Current VA Interest Rates 2024 are a critical factor for veterans seeking homeownership. This year, the VA loan market is experiencing dynamic shifts, influenced by the Federal Reserve’s monetary policy, market conditions, and lender competition. Understanding these fluctuations is crucial for veterans to secure the best possible rates and navigate the homebuying process effectively.

For those seeking financing for commercial properties, consider connecting with a commercial mortgage broker in 2024. They can guide you through the process and help you secure the right loan.

This comprehensive guide will delve into the intricacies of VA loan interest rates, providing insights into current trends, historical comparisons, and factors that impact individual borrowers. We will also explore the benefits of VA loans, eligibility requirements, and practical tips for securing the most competitive rates.

Discover offers a HELOC, or home equity line of credit. Explore their Discover HELOC options in 2024 to see if it’s a suitable financial tool for you.

VA Loan Interest Rates in 2024: Current Va Interest Rates 2024

VA loans are a fantastic option for eligible veterans, active-duty military personnel, and surviving spouses. They offer a unique set of benefits that can make homeownership more accessible. Understanding the current VA loan interest rates and how they compare to historical trends is crucial for making informed decisions about financing your home.

When searching for the best mortgage deal, you’ll want to look at best home loan interest rates available in 2024. This can save you a significant amount of money over the life of your loan.

This guide will delve into the key aspects of VA loan interest rates in 2024, helping you navigate the process of securing a mortgage.

For military members, Navy Federal Credit Union offers mortgage options. Check out their Navy Federal mortgage rates in 2024 to see if they are competitive.

