CPI Through the Decades: Key Trends and Patterns Leading to November 2024, this exploration delves into the historical evolution of the Consumer Price Index (CPI) and its crucial role in measuring inflation. From the early 20th century to the present day, the CPI has witnessed significant shifts and trends, reflecting the changing economic landscape and consumer behavior.

This analysis will examine key events, economic forces, and emerging patterns that have shaped the CPI’s trajectory, providing insights into its potential impact on consumers and businesses in the years ahead.

The CPI, a vital economic indicator, offers a comprehensive snapshot of the average price changes for a basket of goods and services consumed by urban households. Understanding its fluctuations is essential for policymakers, economists, and individuals alike. By analyzing historical trends and considering current economic factors, we can gain a deeper understanding of inflation’s impact on purchasing power, investment strategies, and overall economic stability.

Understanding CPI: A Historical Overview

The Consumer Price Index (CPI) is a crucial economic indicator that measures changes in the prices of a basket of goods and services consumed by urban households. It serves as a vital gauge of inflation, providing insights into the purchasing power of consumers and the overall health of the economy.

The Evolution of CPI Calculation Methodology

The CPI has undergone significant evolution in its calculation methodology over the decades. Initially, the CPI was based on a fixed basket of goods and services, which was updated periodically. However, this approach faced challenges in accurately reflecting changing consumer preferences and the introduction of new products.In the 1970s, the CPI calculation shifted to a more dynamic approach using a “chained” methodology.

This method accounts for substitution effects, where consumers switch to less expensive alternatives when prices rise. The chained CPI has been widely adopted by developed economies, offering a more accurate representation of inflation.

A Historical Timeline of CPI Events

The CPI has witnessed periods of high inflation, deflation, and economic stability throughout history. Notable events include:

