Equivest Variable Annuity Series 100 2024 offers a unique approach to retirement planning, combining the security of an annuity with the potential for growth through investment options. This series provides a comprehensive solution for individuals seeking to protect their assets while aiming for long-term financial security.

For a quick and easy way to calculate your annuity, try the Annuity Calculator Quick 2024. This tool can help you estimate your future payments and understand the total amount you can expect to receive from your annuity.

The Equivest Variable Annuity Series 100 2024 is designed to cater to a wide range of investor profiles, offering a variety of investment options to suit different risk tolerances and financial goals. The product features a range of guarantees, including death benefits and living benefits, providing peace of mind for both the investor and their beneficiaries.

Annuity is not the same as life insurance. The Is Annuity Life Insurance 2024 article clarifies the differences between annuities and life insurance, helping you understand the unique features of each.

This comprehensive guide will delve into the key features, investment options, and potential benefits and risks associated with this annuity.

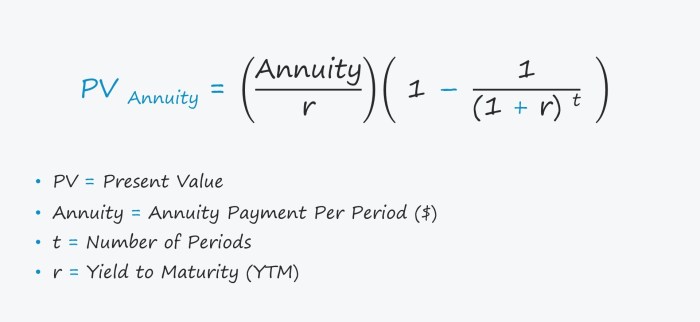

Visualizing your annuity’s present value can be helpful. The Pv Annuity Chart 2024 page offers a chart that visually represents the present value of your annuity, making it easier to understand its value.

Equivest Variable Annuity Series 100 2024 Overview

Equivest Variable Annuity Series 100 2024 is a variable annuity designed to provide investors with the potential for growth while offering certain guarantees. This product allows individuals to allocate their investments across a variety of sub-accounts, each representing a different investment strategy.

Understanding the present value of your annuity is crucial. The Annuity Is Present Value 2024 page can help you grasp the concept of present value and how it relates to your annuity payments.

The performance of these sub-accounts is directly linked to the underlying investments, meaning that the value of your annuity can fluctuate based on market conditions. While there is no guarantee of returns, Equivest Variable Annuity Series 100 2024 offers certain features designed to protect your principal and provide a steady stream of income in retirement.

To figure out how much you’ll receive in regular payments, use the Calculate Annuity Amount 2024 tool. This calculator can help you determine the amount of each payment based on your annuity’s terms and conditions.

This comprehensive guide will delve into the key aspects of this product, exploring its features, investment options, contractual provisions, tax implications, and suitability for various investor profiles.

Annuity due is a type of annuity where payments are made at the beginning of each period. The Calculating Annuity Due 2024 article explains the concept of annuity due and how to calculate its value.

Key Features

Equivest Variable Annuity Series 100 2024 offers a range of features that cater to different investment goals and risk tolerances. Some key features include:

- Investment Flexibility:Choose from a diverse range of investment options, allowing you to customize your portfolio based on your risk appetite and investment goals.

- Potential for Growth:The variable nature of the annuity allows your investment to potentially grow in line with the performance of the underlying investments.

- Guaranteed Income Options:Access various living benefit options that can provide a guaranteed stream of income during retirement, regardless of market performance.

- Death Benefit Protection:Ensure that your beneficiaries receive a minimum death benefit, even if the market value of your annuity has declined.

- Tax-Deferred Growth:Your investment earnings grow tax-deferred, allowing you to potentially maximize your returns over time.

Investment Options

Equivest Variable Annuity Series 100 2024 offers a variety of investment options, allowing you to allocate your investment based on your risk tolerance and investment goals. These options can include:

- Equity Sub-accounts:These sub-accounts invest in stocks, offering the potential for higher returns but also carrying higher risk.

- Fixed Income Sub-accounts:These sub-accounts invest in bonds, providing a more stable and predictable income stream with lower risk compared to equities.

- Balanced Sub-accounts:These sub-accounts offer a blend of stocks and bonds, aiming to provide a balanced portfolio with moderate risk and potential for growth.

- Target-Date Funds:These sub-accounts automatically adjust the asset allocation over time, becoming more conservative as you approach retirement.

Contractual Provisions and Guarantees

Equivest Variable Annuity Series 100 2024 includes several contractual provisions designed to protect your investment and provide certain guarantees. These provisions can include:

- Death Benefit Guarantee:This provision ensures that your beneficiaries will receive a minimum death benefit, regardless of the market value of your annuity at the time of your death.

- Living Benefit Options:These options can provide a guaranteed stream of income during retirement, even if the market value of your annuity declines. Some common living benefit options include guaranteed minimum income benefits (GMIBs) and guaranteed minimum withdrawal benefits (GMWBs).

- Surrender Charges:These charges may apply if you withdraw your investment before a certain period, typically a few years. The surrender charge is designed to protect the insurer from losses incurred by early withdrawals.

Tax Implications

Understanding the tax implications of Equivest Variable Annuity Series 100 2024 is crucial for maximizing your returns. Key tax considerations include:

- Tax-Deferred Growth:Your investment earnings grow tax-deferred within the annuity, meaning you will not pay taxes on the earnings until you withdraw them.

- Taxable Withdrawals:When you withdraw money from the annuity, the withdrawals are typically taxed as ordinary income.

