Electronic Remittance Advice (ERA) sets the stage for a modern financial landscape, offering a streamlined and efficient alternative to traditional paper-based methods. ERA facilitates the electronic exchange of payment information between senders and receivers, eliminating the need for physical documents and enhancing transparency throughout the transaction process.

For information on Renfroe Claims, Renfroe Claims offers a dedicated resource for navigating the process and understanding your rights.

This digital approach brings numerous advantages, including reduced costs, improved accuracy, and faster reconciliation times, making ERA a valuable tool for businesses of all sizes.

Understanding subrogation claims can be complex, but Subrogation Claim provides a comprehensive guide to navigating this specific type of claim.

ERA systems typically employ secure communication protocols, ensuring the confidentiality and integrity of sensitive financial data. The adoption of industry-specific standards and formats ensures interoperability between different systems, fostering a seamless exchange of information across the financial ecosystem.

Applying for disability allowance can be a lengthy process, but Apply For Disability Allowance provides valuable information and resources to guide you through the process.

Electronic Remittance Advice: Definition and Purpose

Electronic Remittance Advice (ERA) is a digital document that provides detailed information about a payment made to a vendor or supplier. It replaces the traditional paper-based remittance advice, streamlining payment processes and improving efficiency for both senders and receivers.

If you have a claim with Guardsman, Guardsman Claim can assist you with understanding your coverage and filing a claim effectively.

Key Functions and Benefits of ERA

ERAs play a crucial role in modern financial transactions by providing a comprehensive overview of payments, facilitating reconciliation, and enhancing security. Here are some key benefits of using ERA:

- Improved Efficiency:ERAs eliminate the need for manual processing and paper handling, leading to faster payment processing and reduced turnaround times.

- Reduced Costs:By automating the remittance process, ERA systems help businesses save on printing, mailing, and administrative costs associated with paper-based advices.

- Enhanced Security:ERAs are typically transmitted electronically, making them less susceptible to loss, damage, or fraud compared to paper-based documents.

- Streamlined Payment Processes:ERAs provide a single source of truth for payment information, enabling businesses to track payments and reconcile invoices more efficiently.

- Accelerated Reconciliation Times:With electronic access to payment details, businesses can reconcile invoices and resolve discrepancies faster, improving cash flow management.

ERA vs. Traditional Paper-Based Remittance Advices

Traditional paper-based remittance advices involve manual processing, which is prone to errors, delays, and security risks. ERAs offer significant advantages over paper-based systems, including:

| Feature | Paper-Based Remittance Advice | Electronic Remittance Advice (ERA) |

|---|---|---|

| Processing | Manual, prone to errors | Automated, efficient, and accurate |

| Delivery | Physical mailing, time-consuming | Electronic transmission, instant delivery |

| Security | Vulnerable to loss, damage, or fraud | Secure electronic transmission, reducing risks |

| Cost | High printing, mailing, and administrative costs | Lower costs due to automation and reduced paper usage |

| Environment | Contributes to paper waste | Environmentally friendly, reducing paper consumption |

