Current Home Loan Rates 2024 are a hot topic for anyone looking to buy a home. With the Federal Reserve’s ongoing efforts to manage inflation, rates are fluctuating, making it crucial to understand the factors influencing them and how they impact your borrowing power.

If you’re looking to refinance your current mortgage, you might be able to secure a lower interest rate and save money. Explore the best refinance rates for 2024 at Best Refinance Rates 2024.

This guide explores the current landscape of home loan rates, different loan types, and strategies for securing the best possible rates.

A mortgage loan is a large financial commitment, so it’s important to understand the terms and conditions before you apply. Learn more about mortgage loans for 2024 at Mortgage Loan 2024.

Navigating the world of home loans can be daunting, but understanding the key factors influencing rates empowers you to make informed decisions. This guide will delve into the factors affecting rates, including economic indicators, your credit score, and the loan terms themselves.

We’ll also explore different types of home loans, their advantages and disadvantages, and provide practical tips for securing the best rates.

If you’re looking to finance a commercial property, there are specific mortgage options available. Learn more about commercial mortgages for 2024 at Commercial Mortgage 2024.

Understanding Current Home Loan Rates

Home loan rates are constantly fluctuating, making it crucial for potential homebuyers to stay informed about the current market conditions. Understanding the factors that influence these rates is essential for making informed decisions and securing the best possible loan terms.

Looking to secure a mortgage in 2024? Rocket Mortgage is a popular choice, and you can find their current rates by visiting Rocket Mortgage Rates Today 2024.

Factors Influencing Home Loan Rates

Several factors contribute to the current home loan rates in 2024. These factors can be categorized into macroeconomic, market-specific, and individual borrower characteristics.

An adjustable rate mortgage (ARM) can be a good option for some borrowers, especially if you plan to sell your home within a few years. Learn more about ARM rates for 2024 at Adjustable Rate Mortgage 2024.

- Federal Reserve’s Monetary Policy:The Federal Reserve’s actions directly impact interest rates across the economy, including home loan rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, leading to higher home loan rates. Conversely, when the Fed lowers rates, borrowing costs decrease, resulting in lower home loan rates.

Home loan rates are constantly changing, so it’s important to stay up-to-date on the latest trends. Find current home loan rates for 2024 at Home Loan Rates 2024.

- Inflation:High inflation erodes the purchasing power of money, prompting the Federal Reserve to increase interest rates to curb inflation. This, in turn, leads to higher home loan rates.

- Economic Growth:Strong economic growth can lead to higher demand for loans, including home loans. This increased demand can push up interest rates.

- Housing Market Conditions:Factors like housing supply, demand, and price trends in the local market also play a role in home loan rates. In a competitive market with high demand and limited supply, lenders may offer higher rates to attract borrowers.

- Investor Demand for Mortgage-Backed Securities:When investors are eager to purchase mortgage-backed securities, it drives down interest rates for home loans. Conversely, low investor demand can lead to higher rates.

Types of Home Loans Available

In 2024, a variety of home loan options are available, each with its own set of features and benefits. Understanding the differences between these options is crucial for choosing the right loan for your individual needs and circumstances.

Finding the lowest interest rate mortgage is a top priority for many homebuyers. You can compare rates from different lenders and find the best deal for you by visiting Lowest Interest Rate Mortgage 2024.

Fixed-Rate Mortgages

Fixed-rate mortgages offer a predictable and stable interest rate throughout the life of the loan. This means your monthly payments will remain the same, providing financial certainty and budgeting ease.

Discover offers a HELOC, which can be a great option for homeowners looking to tap into their equity. Learn more about their current rates and terms at Discover Heloc 2024.

- Advantages:Predictable monthly payments, protection from rising interest rates, long-term financial stability.

- Disadvantages:Potentially higher initial interest rates compared to adjustable-rate mortgages, limited flexibility for refinancing.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages offer an initial interest rate that is typically lower than fixed-rate mortgages. However, the interest rate adjusts periodically, usually every 5, 7, or 10 years, based on a predetermined index.

Ready to take the next step and apply for a mortgage? Check out these resources to get started: Apply For Mortgage 2024.

- Advantages:Lower initial interest rates, potential for lower monthly payments during the initial period, flexibility for refinancing.

- Disadvantages:Interest rate fluctuations can lead to unpredictable monthly payments, potential for higher payments in the future, risk of interest rate increases exceeding affordability.