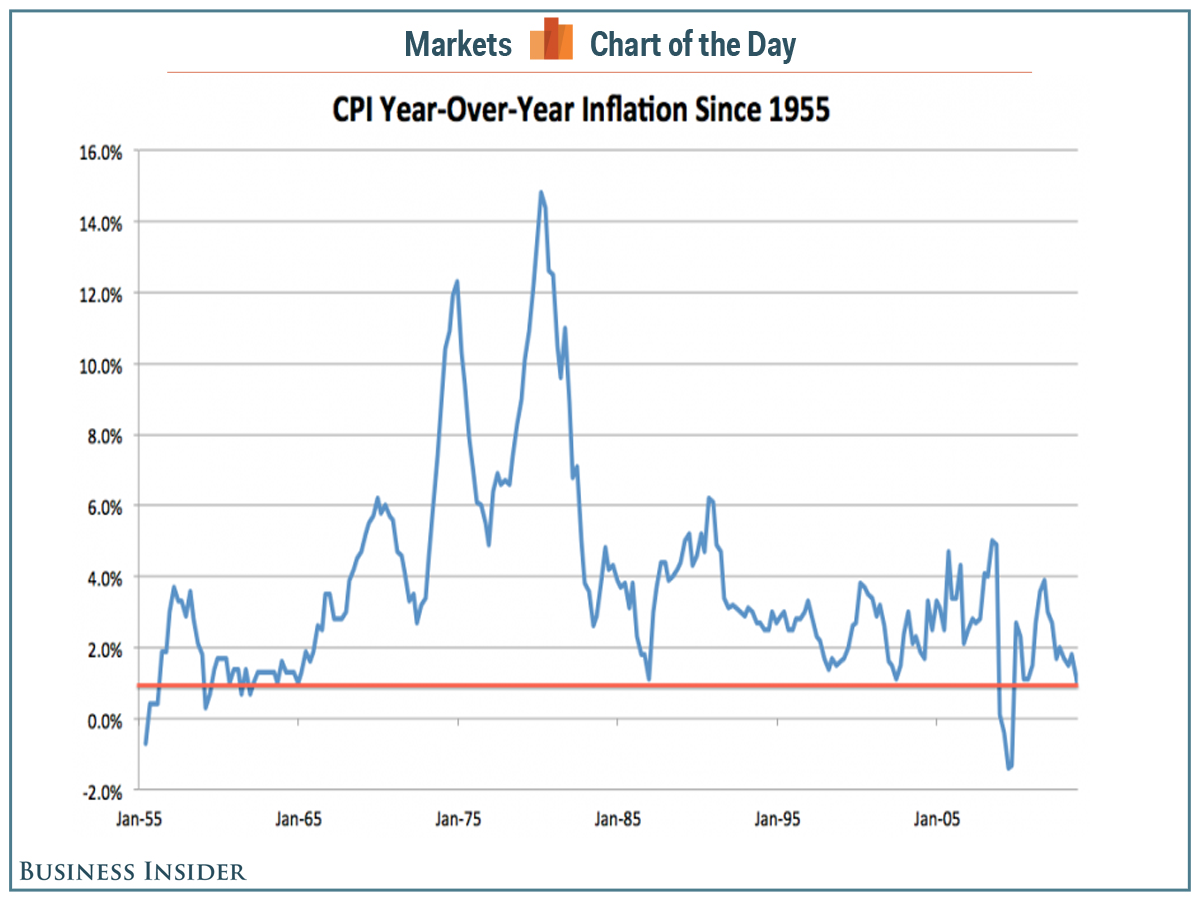

- The Great Depression (1929-1939):Deflationary pressures gripped the global economy, leading to a significant decline in the CPI.

- World War II (1939-1945):The war effort led to price controls and rationing, impacting CPI fluctuations.

- The 1970s Oil Crisis:The energy crisis caused a surge in oil prices, contributing to a period of high inflation known as “stagflation.”

- The 1980s and 1990s:Economic policies implemented by central banks helped tame inflation, resulting in a period of relative price stability.

CPI Trends in the 20th Century: CPI Through The Decades: Key Trends And Patterns Leading To November 2024

The 20th century witnessed significant shifts in CPI trends, driven by a combination of historical events, technological advancements, and economic policies.

The Impact of Major Historical Events

World Wars, economic depressions, and technological innovations played a crucial role in shaping CPI trends throughout the 20th century.

- World War I (1914-1918):The war led to increased demand for goods and services, contributing to a rise in the CPI.

- The Great Depression (1929-1939):The economic downturn resulted in a sharp decline in consumer spending and deflationary pressures.

- World War II (1939-1945):The war effort led to price controls and rationing, impacting CPI fluctuations.

- The Post-War Boom (1945-1970s):The period following World War II saw rapid economic growth and increased consumer demand, contributing to a rise in the CPI.

Comparing CPI Trends Across Decades

The CPI experienced periods of both high and low inflation throughout the 20th century. The 1970s witnessed a period of high inflation, driven by factors such as the oil crisis and the Vietnam War. In contrast, the 1980s and 1990s saw a period of relative price stability due to economic policies implemented by central banks.

Examine how CPI and PCE: Implications for Policymakers in November 2024 can boost performance in your area.

CPI in the 21st Century: A New Era of Inflation

The 21st century has presented a unique set of challenges and opportunities for the CPI, with globalization, technological disruptions, and shifting consumer behavior playing a significant role in shaping inflation trends.

Factors Driving CPI Trends in the 21st Century

The globalized economy, rapid technological advancements, and changing consumer preferences have contributed to a new era of inflation in the 21st century.

Obtain recommendations related to The CPI Basket of Goods and Services in November 2024: What’s Included? that can assist you today.

- Globalization:The increasing interconnectedness of global economies has led to increased competition and lower prices for goods and services, but also to potential supply chain disruptions and price volatility.

- Technological Disruptions:Technological advancements have led to the introduction of new products and services, while also impacting the production and distribution of goods, influencing CPI fluctuations.

- Shifts in Consumer Behavior:Changing consumer preferences and spending patterns have also impacted CPI trends. For example, the rise of online shopping and the demand for experiences over material goods have influenced inflation in different sectors.

