Elastic Loans, a revolutionary concept in the financial world, offers borrowers a unique and adaptable way to manage their debt. Unlike traditional loans with rigid terms, elastic loans provide flexibility in repayment schedules and interest rates, adjusting to individual circumstances.

Sometimes you need cash fast, and instant cash loans can provide a quick solution. These loans are designed for urgent situations, but be sure to compare rates and terms carefully.

This innovative approach empowers borrowers to navigate financial challenges with greater control and potentially lower costs.

Having fair credit doesn’t mean you can’t find good loan options. Best personal loans for fair credit are available, but you may need to compare rates and terms carefully.

The concept of elastic loans stems from the need for more personalized and responsive financial solutions. Recognizing that individuals’ financial situations can fluctuate, elastic loans allow borrowers to adapt their repayment plans as their income or expenses change. This flexibility can be a significant advantage, particularly for individuals facing unforeseen financial difficulties.

Wells Fargo offers a variety of personal loan options, and Wells Fargo personal loan rates can be competitive. However, it’s always wise to compare rates and terms from other lenders as well.

What are Elastic Loans?

Elastic loans, also known as flexible loans or adjustable loans, are a relatively new type of loan that offers borrowers more flexibility and control over their repayment terms. Unlike traditional loans with fixed interest rates and repayment schedules, elastic loans allow borrowers to adjust their loan terms based on their changing financial circumstances.

When buying a new or used car, understanding car loan interest rates is key. Rates can fluctuate, so it’s wise to shop around and compare offers from different lenders.

Key Features of Elastic Loans

Elastic loans are characterized by several key features that distinguish them from traditional loans:

- Flexible Repayment Terms:Borrowers can adjust their monthly payments, loan duration, or interest rates to fit their current financial situation.

- Variable Interest Rates:Interest rates on elastic loans can fluctuate based on market conditions or the borrower’s creditworthiness.

- Dynamic Repayment Schedules:Repayment schedules can be adjusted to accommodate changes in income, expenses, or other financial obligations.

- Transparency and Communication:Lenders are typically required to provide clear and transparent information about loan terms, interest rates, and repayment options.

How Elastic Loans Differ from Traditional Loans

Elastic loans differ significantly from traditional loans in terms of their flexibility and adaptability. Traditional loans typically have fixed interest rates, fixed repayment schedules, and limited options for adjusting loan terms. This can make it difficult for borrowers to manage their finances if their circumstances change unexpectedly.

If you’re looking to tap into your home’s equity, a US Bank HELOC could be a good option. HELOCs offer flexible credit lines, allowing you to borrow against your home’s value as needed.

In contrast, elastic loans offer greater flexibility by allowing borrowers to adjust their loan terms to suit their evolving financial situation. This can be particularly beneficial for borrowers who experience fluctuations in income, expenses, or other financial obligations.

Need a quick cash injection? A $500 cash advance no credit check can be a tempting option, but be aware of the high interest rates and potential for debt.

Examples of Elastic Loans

- Interest-Only Loans:These loans allow borrowers to pay only the interest on the loan for a specified period, deferring principal repayment. This can be advantageous for borrowers who need short-term financing or have a temporary cash flow shortage.

- Revolving Credit Lines:Revolving credit lines, such as credit cards, offer a flexible line of credit that borrowers can access and repay as needed. This allows borrowers to manage their expenses and borrow funds when necessary, subject to credit limits.

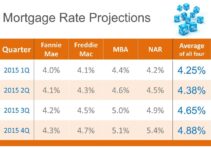

- Variable Rate Mortgages:These mortgages have interest rates that fluctuate based on market conditions. Borrowers can benefit from lower interest rates during periods of low market rates, but they also face the risk of higher rates during periods of market volatility.

Benefits of Elastic Loans

Advantages for Borrowers

Elastic loans offer several advantages for borrowers, including:

- Increased Flexibility:Borrowers can adjust their loan terms to fit their changing financial circumstances, reducing the risk of default or financial strain.