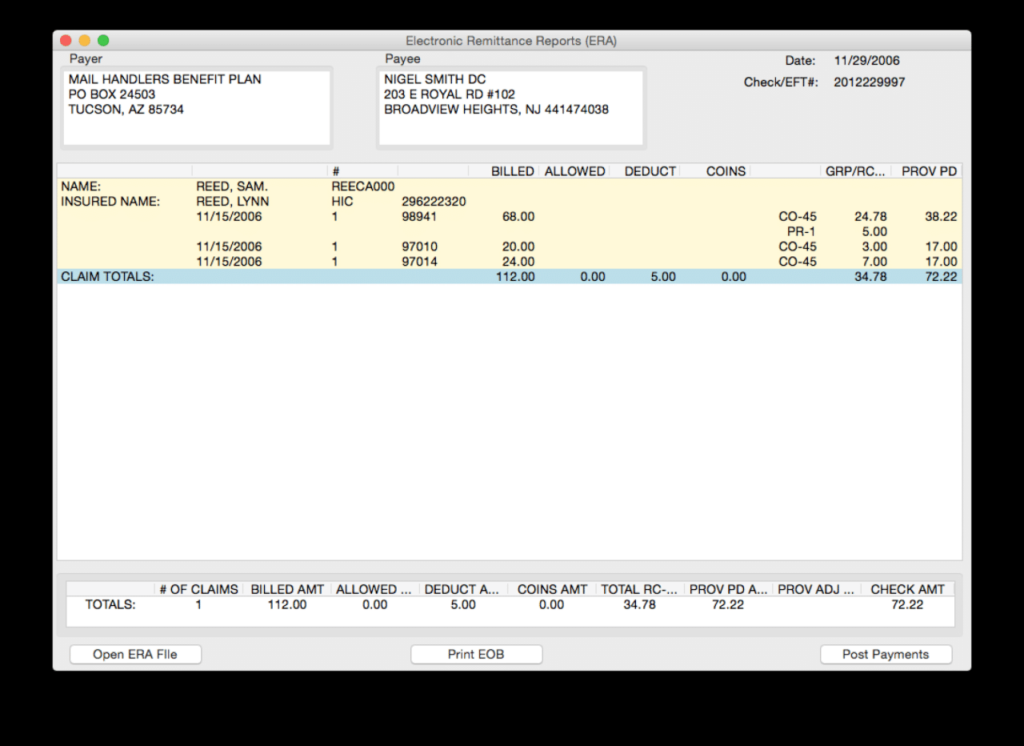

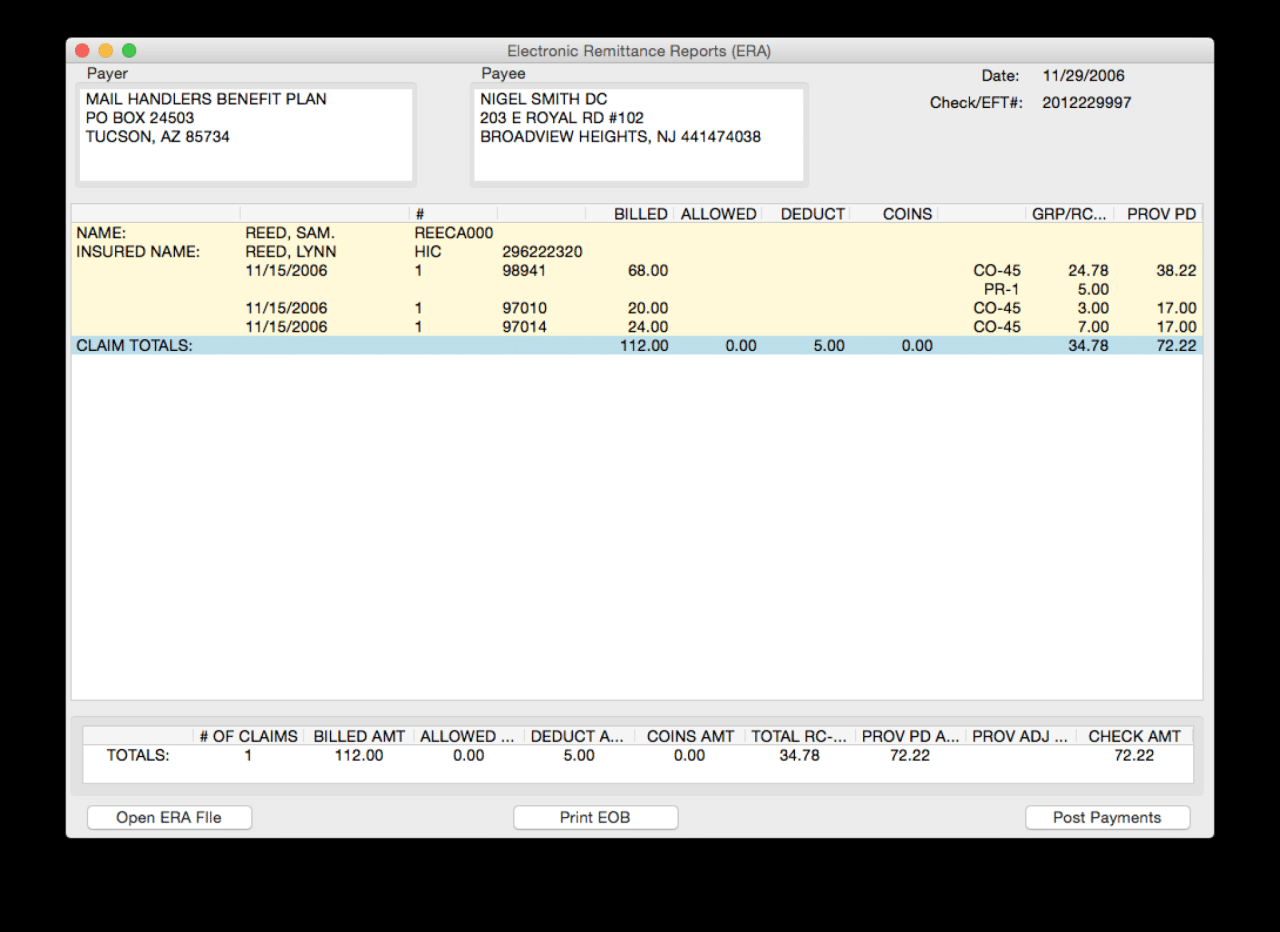

Components of an Electronic Remittance Advice

ERAs typically contain essential elements that provide a comprehensive overview of a payment. These components are crucial for accurate reconciliation, tracking, and financial reporting.

If you need to file a claim, File A Claim provides valuable insights on the process and the necessary steps to take.

Essential Elements of an ERA

The following elements are commonly included in ERAs:

- Payer Information:Name, address, and contact details of the payer.

- Payee Information:Name, address, and contact details of the payee (vendor or supplier).

- Payment Date:Date when the payment was made.

- Payment Amount:Total amount paid for the invoice.

- Invoice Number:Unique identifier of the invoice being paid.

- Payment Reference Number:Unique identifier assigned to the payment by the payer.

- Payment Method:Method used for the payment (e.g., ACH, wire transfer, check).

- Remittance Advice Number:Unique identifier assigned to the remittance advice.

- Details of Deductions or Adjustments:Any deductions or adjustments made to the original invoice amount.

- Payment Status:Indicates whether the payment has been processed and received by the payee.

- Other Relevant Information:Additional details specific to the payment, such as payment instructions, notes, or attachments.

Standard Fields and Data Points

ERAs often adhere to industry-specific standards and formats to ensure interoperability and data exchange between different systems. Some common ERA formats include:

- EDI (Electronic Data Interchange):A standard for exchanging business documents electronically. EDI formats for ERAs typically use specific codes and structures to represent the data elements.

- XML (Extensible Markup Language):A flexible and widely used format for representing data in a structured way. XML-based ERAs use tags to define the data elements and their relationships.

- Web-Based Platforms:Some ERA systems use web-based platforms to transmit and receive remittance advice electronically. These platforms often provide a standardized format for data exchange.

Significance of ERA Components

Each component of an ERA plays a crucial role in ensuring accurate reconciliation and tracking of payments. For example:

- Payer and Payee Information:Ensures that payments are directed to the correct recipient.