The Impact of Global Events on CPI, CPI Through the Decades: Key Trends and Patterns Leading to November 2024

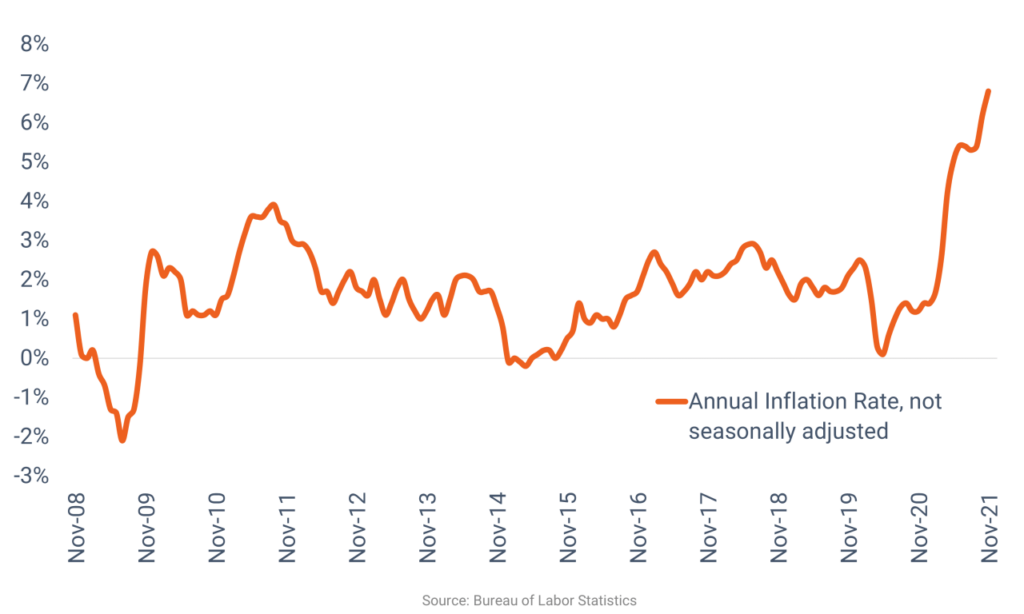

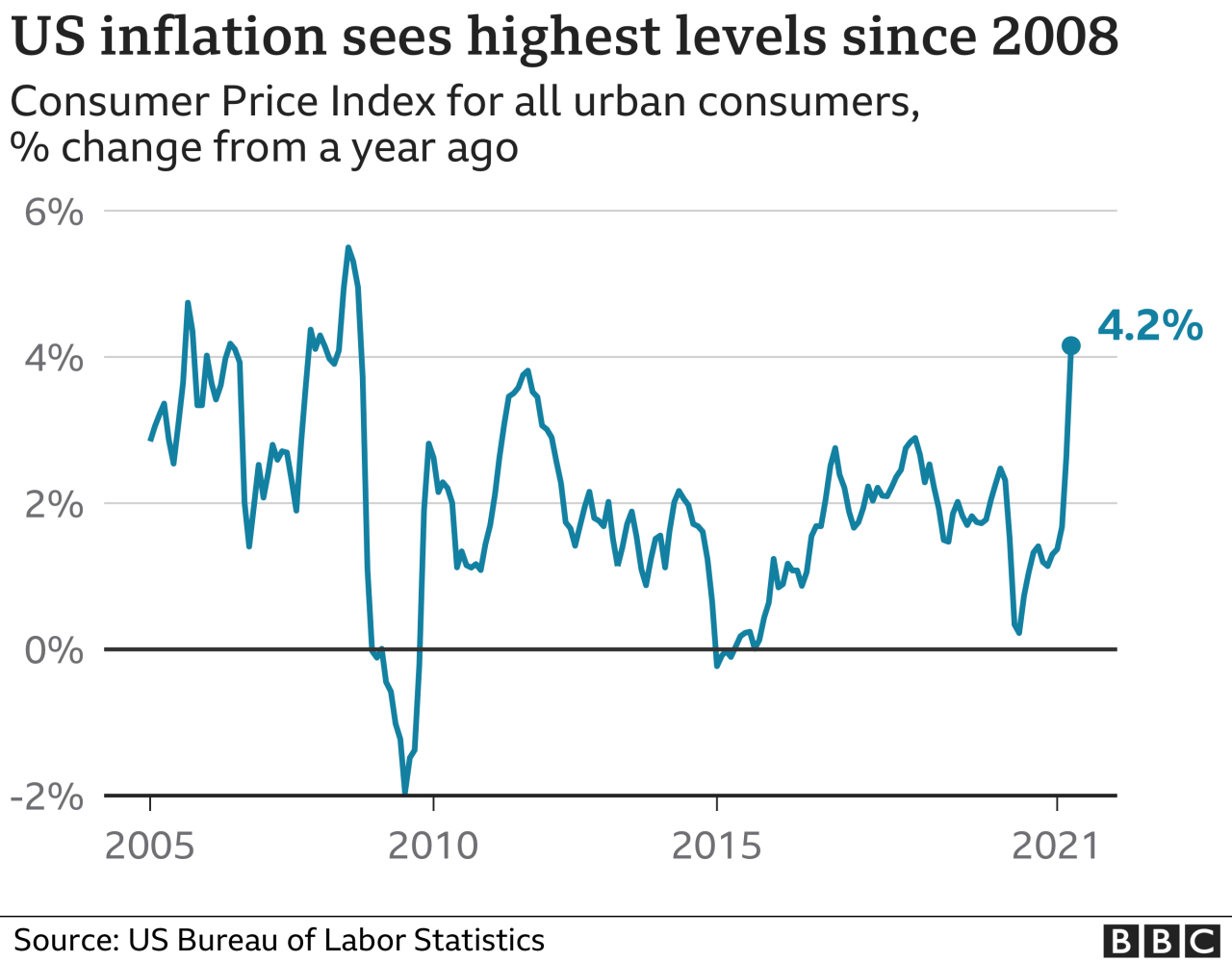

Major global events, such as the 2008 financial crisis and the COVID-19 pandemic, have had a significant impact on CPI fluctuations.

Find out further about the benefits of The Coverage and Scope of CPI and PCE in November 2024 that can provide significant benefits.