- Lower Monthly Payments:Borrowers can reduce their monthly payments during periods of financial hardship, providing more financial breathing room.

- Potential for Lower Interest Rates:Borrowers may benefit from lower interest rates if market conditions improve or their creditworthiness increases.

- Improved Financial Management:Elastic loans can help borrowers better manage their finances by providing them with more control over their repayment terms.

Advantages for Lenders

Elastic loans also offer potential benefits for lenders, such as:

- Reduced Risk of Default:By allowing borrowers to adjust their repayment terms, lenders can reduce the risk of borrowers defaulting on their loans.

- Increased Loan Utilization:Elastic loans can encourage borrowers to take on larger loans, as they have the flexibility to adjust their repayment terms if needed.

- Enhanced Customer Loyalty:By offering flexible loan terms, lenders can build stronger relationships with their borrowers and increase customer loyalty.

Comparing Advantages to Traditional Loans

Compared to traditional loans, elastic loans offer greater flexibility and adaptability, which can be beneficial for both borrowers and lenders. While traditional loans provide predictable and fixed repayment terms, they lack the flexibility to accommodate changing financial circumstances. Elastic loans address this limitation by offering adjustable repayment terms, potentially leading to improved financial outcomes for both borrowers and lenders.

If you’re facing a financial challenge and need a loan, I need a loan is a common search term. Explore different loan options and compare rates before making a choice.

How Elastic Loans Work

Mechanics of Repayment

Elastic loan repayment typically involves a combination of principal and interest payments, with the ability to adjust the balance of each payment. Borrowers can choose to pay more principal and less interest to shorten the loan term or pay more interest and less principal to reduce their monthly payments.

Bank of America offers a variety of mortgage options, and Bank of America mortgage rates can be competitive. However, it’s always wise to compare rates and terms from other lenders as well.

Role of Interest Rates

Interest rates on elastic loans can be fixed or variable. Fixed interest rates remain constant throughout the loan term, while variable interest rates fluctuate based on market conditions or the borrower’s creditworthiness. Variable interest rates can offer potential benefits during periods of low market rates, but they also carry the risk of higher rates during periods of market volatility.

Adjusting Loan Terms

The process of adjusting loan terms varies depending on the specific loan product. Some elastic loans allow borrowers to make adjustments online or through a mobile app, while others may require contacting the lender directly. Adjustments are typically subject to certain limitations, such as minimum payment amounts or maximum loan term extensions.

If you’re looking to release equity from your home, equity release interest rates can vary widely. Be sure to compare offers from different lenders and understand the terms before making a decision.

Lenders often have specific criteria for evaluating loan term adjustments. These criteria may include the borrower’s credit score, payment history, income, and other financial factors. Lenders may also have restrictions on the frequency of adjustments or the total amount of adjustment allowed over the loan term.

Examples of Elastic Loan Products

Real-World Examples

Several real-world examples of elastic loan products are available in the market. These products offer varying levels of flexibility and adaptability, catering to different borrower needs and financial circumstances.

Securing financing for a new or used car can be a smooth process with car finance. Many lenders offer competitive rates and terms, so it’s wise to shop around and compare offers.

| Loan Type | Provider | Key Features | Eligibility Criteria |

|---|---|---|---|

| Interest-Only Mortgage | Various Banks and Mortgage Lenders | Allows borrowers to pay only the interest on the mortgage for a specified period, deferring principal repayment. | Good credit score, sufficient income to cover interest payments, and a down payment. |

| Home Equity Line of Credit (HELOC) | Various Banks and Credit Unions | Provides a revolving line of credit secured by the borrower’s home equity. Interest rates can be fixed or variable. | Good credit score, sufficient home equity, and a debt-to-income ratio within acceptable limits. |

| Variable Rate Auto Loan | Various Auto Lenders | Offers lower interest rates during periods of low market rates, but rates can increase during periods of market volatility. | Good credit score, sufficient income to cover monthly payments, and a down payment. |

Considerations for Borrowers

Potential Risks and Drawbacks

While elastic loans offer significant advantages, borrowers should also be aware of potential risks and drawbacks:

- Increased Interest Costs:Variable interest rates can lead to higher interest costs over the loan term if market rates rise.

