CPI and the Limits of Prediction: Understanding the Uncertainties for November 2024 – this is a topic that often sparks debate and intrigue. While the Consumer Price Index (CPI) serves as a vital measure of inflation, accurately predicting its future trajectory is a complex task.

This is due to the intricate interplay of economic factors, global events, and unforeseen circumstances that can significantly impact CPI fluctuations.

Finish your research with information from November 2024 CPI and Fiscal Policy: Assessing the Impact.

This article delves into the challenges of predicting CPI, particularly for November 2024, by examining key factors that influence its trajectory. We’ll explore how current economic trends, potential policy changes, and global events could shape CPI in the coming months.

Obtain recommendations related to Using CPI and PCE for Economic Analysis in November 2024 that can assist you today.

By analyzing different scenarios and their potential impact on consumers and businesses, we aim to provide a comprehensive understanding of the uncertainties surrounding CPI and its implications for the future.

Understanding CPI

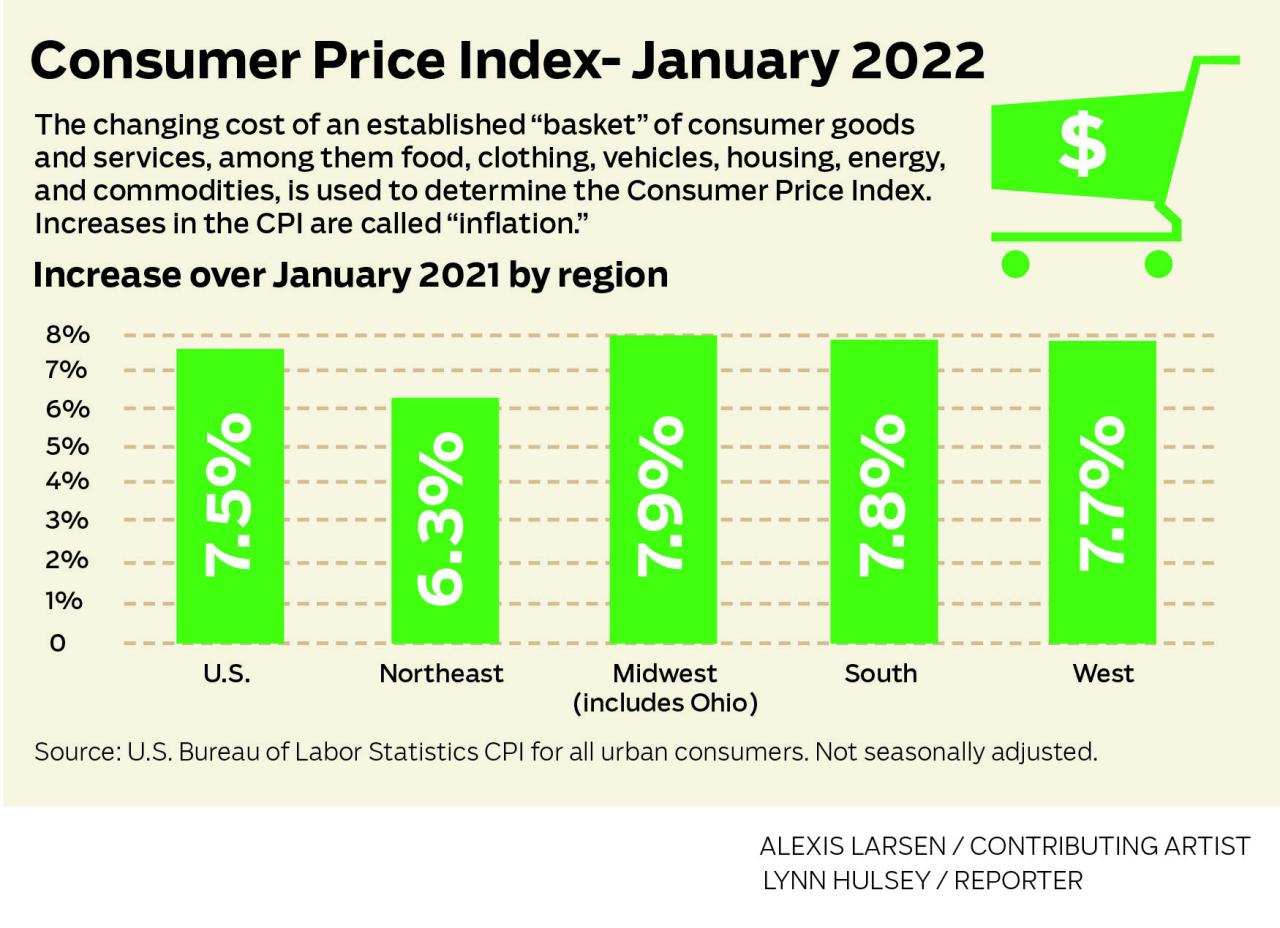

The Consumer Price Index (CPI) is a vital economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It serves as a key gauge of inflation, reflecting the purchasing power of the dollar and its impact on the overall economy.

Find out about how The Affordability Crisis and the November 2024 CPI can deliver the best answers for your issues.

Understanding CPI is crucial for both consumers and businesses, as it influences everything from purchasing decisions to investment strategies.

Components of CPI

The CPI is composed of various components, each representing a specific category of goods and services. These components are weighted according to their relative importance in the overall consumer spending pattern. The major categories include:

- Food and beverages

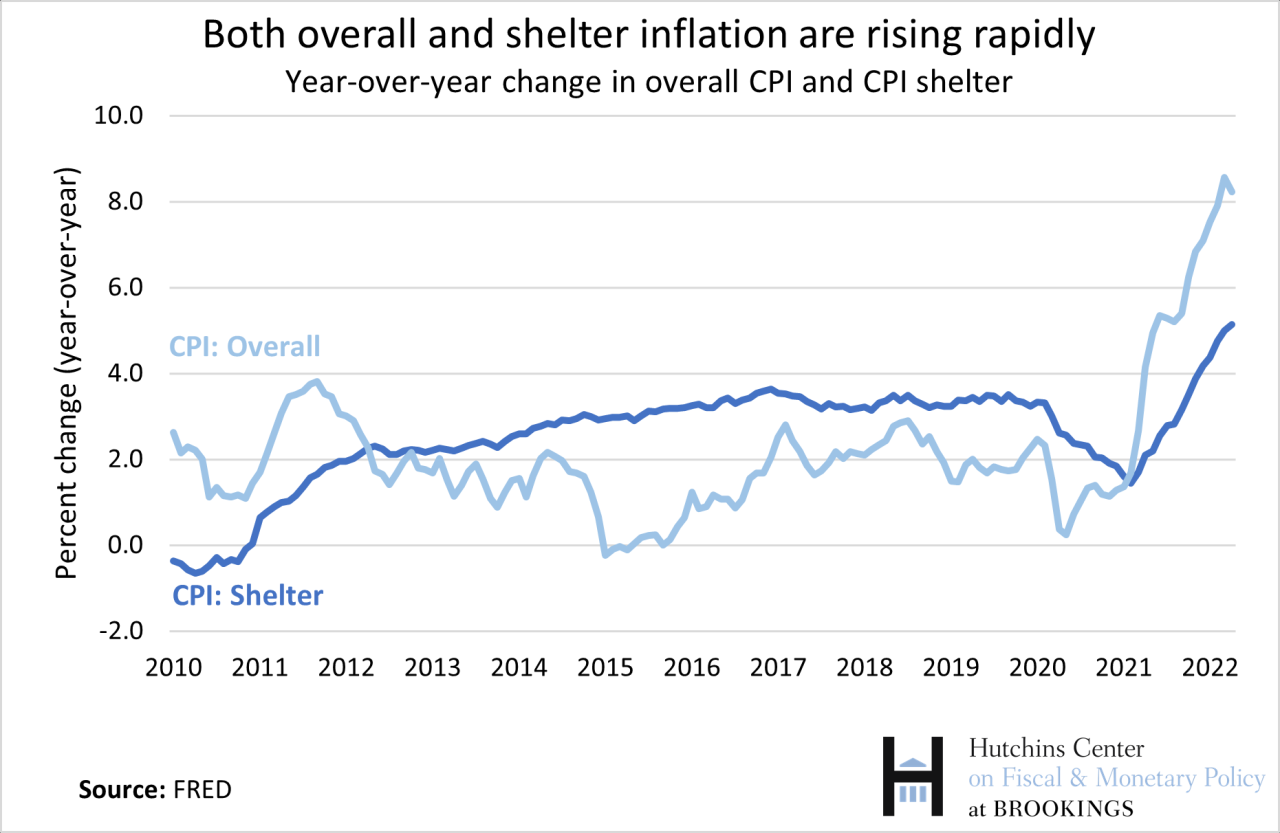

- Housing

- Apparel

- Transportation

- Medical care

- Recreation

- Education and communication

- Other goods and services

For instance, housing typically accounts for the largest share of the CPI basket, followed by transportation and food and beverages. The weights are adjusted periodically to reflect changes in consumer spending habits.