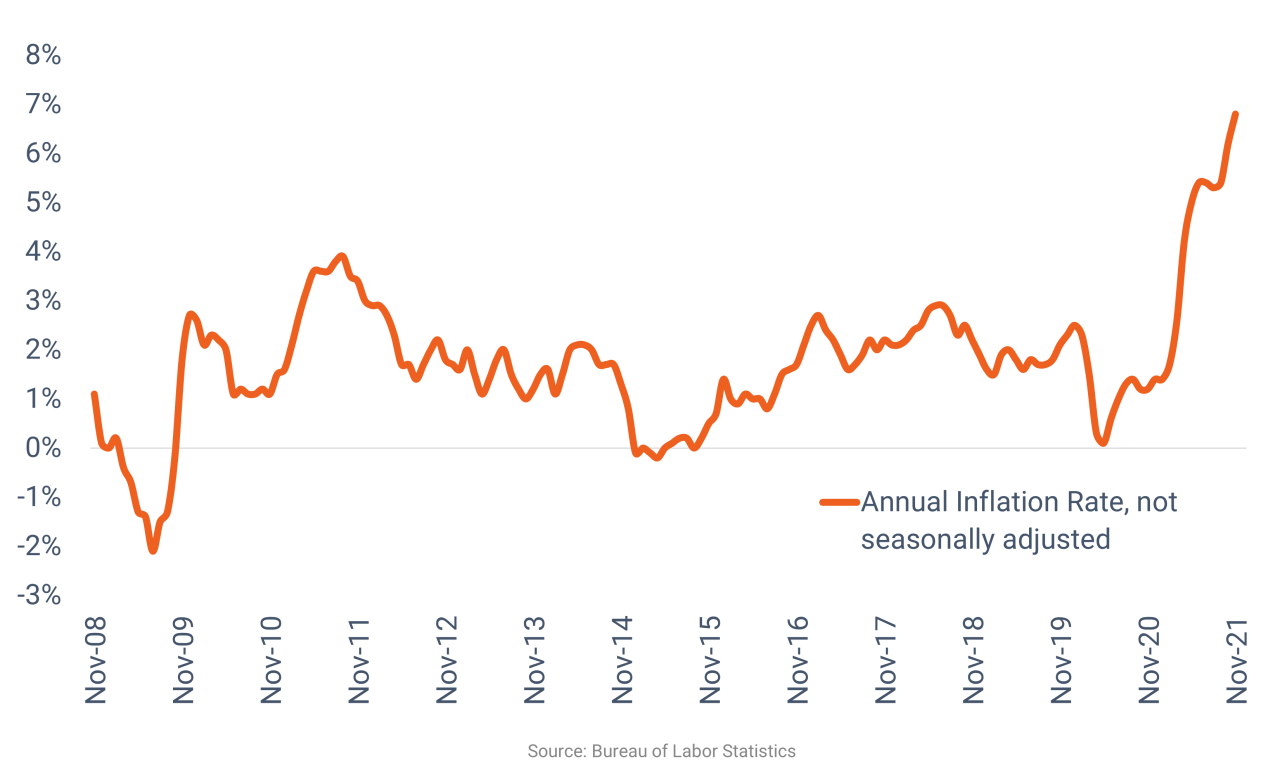

- The 2008 Financial Crisis:The global financial crisis led to a decline in consumer spending and a decrease in the CPI.

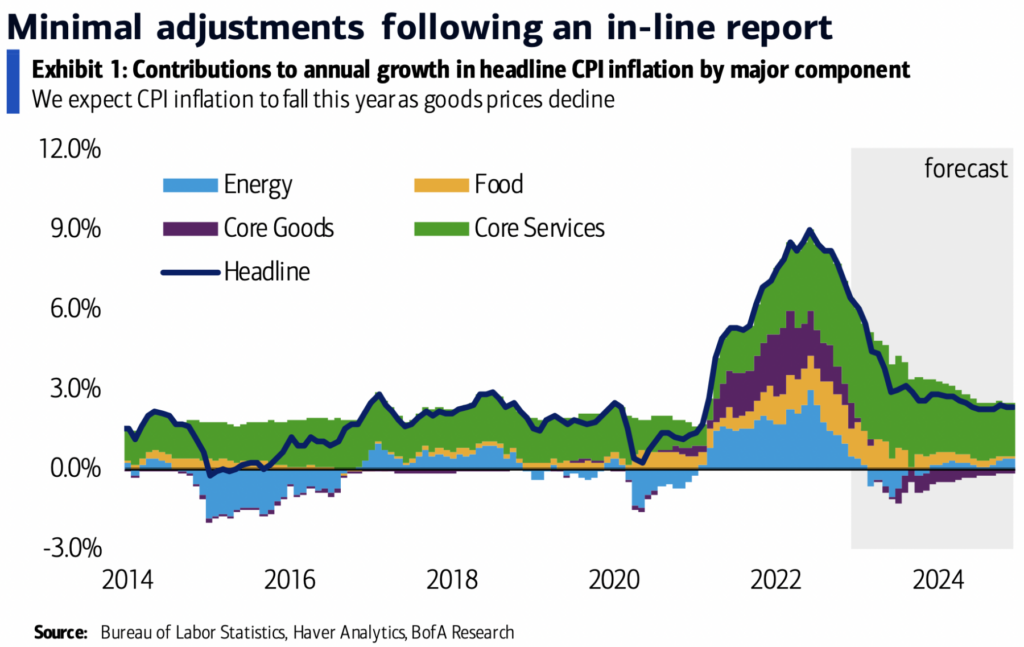

- The COVID-19 Pandemic:The pandemic caused disruptions in supply chains, leading to price increases for essential goods and services, contributing to a surge in the CPI.

Emerging Trends in CPI Data

The increasing influence of services and digital goods on consumer spending has led to emerging trends in CPI data.

Check what professionals state about CPI and PCE: A Historical Comparison Leading to November 2024 and its benefits for the industry.