Current VA Loan Interest Rates

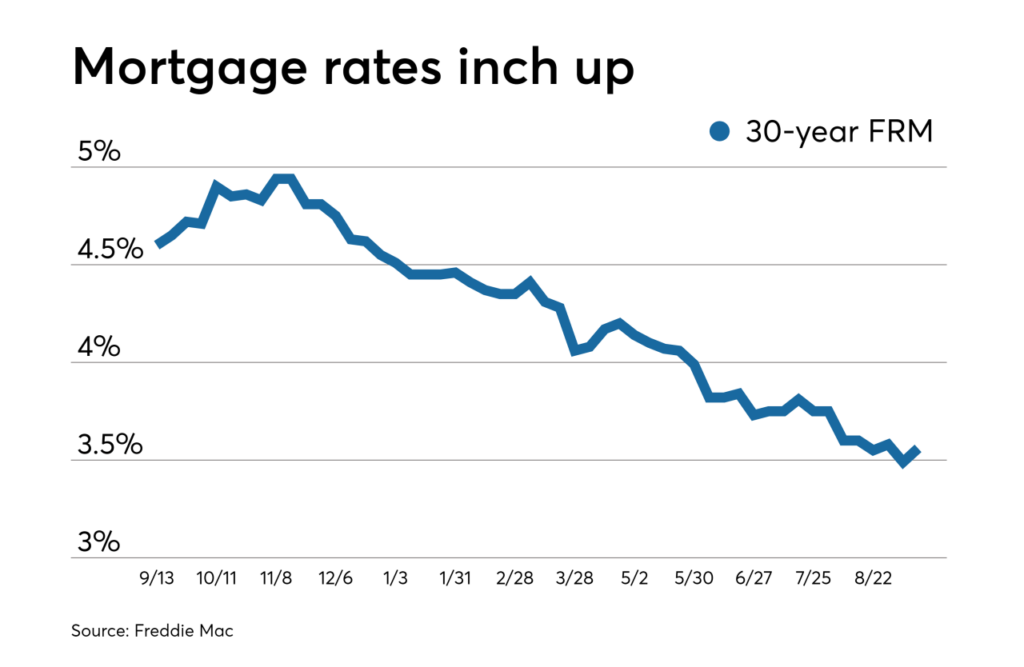

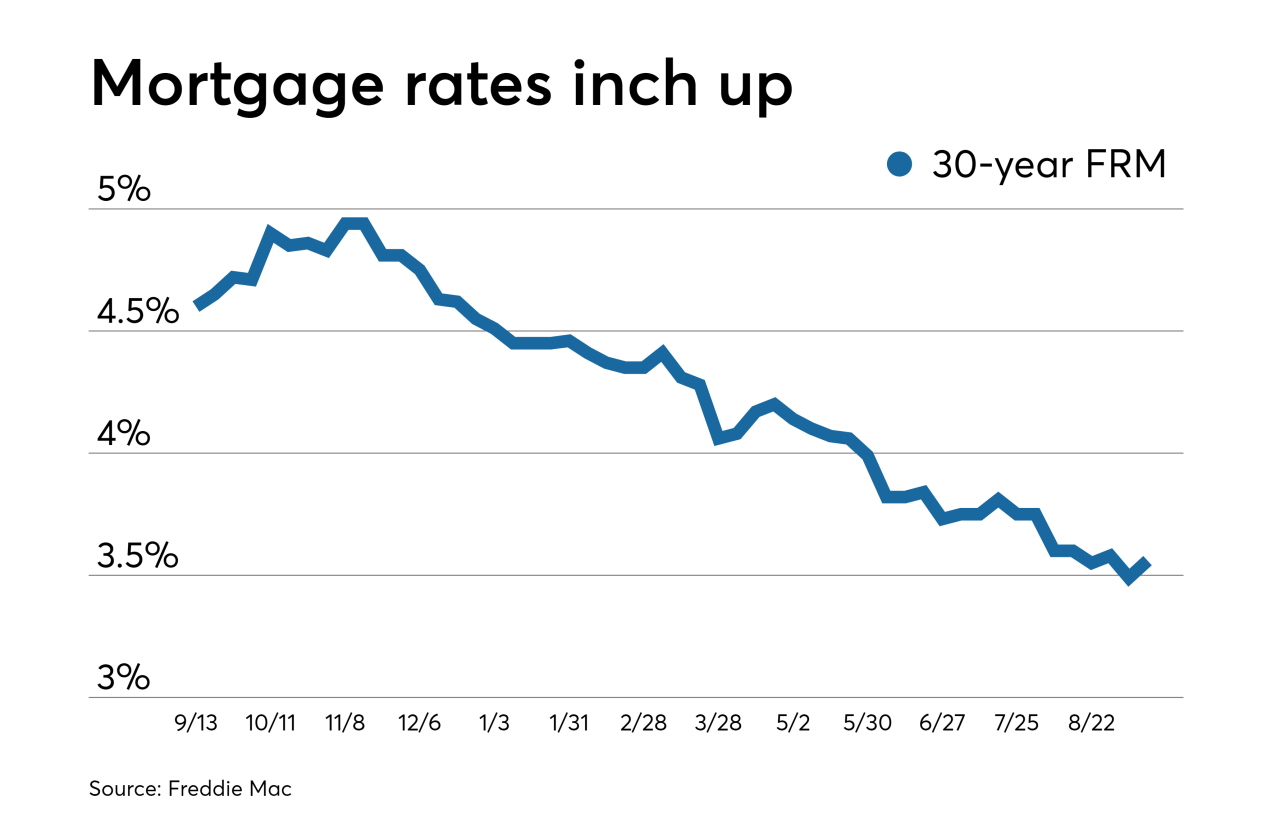

VA loan interest rates are constantly fluctuating, influenced by various economic factors. To get the most up-to-date information, it’s best to contact a VA-approved lender directly. However, here’s a general overview of current trends:

- As of [date], VA loan interest rates for fixed-rate mortgages are generally lower than conventional mortgage rates. This is due to the unique government backing that VA loans receive.

- Rates for 30-year fixed-rate VA loans typically fall within the range of [rate range]%, while rates for 15-year fixed-rate VA loans are generally in the range of [rate range]%.

- It’s important to remember that these rates are subject to change daily. Factors like the Federal Reserve’s monetary policy, inflation, and market conditions can all impact interest rates.

Understanding VA Loan Eligibility and Benefits

VA loans are designed to help eligible veterans, active-duty military personnel, and surviving spouses achieve homeownership. To qualify for a VA loan, you must meet specific criteria:

- Service History:You must have served on active duty in the U.S. military for a minimum period of time, typically 90 days or more. Certain exceptions apply, such as those who served during wartime or who were discharged due to a service-related disability.

Mortgage rates are constantly changing, so it’s helpful to check home mortgage rates today in 2024 to get a current understanding of the market.

- Credit Score:Lenders typically have minimum credit score requirements for VA loans, which can vary depending on the lender. A good credit score is essential for securing favorable interest rates and loan terms.

- Debt-to-Income Ratio:Your debt-to-income ratio (DTI) is calculated by dividing your monthly debt payments by your gross monthly income. Lenders generally prefer a DTI below a certain threshold to ensure you can comfortably manage your mortgage payments.

VA loans offer numerous benefits, including:

- No Down Payment:One of the most significant advantages of VA loans is the ability to purchase a home with no down payment. This can be a game-changer for veterans who may not have saved a large down payment.

- No Private Mortgage Insurance (PMI):Conventional loans often require PMI if you make a down payment of less than 20%. VA loans do not require PMI, saving you money on your monthly mortgage payments.

- Competitive Interest Rates:VA loans generally offer competitive interest rates compared to conventional loans. The government backing of VA loans helps to reduce risk for lenders, allowing them to offer lower rates.

VA Loan Rates for Different Loan Types, Current Va Interest Rates 2024

VA loans are available in various forms, each with its own set of advantages and disadvantages:

Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments, as the interest rate remains the same throughout the loan term. This provides financial stability and allows you to budget effectively. VA fixed-rate mortgages are a popular choice for borrowers seeking long-term certainty.

Adjustable-Rate Mortgages (ARMs)

ARMs have interest rates that can adjust periodically based on market conditions. They often start with a lower initial interest rate compared to fixed-rate mortgages, making them attractive for borrowers who plan to sell their home or refinance within a shorter timeframe.

