, in turn, is driving demand for comprehensive health insurance plans that can provide financial protection against these costs.

If you’re interested in a faith-based health sharing ministry, Medishare Insurance is worth checking out. They offer a community-based approach to healthcare.

Furthermore, the growing number of young adults entering the workforce is also contributing to the rise in demand for first health insurance. These individuals are often starting families and need coverage for themselves and their dependents. The increasing prevalence of lifestyle-related health conditions among young adults is also contributing to the demand for health insurance.

Colonial Life Insurance is a popular choice for supplemental coverage. You can learn more about their plans for 2024 at Colonial Life Insurance 2024.

Technology’s Impact on First Health Insurance, First Health Insurance 2024

Technology is playing a transformative role in shaping the first health insurance landscape. Telehealth, which enables patients to consult with doctors remotely, is making healthcare more accessible and convenient. This is reducing the need for expensive and time-consuming in-person visits, potentially leading to lower healthcare costs.

AIG is a well-known name in the insurance industry. If you’re looking for car insurance, check out their options at AIG Car Insurance 2024.

Personalized medicine, which tailors treatment plans to individual patients based on their genetic makeup and other factors, is also changing the way healthcare is delivered. This approach can lead to more effective treatments and better outcomes, potentially reducing the overall cost of healthcare.

For seniors looking for Medicare Advantage plans, Humana Medicare Advantage Plans offer a wide selection of options to suit different needs and budgets.

Technology is also streamlining the process of purchasing and managing health insurance. Online platforms and mobile apps are making it easier for individuals to compare plans, get quotes, and enroll in coverage.

Need insurance for your bike? Getting a quote online is easy with Bike Insurance Online. They offer competitive rates and comprehensive coverage.

Types of First Health Insurance Plans in 2024

The first health insurance market offers a variety of plans to meet different needs and budgets. These plans can be categorized into several broad types, each with its own features, benefits, and limitations.

| Plan Type | Key Features | Benefits | Limitations |

|---|---|---|---|

| Individual Health Insurance | Coverage for individuals, typically purchased directly from an insurance company. | Wide range of coverage options, flexibility in choosing providers. | Higher premiums compared to group plans, limited benefits for pre-existing conditions. |

| Group Health Insurance | Coverage provided through an employer or organization. | Lower premiums compared to individual plans, often more comprehensive coverage. | Limited choice of providers, coverage may be lost if employment changes. |

| Short-Term Health Insurance | Temporary coverage for individuals who are between jobs or do not qualify for other plans. | Affordable premiums, provides coverage for a limited period. | Limited benefits, may not cover pre-existing conditions, often has high deductibles. |

| Catastrophic Health Insurance | Designed to cover catastrophic medical expenses, typically for young, healthy individuals. | Low premiums, provides coverage for major medical events. | High deductibles, limited coverage for routine medical care. |

Key Considerations for Choosing First Health Insurance

Selecting the right first health insurance plan is a crucial decision that requires careful consideration. Individuals should evaluate their health needs, coverage requirements, and budget constraints before making a choice. Here are some key factors to consider:

- Health Needs:Assess your current health status and any pre-existing conditions. Consider the likelihood of needing medical care in the future.

- Coverage Requirements:Determine the types of medical services you need coverage for, such as doctor visits, hospital stays, prescription drugs, and mental health services.

- Budget Constraints:Consider your financial situation and how much you can afford to spend on premiums, deductibles, and copayments.

- Provider Network:Choose a plan that includes your preferred doctors and hospitals.

- Benefits and Exclusions:Carefully review the benefits and exclusions of each plan to ensure it meets your needs.

Trends Shaping the Future of First Health Insurance

The first health insurance market is constantly evolving, driven by emerging trends that are reshaping the industry. These trends include:

- Telehealth:Telehealth is becoming increasingly integrated into health insurance plans, offering virtual consultations and remote monitoring services. This is making healthcare more accessible and convenient, while potentially reducing costs.

- Preventive Care:Health insurance plans are increasingly emphasizing preventive care, covering services like screenings and vaccinations. This is aimed at promoting early detection and prevention of health issues, leading to better health outcomes and lower overall healthcare costs.

- Personalized Medicine:Personalized medicine is gaining traction, with insurance plans exploring ways to cover genetic testing and other personalized treatments. This approach can lead to more effective and efficient healthcare, potentially reducing costs in the long run.

Financial Aspects of First Health Insurance in 2024

Understanding the financial aspects of first health insurance is crucial for making informed decisions. Here are some key cost considerations:

- Premiums:The monthly cost of your health insurance plan.

- Deductibles:The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Copayments:A fixed amount you pay for specific medical services, such as doctor visits or prescriptions.

- Coinsurance:A percentage of the cost of medical services that you are responsible for after your deductible has been met.

Managing healthcare expenses effectively is essential, especially when considering the costs associated with health insurance. Here are some strategies to maximize the value of your coverage:

- Choose a Plan That Fits Your Needs and Budget:Carefully consider your health needs, coverage requirements, and financial situation when selecting a plan.

- Utilize Preventive Care Benefits:Take advantage of preventive care services covered by your plan, such as screenings and vaccinations, to promote early detection and prevention of health issues.

- Compare Prices for Prescription Drugs:Shop around for the best prices on prescription drugs, as prices can vary significantly between pharmacies.