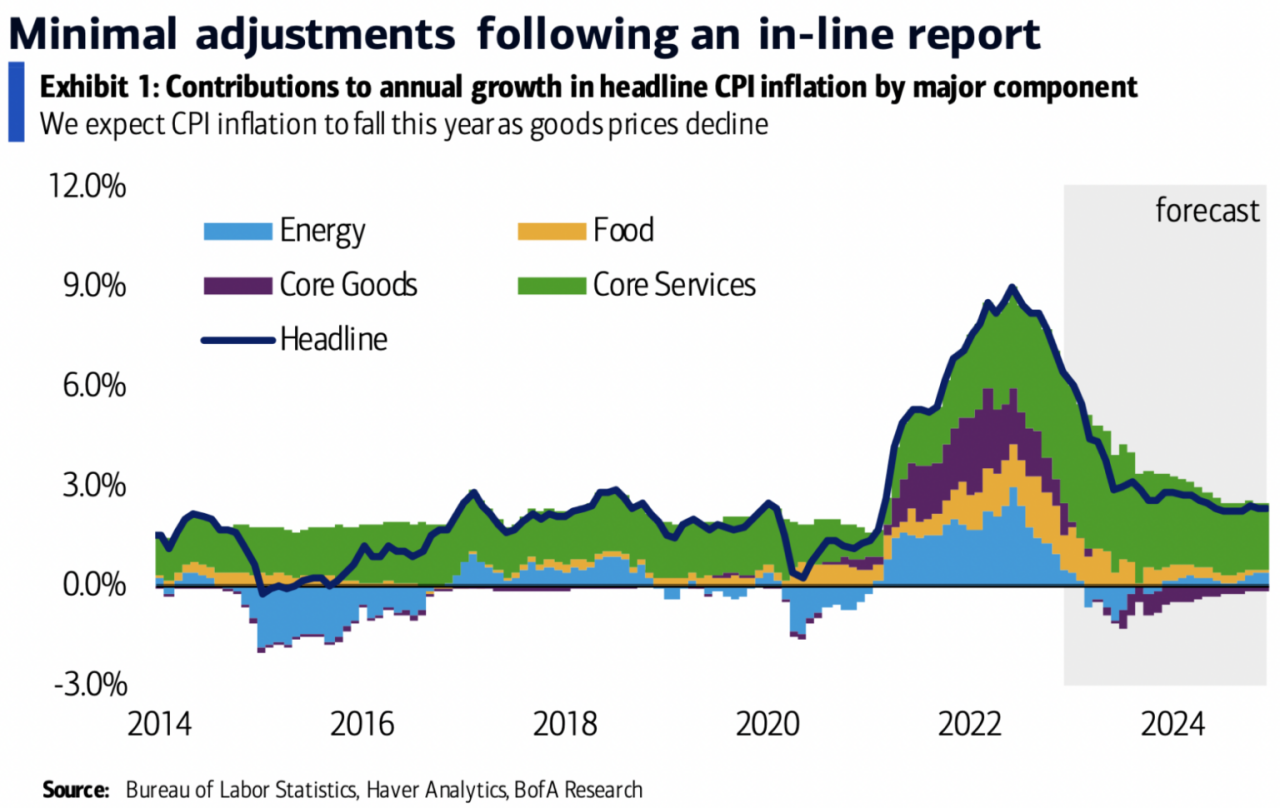

- The Rise of Services:The share of services in consumer spending has been increasing, impacting CPI trends as service prices tend to be more volatile than prices for goods.

- The Growth of Digital Goods:The increasing adoption of digital goods and services has also influenced CPI data, as prices for digital goods can fluctuate rapidly due to technological advancements and competition.

CPI Projections and Outlook to November 2024

Predicting future CPI trends is a complex task, requiring careful consideration of economic forecasts, global trends, and potential influencing factors.

Investigate the pros of accepting The Relationship Between CPI and Inflation Expectations in November 2024 in your business strategies.

Current State of Inflation and Projections

As of [Current Date], inflation is [Insert current inflation rate and its trend, e.g., “at its highest level in decades, with a projected increase in the coming months”]. This is largely attributed to [Explain the main factors driving inflation, e.g., “supply chain disruptions, energy prices, and strong consumer demand”].

