Daily Mortgage Rates 2024: Navigating the Market is a critical topic for anyone considering buying a home in the current economic climate. Understanding the factors influencing daily mortgage rates is essential for making informed financial decisions, especially in a year marked by significant volatility.

Keep up-to-date on the latest interest rate changes by checking current home loan interest rates regularly.

Mortgage rates are a key driver of affordability and can impact the overall housing market. In 2024, we’ve witnessed a dynamic landscape of rate fluctuations influenced by factors like the Federal Reserve’s monetary policy, inflation, and global events. This article explores the current trends, key influences, and strategies for navigating this complex market.

Want to know how much your monthly mortgage payments might be? Use an online calculator to get an estimated mortgage payment.

Daily Mortgage Rates 2024: A Guide for Homebuyers

Understanding daily mortgage rates is crucial for anyone planning to buy a home in 2024. These rates, which fluctuate constantly, directly impact the cost of borrowing money to finance a mortgage. By staying informed about daily mortgage rate trends and the factors influencing them, homebuyers can make more informed decisions and potentially secure a favorable rate.

ARM rates, or adjustable-rate mortgages, can be a good option for those who plan to sell their home within a few years. You can learn more about ARM rates and see if they’re right for you.

Introduction to Daily Mortgage Rates

Daily mortgage rates represent the interest rate charged on a mortgage loan on any given day. They are influenced by a complex interplay of economic and market forces, resulting in constant fluctuations. These rates are expressed as an annual percentage rate (APR) and are used to calculate the monthly mortgage payments.

Tracking daily mortgage rate fluctuations is vital for homebuyers because it allows them to:

- Identify potential opportunities to secure a lower rate.

- Make informed decisions about when to lock in a rate.

- Understand the impact of market changes on their borrowing costs.

Several key factors influence daily mortgage rates, including:

- Federal Reserve monetary policy:The Federal Reserve’s actions, such as adjusting interest rates, can significantly impact mortgage rates.

- Inflation:Rising inflation can lead to higher mortgage rates as lenders adjust their rates to reflect the increased cost of borrowing.

- Economic indicators:Economic data, such as employment figures and GDP growth, can influence market sentiment and, in turn, mortgage rates.

- Global events:Geopolitical events, such as wars or trade disputes, can create uncertainty in the market and impact mortgage rates.

Current Trends in Daily Mortgage Rates 2024

As of [current date], daily mortgage rates are currently [mention the current rate trend, e.g., slightly higher, stable, or slightly lower] than they were at the beginning of the year. [Insert specific rate data, if available].

Throughout 2024, mortgage rates have been [describe the major trends, e.g., volatile, steadily increasing, or fluctuating within a narrow range]. This trend can be attributed to [mention the primary factors driving the trend, e.g., rising inflation, the Federal Reserve’s tightening monetary policy, or global economic uncertainty].

Already have a mortgage? You might be able to save money by refinancing. See what best refinance rates are available and see if it’s a good fit for your financial situation.

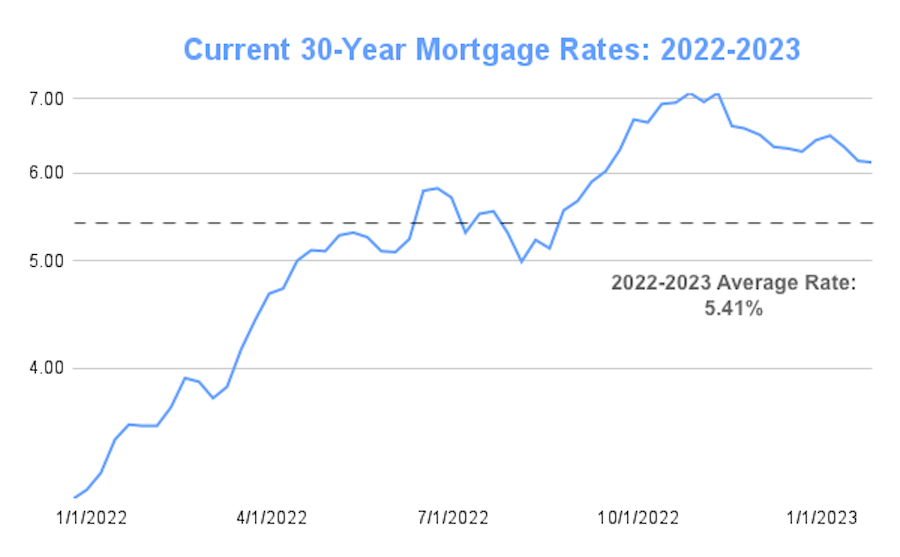

Comparing current rates to historical averages, current mortgage rates are [higher, lower, or similar] than the average rates in previous years. [Include relevant data or historical context for comparison].

Wells Fargo is a popular choice for mortgage lenders. To see their current rates, check out Wells Fargo mortgage rates.

Factors Affecting Daily Mortgage Rate Changes

The Federal Reserve’s monetary policy plays a crucial role in influencing mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, which often leads to higher mortgage rates. Conversely, when the Fed lowers interest rates, it can make borrowing cheaper and potentially lead to lower mortgage rates.

Whether you’re buying a new home or refinancing your current mortgage, it’s important to shop around and compare home loan rates from different lenders.

Inflation is another significant factor affecting mortgage rates. As inflation rises, lenders may increase their rates to compensate for the increased cost of borrowing. Conversely, if inflation is low, lenders may offer lower rates.

