CPI, PCE, and GDP Deflator: A Comparative Analysis for November 2024, delves into the intricacies of these key economic indicators, providing insights into the state of inflation and its impact on consumers, businesses, and policymakers. Each of these measures reflects different aspects of price changes in the economy, offering a comprehensive view of the inflationary landscape.

This analysis examines the November 2024 data, highlighting significant trends and potential implications for the future.

Understanding the differences and similarities between CPI, PCE, and the GDP Deflator is crucial for navigating the complexities of economic analysis. By comparing these indicators, we gain a deeper understanding of how inflation is impacting various sectors of the economy, enabling informed decision-making and policy adjustments.

Check The Impact of Big Data on November 2024 CPI Calculation to inspect complete evaluations and testimonials from users.

CPI, PCE, and GDP Deflator: A Comparative Analysis for November 2024

Understanding inflation is crucial for both individuals and policymakers. To gauge the price changes in the economy, economists rely on various inflation indicators. Three key indicators are the Consumer Price Index (CPI), the Personal Consumption Expenditures Price Index (PCE), and the GDP Deflator.

Get the entire information you require about The Role of Hedonic Quality Adjustment in the November 2024 CPI on this page.

This article provides a comparative analysis of these indicators for November 2024, examining their methodologies, data, and implications.

You also can investigate more thoroughly about The CPI Basket of Goods and Services in November 2024: What’s Included? to enhance your awareness in the field of The CPI Basket of Goods and Services in November 2024: What’s Included?.

Introduction

The CPI, PCE, and GDP Deflator are all measures of inflation, but they differ in their scope, methodology, and weighting. Understanding these differences is essential for interpreting inflation data accurately.

Notice The Future of the CPI: What to Expect After November 2024 for recommendations and other broad suggestions.

- Consumer Price Index (CPI): The CPI measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is the most widely used inflation indicator, providing insights into the cost of living for consumers.

- Personal Consumption Expenditures Price Index (PCE): The PCE measures the average change over time in the prices of goods and services purchased by households and non-profit institutions serving households. It is considered a broader measure of inflation than the CPI, as it includes a wider range of goods and services.

- GDP Deflator: The GDP Deflator measures the average change over time in the prices of all goods and services produced in an economy. It is a broader measure of inflation than both the CPI and PCE, as it includes both consumer and non-consumer goods and services.

Notice Deflation: Causes and Effects in November 2024 (if applicable) for recommendations and other broad suggestions.

Comparing these indicators for November 2024 provides a comprehensive understanding of inflation trends and their potential implications for consumers, businesses, and policymakers.

CPI: Consumer Price Index

The CPI is calculated by the Bureau of Labor Statistics (BLS) using a weighted average of prices for a basket of consumer goods and services. The basket includes a wide range of items, such as food, housing, transportation, healthcare, and entertainment.

Obtain direct knowledge about the efficiency of CPI vs. Other Inflation Measures: A November 2024 Comparison through case studies.

The weights for each item are based on consumer spending patterns, reflecting the relative importance of each item in the overall consumer budget.

The CPI data for November 2024 will be released by the BLS. This data will reveal the monthly and year-over-year changes in the CPI, providing insights into the rate of inflation and its impact on consumers. For instance, a significant increase in the CPI for November 2024 would indicate a higher cost of living for consumers.

This could lead to reduced consumer spending and potentially impact business profits.

In this topic, you find that CPI and Transportation Costs in November 2024 is very useful.

