CPI and the Cost of Living for Different Demographics in November 2024 is a crucial topic, especially as inflation continues to impact household budgets. This analysis explores how the Consumer Price Index (CPI) affects the cost of living for various groups, from different income levels to age groups and geographic locations.

We delve into the factors that influence the cost of living, including housing, transportation, healthcare, and education, and examine how these trends manifested in November 2024. By understanding the impact of CPI on the cost of living, individuals can make informed decisions to manage their finances and navigate the economic landscape.

Remember to click How the November 2024 CPI Affects Your Daily Life to understand more comprehensive aspects of the How the November 2024 CPI Affects Your Daily Life topic.

This exploration examines the cost of living for different demographics, highlighting the disparities that exist. We will analyze how income levels, age, geographical location, and family size influence the cost of living, providing insights into the challenges faced by various segments of society.

The analysis will also discuss the key factors that contribute to the cost of living, including inflation, housing costs, transportation expenses, healthcare, and education. By understanding these factors, we can gain a deeper understanding of the forces shaping the cost of living and identify strategies to mitigate their impact.

Understanding CPI and Cost of Living

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It plays a vital role in understanding the cost of living, as it reflects the purchasing power of consumers and the overall inflation rate.

Defining CPI and its Relevance to Cost of Living

The CPI is a weighted average of prices for a basket of goods and services that are representative of the consumption patterns of urban households. It provides a comprehensive measure of inflation, reflecting changes in the cost of living for consumers.

Methodology for Calculating CPI

The CPI is calculated by the Bureau of Labor Statistics (BLS) through a rigorous process that involves:

- Collecting Price Data:The BLS collects price data from a wide range of retailers and service providers across the country.

- Creating a Market Basket:The BLS defines a “market basket” of goods and services that represents the typical consumption patterns of urban households.

- Calculating Weighted Averages:The BLS assigns weights to each item in the market basket based on its relative importance in consumer spending.

- Tracking Price Changes:The BLS tracks price changes over time for each item in the market basket, comparing prices to a base period.

- Calculating the CPI:The BLS calculates the CPI by combining the weighted average prices for each item in the market basket, resulting in an index that reflects the overall change in prices.

Limitations of CPI as a Measure of Cost of Living

While the CPI is a valuable tool for understanding inflation, it has certain limitations as a measure of the cost of living:

- Consumer Preferences:The CPI assumes that consumer preferences remain constant over time, which may not always be the case.

- Substitution Bias:Consumers may switch to cheaper alternatives when prices rise, which is not fully captured by the CPI.

- Quality Changes:The CPI does not always account for changes in the quality of goods and services, which can impact their value.

- Geographic Variations:The CPI is a national index, and it may not accurately reflect the cost of living in different regions of the country.

Cost of Living for Different Demographics

The cost of living can vary significantly across different demographics, reflecting factors such as income levels, age groups, geographical regions, and family size.

Impact of CPI on Different Income Levels

The CPI can have a disproportionate impact on different income levels. For lower-income households, a higher inflation rate can significantly erode their purchasing power, as a larger proportion of their income is spent on essential goods and services. Higher-income households may be less affected by inflation, as they have more disposable income and can potentially adjust their spending patterns.

Cost of Living for Different Age Groups, CPI and the Cost of Living for Different Demographics in November 2024

The cost of living can vary across different age groups due to differences in spending patterns and needs. For example, younger adults may have higher expenses related to housing, transportation, and entertainment, while older adults may have higher healthcare and housing costs.

The CPI can provide insights into the relative cost of living for different age groups.

Cost of Living Differences Across Geographical Regions

The cost of living can vary significantly across geographical regions due to factors such as housing costs, taxes, and the availability of goods and services. Urban areas generally have higher costs of living compared to rural areas. The CPI can help to understand the relative cost of living in different regions of the country.

Impact of Family Size on Cost of Living

Family size can significantly impact the cost of living. Larger families typically have higher expenses related to housing, food, transportation, and childcare. The CPI can be used to compare the cost of living for families of different sizes.

Browse the multiple elements of CPI and Healthcare Costs in November 2024 to gain a more broad understanding.

Key Factors Influencing Cost of Living

Several key factors contribute to the cost of living, influencing the overall price level and the affordability of goods and services for consumers.