CPI and Inflation Measurement

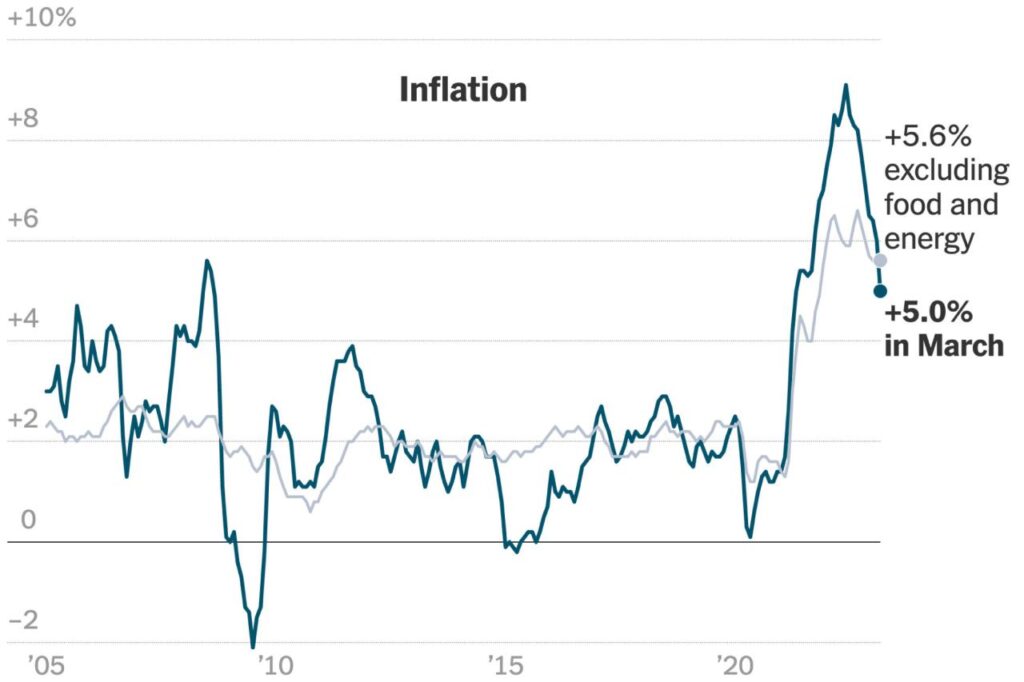

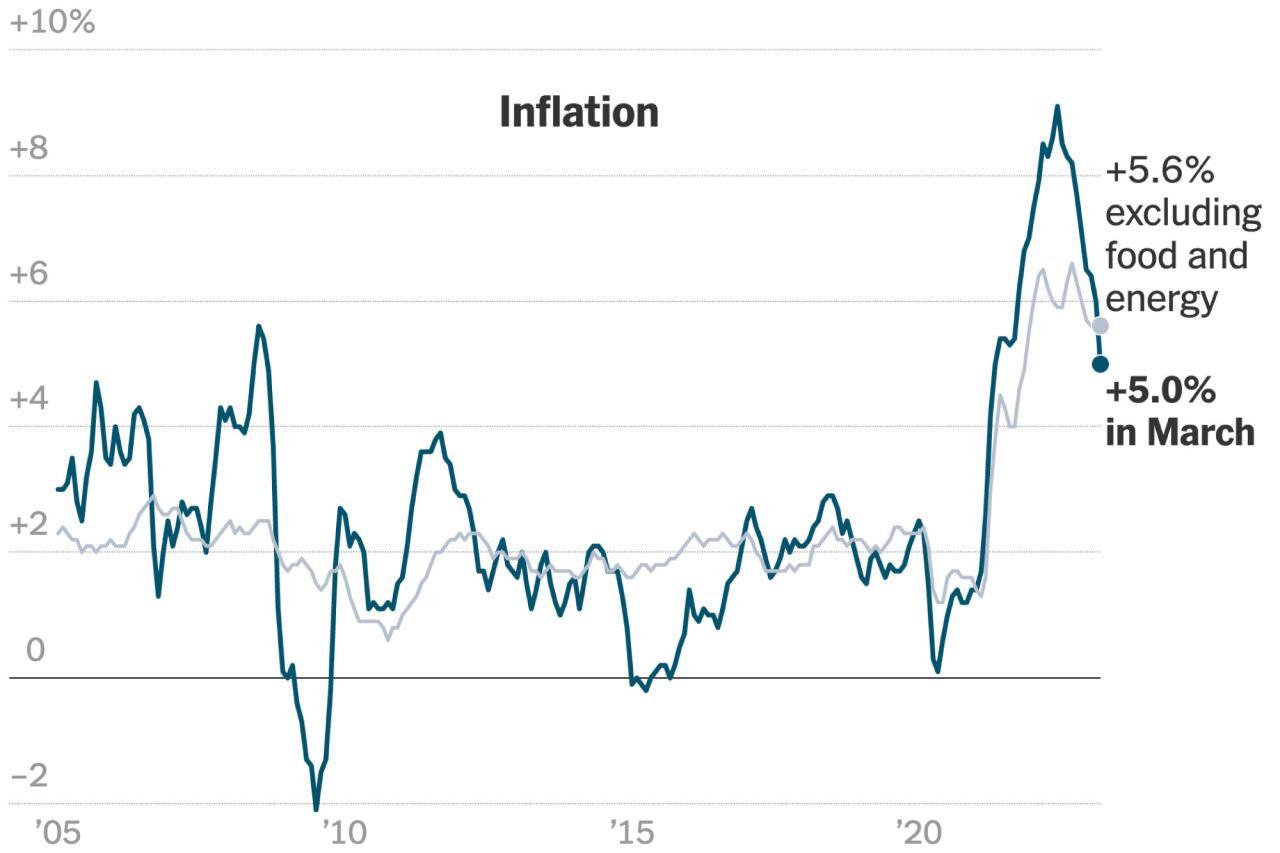

The CPI is used to measure inflation, which is the rate at which the general price level of goods and services rises over time. A rising CPI indicates inflation, while a declining CPI signifies deflation. The inflation rate is calculated as the percentage change in the CPI over a specific period, typically a year or a month.

For example, if the CPI increases by 2% from one year to the next, it indicates that prices have risen by 2% on average. This means that consumers need to spend 2% more to purchase the same goods and services as the previous year.

Expand your understanding about November 2024 CPI and Sector Rotation: Investing in Winning Industries with the sources we offer.

Inflation can erode purchasing power, making it more expensive for consumers to maintain their standard of living.

Notice The Impact of Past Recessions on the November 2024 CPI for recommendations and other broad suggestions.

The Limits of Prediction

Predicting CPI accurately is a complex and challenging task due to the inherent uncertainties and complexities involved. While economic indicators can provide valuable insights, they are not always reliable predictors of future price changes. Several factors can influence CPI beyond typical economic indicators, making it difficult to anticipate its trajectory with certainty.

Unforeseen Events and their Impact

Unforeseen events, such as natural disasters, geopolitical conflicts, and unexpected technological advancements, can have significant and unpredictable impacts on CPI. These events can disrupt supply chains, affect commodity prices, and alter consumer behavior, making it difficult to accurately forecast CPI.

