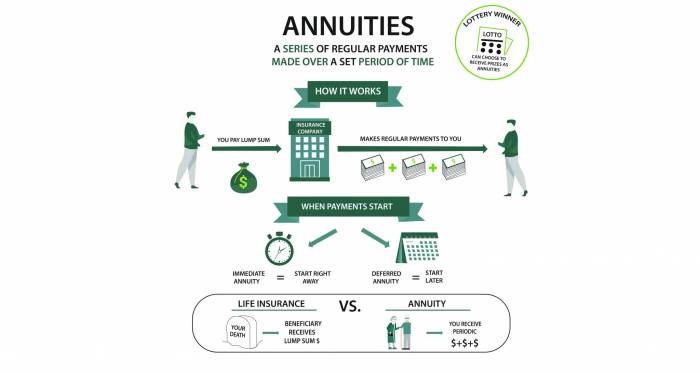

Do Variable Annuities Pay Dividends 2024 – Do Variable Annuities Pay Dividends in 2024? This question arises frequently among individuals seeking to understand the intricacies of this complex financial instrument. Variable annuities, unlike their fixed counterparts, are linked to the performance of underlying investments, offering the potential for greater returns but also exposing investors to market volatility.

Understanding the tax implications of an annuity is essential. Is Annuity Death Benefit Taxable 2024 explores the taxability of death benefits, helping you plan for your legacy.

This article delves into the relationship between variable annuities and dividends, exploring how investment choices within these annuities can impact potential returns and the overall landscape of variable annuities in 2024.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore Annuity Is A Single Sum 2024 to understand the different types and their potential benefits.

Variable annuities are a type of insurance contract that allows individuals to invest in a range of sub-accounts, typically mutual funds or exchange-traded funds (ETFs). The value of these sub-accounts fluctuates with the market performance of the underlying investments. Unlike traditional fixed annuities, which offer guaranteed returns, variable annuities do not guarantee a specific rate of return.

Instead, they provide the potential for higher returns, but also expose investors to the risk of losing money if the market declines.

Understanding Variable Annuities

Variable annuities are a type of retirement savings product that offers the potential for higher returns than traditional fixed annuities. They differ from fixed annuities in that they are tied to the performance of underlying investments, which can fluctuate in value.

Key Features of Variable Annuities

- Investment Flexibility:Variable annuities allow investors to choose from a variety of investment options, such as stocks, bonds, and mutual funds, providing greater control over their investment strategy.

- Growth Potential:The potential for higher returns is a key advantage of variable annuities. However, it is important to note that these returns are not guaranteed and are subject to market fluctuations.

- Tax-Deferred Growth:Earnings within a variable annuity grow tax-deferred, meaning that taxes are not paid until the money is withdrawn. This can lead to significant tax savings over time.

- Death Benefit:Variable annuities often include a death benefit that guarantees a minimum payout to beneficiaries in the event of the annuitant’s death.

Sub-Accounts within Variable Annuities

Variable annuities typically operate through sub-accounts, which are individual investment accounts within the annuity contract. Each sub-account is invested in a specific investment option, such as a mutual fund or a separate account managed by an investment professional. The performance of each sub-account is tracked separately, and the overall value of the variable annuity is determined by the combined value of all sub-accounts.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore An Annuity Is Known 2024 to understand the different types and their potential benefits.

For example, an individual might choose to allocate their variable annuity funds across three sub-accounts: a stock mutual fund, a bond mutual fund, and a separate account managed by an investment advisor. The performance of each sub-account would be tracked separately, and the overall value of the variable annuity would be determined by the combined value of all three sub-accounts.

Variable Annuities and Dividends

Variable annuities do not directly pay dividends in the same way that stocks do. However, the performance of the underlying investments within a variable annuity can be influenced by dividends paid by the companies in which those investments are held.

A common question when considering annuities is the interest rate. Annuity 4 Percent 2024 offers insights into the current interest rates for annuities, helping you make informed decisions.

Relationship Between Variable Annuity Performance and Market Dividends, Do Variable Annuities Pay Dividends 2024

When the companies in which a variable annuity is invested pay dividends, the value of those investments may increase, leading to a higher overall value for the variable annuity. This is because dividends represent a portion of a company’s profits that are distributed to shareholders.