- Payment Date and Amount:Provides a clear record of the payment and its value.

- Invoice Number:Enables businesses to match payments with specific invoices.

- Payment Reference Number:Allows for easy tracking of payments and reconciliation.

- Payment Method:Helps businesses understand how payments were processed and reconcile bank statements.

- Deductions or Adjustments:Provides transparency and ensures accurate accounting for any changes to the original invoice amount.

- Payment Status:Indicates whether the payment has been processed and received by the payee, facilitating timely follow-up.

ERA Transmission Methods and Standards

ERAs are typically transmitted electronically using various methods and standards to ensure secure and reliable data exchange.

If you’re owed unpaid wages, Wage Claim provides information and resources to help you file a claim and recover your rightful earnings.

Transmission Methods

Common methods used for transmitting ERAs include:

- EDI (Electronic Data Interchange):A standard for exchanging business documents electronically. EDI formats for ERAs typically use specific codes and structures to represent the data elements. EDI transmission is often used for large-volume transactions between businesses with established trading partner relationships.

- XML (Extensible Markup Language):A flexible and widely used format for representing data in a structured way. XML-based ERAs use tags to define the data elements and their relationships. XML transmission is suitable for various applications, including web-based systems and online payment platforms.

- Web-Based Platforms:Some ERA systems use web-based platforms to transmit and receive remittance advice electronically. These platforms often provide a standardized format for data exchange and allow for secure file transfer.

Industry-Specific Standards and Protocols, Electronic Remittance Advice

To ensure interoperability and data exchange between different systems, industry-specific standards and protocols are essential for ERA transmission. These standards define the structure, format, and content of ERAs, ensuring consistent data representation and processing.

Third-party claims can be complicated, but Third Party Claim provides a comprehensive guide to understanding and navigating these types of claims.

- ANSI X12:A widely adopted standard for EDI transactions in the United States. ANSI X12 defines specific formats for various business documents, including ERAs.

