Eyemed Insurance 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. EyeMed Insurance has become a trusted name in vision care, providing comprehensive coverage for individuals, families, and employers.

Professionals need protection! Errors And Omissions Insurance 2024 can shield you from financial risks related to your work.

This guide delves into the intricacies of EyeMed Insurance, exploring its coverage, benefits, pricing, network, customer experience, and alternatives. Whether you’re seeking information on eye exams, eyeglasses, contact lenses, or simply curious about the world of vision insurance, this comprehensive exploration will illuminate the path to optimal eye care.

EyeMed Insurance stands out for its diverse plan options, catering to a wide range of needs and budgets. From individual plans that prioritize personal vision care to comprehensive family coverage, EyeMed offers a spectrum of choices. The company’s dedication to customer satisfaction is evident in its user-friendly online platforms, accessible customer support channels, and streamlined claim processing procedures.

This guide will also shed light on the nuances of EyeMed’s network of vision care providers, ensuring you have the information needed to make informed decisions about your eye care.

EyeMed Insurance Overview: Eyemed Insurance 2024

EyeMed Insurance is a leading provider of vision care plans in the United States. It offers a range of plans to meet the needs of individuals, families, and employers. EyeMed is known for its extensive network of vision care providers, affordable premiums, and comprehensive coverage for various vision care services.

Supplement your Medicare coverage! Medigap Plans 2024 can help you pay for out-of-pocket expenses and reduce your medical bills.

Core Services Offered by EyeMed Insurance

EyeMed Insurance provides a comprehensive suite of vision care services, including:

- Eye Exams:EyeMed plans cover routine eye exams, which are essential for detecting vision problems and ensuring eye health.

- Eyeglasses:Coverage for eyeglasses includes frames, lenses, and coatings. Plan benefits may vary in terms of the allowance for frame selection and lens options.

- Contact Lenses:EyeMed plans often cover contact lenses, including soft, hard, and specialty lenses. Coverage limits and frequency of replacement may vary by plan.

- Vision Therapy:Some EyeMed plans may cover vision therapy, which is a specialized treatment for vision-related issues like amblyopia (lazy eye) or strabismus (crossed eyes).

- Laser Vision Correction:While EyeMed doesn’t typically cover laser vision correction procedures like LASIK, some plans may offer discounts or rebates for these services.

Types of Vision Care Plans Available

EyeMed Insurance offers a variety of vision care plans to cater to different needs and budgets:

- Individual Plans:These plans are designed for individuals who are not covered by employer-sponsored insurance. They provide coverage for vision care services on a personal basis.

- Family Plans:Family plans provide coverage for multiple individuals within a household. They are often more cost-effective than purchasing individual plans for each family member.

- Employer-Sponsored Plans:Many employers offer EyeMed vision insurance as part of their employee benefits package. These plans typically provide coverage for employees and their dependents.

History of EyeMed Insurance

EyeMed Insurance has a long history of providing vision care solutions. It was founded in 1987 and has since grown to become one of the largest vision insurance providers in the United States. EyeMed has a strong track record of innovation and customer satisfaction, constantly adapting its offerings to meet the evolving needs of its members.

New Jersey residents, get covered! Getcoverednj 2024 provides resources and information to help you find health insurance.

EyeMed Insurance Coverage and Benefits

EyeMed Insurance plans offer coverage for a wide range of vision care needs, ensuring that members have access to the care they require.

Find out how much you could be paying for car insurance in 2024. Car Insurance Price 2024 provides insights into current rates and trends.

Coverage for Various Vision Care Needs

EyeMed plans typically cover the following vision care services:

- Routine Eye Exams:EyeMed plans cover regular eye exams, which are essential for detecting and managing vision problems. These exams typically include a comprehensive eye health evaluation, refraction, and visual field testing.

- Eyeglasses:EyeMed plans provide coverage for eyeglasses, including frames, lenses, and coatings. Coverage limits may vary by plan, but generally include an allowance for frame selection and a certain amount for lenses.

- Contact Lenses:EyeMed plans often cover contact lenses, including soft, hard, and specialty lenses. Coverage may include a specific number of lenses per year or a set allowance for contact lens purchases.

- Vision Therapy:Some EyeMed plans may cover vision therapy, which is a specialized treatment for vision-related issues like amblyopia or strabismus. This coverage may vary by plan and may require prior authorization.