Economic indicators, such as employment figures and GDP growth, provide insights into the overall health of the economy. Strong economic indicators can boost market confidence and potentially lead to lower mortgage rates. Conversely, weak economic indicators can increase uncertainty and lead to higher rates.

Global events, such as wars, trade disputes, or natural disasters, can create volatility in the financial markets and impact mortgage rates. These events can create uncertainty and potentially lead to higher rates.

Learn more about the ins and outs of mortgages and the current market by checking out mortgage information online.

Understanding Different Mortgage Rate Types

There are two main types of mortgage rates: fixed-rate and adjustable-rate mortgages (ARMs).

Veterans looking for a mortgage can check out VA loan rates today to see if they qualify for a VA loan.

- Fixed-rate mortgages:These mortgages have an interest rate that remains fixed for the entire loan term, typically 15 or 30 years. This provides borrowers with predictable monthly payments and protects them from fluctuations in interest rates.

- Adjustable-rate mortgages (ARMs):These mortgages have an interest rate that adjusts periodically based on a benchmark index, such as the LIBOR or the prime rate. ARMs typically offer lower initial interest rates compared to fixed-rate mortgages, but the rates can fluctuate over time, potentially leading to higher payments.

Want to see what mortgage rates look like today? Check out home mortgage rates today.

Choosing between a fixed-rate or an adjustable-rate mortgage depends on individual circumstances and financial goals. For example:

- Fixed-rate mortgagesare suitable for borrowers who prioritize stability and predictability in their monthly payments, even if it means potentially paying a higher initial interest rate.

- Adjustable-rate mortgagesmight be advantageous for borrowers who anticipate a shorter time frame in their home, such as those planning to sell or refinance within a few years. However, ARMs come with the risk of higher payments if interest rates rise significantly.

To get a general idea of what to expect, you can look at the average home loan interest rate for the current year.

Impact of Daily Mortgage Rates on Homebuyers, Daily Mortgage Rates 2024

Fluctuating mortgage rates can significantly impact homebuyers’ affordability and purchasing power. When rates rise, the cost of borrowing increases, making it more expensive to finance a mortgage. This can reduce the amount of money a homebuyer can borrow and limit the price range of homes they can afford.

The impact of rising mortgage rates on the housing market can be multifaceted. It can lead to a slowdown in home sales activity as buyers become more cautious due to increased borrowing costs. Additionally, it can put downward pressure on home prices as sellers may need to adjust their asking prices to attract buyers in a less competitive market.

If you’re considering refinancing your mortgage, it’s important to research refinance rates from different lenders to find the best deal.

Here are some tips for navigating the current rate environment for homebuyers:

- Get pre-approved for a mortgage:This gives you a better understanding of your borrowing power and helps you make informed offers on homes.

- Shop around for lenders:Compare rates and fees from multiple lenders to secure the best possible deal.

- Consider a shorter loan term:A 15-year mortgage typically has a lower interest rate than a 30-year mortgage, which can save you money over the life of the loan.

- Be prepared to adjust your expectations:In a market with rising mortgage rates, you may need to be flexible with your budget and consider homes within a slightly lower price range.

Strategies for Managing Mortgage Rates

Several strategies can help homebuyers manage mortgage rates and potentially secure favorable terms:

- Lock in a rate:Once you find a rate that you’re comfortable with, consider locking it in to protect yourself from potential rate increases.

- Research and compare lenders:Different lenders offer varying rates and fees, so it’s crucial to shop around and compare options to find the best deal.

- Consider refinancing options:If interest rates fall after you’ve taken out a mortgage, refinancing can help you lower your monthly payments and potentially save money over the life of the loan.

- Explore rate adjustments:Some lenders may offer rate adjustments or modifications, which can help you manage your mortgage payments in case of financial hardship.

Ending Remarks

Navigating the world of daily mortgage rates in 2024 requires staying informed and proactive. By understanding the factors influencing rates, researching lenders, and considering various mortgage options, potential homebuyers can make informed decisions and achieve their financial goals. This guide has provided insights into the current market landscape, strategies for managing rates, and the impact on homeownership.

Remember, seeking professional financial advice tailored to your individual circumstances is always recommended.

Bank of America is another major lender offering refinance options. You can compare their rates by checking out Bank of America refinance rates.

Question Bank: Daily Mortgage Rates 2024

What is the average daily mortgage rate in 2024?

If you’re a veteran, you may be eligible for a VA loan, which offers competitive rates and no down payment requirements. Check out VA interest rates to see if this is the right option for you.

The average daily mortgage rate in 2024 has fluctuated, but it’s best to check current rates with reputable lenders for the most accurate information.

How often do mortgage rates change?

Variable home loan rates can be a good option if you think interest rates will go down in the future. You can compare variable home loan rates to see if they’re right for you.

Mortgage rates can change daily, sometimes even multiple times a day, based on market conditions.

What are the main factors that affect mortgage rates?

Key factors include the Federal Reserve’s monetary policy, inflation, economic growth, global events, and investor sentiment.

Is it better to get a fixed-rate or adjustable-rate mortgage in 2024?

Looking to buy a home in 2024? You’ll want to keep an eye on current mortgage rates to make sure you get the best deal. Rates can fluctuate daily, so it’s important to stay informed.

The best choice depends on your individual circumstances and risk tolerance. Fixed-rate mortgages offer stability, while adjustable-rate mortgages can offer lower initial rates but come with potential future increases.

How can I lock in a favorable mortgage rate?

You can lock in a rate for a specific period, typically 30 to 60 days, to secure a certain rate. However, locking in comes with potential costs and limitations.