Major Components of the CPI Basket

The CPI basket includes a wide range of goods and services, categorized into eight major groups:

- Food and Beverages

- Housing

- Apparel

- Transportation

- Medical Care

- Recreation

- Education and Communication

- Other Goods and Services

Impact of Inflation on Cost of Living

Inflation is a key driver of the cost of living. When prices rise, the purchasing power of consumers decreases, making it more expensive to maintain their standard of living. The CPI provides a measure of inflation, allowing consumers and policymakers to track the impact of rising prices on the economy.

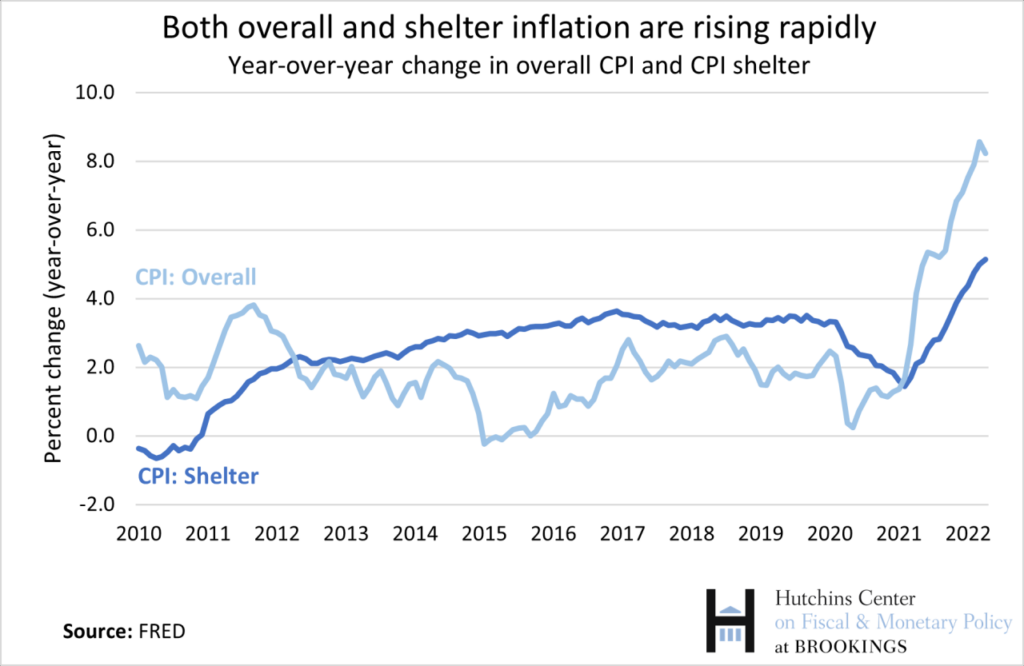

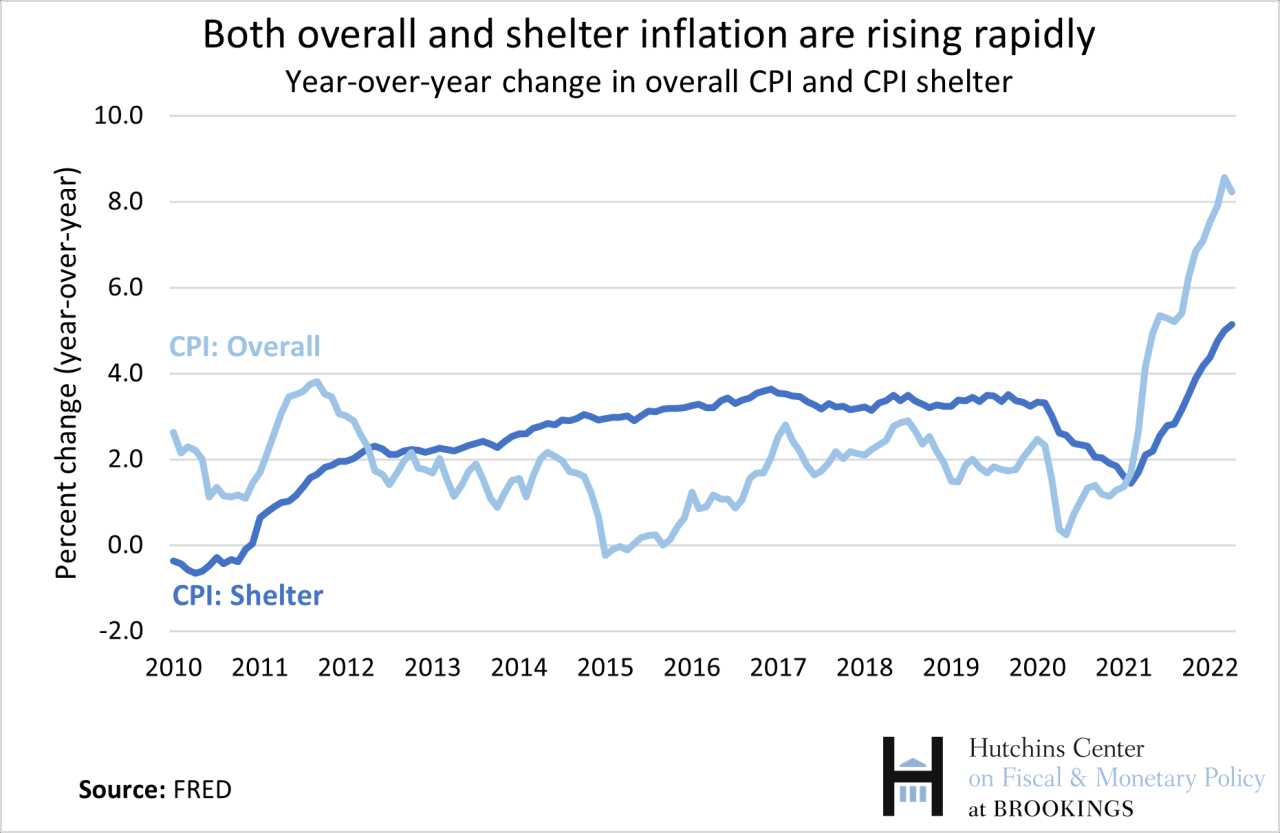

Influence of Housing Costs on Cost of Living

Housing costs are a significant component of the CPI and a major factor influencing the cost of living. Housing costs include rent, mortgage payments, property taxes, and utilities. Rising housing costs can significantly impact the affordability of housing for consumers.

You also will receive the benefits of visiting Inflationary Periods in History and Their Impact on November 2024 today.

Role of Transportation Costs in Cost of Living

Transportation costs, including gasoline, vehicle maintenance, and public transportation fares, can contribute significantly to the cost of living. Rising transportation costs can impact the affordability of commuting and travel for consumers.

Browse the multiple elements of The Low Inflation Era and its Relevance to November 2024 to gain a more broad understanding.

Impact of Healthcare Expenses on Cost of Living