Trusted by many, Travelers Auto Insurance 2024 offers reliable coverage and excellent customer service.

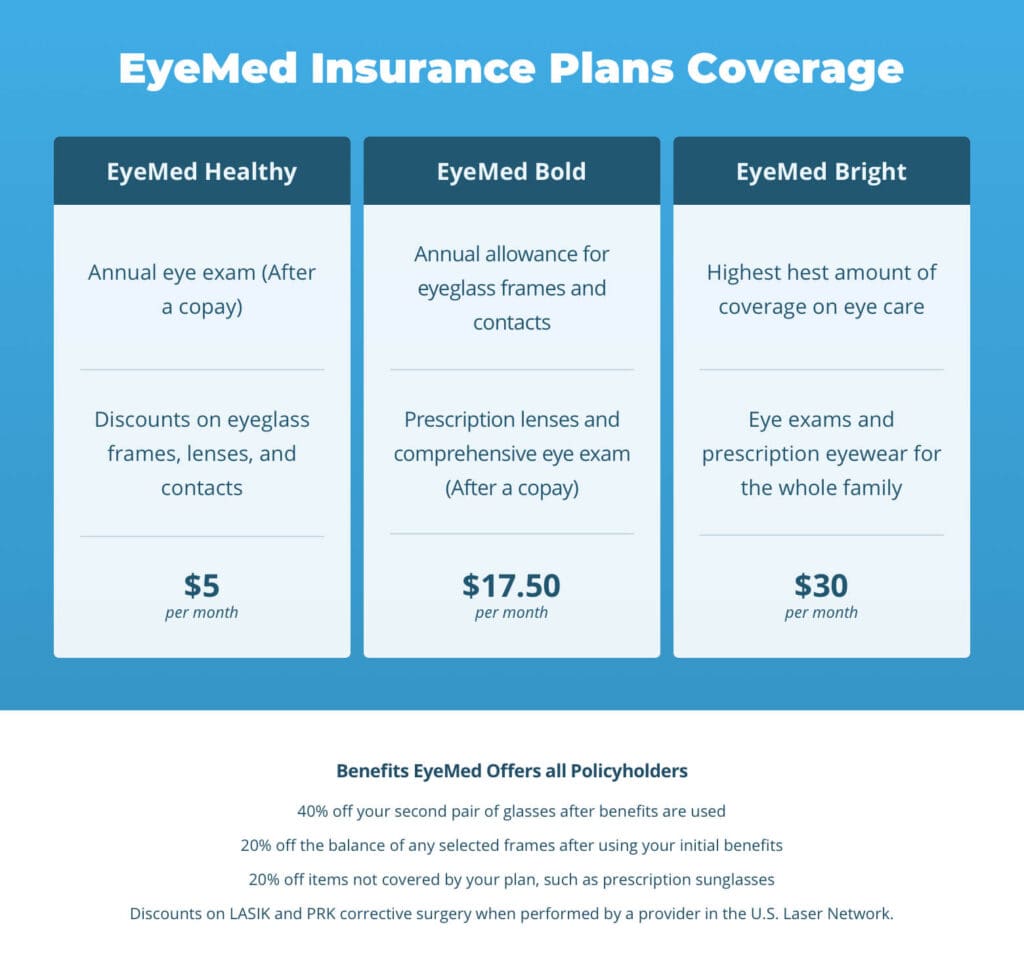

Comparison of Plan Options

EyeMed Insurance offers different plan options with varying coverage levels and deductibles.

AARP members, explore your healthcare options! Aarp Unitedhealthcare 2024 offers a range of plans designed specifically for seniors.

- Basic Plans:These plans typically have lower premiums but offer limited coverage for vision care services. They may have higher deductibles and lower coverage allowances for eyeglasses and contact lenses.

- Premium Plans:Premium plans offer more comprehensive coverage for vision care services, including higher coverage allowances for eyeglasses and contact lenses. They may also have lower deductibles and broader coverage for vision therapy and other specialized services.

Additional Benefits and Discounts

EyeMed Insurance may offer additional benefits and discounts to its members, such as:

- Discounts on Laser Vision Correction:While EyeMed doesn’t typically cover laser vision correction procedures, some plans may offer discounts or rebates for these services.

- Prescription Drug Discounts:Some EyeMed plans may offer discounts on prescription drugs, particularly those related to eye health.

- Retailer Discounts:EyeMed may have partnerships with retailers, providing members with discounts on eyewear, contact lenses, and other vision care products.

