CPI and the Informal Economy in November 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Consumer Price Index (CPI) is a critical measure of inflation, and its impact on the informal economy is a topic of significant interest.

Obtain direct knowledge about the efficiency of How the November 2024 CPI Affects Your Daily Life through case studies.

This sector, encompassing a vast array of businesses and activities, often operates outside the formal regulatory framework, making it particularly vulnerable to economic shocks like rising prices.

Learn about more about the process of The Role of the CPI in Economic Policy in November 2024 in the field.

November 2024 presents a unique backdrop for exploring this relationship, as economic conditions and the informal economy’s resilience are likely to be intertwined. The analysis will delve into the latest data, trends, and potential policy interventions, highlighting the intricate connection between CPI fluctuations and the informal economy’s dynamics.

Understanding CPI and Its Impact

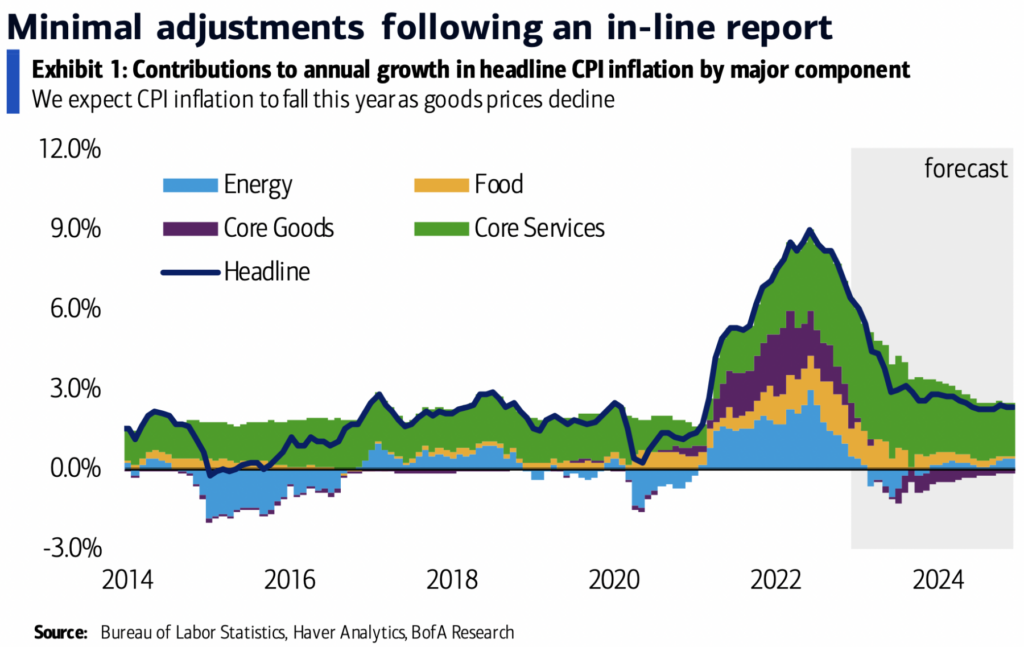

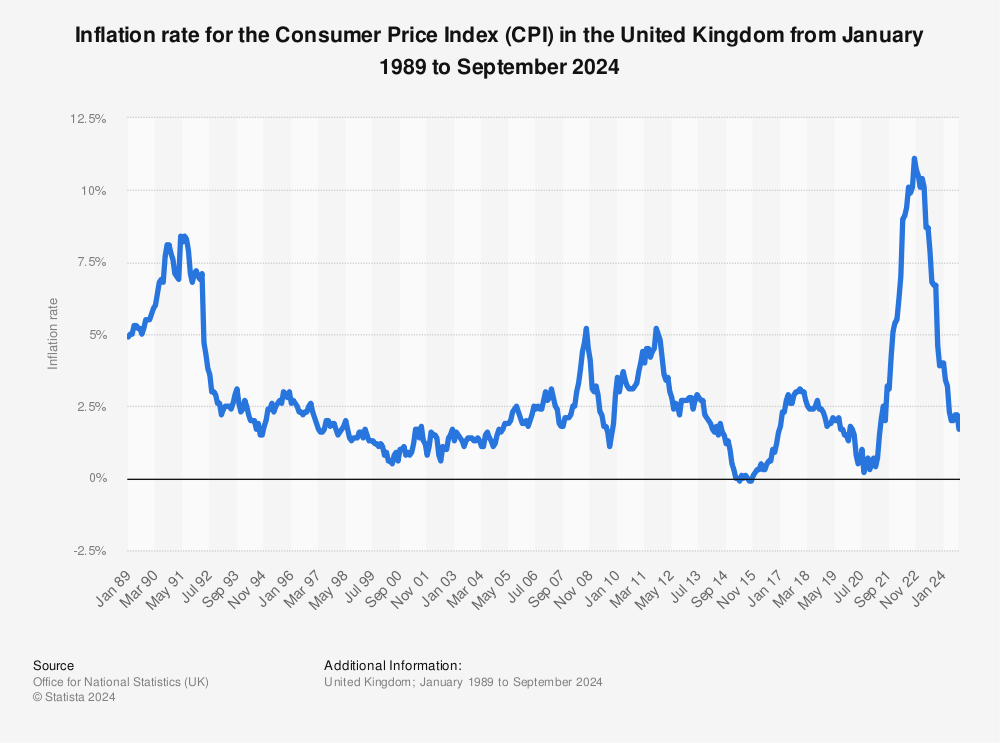

The Consumer Price Index (CPI) is a crucial economic indicator that tracks the average change in prices paid by urban consumers for a basket of consumer goods and services. In November 2024, understanding the CPI’s impact on the informal economy is essential, as it provides insights into the cost of living for a significant portion of the population.

In this topic, you find that The Future of the CPI: What to Expect After November 2024 is very useful.

Impact of Inflation on the Informal Economy, CPI and the Informal Economy in November 2024

Inflation, as measured by the CPI, can have a multifaceted impact on the informal economy. Rising prices can erode purchasing power, impacting the affordability of essential goods and services for informal sector workers. This can lead to reduced consumption, lower income, and potentially, a decline in economic activity within the informal sector.

Notice How to Use November 2024 CPI Data for Personal Finance Decisions for recommendations and other broad suggestions.

- Street vendors and small businesses:Increased input costs for raw materials, transportation, and rent can squeeze profit margins, making it challenging for informal businesses to maintain operations.

- Informal service providers:Rising prices for basic necessities can force informal workers to allocate a larger portion of their earnings towards living expenses, leaving less disposable income for discretionary spending.

- Informal laborers:Wage increases may not keep pace with inflation, leading to a decline in real wages and potentially impacting the ability of informal laborers to meet their basic needs.

The Informal Economy in November 2024

The informal economy, encompassing activities that are not officially registered or taxed, plays a vital role in many economies, including those in November 2024. It provides employment, generates income, and contributes to economic activity, particularly in developing countries.