Healthcare expenses, including medical insurance premiums, doctor visits, and prescription drugs, can have a substantial impact on the cost of living. Rising healthcare costs can strain household budgets and limit access to healthcare for some consumers.

Influence of Education Costs on Cost of Living

Education costs, including tuition fees, books, and supplies, can significantly impact the cost of living, particularly for families with children. Rising education costs can make it more challenging for families to afford quality education for their children.

When investigating detailed guidance, check out International Comparisons of CPI and PCE in November 2024 now.

Cost of Living Trends in November 2024

The cost of living trends in November 2024 will be influenced by a complex interplay of economic factors, including inflation, employment, and consumer confidence.

Further details about CPI and PCE: Implications for Policymakers in November 2024 is accessible to provide you additional insights.

Comprehensive Overview of CPI and Cost of Living Trends in November 2024

To provide a comprehensive overview of CPI and cost of living trends in November 2024, it is crucial to analyze the specific changes in the CPI basket for the month and discuss the potential impact of these trends on different demographics.

Remember to click CPI and Housing Costs: Historical Trends Leading to November 2024 to understand more comprehensive aspects of the CPI and Housing Costs: Historical Trends Leading to November 2024 topic.

Additionally, comparing the cost of living in November 2024 to previous months and years will provide valuable insights into the direction of the cost of living.

When investigating detailed guidance, check out CPI, PCE, and GDP Deflator: A Comparative Analysis for November 2024 now.