- Potential Tax Advantages:Some withdrawals, such as those taken after age 59 1/2, may qualify for preferential tax treatment. However, it’s important to consult with a tax advisor to determine your specific tax situation.

| Tax Consideration | Explanation |

|---|---|

| Tax-Deferred Growth | Earnings within the annuity grow tax-deferred, meaning you will not pay taxes on them until you withdraw them. |

| Taxable Withdrawals | Withdrawals from the annuity are generally taxed as ordinary income. |

| Potential Tax Advantages | Some withdrawals, such as those taken after age 59 1/2, may qualify for preferential tax treatment. |

Comparison with Other Annuities, Equivest Variable Annuity Series 100 2024

Equivest Variable Annuity Series 100 2024 competes with other variable annuity products available in the market. When comparing this product with its competitors, consider factors such as:

- Investment Options:The range and diversity of investment options offered by each product.

- Fees and Expenses:The fees associated with each product, including annual fees, surrender charges, and expense ratios.

- Guarantees and Benefits:The types and levels of guarantees offered, such as death benefits, living benefits, and income guarantees.

- Contractual Provisions:The terms and conditions of the annuity contract, including the surrender charge schedule and the availability of riders or optional features.

| Feature | Equivest Variable Annuity Series 100 2024 | Competitor A | Competitor B |

|---|---|---|---|

| Investment Options | [Insert details] | [Insert details] | [Insert details] |

| Fees and Expenses | [Insert details] | [Insert details] | [Insert details] |

| Guarantees and Benefits | [Insert details] | [Insert details] | [Insert details] |

| Contractual Provisions | [Insert details] | [Insert details] | [Insert details] |

Potential Risks

Investing in Equivest Variable Annuity Series 100 2024 involves certain risks that you should carefully consider before making a decision. These risks include:

- Market Volatility:The value of your annuity can fluctuate based on the performance of the underlying investments, meaning you could experience losses during periods of market downturn.

- Loss of Principal:There is no guarantee that you will recover your initial investment, and you could potentially lose a portion of your principal. It is crucial to consider your risk tolerance and investment goals before investing.

- Fees and Expenses:The fees and expenses associated with the annuity can impact your overall returns. It’s essential to understand all fees and expenses before investing.

- Surrender Charges:These charges may apply if you withdraw your investment before a certain period. This can limit your access to your funds and impact your returns.

Suitable Investor Profiles

Equivest Variable Annuity Series 100 2024 may be suitable for a variety of investor profiles, depending on individual circumstances, investment goals, and risk tolerance. This product may be particularly well-suited for:

- Individuals Seeking Growth Potential:The variable nature of the annuity offers the potential for growth in line with the performance of the underlying investments.

- Individuals Seeking Income Generation:The living benefit options can provide a guaranteed stream of income during retirement, regardless of market performance.

- Individuals Seeking Principal Protection:The death benefit guarantee ensures that your beneficiaries will receive a minimum death benefit, even if the market value of your annuity has declined.

| Investor Profile | Suitability |

|---|---|

| Retirees seeking guaranteed income | High |

| Individuals with a long investment horizon | Moderate |

| Individuals seeking growth potential | High |

| Individuals with a low risk tolerance | Moderate |

Final Conclusion

Equivest Variable Annuity Series 100 2024 presents a compelling opportunity for individuals seeking to secure their financial future. With its diverse investment options, guaranteed benefits, and comprehensive features, this annuity provides a solid foundation for long-term financial planning. However, it’s crucial to carefully consider the potential risks and suitability of this product for your specific circumstances before making an investment decision.

Excel can be a powerful tool for annuity calculations. The Calculate Annuity Rate In Excel 2024 article provides guidance on using Excel formulas to calculate annuity rates and analyze your investment.

Questions Often Asked

What are the minimum investment requirements for Equivest Variable Annuity Series 100 2024?

Want to figure out how much your annuity is worth in 2024? You can use an online calculator like the Calculate Annuity Return 2024 tool to get a quick estimate. These calculators can help you understand the potential growth of your annuity based on current market conditions and interest rates.

The minimum investment requirement for Equivest Variable Annuity Series 100 2024 varies depending on the specific investment option chosen. It’s best to consult the product brochure or your financial advisor for the most accurate information.

What are the fees associated with Equivest Variable Annuity Series 100 2024?

If you’re curious about how long your annuity payments will last, use the Annuity Number Of Periods Calculator 2024. This tool can help you determine the number of payments you’ll receive based on your initial investment and the interest rate.

Equivest Variable Annuity Series 100 2024 charges various fees, including annual administrative fees, mortality and expense charges, and investment management fees. The specific fees and their associated costs can be found in the product prospectus.

How can I access my funds invested in Equivest Variable Annuity Series 100 2024?

You can access your funds invested in Equivest Variable Annuity Series 100 2024 through withdrawals or distributions. However, the availability and terms of these options are subject to the specific provisions of the annuity contract.

If you have questions about annuity calculations, the Annuity Calculation Questions And Answers 2024 page provides a comprehensive list of frequently asked questions and answers related to annuity calculations.

Annuity 20 Year Certain is a type of annuity that guarantees payments for at least 20 years, regardless of your lifespan. The Annuity 20 Year Certain 2024 article provides information on this type of annuity and its benefits.

Variable annuities offer the potential for growth, but they also come with risks. The Understanding Variable Annuities 2024 article explains the features and risks associated with variable annuities.

For UK residents, the Annuity Calculator Gov Uk 2024 can be a helpful tool for estimating annuity payments based on UK-specific regulations and interest rates.

If you’re in Nigeria, the Annuity Calculator Nigeria 2024 can provide tailored calculations based on Nigerian financial regulations and market conditions.

The Annuity 59 1/2 Rule 2024 is an important rule for those considering early withdrawal from their annuities. Understanding this rule can help you make informed decisions about your retirement planning.