EyeMed Insurance Pricing and Costs

The cost of EyeMed Insurance premiums can vary depending on several factors.

Factors Influencing Premiums

Several factors influence the cost of EyeMed Insurance premiums, including:

- Plan Type:Premium plans with more comprehensive coverage typically have higher premiums than basic plans.

- Age:Older individuals may face higher premiums due to a greater risk of vision problems.

- Geographic Location:Premiums may vary based on the cost of living and healthcare expenses in a particular geographic area.

- Coverage Limits:Plans with higher coverage limits for eyeglasses, contact lenses, and other services may have higher premiums.

- Deductibles:Plans with lower deductibles may have higher premiums.

Looking for the best coverage for your family? Family Health Insurance 2024 can help you compare plans and find the right fit for your needs and budget.

Cost Variations Between Plan Options

EyeMed Insurance offers a range of plan options with varying costs.

- Basic Plans:Basic plans typically have lower premiums but may have higher deductibles and lower coverage allowances for vision care services.

- Premium Plans:Premium plans offer more comprehensive coverage and may have lower deductibles but typically have higher premiums.

Examples of Out-of-Pocket Expenses

Here are some examples of potential out-of-pocket expenses for common vision care services:

- Eye Exam:The copay for a routine eye exam may range from $10 to $50, depending on the plan.

- Eyeglasses:The out-of-pocket expense for eyeglasses can vary significantly based on the frame selection, lens options, and coverage limits of the plan. The copay for eyeglasses may range from $25 to $100.

- Contact Lenses:The out-of-pocket expense for contact lenses can also vary depending on the type of lenses, the frequency of replacement, and the coverage limits of the plan.

EyeMed Insurance Network and Provider Access

EyeMed Insurance has a vast network of vision care providers across the United States.

Make smarter insurance decisions! Smart Insurance 2024 offers tools and resources to help you find the best policies for your needs.

Network of Vision Care Providers

EyeMed Insurance has a comprehensive network of vision care providers, including:

- Ophthalmologists:Eye doctors who specialize in diagnosing and treating eye diseases and conditions.

- Optometrists:Eye doctors who provide comprehensive eye care, including eye exams, contact lens fitting, and treatment for vision problems.

- Opticians:Professionals who dispense eyeglasses and contact lenses.

Looking for affordable auto insurance? The General Auto Insurance 2024 offers flexible coverage options for drivers of all backgrounds.

Finding an In-Network Provider

To find an in-network vision care provider in your area, you can:

- Use the EyeMed Provider Directory:The EyeMed website and mobile app provide a directory of in-network providers by location.

- Contact EyeMed Customer Service:EyeMed customer service representatives can help you locate in-network providers in your area.

Planning a trip? Annual Travel Insurance 2024 can provide peace of mind with comprehensive coverage for your travels.

Using Out-of-Network Providers

While it’s generally recommended to use in-network providers, you may have the option to see an out-of-network provider. However, using out-of-network providers may result in higher out-of-pocket expenses.

Don’t overpay for car insurance! Cheap Car Insurance 2024 can help you find affordable rates from top-rated providers.

EyeMed Insurance Customer Experience

EyeMed Insurance strives to provide a positive customer experience for its members.

Customer Testimonials and Reviews, Eyemed Insurance 2024

EyeMed Insurance has generally received positive customer reviews, with members praising its extensive network of providers, affordable premiums, and responsive customer service.

Customer Support Channels

EyeMed Insurance offers various customer support channels to assist members:

- Phone:EyeMed has a dedicated customer service phone line for members to reach representatives for assistance.

- Website:The EyeMed website provides a wealth of information, including FAQs, plan details, and provider directories.

- Email:Members can contact EyeMed customer service via email for inquiries or concerns.

Mobile home owners, don’t forget your insurance! Mobile Home Insurance 2024 can provide peace of mind with specialized coverage for your unique property.

Claim Processing Procedures

EyeMed Insurance has a straightforward claim processing procedure:

- Submit Claims:Members can submit claims electronically through the EyeMed website or mobile app, or by mail.

- Claim Processing Time:EyeMed aims to process claims promptly, with typical processing times ranging from a few days to a couple of weeks.

EyeMed Insurance Comparisons and Alternatives

EyeMed Insurance is a popular choice for vision care coverage, but it’s essential to compare it with other providers to find the best plan for your needs.