Specific Changes in the CPI Basket for November 2024

Analyzing the specific changes in the CPI basket for November 2024 will provide insights into the specific goods and services that have experienced the most significant price changes. For example, examining the price changes for food, energy, and healthcare will reveal the areas where consumers are experiencing the greatest cost pressures.

Obtain access to Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 to private resources that are additional.

Potential Impact of Trends on Different Demographics

The potential impact of these trends on different demographics will vary depending on their income levels, age groups, geographical locations, and family sizes. For example, lower-income households may be disproportionately affected by rising food and energy prices, while older adults may experience higher healthcare costs.

Comparison of Cost of Living in November 2024 to Previous Months and Years

Comparing the cost of living in November 2024 to previous months and years will provide a historical context for understanding the current trends. For example, analyzing the year-over-year change in the CPI will reveal the rate of inflation and its impact on the cost of living.

You also will receive the benefits of visiting November 2024 CPI and the Risk of Deflation: Will it Be a Factor? today.

Strategies for Managing Cost of Living: CPI And The Cost Of Living For Different Demographics In November 2024

In an era of rising costs, consumers need to adopt strategies to manage their expenses and maintain their standard of living.

Tips for Reducing Household Expenses

Reducing household expenses is a crucial step in managing the cost of living. Here are some tips:

- Create a Budget:Track your income and expenses to identify areas where you can cut back.

- Negotiate Bills and Services:Contact your service providers to negotiate lower rates for utilities, internet, and phone services.

- Shop Around for Deals:Compare prices for groceries, insurance, and other essential goods and services to find the best deals.

- Reduce Energy Consumption:Conserve energy by turning off lights, using energy-efficient appliances, and adjusting thermostats.

- Cook at Home:Eating out frequently can be expensive. Cook more meals at home to save money.

Strategies for Saving Money on Groceries and Utilities

Groceries and utilities are significant household expenses. Here are some strategies for saving money:

- Plan Your Meals:Make a weekly meal plan to avoid impulse purchases and reduce food waste.

- Buy in Bulk:Purchase non-perishable items in bulk to save money per unit.

- Compare Prices:Compare prices at different grocery stores to find the best deals.

- Use Coupons and Discounts:Take advantage of coupons, discounts, and loyalty programs.

- Adjust Your Thermostat:Lower your thermostat in the winter and raise it in the summer to reduce energy consumption.

- Use Energy-Efficient Appliances:Upgrade to energy-efficient appliances to reduce your energy bills.

Cost-Effective Alternatives for Common Household Expenses

Here is a table outlining cost-effective alternatives for common household expenses:

| Expense | Cost-Effective Alternative |

|---|---|

| Entertainment | Free or low-cost events, streaming services, libraries |

| Transportation | Public transportation, biking, walking, carpooling |

| Food | Cooking at home, meal prepping, grocery shopping at discount stores |

| Clothing | Thrift stores, consignment shops, online marketplaces |

| Healthcare | Preventive care, generic medications, telehealth services |

Conclusive Thoughts

The cost of living is a complex issue that affects all of us, and understanding the nuances of CPI and its impact on different demographics is essential for informed decision-making. By analyzing the trends in November 2024, we can gain insights into the challenges and opportunities facing various groups.

This analysis serves as a starting point for further exploration and discussion, encouraging individuals to take proactive steps to manage their finances and navigate the ever-changing economic landscape.

FAQ Explained

What is the CPI and how is it calculated?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is calculated by tracking the prices of a representative sample of goods and services over time, weighting them according to their importance in the average consumer’s budget.

How does the CPI relate to the cost of living?

The CPI provides a measure of inflation, which is the rate at which prices rise over time. As the CPI increases, the cost of living also increases because consumers need to spend more money to purchase the same goods and services.

What are some strategies for managing the cost of living?

Strategies for managing the cost of living include budgeting, reducing unnecessary expenses, negotiating bills and services, shopping for discounts, and exploring cost-effective alternatives for common household expenses.

How can I track the CPI and cost of living trends?

You can track the CPI and cost of living trends by visiting the website of the Bureau of Labor Statistics (BLS), which publishes the CPI data on a monthly basis. You can also subscribe to newsletters and alerts from financial institutions and consumer advocacy groups that provide updates on these trends.