If you’re a veteran, you may be eligible for a VA loan. Explore VA mortgage rates in 2024 to see if this option could work for you.

However, the potential for rate increases can create uncertainty in your monthly payments.

VA Refinance Loans

VA refinance loans allow you to refinance an existing VA loan or even a conventional loan into a VA loan. This can help you lower your interest rate, shorten your loan term, or consolidate debt. VA refinance loans can be a valuable tool for improving your financial situation.

Navigating the mortgage process can be complex, so consider consulting with a mortgage advisor in 2024. They can help you understand your options and find the best loan for your situation.

| Loan Term | Current Average VA Interest Rates (as of [date]) |

|---|---|

| 15-year Fixed-Rate | [rate range]% |

| 20-year Fixed-Rate | [rate range]% |

| 30-year Fixed-Rate | [rate range]% |

Remember that these are just average rates and actual rates may vary depending on your individual circumstances.

For those who prefer a predictable monthly payment, a best fixed-rate mortgage in 2024 could be the right choice. This type of mortgage offers a set interest rate that won’t change, providing peace of mind.

Factors Affecting VA Loan Rates for Individual Borrowers

While VA loan interest rates are influenced by broader economic factors, several individual factors can also affect your specific rate:

- Credit Score:A higher credit score generally translates to lower interest rates. Lenders view borrowers with good credit as less risky, allowing them to offer more favorable terms.

- Loan Amount:Larger loan amounts may come with slightly higher interest rates. Lenders may consider larger loans to be riskier and adjust rates accordingly.

- Property Location:The location of the property can influence interest rates. Properties in high-demand areas may have lower rates due to greater perceived value and lower risk for lenders.

- Debt-to-Income Ratio (DTI):A lower DTI generally indicates a better ability to manage debt, leading to potentially lower interest rates. Lenders consider DTI as a key indicator of your financial stability.

The impact of credit score on VA loan rates can be significant. Here’s a general illustration:

Credit Score Range | Average VA Interest Rate

760-850 | [rate range]%

A second mortgage can provide additional financing for a variety of needs. Check out 2nd mortgage options in 2024 to see if it’s a good fit for your situation.

700-759 | [rate range]%

660-699 | [rate range]%

If you’re looking to avoid upfront costs, a no closing cost mortgage in 2024 might be an attractive option. However, it’s important to understand the trade-offs involved.

620-659 | [rate range]%

Below 620 | May face difficulty qualifying for a VA loan

US Bank is a well-known lender, and it’s worth checking out their US Bank mortgage options in 2024 to see if they fit your needs.

This table provides a general idea of how credit score can influence rates. Actual rates may vary depending on the lender and other factors.

A reverse mortgage, or HECM, can be a helpful option for older homeowners. Learn more about HECM options in 2024 to see if it could benefit you.

Tips for Obtaining the Best VA Loan Rate

To maximize your chances of securing the most competitive VA loan rate, consider these strategies:

- Improve Your Credit Score:A higher credit score is crucial for obtaining favorable loan terms. Pay down debt, make payments on time, and avoid opening new credit accounts unnecessarily.

- Shop Around for Lenders:Don’t settle for the first lender you encounter. Compare rates and terms from multiple VA-approved lenders to find the best deal. You can use online tools or contact lenders directly.

- Negotiate Loan Terms:Once you’ve identified a lender you’re comfortable with, don’t be afraid to negotiate loan terms, such as interest rate and closing costs. Be prepared to explain your financial situation and why you deserve a lower rate.

- Understand Lender Fees and Closing Costs:VA loans typically have certain lender fees and closing costs. Make sure you understand these fees upfront and factor them into your overall budget. Ask lenders for detailed breakdowns of all fees and charges.

Last Recap

Navigating the VA loan landscape requires careful planning and informed decision-making. By understanding current VA interest rates, exploring different loan types, and taking advantage of available resources, veterans can secure a mortgage that aligns with their financial goals and provides a path to homeownership.

To get a clear picture of the current lending landscape, it’s a good idea to research home interest rates today in 2024. This can help you make informed decisions about your mortgage.

Remember to shop around, compare lenders, and prioritize a loan that offers favorable terms and long-term affordability.

If you’re considering taking out a mortgage in 2024, you’ll want to stay up-to-date on ARM mortgage rates. These rates can fluctuate, so it’s important to shop around and compare offers from different lenders.

FAQ Overview

What is the current average VA interest rate for 2024?

Getting pre-approved for a mortgage can strengthen your offer when you’re ready to buy a home. Check out home loan pre-approval options for 2024.

The average VA interest rate fluctuates daily. To get the most up-to-date information, it’s best to contact multiple lenders directly.

How can I improve my chances of getting a lower VA loan rate?

Improve your credit score, shop around for lenders, and consider a shorter loan term.

What are some common lender fees associated with VA loans?

Common fees include origination fees, appraisal fees, and closing costs.

Are VA loans available for refinancing existing mortgages?

Yes, VA loans can be used to refinance existing mortgages. This can help lower your interest rate, shorten your loan term, or consolidate debt.