Deferred Variable Annuity Definition 2024: A deferred variable annuity is a type of annuity contract that allows you to defer receiving payments until a later date. This type of annuity is often used as a retirement savings tool, as it allows you to grow your money tax-deferred and potentially benefit from market gains.

Annuity contracts can seem complex, but they can be a valuable retirement planning tool. If you’re interested in learning more about how annuities work, you can check out this article that provides a clear explanation: Annuity Explained 2024.

In essence, you are investing in a portfolio of sub-accounts that hold various investment options, aiming to achieve long-term financial growth.

Annuity contracts can be a good option for some individuals, but they may not be suitable for everyone. Before making a decision, it’s essential to weigh the pros and cons of annuities to see if they align with your financial goals and risk tolerance.

This article discusses the potential benefits and drawbacks of annuities: Annuity Is Good Or Bad 2024.

The key feature of a deferred variable annuity is that it offers a guaranteed minimum death benefit. This means that even if your investment loses value, your beneficiaries will receive a minimum amount of money. This feature can provide peace of mind, knowing that your loved ones will be protected even in the event of a market downturn.

The world of annuities is constantly evolving, with new products and regulations emerging. Staying informed about the latest developments can help you make informed decisions about your retirement planning. You can find up-to-date news and information on annuities in this article: Annuity News 2024.

Deferred Variable Annuity Definition 2024

A deferred variable annuity is a type of retirement savings plan that allows you to invest your money in a variety of investment options, such as stocks, bonds, and mutual funds. The primary benefit of a deferred variable annuity is the potential for tax-deferred growth, which means that you won’t have to pay taxes on your earnings until you withdraw them in retirement.

What is a Deferred Variable Annuity?

A deferred variable annuity is a type of retirement savings plan that allows you to invest your money in a variety of investment options, such as stocks, bonds, and mutual funds. The primary benefit of a deferred variable annuity is the potential for tax-deferred growth, which means that you won’t have to pay taxes on your earnings until you withdraw them in retirement.

Withdrawing from an annuity before age 59 1/2 generally incurs a 10% penalty. This penalty can significantly reduce your payout, so it’s important to understand the rules and potential consequences before making a withdrawal. You can learn more about the 10% penalty for early withdrawals from annuities in this article: Annuity 10 Penalty 2024.

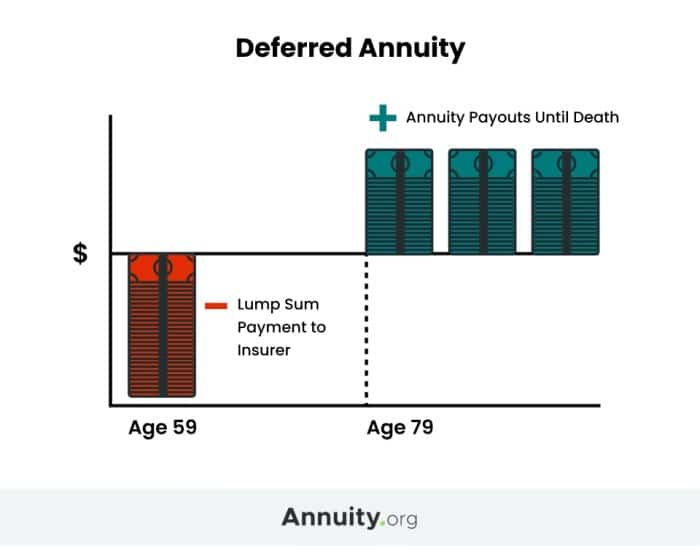

Deferred variable annuities are a type of annuity that allows you to defer receiving payments until a later date, typically during retirement. This type of annuity differs from other types, such as immediate annuities, which begin paying out immediately after you purchase them.

Variable annuities offer some unique features, including the ability to invest in a variety of sub-accounts. These sub-accounts can include stocks, bonds, and other investment options, providing potential for growth but also exposing you to market risk. To learn more about the key characteristics of variable annuities, you can read this article: Variable Annuity Characteristics 2024.

The key feature of a deferred variable annuity is that it allows you to invest your money in a variety of investment options, which can provide the potential for growth.

While some aspects of annuities may be tax-advantaged, it’s important to understand that the payouts you receive are generally taxable. This article discusses the tax implications of annuities and whether they are exempt from taxes: Is Annuity Exempt From Tax 2024.

