EV tax credit changes in October 2024 are poised to significantly impact the electric vehicle landscape. These changes, driven by a combination of policy objectives and market realities, will reshape the incentives for both consumers and manufacturers. The historical context of the EV tax credit, which has played a crucial role in driving adoption, will be reviewed, along with the motivations behind the recent modifications.

Stay informed about the latest developments regarding the Virginia tax rebate. Get the latest news and updates on the Virginia tax rebate news and updates for October 2024.

The new eligibility criteria, a key focus of the changes, will be dissected, highlighting the differences from previous requirements and the implications for various vehicle types. This analysis will provide insights into how these changes are likely to affect consumer purchasing decisions, the dynamics of the used EV market, and the overall trajectory of EV adoption.

EV Tax Credit Changes in October 2024

The EV tax credit, a key incentive for Americans to adopt electric vehicles, is undergoing significant changes in October 2024. These changes, part of the Inflation Reduction Act (IRA) of 2022, aim to reshape the landscape of the EV market, influencing consumer choices, industry strategies, and the overall trajectory of EV adoption in the United States.

Curious about the latest updates on stimulus checks? Check out the October 2024 stimulus check news updates for the most recent information.

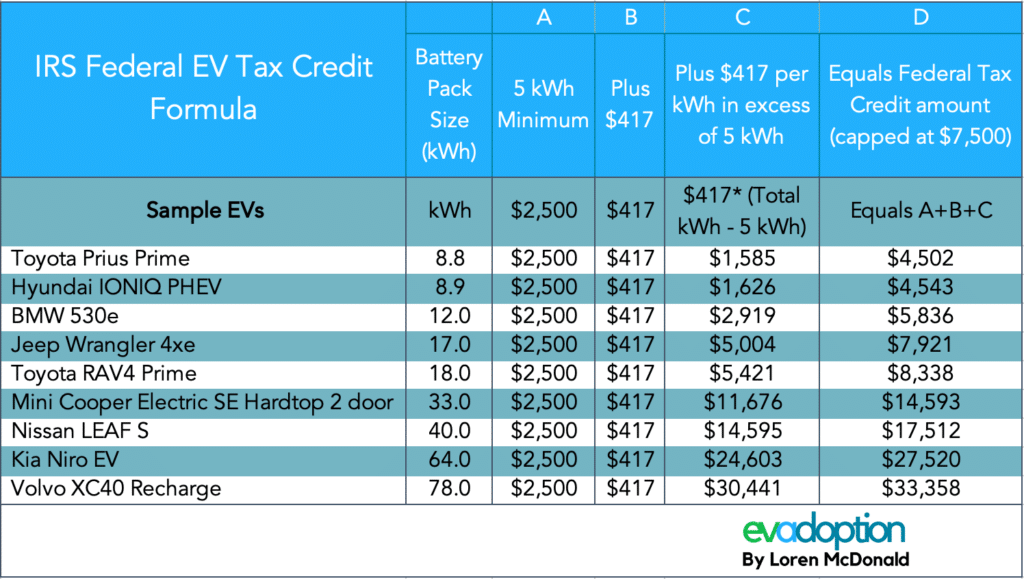

The EV tax credit has a rich history, having been introduced in 2009 to encourage the development and adoption of EVs. The initial credit, capped at $7,500, provided a significant financial incentive for consumers to purchase EVs, contributing to the early growth of the EV market.

Over the years, the credit has undergone various modifications, with adjustments to the eligibility criteria and the maximum credit amount.

The recent changes in the EV tax credit are primarily driven by a desire to promote American manufacturing, address climate change, and ensure equitable access to EV benefits. The IRA aims to incentivize the production of EVs and their components within the United States, while also encouraging the adoption of vehicles with a lower environmental impact.

The entertainment and media industry is constantly evolving. Learn about the key events that shaped the industry in the third quarter of 2024.

Eligibility Criteria

The new eligibility requirements for the EV tax credit are designed to promote American-made EVs and prioritize vehicles with lower emissions. The key changes include:

- Vehicle Assembly:The vehicle must be assembled in North America. This requirement aims to support domestic manufacturing and job creation in the EV industry.

- Battery Component Sourcing:A certain percentage of battery components must be sourced from North America or countries with free trade agreements with the United States. This aims to promote the development of a domestic battery supply chain.

- Critical Mineral Sourcing:A percentage of critical minerals used in the battery must be extracted or processed in North America or countries with free trade agreements. This requirement aims to reduce reliance on foreign sources for these critical minerals.

- Price Caps:The tax credit is limited to vehicles with a maximum retail price of $55,000 for sedans and $80,000 for SUVs and pickup trucks. This aims to ensure that the credit benefits a broader range of consumers, including those with more modest incomes.

Wondering how to claim your Virginia tax rebate? You can find all the information you need about the Virginia tax rebate in October 2024 , including eligibility requirements and how to apply, right here.

- Income Limits:There are income limits for individuals and households to qualify for the full credit. This aims to ensure that the benefits of the credit are directed towards those who need it most.

The new eligibility criteria differ significantly from the previous requirements. Earlier versions of the tax credit primarily focused on the vehicle’s electric drive system and did not have strict requirements regarding vehicle assembly, battery sourcing, or price caps. The new requirements create a more nuanced and complex set of criteria, which can be challenging for consumers to navigate.

As the economy shifts, it’s important to stay informed about potential stimulus plans. Discover the potential economic stimulus plans for October 2024.

These changes will have a significant impact on different vehicle types. For example, imported EVs that do not meet the new sourcing and assembly requirements will no longer qualify for the full tax credit. Similarly, high-priced luxury EVs may not be eligible due to the price caps.