Current Market Trends and Predictions

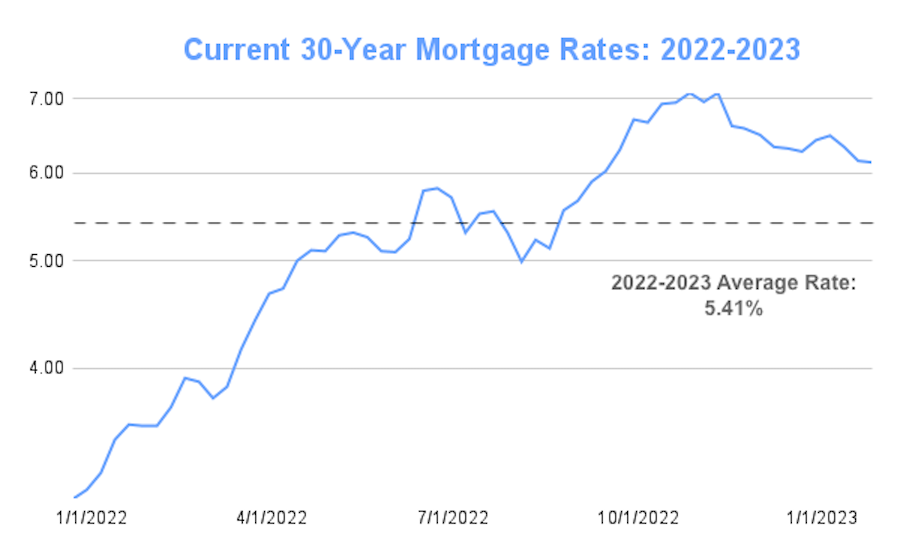

Home loan rates have been fluctuating significantly in recent years, reflecting the dynamic economic environment. Experts predict that rates will continue to be influenced by factors like inflation, economic growth, and Federal Reserve policy.

Getting a cheap home loan can help you save money over the life of your mortgage. Explore your options and find the best deals on Cheap Home Loans 2024.

Factors Affecting Individual Loan Rates, Current Home Loan Rates 2024

| Factor | Impact on Loan Rate |

|---|---|

| Credit Score | Higher credit scores generally result in lower interest rates. |

| Debt-to-Income Ratio (DTI) | A lower DTI indicates a lower risk to lenders, often leading to more favorable rates. |

| Loan-to-Value Ratio (LTV) | A lower LTV, signifying a larger down payment, typically translates to lower interest rates. |

| Loan Amount | Larger loan amounts may be associated with slightly higher interest rates due to increased risk for lenders. |

| Amortization Period | Longer loan terms (e.g., 30 years) often come with higher interest rates compared to shorter terms (e.g., 15 years). |

Strategies for Obtaining the Best Rates

Securing the most favorable home loan rates requires proactive research, comparison, and negotiation. Here are some key strategies to consider:

- Shop Around:Obtain quotes from multiple lenders to compare interest rates, fees, and loan terms.

- Pre-Approval:Get pre-approved for a mortgage before you start house hunting. This demonstrates your financial readiness and can strengthen your negotiating position.

- Improve Your Credit Score:A higher credit score can significantly improve your chances of getting a lower interest rate.

- Negotiate:Don’t hesitate to negotiate with lenders to try to secure a better interest rate.

Resources and Tools for Homebuyers

Several online resources and tools can assist homebuyers in researching home loan rates and making informed decisions.

Buying your first home is an exciting milestone! There are resources available to help first-time homebuyers navigate the process. Find helpful tips and information at First Time Home Buyers 2024.

- Mortgage Calculators:Use online mortgage calculators to estimate monthly payments and compare different loan scenarios.

- Rate Comparison Websites:Websites that compare mortgage rates from various lenders can help you find the best deals.

- Mortgage Professionals:Consult with a qualified mortgage professional for personalized advice and guidance.

End of Discussion: Current Home Loan Rates 2024

As you embark on your home buying journey, remember that understanding current home loan rates is crucial. By staying informed about market trends, your individual financial situation, and the various loan options available, you can make confident decisions that align with your financial goals.

If you’re a veteran, you may be eligible for a VA loan, which often has competitive rates. Learn more about VA loan rates for 2024 at Va Loan Interest Rate 2024.

Don’t hesitate to seek professional guidance from a qualified mortgage professional to ensure you secure the best possible rates and terms for your unique circumstances.

Expert Answers

What are the current average home loan rates?

A mortgage broker can help you navigate the mortgage process and find the best loan for your needs. Find a broker in your area at Mortgage Broker Near Me 2024.

Average home loan rates fluctuate daily. To get the most up-to-date information, it’s best to consult reputable online resources or speak with a mortgage lender.

UWM Mortgage is another popular lender, and their rates are often competitive. Check out their rates and options at Uwm Mortgage 2024.

How do I know if I qualify for a home loan?

Lenders use various factors to determine your eligibility, including your credit score, debt-to-income ratio, and income verification. It’s recommended to get pre-approved for a loan before starting your home search to understand your borrowing power.

What is the difference between a fixed-rate and adjustable-rate mortgage?

Chase is another major lender, and their rates can be found on their website, or you can check out this helpful resource: Chase Mortgage Rates 2024.

A fixed-rate mortgage offers a consistent interest rate throughout the loan term, while an adjustable-rate mortgage has an initial fixed rate that adjusts periodically based on market conditions.