- Stocks:Stocks represent ownership in publicly traded companies. They have the potential for higher returns than bonds, but they also carry more risk.

- Bonds:Bonds are debt securities issued by companies or governments. They generally offer lower returns than stocks, but they also carry less risk.

- Mutual Funds:Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

How Deferred Variable Annuities Work

Deferred variable annuities work by accumulating your contributions over time, allowing them to grow through investment options within the annuity contract. This process is known as the accumulation phase.

Deferred variable annuities operate through a system of sub-accounts. These sub-accounts represent different investment options within the annuity contract. Each sub-account has its own investment strategy and potential for growth. The growth of your annuity is determined by the performance of the sub-accounts you choose to invest in.

Microsoft Excel is a powerful tool for financial calculations, including annuity calculations. You can use Excel to calculate the present value (PV) of an annuity, which can help you determine the lump sum amount needed to generate a desired stream of income.

This article provides guidance on calculating the PV of an annuity in Excel: Pv Annuity Excel 2024.

A guaranteed minimum death benefit is a feature that can be added to a deferred variable annuity. This feature guarantees that your beneficiaries will receive a minimum payout, even if the value of your annuity falls below that amount. The minimum death benefit is typically a percentage of your original investment, and it can be adjusted over time.

It’s important to understand that annuities are generally taxable, and this includes the payouts you receive. To learn more about the specifics of how annuities are taxed in 2024, you can check out this article: Annuity Is Taxable 2024.

This feature can provide peace of mind, knowing that your beneficiaries will be protected from market losses.

Edward Jones is a well-known financial services firm that offers annuity products. If you’re considering an annuity from Edward Jones, you can use their annuity calculator to estimate potential payouts and compare different options. This article provides information about Edward Jones’s annuity calculator: Annuity Calculator Edward Jones 2024.

Benefits of Deferred Variable Annuities, Deferred Variable Annuity Definition 2024

Deferred variable annuities offer several advantages for retirement savings.

- Tax-Deferred Growth:The primary benefit of a deferred variable annuity is the potential for tax-deferred growth. This means that you won’t have to pay taxes on your earnings until you withdraw them in retirement. This can significantly increase the amount of money you have available in retirement.

Annuity calculations often involve interest rates, which can impact the amount of your payments. To help you understand how interest rates affect annuities, you can use an interest calculator designed specifically for annuities. This article provides information on using an interest calculator for annuities: Interest Calculator Annuity 2024.

- Compounding:Deferred variable annuities allow you to benefit from the power of compounding. This means that your earnings are reinvested, earning more interest over time. Compounding can accelerate the growth of your retirement savings.

- Protection Against Market Volatility:Deferred variable annuities can provide some protection against market volatility. This is because your investments are held within the annuity contract, which can help to mitigate the impact of market downturns.

Considerations and Risks

Deferred variable annuities have potential downsides, including fees and surrender charges.

Variable annuities often have different “classes” of shares, with Class B shares being one common type. These shares typically have higher fees initially but may decrease over time. To learn more about the characteristics and potential benefits of variable annuity Class B shares, check out this resource: Variable Annuity Class B 2024.

- Fees:Deferred variable annuities typically come with a variety of fees, such as administrative fees, mortality and expense charges, and investment management fees. These fees can eat into your returns, so it’s important to understand them before investing.

- Surrender Charges:If you withdraw money from your deferred variable annuity before a certain period, you may be subject to surrender charges. These charges can be substantial, so it’s important to consider the potential impact before withdrawing money.

- Market Performance:The value of your deferred variable annuity is tied to the performance of the underlying investments. If the market performs poorly, the value of your annuity could decline.

Choosing the Right Deferred Variable Annuity

When selecting a deferred variable annuity, there are several factors to consider.

Variable annuities can be structured in different ways, including “B Shares.” These shares typically come with higher fees, but they may also offer potential for growth. If you’re considering variable annuities and want to learn more about B Shares, you can read this article: Variable Annuity B Shares 2024.

- Investment Options:Make sure the annuity offers a variety of investment options that align with your risk tolerance and investment goals.

- Fees:Compare the fees charged by different providers to ensure you’re getting a competitive deal.