Browse the multiple elements of CPI and Healthcare Costs in November 2024 to gain a more broad understanding.

Vulnerabilities of the Informal Economy

The informal economy is often characterized by a lack of access to formal financial services, social safety nets, and legal protection. This makes it particularly vulnerable to economic shocks, such as inflation.

- Limited access to capital:Informal businesses often rely on personal savings or informal lending networks, which can be insufficient to cope with rising costs and economic uncertainty.

- Lack of insurance:Informal workers are typically uninsured, leaving them exposed to financial hardship in the face of unexpected events like illness or job loss.

- Unstable income:Informal sector income can be irregular and unpredictable, making it difficult to save and plan for future financial needs.

Adaptation Strategies

Despite these challenges, the informal economy often demonstrates resilience and adaptability. Informal sector actors may adopt various strategies to navigate economic shocks, including:

- Shifting to lower-cost inputs:Informal businesses may seek cheaper alternatives for raw materials or supplies to maintain profitability.

- Expanding into new markets:Informal workers may diversify their income streams by seeking new opportunities or venturing into new markets.

- Increased bargaining power:Informal workers may form cooperatives or associations to collectively negotiate better prices or working conditions.

Data and Trends

Tracking the impact of CPI on the informal economy requires analyzing relevant data and identifying emerging trends. This information provides valuable insights into the dynamics of the informal sector and its response to changing economic conditions.

Obtain a comprehensive document about the application of CPI Calculation in November 2024: Addressing Substitution Bias that is effective.

CPI and Informal Economy Data

While comprehensive data on the informal economy is often limited, various sources can shed light on its performance and vulnerabilities. These may include:

- National surveys:Household surveys can provide insights into informal sector employment, income, and expenditures.

- Informal sector statistics:Government agencies may collect data on specific informal sector activities, such as street vending or small-scale manufacturing.

- Microfinance data:Microfinance institutions often work with informal sector clients and can provide data on lending trends and borrower characteristics.

Trends in the Informal Economy

Analyzing data on the informal economy in November 2024 can reveal important trends, such as:

- Changes in employment:Examining the growth or decline of informal sector employment can indicate the impact of inflation on job creation and opportunities.

- Income variations:Tracking changes in informal sector income can reveal how inflation affects the earnings of informal workers.

- Expenditure patterns:Analyzing how informal sector households allocate their spending can provide insights into the impact of inflation on their consumption choices.