Calculating the exact amount of your annuity payments requires understanding the Annuity Factor 2024. This factor, based on interest rates and your life expectancy, helps determine the amount you receive each period.

When a company pays dividends, it signals that it is financially healthy and profitable, which can boost investor confidence and drive up the stock price.

Influence of Investment Options on Potential Returns

The specific investment options chosen within a variable annuity can significantly impact potential returns. For example, an investment strategy that focuses on stocks with high dividend yields may generate higher returns over time than an investment strategy that focuses on low-dividend-paying stocks or bonds.

To understand the factors influencing annuity payouts, you might need to know about the Annuity 2000 Mortality Table 2024. This table helps determine life expectancies, impacting the calculation of annuity payments.

It is important to carefully consider the risk and reward profiles of different investment options within a variable annuity. While some investments may offer higher potential returns, they may also carry higher risk. It is important to select investments that align with your individual financial goals and risk tolerance.

The interest rate plays a crucial role in determining your annuity payments. Annuity 7 Percent 2024 provides a glimpse into the potential payouts with a specific interest rate, helping you assess its suitability for your financial goals.

Investment Strategies within Variable Annuities

Variable annuities offer a wide range of investment options, allowing individuals to tailor their investment strategies to their specific financial goals and risk tolerance. Here are some common investment strategies within variable annuities:

Common Investment Strategies

- Growth-Oriented Strategy:This strategy focuses on investments with the potential for high growth, such as stocks or aggressive mutual funds. This strategy is typically suitable for individuals with a long investment horizon and a higher risk tolerance.

- Income-Oriented Strategy:This strategy emphasizes investments that generate regular income, such as bonds or dividend-paying stocks. This strategy is often suitable for individuals nearing retirement who are seeking a steady stream of income.

- Balanced Strategy:This strategy aims to achieve a balance between growth and income by diversifying investments across different asset classes, such as stocks, bonds, and real estate. This strategy is often suitable for individuals with a moderate risk tolerance and a long-term investment horizon.

Thinking about a specific lump sum for your annuity? Annuity 600 000 2024 explores the possibilities of starting an annuity with a specific amount, allowing you to plan for your financial future.

Risk and Reward Profiles

The risk and reward profiles associated with different investment strategies within variable annuities can vary significantly. For example, a growth-oriented strategy may offer the potential for higher returns but also carries a higher risk of losses. An income-oriented strategy may offer lower potential returns but also carries a lower risk of losses.

Investment Strategies for Individuals Nearing Retirement

Individuals nearing retirement may want to consider investment strategies that emphasize income generation and preservation of capital. This may involve shifting their investment portfolio toward investments with lower risk, such as bonds or dividend-paying stocks. They may also want to consider utilizing the guaranteed death benefit feature offered by some variable annuities to provide a safety net for their beneficiaries.

Factors Affecting Variable Annuity Returns

The performance of a variable annuity is influenced by a number of factors, including market fluctuations, fees and expenses, and surrender charges.

Need to calculate your annuity payments on a quarterly basis? Annuity Calculator Quarterly 2024 provides a tool for understanding the specific amount you can expect to receive every three months.

Market Fluctuations

The value of a variable annuity is directly tied to the performance of the underlying investments. As market conditions change, the value of these investments can fluctuate, impacting the overall value of the annuity. During periods of market volatility, the value of a variable annuity may decline, while during periods of market growth, the value of the annuity may increase.

Fees and Expenses

Variable annuities come with a variety of fees and expenses, which can impact overall returns. These fees can include administrative fees, investment management fees, and mortality and expense charges. It is important to carefully review the fee structure of a variable annuity before making an investment decision.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore Annuity Calculator Lottery 2024 to understand the different types and their potential benefits.

Surrender Charges

Surrender charges are fees that may be assessed if an individual withdraws money from a variable annuity before a certain period of time. These charges can vary depending on the specific annuity contract and the length of time the money has been invested.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore T-C Annuity 2024 to understand the different types and their potential benefits.

Surrender charges are designed to discourage investors from withdrawing their money early and can significantly impact overall returns.