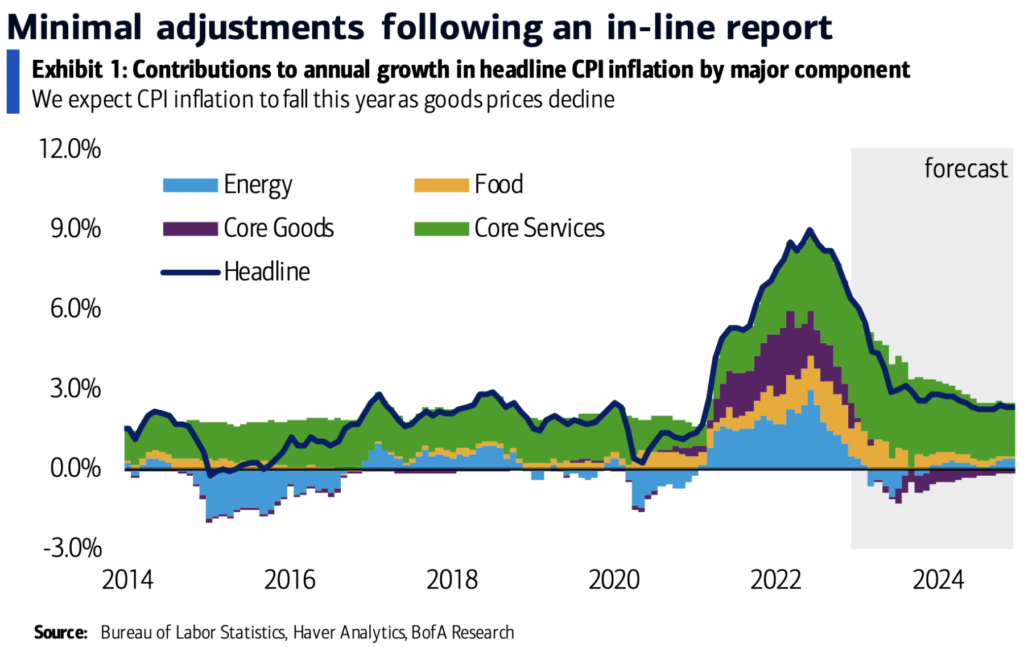

For example, the COVID-19 pandemic led to widespread supply chain disruptions and increased demand for certain goods, resulting in a surge in inflation. The war in Ukraine has also had a major impact on global energy prices and food supplies, further contributing to inflationary pressures.

When investigating detailed guidance, check out CPI Predictions for November 2024: What the Experts Are Saying now.

Key Factors Influencing CPI

- Monetary Policy:Central banks’ interest rate decisions and other monetary policy actions can significantly impact inflation and, consequently, CPI. Lower interest rates tend to stimulate borrowing and spending, potentially leading to higher inflation. Conversely, higher interest rates can curb economic activity and dampen inflationary pressures.

Check what professionals state about CPI and Real Wages in November 2024: Understanding Your Purchasing Power and its benefits for the industry.

- Government Policies:Government policies, such as tax changes, subsidies, and regulations, can also influence CPI. For example, tax cuts can boost consumer spending and fuel inflation, while subsidies can lower prices for certain goods and services.

- Global Economic Conditions:Global economic trends, such as exchange rate fluctuations, commodity prices, and international trade patterns, can impact CPI. For instance, a weakening dollar can make imported goods more expensive, leading to higher inflation.

- Consumer Confidence and Spending:Consumer confidence and spending habits play a significant role in shaping demand and influencing prices. When consumers are optimistic about the economy, they tend to spend more, which can contribute to inflation.

Factors Influencing November 2024 CPI

Predicting CPI for November 2024 requires considering current economic trends, potential policy changes, and global events. While it’s impossible to predict the future with absolute certainty, analyzing these factors can provide insights into potential scenarios for CPI in the coming months.

Current Economic Trends, CPI and the Limits of Prediction: Understanding the Uncertainties for November 2024

The current economic environment is characterized by ongoing inflation, driven by factors such as supply chain disruptions, strong consumer demand, and rising energy prices. The Federal Reserve is actively trying to combat inflation through interest rate hikes, but the impact of these measures on CPI is yet to be fully realized.

The trajectory of inflation and its impact on CPI in November 2024 will depend on the effectiveness of these monetary policy actions and the evolution of other economic factors.

Potential Policy Changes

Government policies, including fiscal and monetary policies, can significantly influence CPI. For example, further interest rate hikes by the Federal Reserve could slow economic growth and dampen inflationary pressures, potentially leading to a lower CPI in November 2024. However, if the Fed decides to ease monetary policy, it could potentially fuel inflation and lead to a higher CPI.