Factors that Could Impact CPI in the Near Future

Several factors could impact CPI trends in the coming years, including:

- Supply Chain Disruptions:Ongoing supply chain disruptions, exacerbated by geopolitical tensions and global events, could continue to contribute to price volatility and inflation.

- Energy Prices:Fluctuations in energy prices, driven by factors such as geopolitical events and global demand, can significantly impact CPI trends.

- Interest Rate Policies:Central banks’ monetary policy decisions, such as interest rate adjustments, can influence inflation by impacting borrowing costs and consumer spending.

Projected CPI Values for Different Categories

| Category | Current CPI | Projected CPI (November 2024) |

|---|---|---|

| Food | [Insert current CPI for food] | [Insert projected CPI for food] |

| Energy | [Insert current CPI for energy] | [Insert projected CPI for energy] |

| Housing | [Insert current CPI for housing] | [Insert projected CPI for housing] |

Implications of CPI Trends for Consumers and Businesses

Fluctuating CPI levels have significant implications for both consumers and businesses.

Find out about how Using CPI and PCE for Economic Analysis in November 2024 can deliver the best answers for your issues.

Impact on Consumer Purchasing Power and Spending Patterns

Inflation erodes consumer purchasing power, meaning that consumers can buy less with the same amount of money. This can lead to changes in spending patterns, with consumers potentially cutting back on discretionary spending or seeking out less expensive alternatives.

Obtain a comprehensive document about the application of Weighting Differences Between CPI and PCE in November 2024 that is effective.

Business Adaptation to Fluctuating CPI Levels

Businesses need to adapt to fluctuating CPI levels to mitigate potential risks and maintain profitability.

- Pricing Strategies:Businesses may need to adjust their pricing strategies to account for inflation, either by raising prices or finding ways to reduce costs.

- Inventory Management:Businesses may need to adjust their inventory management practices to avoid being caught off guard by price increases or shortages.

- Cost Control:Businesses may need to implement cost control measures to offset the impact of inflation on their bottom line.

Strategies for Managing Inflation

Individuals and businesses can implement strategies to manage inflation effectively:

- Budgeting:Carefully track expenses and create a budget to prioritize essential spending and reduce discretionary spending.

- Saving and Investing:Save and invest to protect your purchasing power from inflation. Consider investing in assets that tend to appreciate in value during inflationary periods.

- Diversification:Diversify investments across different asset classes to reduce risk and potentially outperform inflation.

- Negotiation:Negotiate with suppliers and creditors to secure better prices and terms.

- Innovation:Businesses can innovate to develop new products and services that meet evolving consumer needs and potentially offset inflationary pressures.

Closure

The CPI’s journey through the decades reveals a dynamic interplay between historical events, economic policies, and consumer behavior. As we look toward November 2024, understanding the factors influencing CPI trends becomes paramount for navigating economic uncertainties and making informed financial decisions.

Learn about more about the process of The Use of Technology in November 2024 CPI Data Collection in the field.

By staying informed about CPI projections, consumers can adjust their spending patterns, businesses can adapt pricing strategies, and policymakers can implement measures to mitigate inflationary pressures. The CPI, therefore, serves as a critical tool for understanding the past, navigating the present, and shaping a more stable economic future.

Obtain access to CPI and Transportation Costs in November 2024 to private resources that are additional.

Q&A

What are the main factors driving CPI trends in the 21st century?

Globalization, technological disruptions, shifts in consumer behavior, and global events like the 2008 financial crisis and the COVID-19 pandemic are major factors influencing CPI trends in the 21st century.

How does the CPI impact consumers and businesses?

Inflation, as measured by the CPI, affects consumer purchasing power, spending patterns, and investment decisions. Businesses must adapt to fluctuating CPI levels, adjusting pricing strategies and managing costs to remain competitive.

Check The Future of CPI and PCE Measurement After November 2024 to inspect complete evaluations and testimonials from users.

What are some strategies for managing inflation?

Individuals can manage inflation by diversifying investments, budgeting effectively, and seeking out value-priced goods and services. Businesses can mitigate inflationary risks through cost-cutting measures, price adjustments, and hedging strategies.