Comparison with Other Vision Insurance Providers

EyeMed Insurance competes with other major vision insurance providers in the market, such as:

- VSP Vision:VSP is a leading provider of vision care plans, known for its extensive network of providers and comprehensive coverage options.

- Humana:Humana offers a range of vision care plans, often bundled with other health insurance products.

- UnitedHealthcare:UnitedHealthcare provides vision care plans as part of its broader health insurance offerings.

Secure your family’s future with a life insurance policy. Fidelity Life Insurance 2024 offers various plans to meet your individual needs and budget.

Strengths and Weaknesses of EyeMed Insurance

EyeMed Insurance has several strengths, including:

- Extensive Provider Network:EyeMed has a large network of vision care providers across the United States.

- Affordable Premiums:EyeMed offers competitive premiums, making vision insurance accessible to a wide range of individuals and families.

- Comprehensive Coverage:EyeMed plans offer coverage for a variety of vision care services, including eye exams, eyeglasses, contact lenses, and vision therapy.

Alternative Options for Vision Care Coverage

Besides traditional vision insurance plans, other options for vision care coverage include:

- Standalone Vision Plans:These plans provide coverage specifically for vision care services, separate from health insurance.

- Bundled Health Insurance Packages:Some health insurance providers offer bundled packages that include vision care coverage as part of a comprehensive health insurance plan.

EyeMed Insurance for Specific Demographics

EyeMed Insurance offers plans that cater to the specific needs of different demographics.

Suitability for Families

EyeMed Insurance plans are well-suited for families, offering family plans that provide coverage for multiple individuals within a household. Family plans can be more cost-effective than purchasing individual plans for each family member.

Suitability for Seniors

EyeMed Insurance plans can be beneficial for seniors, as vision problems become more common with age. EyeMed plans cover routine eye exams, which are essential for detecting and managing age-related vision changes.

Suitability for Individuals with Specific Vision Needs

EyeMed Insurance offers plans that may cover vision therapy, which is a specialized treatment for vision-related issues like amblyopia or strabismus. Individuals with specific vision needs should carefully review the coverage details of different EyeMed plans to ensure they meet their requirements.

Special Programs and Discounts

EyeMed Insurance may offer special programs and discounts for particular groups, such as:

- Discounts for Seniors:Some EyeMed plans may offer discounts for seniors.

- Programs for Military Families:EyeMed may have programs specifically designed for military families.

Potential Challenges or Limitations

While EyeMed Insurance offers comprehensive coverage for many vision care needs, it’s important to be aware of potential challenges or limitations:

- Limited Coverage for Certain Services:EyeMed plans may have limitations on coverage for certain services, such as laser vision correction or specialized vision therapy.

- Out-of-Network Expenses:Using out-of-network providers can result in higher out-of-pocket expenses.

Closing Summary

As you navigate the landscape of vision care, EyeMed Insurance emerges as a valuable resource. This guide has provided a comprehensive overview of EyeMed’s services, outlining its coverage, benefits, pricing, network, customer experience, and alternatives. With a clear understanding of EyeMed’s offerings, you can confidently choose the plan that best aligns with your vision care needs and financial considerations.

EyeMed Insurance stands ready to support your journey towards optimal eye health, ensuring you have the vision you need to experience the world in all its vibrancy.

Detailed FAQs

What are the different types of EyeMed Insurance plans available?

Protect your home with a trusted provider. State Farm Homeowners Insurance 2024 offers comprehensive coverage and excellent customer service.

EyeMed offers a variety of plan options, including individual, family, and employer-sponsored plans. Each plan type provides different coverage levels and benefits to suit different needs and budgets.

Protect yourself financially in case of an accident. Gap Insurance 2024 can cover the difference between your car’s value and what your insurance pays.

How can I find an in-network EyeMed provider near me?

You can easily locate in-network providers on EyeMed’s website by entering your zip code or location. The website also provides provider details, including contact information and directions.

What are the typical processing times for EyeMed claims?

EyeMed claims processing times vary depending on the complexity of the claim. However, most claims are processed within a few business days.

What are the potential out-of-pocket expenses for common vision care services?

Out-of-pocket expenses for vision care services depend on the specific plan you choose. Some common expenses include deductibles, copayments, and coinsurance.

Are there any special programs or discounts available for specific demographics?

EyeMed may offer special programs or discounts for certain demographics, such as seniors, students, or military personnel. Contact EyeMed directly for more information.