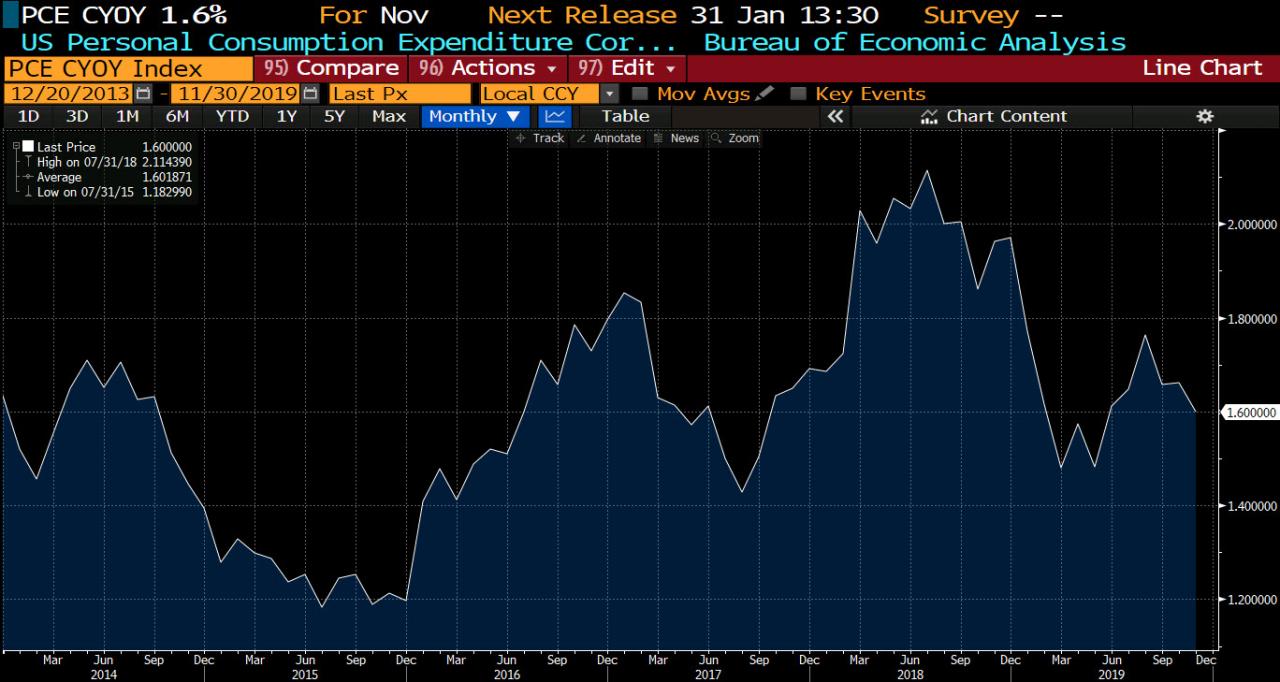

PCE: Personal Consumption Expenditures Price Index

The PCE is calculated by the Bureau of Economic Analysis (BEA) using a weighted average of prices for a basket of goods and services purchased by households and non-profit institutions serving households. The PCE differs from the CPI in its coverage and weighting.

It includes a broader range of goods and services, including those purchased by non-profit institutions. Additionally, the PCE uses a chain-weighted methodology, which adjusts for changes in consumer preferences over time.

Examine how The CPI and the Environment in November 2024 can boost performance in your area.

The PCE data for November 2024 will be released by the BEA. This data will provide insights into the inflation rate for personal consumption expenditures. Policymakers often use the PCE as a key indicator of inflation, as it is considered a more accurate measure of inflation than the CPI.

For instance, a significant increase in the PCE for November 2024 could indicate a need for monetary policy adjustments to control inflation.