- Surrender Charges:Understand the surrender charges associated with the annuity and how they might impact your investment strategy.

- Guaranteed Minimum Death Benefit:Consider whether a guaranteed minimum death benefit is right for you and your beneficiaries.

- Annuity Provider:Evaluate the financial strength and reputation of the annuity provider to ensure that your money is secure.

Here is a table comparing different features of deferred variable annuities from various providers:

| Provider | Investment Options | Fees | Surrender Charges | Guaranteed Minimum Death Benefit |

|---|---|---|---|---|

| Provider A | Stocks, bonds, mutual funds | 1.5% annual fee | 7% for the first 5 years | Yes, 100% of original investment |

| Provider B | Stocks, bonds, mutual funds, real estate | 1.0% annual fee | 5% for the first 3 years | Yes, 110% of original investment |

| Provider C | Stocks, bonds, mutual funds, commodities | 2.0% annual fee | 8% for the first 7 years | No |

To evaluate the financial strength and reputation of an annuity provider, you can check their ratings with independent organizations such as A.M. Best, Standard & Poor’s, and Moody’s. You can also research the provider’s track record and customer satisfaction ratings.

When you receive annuity payments, you’ll likely receive a Form 1099-R from the annuity provider. This form outlines the amount of your annuity payments, and you’ll need to report this income on your tax return. For more details on how annuities are reported on Form 1099-R in 2024, take a look at this resource: Annuity 1099 2024.

Deferred Variable Annuity in 2024

The deferred variable annuity market has seen some recent changes and trends. The rise of low-cost index funds and ETFs has put pressure on annuity providers to offer more competitive fees. Some providers are now offering deferred variable annuities with lower fees and more investment options.

Annuity calculations often involve specific formulas that determine how much you’ll receive in payments. If you’re interested in understanding the math behind annuities, you can find a detailed explanation of the annuity formula in this article: Annuity Formula Is 2024.

Economic factors, such as interest rates and inflation, can impact the performance of deferred variable annuities. Rising interest rates can make bonds less attractive, which could lead to lower returns for annuity holders. Inflation can erode the purchasing power of your retirement savings, making it more difficult to maintain your desired lifestyle.

Emerging trends in deferred variable annuity products include:

- Variable Annuities with Guaranteed Income Riders:These annuities offer a guaranteed income stream in retirement, providing greater security and peace of mind.

- Deferred Variable Annuities with Longevity Riders:These annuities offer protection against the risk of outliving your retirement savings, ensuring that you have income for the rest of your life.

- Deferred Variable Annuities with Social Security Integration:These annuities allow you to integrate your Social Security benefits into your annuity plan, potentially maximizing your retirement income.

Conclusion

Understanding the Deferred Variable Annuity Definition 2024 can help you make informed decisions about your retirement savings. It’s important to weigh the potential benefits and risks, consider your individual financial goals and risk tolerance, and carefully evaluate the features of different annuity products.

Financial calculators can be incredibly helpful when it comes to planning for retirement, especially when you’re considering annuities. You can find calculators specifically designed for annuities that can help you estimate potential payouts and make informed decisions. This article offers guidance on using financial calculators for annuities: Financial Calculator Annuity 2024.

Remember, the key to success with any investment is to conduct thorough research, understand the terms and conditions, and seek advice from a qualified financial advisor.

Key Questions Answered: Deferred Variable Annuity Definition 2024

How does a deferred variable annuity differ from a fixed annuity?

Unlike a fixed annuity that offers a guaranteed rate of return, a deferred variable annuity’s returns are tied to the performance of the underlying investment options. This means your returns are not guaranteed and can fluctuate with market conditions.

What are the potential risks associated with deferred variable annuities?

As with any investment, deferred variable annuities carry risks. Market volatility can negatively impact the value of your investment. Additionally, deferred variable annuities often have fees and surrender charges, which can reduce your overall returns.

When should I consider a deferred variable annuity for my retirement savings?

Deferred variable annuities can be a good option for individuals who are seeking to grow their retirement savings, have a long investment horizon, and are comfortable with some level of investment risk.

How do I choose the right deferred variable annuity provider?

It’s crucial to choose a reputable and financially sound annuity provider. Consider factors like the provider’s financial strength, investment options, fees, and customer service.