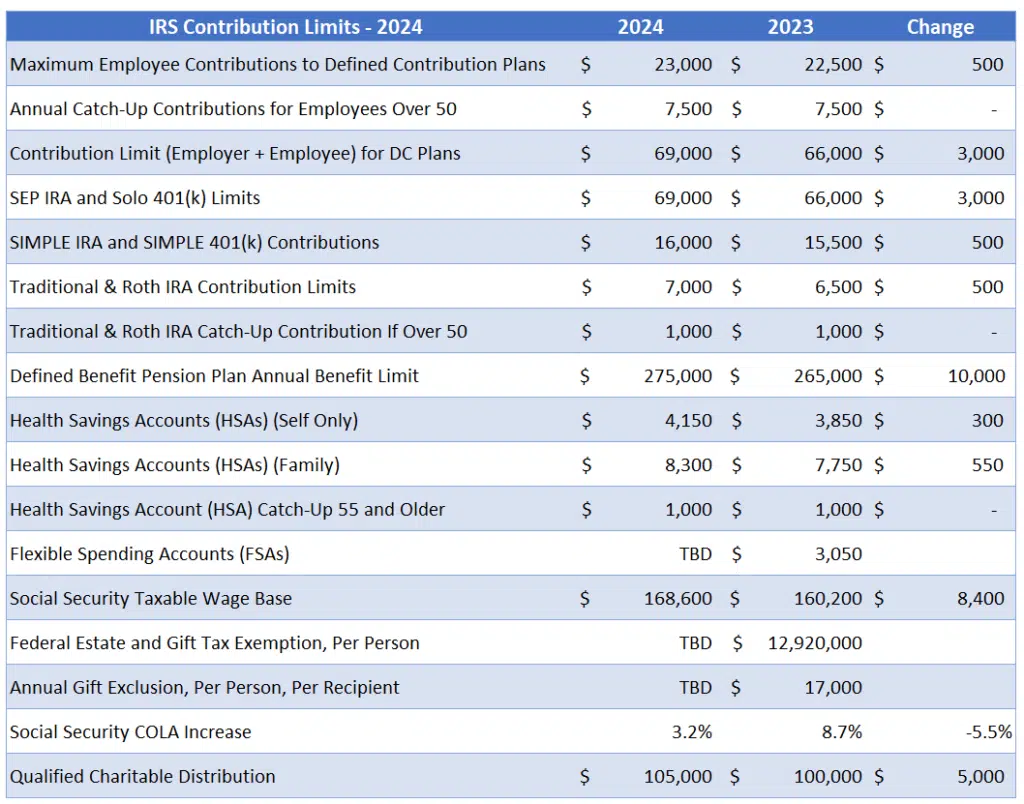

- Consider a Health Savings Account (HSA):If you have a high-deductible health plan, consider opening an HSA to save pre-tax money for healthcare expenses.

| Plan Type | Average Monthly Premium (2024) |

|---|---|

| Individual Health Insurance | $450

Workers Compensation insurance is a legal requirement for most employers. Find out more about your options at Workers Compensation 2024.

|

| Group Health Insurance | $200

If you live in California and are looking for health insurance, Covered California is a great resource. They offer a variety of plans to choose from and can help you find affordable coverage.

|

| Short-Term Health Insurance | $100

Aetna is a leading provider of dental insurance. Learn more about their plans for 2024 at Aetna Dental 2024.

|

| Catastrophic Health Insurance | $50

For those who prefer a more established name, Blue Cross Blue Shield is a solid choice. They’re known for their nationwide coverage and strong reputation.

|

Resources and Support for First Health Insurance

Navigating the first health insurance market can be daunting, but there are resources and support services available to assist individuals. Here are some key sources of information and assistance:

- Government Agencies:The Centers for Medicare & Medicaid Services (CMS) provides information and resources on health insurance options.

- Insurance Brokers:Insurance brokers can help you compare plans and find the best coverage for your needs.

- Healthcare Providers:Your doctor or other healthcare providers can offer guidance on health insurance options and coverage.

- Online Platforms:Websites like Healthcare.gov and eHealth provide tools for comparing plans and enrolling in coverage.

Epilogue

As we conclude our exploration of First Health Insurance 2024, it’s evident that the landscape is undergoing a profound shift. Individuals are empowered to take control of their health and navigate the insurance market with confidence. By understanding the key factors driving the growth of the first health insurance market, considering individual needs, and leveraging available resources, individuals can make informed decisions that secure their health and financial well-being.

User Queries: First Health Insurance 2024

What are the main types of first health insurance plans available in 2024?

First health insurance plans in 2024 typically fall into categories like individual health insurance, family health insurance, and student health insurance. Each plan offers varying levels of coverage, benefits, and premiums, tailored to specific needs and budgets.

Planning a trip abroad? Don’t forget to get Blue Cross Travel Insurance for peace of mind while you’re away.

How can I find the right first health insurance plan for me?

Start by assessing your health needs, budget, and coverage requirements. Research different plans, compare features, and consider factors like deductibles, copayments, and network coverage. Consulting with an insurance broker or healthcare provider can provide valuable guidance.

What are some strategies for managing healthcare expenses?

If you’re in Florida, you might want to consider Ambetter Sunshine Health. They’re a well-respected provider with a variety of plans to choose from.

Strategies for managing healthcare expenses include utilizing preventive care services, understanding your plan’s coverage, negotiating medical bills, and exploring cost-saving options like generic medications and telehealth services.