- EDIFACT:A United Nations standard for EDI transactions used globally. EDIFACT defines formats for ERAs and other business documents, facilitating international trade.

- ISO 20022:A global standard for financial messaging that is increasingly being adopted for ERAs. ISO 20022 provides a comprehensive framework for financial data exchange, promoting interoperability and standardization.

Examples of ERA Formats

Various ERA formats are widely adopted, each offering specific advantages:

- 820 (Remittance Advice):A standard EDI format defined by ANSI X12, commonly used for transmitting remittance advice in the United States.

- FIN (Financial Institution):A standard EDIFACT format used for exchanging financial messages, including remittance advice, in international trade.

- XML-based ERA Formats:Customized XML formats are often used by businesses for exchanging ERAs through web-based platforms or online payment systems.

Benefits of Electronic Remittance Advice

ERAs offer numerous benefits for both senders and receivers, contributing to a more efficient, cost-effective, and secure financial ecosystem.

If you’re struggling to manage your finances, Citizens Advice Universal Credit can provide valuable guidance on claiming Universal Credit and navigating the process.

Advantages for Senders

ERAs provide significant advantages for businesses that send payments, including:

- Reduced Processing Time:ERAs eliminate the need for manual processing, leading to faster payment processing and reduced turnaround times.

- Lower Costs:By automating the remittance process, businesses can save on printing, mailing, and administrative costs associated with paper-based advices.

- Improved Accuracy:ERAs minimize the risk of errors associated with manual data entry, leading to more accurate payment records.

- Enhanced Security:ERAs are typically transmitted electronically, making them less susceptible to loss, damage, or fraud compared to paper-based documents.

- Streamlined Payment Processes:ERAs provide a single source of truth for payment information, enabling businesses to track payments and reconcile invoices more efficiently.

- Improved Cash Flow Management:By automating the remittance process, businesses can improve their cash flow management by reducing delays and improving reconciliation times.

Advantages for Receivers

ERAs also offer significant benefits for businesses that receive payments, including:

- Faster Reconciliation:ERAs provide electronic access to payment details, enabling businesses to reconcile invoices and resolve discrepancies faster.

- Improved Cash Flow:Faster reconciliation and access to payment information can improve cash flow by accelerating the collection of funds.

- Reduced Administrative Costs:By eliminating the need for manual processing of paper-based remittance advices, businesses can reduce administrative costs and improve efficiency.

- Enhanced Security:Electronic transmission of ERAs provides enhanced security, reducing the risk of loss, damage, or fraud.

- Improved Customer Service:Faster payment processing and reconciliation can lead to improved customer service by reducing delays and resolving disputes more quickly.

Environmental Sustainability

ERAs contribute to a more environmentally sustainable approach to financial transactions by reducing paper consumption and waste. This aligns with the growing trend of adopting sustainable business practices and minimizing environmental impact.

Claimxperience provides a user-friendly platform for managing and processing claims. Claimxperience aims to simplify the claim process and provide a seamless experience for users.

Implementation and Integration of ERA Systems

Implementing an ERA system within an organization involves several steps to ensure seamless integration with existing processes and systems.

Having issues with your Metropcs service? Metropcs Claim can assist you in filing a claim and seeking resolution for any problems you encounter.

Steps Involved in Implementing an ERA System

The following steps are typically involved in implementing an ERA system:

- Needs Assessment:Identify the specific requirements and goals for implementing an ERA system, considering factors such as payment volume, existing systems, and security needs.

- Selection of ERA Software:Choose an ERA software solution that meets the organization’s needs and integrates with existing accounting software and payment platforms.

- Data Mapping and Integration:Map data fields from existing systems to the ERA software and integrate the ERA system with relevant accounting software, payment platforms, and other business applications.

- User Training:Train staff on how to use the ERA system, including data entry, processing, and reporting functions.

- Testing and Rollout:Thoroughly test the ERA system before full implementation to ensure accuracy and functionality. Gradually roll out the system to users, starting with a pilot group.

- Ongoing Monitoring and Maintenance:Regularly monitor the ERA system’s performance, identify any issues, and implement necessary updates or enhancements.

Integration with Existing Systems

ERA systems can be integrated with existing accounting software, payment platforms, and other business applications to streamline processes and improve efficiency. This integration enables automated data exchange and eliminates the need for manual data entry.