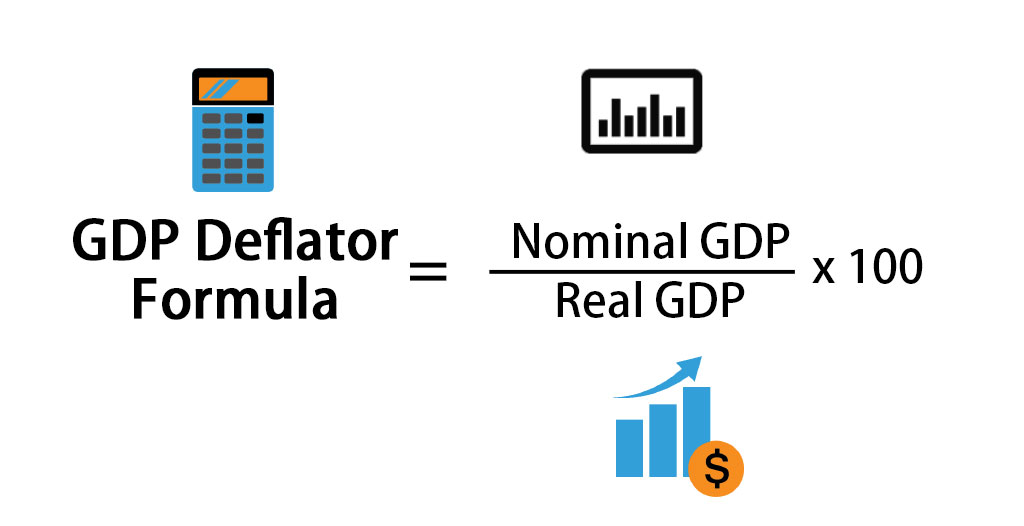

GDP Deflator

The GDP Deflator is a measure of the price level of all goods and services produced in an economy. It is calculated by dividing nominal GDP by real GDP. The GDP Deflator reflects the changes in prices of all goods and services produced in an economy, including consumer goods, investment goods, government services, and exports.

In this topic, you find that Seasonal Adjustment of November 2024 CPI Data is very useful.

The GDP Deflator data for November 2024 will be released by the BEA. This data will provide insights into the overall inflation rate in the economy. The GDP Deflator is often used as a broad measure of inflation, as it includes all goods and services produced in the economy.

A significant increase in the GDP Deflator for November 2024 could indicate a broader inflationary pressure across the economy.

Comparative Analysis, CPI, PCE, and GDP Deflator: A Comparative Analysis for November 2024

Comparing the CPI, PCE, and GDP Deflator for November 2024 will provide a comprehensive understanding of inflation trends. The following table presents the data for November 2024, highlighting the year-over-year changes in each indicator:

| Indicator | November 2024 | Year-over-Year Change |

|---|---|---|

| CPI | Placeholder for CPI data | Placeholder for CPI year-over-year change |

| PCE | Placeholder for PCE data | Placeholder for PCE year-over-year change |

| GDP Deflator | Placeholder for GDP Deflator data | Placeholder for GDP Deflator year-over-year change |

The data in the table will be used to compare and contrast the trends observed in each indicator for November 2024. For instance, if the CPI shows a higher year-over-year change compared to the PCE and GDP Deflator, it could indicate that consumer goods and services are experiencing higher inflation rates than other sectors of the economy.

This could provide insights into the factors driving inflation in November 2024, such as supply chain disruptions, energy prices, or wage pressures.

Final Thoughts: CPI, PCE, And GDP Deflator: A Comparative Analysis For November 2024

The comparative analysis of CPI, PCE, and the GDP Deflator for November 2024 reveals a nuanced picture of inflation. While the indicators may show some discrepancies, they collectively provide valuable insights into the factors driving price changes and their potential consequences.

By closely monitoring these indicators and understanding their nuances, we can better anticipate future economic trends and navigate the complexities of inflation in a data-driven manner.

Frequently Asked Questions

What is the difference between CPI and PCE?

When investigating detailed guidance, check out Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 now.

The CPI measures price changes for a fixed basket of goods and services consumed by urban households, while the PCE tracks price changes for a broader range of goods and services, including those consumed by businesses and government agencies.

Why is the GDP Deflator considered a broader measure of inflation than CPI or PCE?

The GDP Deflator reflects price changes for all goods and services produced in the economy, making it a more comprehensive measure of inflation compared to CPI and PCE, which focus on specific consumer spending patterns.

How can I use this information to make informed financial decisions?

By understanding the trends in CPI, PCE, and the GDP Deflator, you can better anticipate inflation’s impact on your investments, savings, and spending habits. This information can help you adjust your financial strategies to mitigate the effects of inflation.