Global Events

Global events, such as geopolitical tensions, natural disasters, and economic crises, can have significant and unpredictable impacts on CPI. For example, the ongoing war in Ukraine continues to disrupt global energy markets and food supplies, contributing to inflationary pressures. Any escalation of geopolitical tensions or unforeseen global events could further impact CPI in November 2024.

Scenario Analysis

Given the uncertainties surrounding CPI, it is helpful to consider different potential scenarios for November 2024. This analysis can provide insights into the potential range of outcomes and their implications for consumers and businesses.

Examine how CPI and the Poverty Line in November 2024 can boost performance in your area.

Potential Scenarios for November 2024 CPI

| Scenario | Underlying Economic Conditions | Potential CPI Impact | Likelihood |

|---|---|---|---|

| Scenario 1: Continued Inflation | Strong consumer demand, persistent supply chain disruptions, and rising energy prices. The Federal Reserve continues to raise interest rates but inflation remains elevated. | CPI continues to rise, potentially exceeding current levels. | Moderate |

| Scenario 2: Moderating Inflation | Economic growth slows, supply chain disruptions ease, and energy prices stabilize. The Federal Reserve continues to raise interest rates, leading to a gradual decline in inflation. | CPI growth slows but remains positive, potentially settling at a lower rate than current levels. | Moderate |

| Scenario 3: Deflationary Pressures | Economic recession, weak consumer demand, and falling commodity prices. The Federal Reserve pauses or reverses interest rate hikes, leading to deflationary pressures. | CPI declines, potentially leading to negative inflation. | Low |

The likelihood of each scenario is based on current economic data, expert opinions, and market expectations. However, it’s important to remember that these are just potential scenarios, and the actual outcome could be different.

Implications for Consumers and Businesses: CPI And The Limits Of Prediction: Understanding The Uncertainties For November 2024

The level of CPI in November 2024 will have significant implications for consumers and businesses. Understanding the potential impact of different CPI outcomes can help individuals and organizations make informed decisions and mitigate potential risks.

Get the entire information you require about November 2024 CPI and Inflation Hedging: Protecting Your Investments on this page.

Impact on Consumers

A higher CPI would erode purchasing power, making it more expensive for consumers to maintain their standard of living. This could lead to a decrease in discretionary spending and an increase in saving. Conversely, a lower CPI would boost purchasing power, allowing consumers to spend more and potentially stimulate economic growth.

Impact on Businesses

Businesses need to carefully consider the potential impact of CPI on their pricing strategies and profitability. A higher CPI could necessitate price increases to maintain profit margins. However, businesses also need to be mindful of consumer demand and the potential impact of price increases on sales volume.

Discover the crucial elements that make CPI and Automation in November 2024: The Future of Work the top choice.

A lower CPI could provide businesses with opportunities to lower prices and gain market share.

Strategies for Consumers and Businesses

- Consumers:

- Track CPI and inflation rates to understand the impact on their purchasing power.

- Consider budgeting and saving strategies to mitigate the impact of rising prices.

- Explore alternative goods and services to find better value.

- Businesses:

- Monitor CPI and inflation trends to adjust pricing strategies.

- Seek ways to improve efficiency and reduce costs to maintain profitability.

- Consider hedging strategies to mitigate the impact of commodity price fluctuations.

Concluding Remarks

Predicting CPI with certainty is an elusive goal. While economic models and expert analysis provide valuable insights, the reality is that unforeseen events can dramatically alter the course of CPI. Understanding the limitations of prediction and the potential range of outcomes is crucial for both consumers and businesses.

By staying informed and adaptable, we can navigate the uncertainties surrounding CPI and make informed decisions in a dynamic economic landscape.

Commonly Asked Questions

What are some of the key factors that can influence CPI beyond typical economic indicators?

Beyond traditional economic indicators, factors such as geopolitical tensions, supply chain disruptions, and unexpected technological advancements can significantly influence CPI. These events can create volatility in commodity prices, production costs, and consumer demand, leading to unpredictable changes in inflation.

How can consumers and businesses mitigate the risks associated with CPI fluctuations?

Consumers can mitigate risks by diversifying their investments, seeking out products and services with price stability, and considering alternative spending strategies. Businesses can adapt by implementing flexible pricing models, diversifying their revenue streams, and exploring cost-saving measures to offset inflationary pressures.