Experiencing property damage can be a stressful situation, but Property Damage provides guidance on understanding your rights and navigating the claim process.

- Accounting Software:Integration with accounting software allows for automatic reconciliation of payments with invoices and provides a comprehensive view of financial transactions.

- Payment Platforms:Integration with payment platforms enables automated payment processing and transmission of ERAs, reducing manual intervention and improving efficiency.

- Other Business Applications:Integration with other business applications, such as inventory management or customer relationship management (CRM) systems, can provide a holistic view of financial transactions and improve overall business operations.

Data Security and Compliance Considerations

When adopting ERA systems, organizations must prioritize data security and compliance to protect sensitive financial information. Key considerations include:

- Data Encryption:Ensure that all data transmitted and stored within the ERA system is encrypted to protect it from unauthorized access.

- Access Control:Implement robust access control measures to restrict access to sensitive data to authorized personnel.

- Regular Security Audits:Conduct regular security audits to identify vulnerabilities and ensure that the ERA system is secure and compliant with industry standards.

- Compliance with Regulations:Adhere to relevant data privacy and security regulations, such as the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS).

Future Trends in Electronic Remittance Advice

The landscape of ERA technologies is constantly evolving, driven by technological advancements and changing business needs. Emerging trends are shaping the future of ERA processes, creating opportunities for enhanced efficiency, security, and innovation.

Dealing with a home warranty claim can be stressful, but Select Home Warranty Claim can help you understand your rights and guide you through the process smoothly.

Evolving Landscape of ERA Technologies

The following trends are driving the evolution of ERA technologies:

- Cloud-Based ERA Systems:Cloud-based ERA systems offer scalability, flexibility, and cost-effectiveness, enabling businesses to access and manage ERA data from anywhere with an internet connection.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML technologies are being incorporated into ERA systems to automate tasks, improve data analysis, and enhance fraud detection capabilities.

- API Integration:Application Programming Interfaces (APIs) are facilitating seamless integration of ERA systems with other business applications, streamlining data exchange and improving automation.

Impact of Blockchain and Other Innovative Technologies

Blockchain and other innovative technologies have the potential to revolutionize ERA processes by enhancing security, transparency, and efficiency. Here’s how:

- Blockchain:Blockchain technology can provide a secure and immutable ledger for recording payment transactions, improving transparency and reducing the risk of fraud. It can also facilitate faster and more efficient cross-border payments.

- Internet of Things (IoT):IoT devices can automate payment processes and provide real-time data on payment transactions, enhancing efficiency and accuracy.

Challenges and Opportunities

While ERA technologies offer significant advantages, there are challenges and opportunities for future development and adoption:

- Interoperability:Ensuring interoperability between different ERA systems and platforms remains a key challenge, requiring industry-wide collaboration and standardization.

- Data Security:Maintaining data security and privacy is crucial, especially as ERA systems become more sophisticated and rely on sensitive financial information.

- Adoption and Integration:Encouraging widespread adoption of ERA systems requires addressing concerns about implementation costs, integration challenges, and user training.

- Innovation:Continued innovation in ERA technologies is essential to meet evolving business needs and address emerging challenges.

Closure: Electronic Remittance Advice

As financial technology continues to evolve, ERA is poised to play an increasingly important role in the future of payment processing. With its ability to enhance efficiency, security, and sustainability, ERA is a testament to the transformative power of digital innovation in the realm of financial transactions.

Filing a claim with State Farm can be a straightforward process with the right resources. State Farm Home Insurance Claims offers helpful information and support to ensure a smooth claim experience.

Clarifying Questions

What are the different formats used for ERA?

ERA formats vary depending on the industry and specific requirements. Common formats include EDI (Electronic Data Interchange), XML (Extensible Markup Language), and web-based platforms. Each format offers its own advantages in terms of data structure, security, and interoperability.

How secure are ERA systems?

Navigating the complexities of claims can be daunting, but Claimsxten offers a streamlined approach to managing and processing claims.

ERA systems prioritize data security through encryption, authentication, and access controls. These measures help protect sensitive financial information from unauthorized access and ensure the integrity of transactions.

What are the challenges associated with implementing ERA?

Implementing ERA requires careful planning and consideration of factors such as system compatibility, data integration, and employee training. Organizations need to ensure their existing systems are compatible with ERA platforms and develop effective processes for data management and reconciliation.

If you’re dealing with an L&I claim, L&I Claim offers valuable information on the process, benefits, and resources available to you.