This could lead to a shift in consumer preferences towards American-made EVs with lower price tags.

Taylor Swift is a global superstar, and her net worth reflects her incredible success. Curious about how much she’s worth? You can learn about Taylor Swift’s net worth in October 2024 here.

Impact on Consumers, EV tax credit changes in October 2024

The changes in the EV tax credit are likely to have a mixed impact on consumer behavior. On the one hand, the credit can provide a significant financial incentive for those who qualify, making EVs more affordable and accessible. This could lead to an increase in EV adoption rates, particularly among consumers who are price-sensitive.

However, the new eligibility requirements could also create confusion and uncertainty for consumers, making it more difficult to determine which EVs qualify for the full credit.

When can you expect to receive your Virginia tax rebate? Get a clear timeline and payment dates with the Virginia tax rebate timeline and payment dates for October 2024.

The financial implications for consumers buying EVs will depend on their individual circumstances and the specific vehicle they choose. Those who qualify for the full credit will experience a significant reduction in the upfront cost of their EV. However, those who do not meet the eligibility criteria may find that the cost of an EV remains relatively high, potentially hindering their decision to purchase an EV.

Wondering if you’re eligible for a stimulus payment? Check the eligibility requirements for stimulus payments in October 2024 to find out.

The changes in the EV tax credit are also likely to have an impact on the used EV market. As new EVs that meet the eligibility criteria become more prevalent, the value of older, non-compliant EVs could decline. This could make used EVs more affordable for budget-conscious consumers but could also lead to a decrease in the resale value of older EVs.

Impact on the EV Industry

The changes in the EV tax credit are expected to have a significant impact on the EV industry, both in the United States and globally. EV manufacturers will need to adapt their production and sourcing strategies to comply with the new requirements.

Families struggling financially might be eligible for the Virginia tax rebate. Find out if you qualify for the Virginia tax rebate for low-income families in October 2024.

This could involve shifting production to North America, establishing partnerships with domestic battery suppliers, and adjusting their vehicle designs to meet the price caps.

Taylor Swift’s net worth is impressive, but how does it compare to other musicians? Discover Taylor Swift’s net worth compared to other musicians.

The changes could also accelerate the development and production of EVs in the United States. By incentivizing domestic manufacturing and battery sourcing, the tax credit creates a more favorable environment for EV production in the country. This could lead to increased investment in EV research and development, as well as the creation of new jobs in the EV sector.

The supply chain for EV components is likely to be significantly impacted by the changes. The requirement for domestic sourcing of battery components and critical minerals could create a surge in demand for these materials, potentially leading to higher prices and supply chain disruptions.

This could also incentivize the development of new domestic mining and processing facilities for these critical minerals.

Taylor Swift’s investments are a significant part of her wealth. Learn about Taylor Swift’s net worth from her investments to see how her financial strategy contributes to her success.

Environmental Implications

The changes in the EV tax credit are expected to have a positive impact on the environment by accelerating the transition to electric vehicles. By making EVs more affordable and accessible, the credit could encourage consumers to switch from gasoline-powered vehicles to EVs, reducing greenhouse gas emissions and improving air quality.

Economic stimulus plans are often debated. Learn about the potential downsides of a stimulus in October 2024 by reading about the potential drawbacks of a stimulus in October 2024.

The requirement for domestic battery sourcing and critical mineral extraction could have both positive and negative environmental implications. On the one hand, it could lead to the development of more sustainable mining practices and the creation of a more environmentally responsible battery supply chain.

If you’re wondering how much the Virginia tax rebate will be, find out what is the amount of the Virginia tax rebate in October 2024.

On the other hand, it could also increase the environmental impact of mining activities if not properly managed.

If you believe you qualify for a stimulus check, learn about the October 2024 stimulus check application process to submit your request.

The long-term impact of these changes on climate change mitigation will depend on the effectiveness of the policies and regulations implemented to support the transition to EVs. If the changes lead to a significant increase in EV adoption and a corresponding decrease in greenhouse gas emissions, they could contribute to a more sustainable future.

However, if the changes fail to achieve their intended goals, they may have a limited impact on climate change mitigation.

Future Outlook

The future of EV tax credits remains uncertain, with the potential for further changes in policy and regulations. The IRA has established a framework for EV incentives, but the specific details of these incentives may evolve over time in response to changing market conditions, technological advancements, and evolving environmental priorities.

Understand the government’s approach to layoffs in October 2024. Find out about the government policies related to layoffs in October 2024.

The October 2024 changes to the EV tax credit represent a significant step towards promoting the adoption of electric vehicles in the United States. The long-term implications of these changes will depend on how effectively they are implemented and how the EV market responds to these incentives.

Final Summary

The EV tax credit changes in October 2024 present a complex landscape with far-reaching implications. The impact on consumers, manufacturers, and the environment will be closely watched. This analysis has explored the key aspects of these changes, highlighting their potential consequences for the future of electric vehicles.

As the EV market continues to evolve, it is crucial to stay informed about these shifting incentives and their impact on the transition to a sustainable transportation future.

FAQ Overview: EV Tax Credit Changes In October 2024

What are the main reasons for the EV tax credit changes in October 2024?

The changes are driven by a combination of factors, including the need to ensure the credit targets truly sustainable vehicles, promote domestic manufacturing, and address concerns about the program’s cost.

Will the changes affect the price of EVs?

The impact on EV prices is complex and will depend on factors like manufacturer response and market demand. Some manufacturers might adjust prices to reflect the new credit structure, while others might maintain current pricing.

What happens to the EV tax credit for used vehicles?

The changes in October 2024 are primarily focused on new EV purchases. The tax credit for used EVs remains unchanged for now.