Tax Implications of Variable Annuities: Do Variable Annuities Pay Dividends 2024

Variable annuities offer tax-deferred growth, meaning that taxes are not paid on earnings until the money is withdrawn. However, it is important to understand the tax implications of variable annuity payouts, as they can vary depending on the type of withdrawal and the individual’s tax bracket.

Tax Treatment of Variable Annuity Payouts

Withdrawals from a variable annuity are generally taxed as ordinary income, subject to the individual’s marginal tax rate. This means that the taxes owed on a withdrawal will depend on the individual’s overall income level. For example, an individual in a higher tax bracket will pay a higher tax rate on their withdrawals than an individual in a lower tax bracket.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore Annuity Is A Series Of 2024 to understand the different types and their potential benefits.

Potential Tax Benefits

Variable annuities can offer certain tax benefits, such as tax-deferred growth and the ability to withdraw earnings tax-free if certain conditions are met. However, it is important to consult with a qualified tax advisor to understand the specific tax implications of your variable annuity.

Calculating the exact amount of your annuity payments requires understanding the Annuity Factor 2024. This factor, based on interest rates and your life expectancy, helps determine the amount you receive each period.

Potential Tax Implications Related to Withdrawals During Retirement

When withdrawing money from a variable annuity during retirement, it is important to consider the potential tax implications. Depending on the type of withdrawal, the money may be taxed as ordinary income, capital gains, or a combination of both. It is important to consult with a financial advisor or tax professional to understand the tax implications of your specific situation.

Calculating the exact amount of your annuity payments requires understanding the Annuity Factor 2024. This factor, based on interest rates and your life expectancy, helps determine the amount you receive each period.

Variable Annuities in 2024

The variable annuity market is constantly evolving, and the performance of variable annuities can be influenced by a variety of factors, including interest rates, market volatility, and economic conditions.

Current Market Conditions

In 2024, the variable annuity market is expected to face a number of challenges, including rising interest rates and ongoing market volatility. However, the market is also expected to benefit from strong economic growth and a robust job market.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might want to explore Annuity Is Sequence Of Mode Of Payment 2024 to understand the different types and their potential benefits.

Recent Changes and Trends

Recent changes in the variable annuity market include a shift towards more sophisticated investment options and a growing emphasis on transparency and disclosure. Many insurers are also offering variable annuities with lower fees and expenses.

Factors Influencing Performance in 2024

A number of factors could influence the performance of variable annuities in 2024, including:

- Interest Rates:Rising interest rates can negatively impact the performance of variable annuities, as they can lead to lower bond yields and higher borrowing costs.

- Market Volatility:Increased market volatility can lead to greater fluctuations in the value of variable annuities, making them more risky for investors.

- Economic Growth:Strong economic growth can boost investor confidence and lead to higher stock prices, potentially benefiting the performance of variable annuities.

- Inflation:High inflation can erode the purchasing power of investment returns, potentially impacting the overall value of variable annuities.

Concluding Remarks

Variable annuities offer a complex and multifaceted investment strategy, particularly for individuals seeking to diversify their portfolios and potentially enhance their retirement savings. While they do not directly pay dividends, the performance of the underlying investments within the sub-accounts can influence potential returns.

Understanding the nuances of variable annuities, including the interplay between investment options, market fluctuations, and tax implications, is crucial for informed decision-making. As the market landscape continues to evolve, staying informed about the latest trends and potential factors impacting variable annuity performance in 2024 and beyond remains essential.

Top FAQs

What are the potential benefits of investing in variable annuities?

Variable annuities offer the potential for higher returns compared to fixed annuities. They also provide tax-deferred growth, allowing investments to grow tax-free until withdrawal. Additionally, they can offer death benefits and income guarantees, depending on the specific contract.

What are the risks associated with variable annuities?

Variable annuities carry the risk of losing money if the market declines. They also involve fees and expenses that can impact returns. Additionally, surrender charges may apply if withdrawals are made before a certain period.

How do variable annuities differ from traditional fixed annuities?

Variable annuities offer the potential for higher returns but do not guarantee a specific rate of return. Fixed annuities provide a guaranteed rate of return, but typically offer lower potential returns.

Are variable annuities suitable for everyone?

Variable annuities are best suited for investors with a long-term investment horizon and a higher risk tolerance. They may not be suitable for individuals seeking guaranteed returns or who are averse to market volatility.