- Unpredictable Repayment Amounts:Fluctuating interest rates and adjustable repayment terms can make it difficult to budget for loan repayments.

- Potential for Higher Payments:Borrowers may face higher monthly payments if their circumstances change or market rates increase.

- Complexity of Loan Terms:Elastic loans can be more complex than traditional loans, requiring borrowers to carefully understand the terms and conditions.

Understanding Loan Terms and Conditions

Before taking out an elastic loan, borrowers should carefully review the loan terms and conditions. This includes understanding the interest rate structure, repayment options, adjustment policies, and any fees or penalties associated with the loan.

For veterans seeking a home loan, VA loan interest rates are often competitive. These rates can vary depending on market conditions, so it’s wise to shop around.

Borrowers should also consider their financial situation and risk tolerance. If they are sensitive to interest rate fluctuations or prefer predictable repayment amounts, traditional loans may be a better option.

Evaluating Suitability

Elastic loans can be a suitable option for borrowers who are comfortable with some level of risk and have the financial flexibility to adjust their repayment terms as needed. However, borrowers should carefully evaluate their individual circumstances and financial goals before deciding if an elastic loan is right for them.

Need a loan quickly? Quick loans online can be a convenient option. These loans often involve a streamlined application process, but it’s important to research lenders and compare offers.

The Future of Elastic Loans

Potential Growth and Development

The elastic loan market is expected to continue growing in the coming years as borrowers increasingly seek more flexible and adaptable loan options. Advancements in technology and financial innovation are driving the development of new and innovative elastic loan products.

A 15-year mortgage can save you money on interest over a 30-year loan, but 15-year mortgage rates may be slightly higher. Weigh the pros and cons before making a decision.

Emerging Trends and Innovations

Emerging trends in elastic lending include:

- AI-Powered Loan Adjustments:Artificial intelligence (AI) is being used to automate loan term adjustments based on real-time data and borrower behavior.

- Personalized Loan Terms:Lenders are developing customized loan terms based on individual borrower profiles and financial needs.

- Blockchain-Based Lending:Blockchain technology is being used to create transparent and secure platforms for elastic lending.

Impact on the Financial Landscape

Elastic loans have the potential to significantly impact the financial landscape by providing borrowers with greater financial flexibility and control. As the market continues to evolve, elastic loans are expected to play an increasingly important role in meeting the diverse needs of borrowers in a dynamic financial environment.

Outcome Summary

The rise of elastic loans marks a significant shift in the lending landscape, offering borrowers greater flexibility and potentially lower costs. As this innovative approach gains traction, it has the potential to transform the way we think about borrowing and lending, fostering a more equitable and responsive financial system.

Popular Questions

How do elastic loans differ from traditional loans?

When you’re considering a second mortgage, understanding second mortgage rates is crucial. These rates can vary depending on your credit score, loan amount, and other factors.

Traditional loans have fixed interest rates and repayment schedules, while elastic loans offer flexibility in both areas, allowing adjustments based on the borrower’s circumstances.

Are elastic loans available for all types of borrowing needs?

Currently, elastic loan products are primarily offered for personal loans and some types of business loans. However, the range of available products is expanding.

What are the potential risks of elastic loans?

An investment loan can help you acquire property for rental income or business purposes. Make sure you understand the terms and potential returns before taking on this type of loan.

While elastic loans offer flexibility, it’s important to understand the potential risks. If a borrower’s financial situation deteriorates, they may find it challenging to manage their debt, potentially leading to higher interest charges or even default.

How can I find an elastic loan provider?

Several online platforms and financial institutions offer elastic loan products. It’s crucial to research and compare different providers before making a decision.