Policy Implications

Understanding the impact of inflation on the informal economy is crucial for policymakers who aim to promote inclusive and sustainable economic growth. Policy interventions can help mitigate the negative effects of inflation and support the resilience of the informal sector.

Get the entire information you require about Challenges in CPI Measurement for November 2024 on this page.

Policy Responses to Inflation

Policymakers can consider a range of measures to address the challenges posed by inflation to the informal economy, including:

- Price stabilization:Monetary policy measures, such as adjusting interest rates, can help control inflation and prevent excessive price increases.

- Targeted subsidies:Providing subsidies for essential goods and services can help reduce the impact of inflation on vulnerable households.

- Income support programs:Cash transfer programs or wage subsidies can provide financial assistance to informal workers affected by inflation.

Effectiveness of Existing Policies

Evaluating the effectiveness of existing policies and programs aimed at supporting the informal sector is essential. This can involve:

- Assessing program reach:Determining the extent to which existing policies and programs are reaching their intended beneficiaries.

- Measuring program impact:Evaluating the effectiveness of programs in addressing the challenges faced by the informal sector.

- Identifying areas for improvement:Identifying areas where policies and programs can be strengthened or adapted to better meet the needs of the informal economy.

Policy Interventions

Policymakers can consider various interventions to improve the resilience of the informal economy to economic shocks, such as:

- Formalization initiatives:Promoting the formalization of informal businesses can provide access to formal financial services, social protection, and legal rights.

- Skills development programs:Providing training and skills development opportunities can enhance the employability of informal workers and improve their earning potential.

- Access to microfinance:Expanding access to microfinance can provide informal businesses with the capital they need to grow and adapt to economic changes.

Case Studies

Examining case studies of specific informal sector businesses or activities can provide valuable insights into the real-world impact of inflation on the informal economy. These case studies can highlight the challenges and opportunities faced by informal actors in different contexts.

Case Study 1: Street Food Vendor

A street food vendor in a bustling city might face rising costs for ingredients, fuel, and rent. Inflation could erode their profit margins, forcing them to either raise prices, reduce portions, or potentially cut back on operating hours.

Case Study 2: Tailoring Business

A small tailoring business might experience increased costs for fabric, thread, and other materials. Inflation could also lead to a decline in demand for their services as consumers tighten their belts. To adapt, the tailor might need to find cheaper suppliers, offer discounts, or explore new product lines.

Discover how Data Collection Methods for the November 2024 CPI has transformed methods in this topic.

Challenges and Opportunities

The informal economy in November 2024 faces a complex interplay of challenges and opportunities amidst CPI fluctuations. While inflation poses significant risks, the informal sector also exhibits remarkable resilience and adaptability, potentially creating new avenues for growth and development.

Challenges

The challenges faced by the informal economy due to CPI fluctuations include:

- Reduced purchasing power:Inflation can erode the purchasing power of informal sector workers, leading to a decline in consumption and economic activity.

- Increased operating costs:Rising input costs can squeeze profit margins for informal businesses, making it difficult to maintain operations.

- Limited access to support:The informal sector often lacks access to formal financial services, social safety nets, and legal protection, making it vulnerable to economic shocks.

Opportunities

Despite these challenges, the informal economy can also benefit from emerging opportunities:

- Increased demand for essential services:In times of economic uncertainty, demand for basic services provided by the informal sector, such as food, transportation, and repair services, may increase.

- Innovation and adaptation:The informal sector is known for its flexibility and adaptability, enabling businesses to find creative solutions to challenges posed by inflation.

- Policy support:Increased policy attention and support for the informal sector can help mitigate the negative impacts of inflation and foster its potential for economic growth.

Conclusion

The intricate relationship between CPI and the informal economy in November 2024 underscores the importance of understanding and addressing the challenges faced by this sector. While inflation presents significant challenges, the informal economy also offers opportunities for growth and development.

You also will receive the benefits of visiting Decoding the November 2024 CPI: Key Terms and Concepts today.

By analyzing the data, trends, and potential policy interventions, we can gain valuable insights into how to support the informal economy’s resilience and contribute to broader economic progress.

General Inquiries: CPI And The Informal Economy In November 2024

What are some examples of informal sector businesses?

Obtain direct knowledge about the efficiency of Common Misconceptions about the CPI in November 2024 through case studies.

Examples include street vendors, small-scale farmers, home-based businesses, and informal transportation services.

How does inflation affect the purchasing power of informal sector workers?

Rising prices erode the purchasing power of informal sector workers, especially those with fixed incomes or who rely on daily earnings.

What are some potential policy interventions to support the informal economy?

Policies could include providing access to microfinance, training programs, and legal recognition for informal businesses.