CPI and Political Uncertainty: Forecasting Inflation in November 2024 explores the intricate relationship between economic indicators and political events, analyzing how they influence inflation projections. The 2024 US Presidential Election looms large, with its potential to impact consumer confidence and spending patterns, ultimately affecting the Consumer Price Index (CPI) and the overall economic landscape.

You also can understand valuable knowledge by exploring The Future of CPI Calculation After November 2024.

This analysis delves into the historical interplay between political uncertainty and inflation, examining key factors that could shape the CPI in November 2024, including economic policies, global events, and technological advancements. By analyzing historical data and current trends, this report aims to provide insights into the potential range of CPI values and the driving forces behind the forecast.

Understanding the interplay between political uncertainty and inflation is crucial for businesses, investors, and policymakers alike. This report provides a comprehensive analysis of the factors that could influence the CPI in November 2024, offering valuable insights into the potential impact on interest rates, economic growth, and consumer spending.

Explore the different advantages of The Affordability Crisis and the November 2024 CPI that can change the way you view this issue.

It also explores the implications of the CPI forecast for various stakeholders, including businesses and investors, and examines potential policy responses to the projected CPI levels.

Find out further about the benefits of The Impact of Technology on the November 2024 CPI that can provide significant benefits.

Understanding CPI and Political Uncertainty

The Consumer Price Index (CPI) is a crucial economic indicator that measures changes in the prices of a basket of goods and services consumed by urban households. Understanding the relationship between CPI and political uncertainty is essential for forecasting inflation and its impact on the economy.

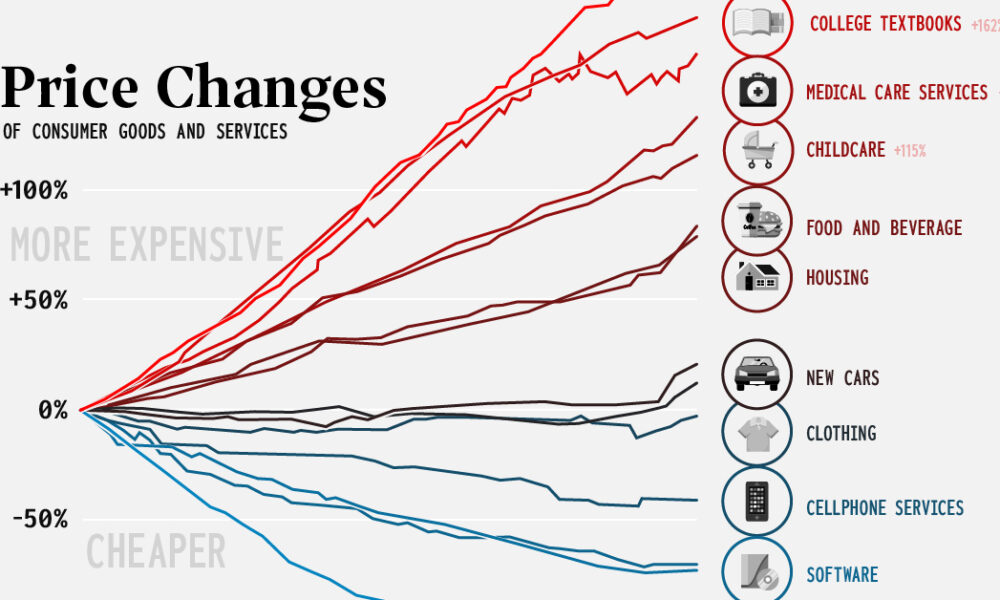

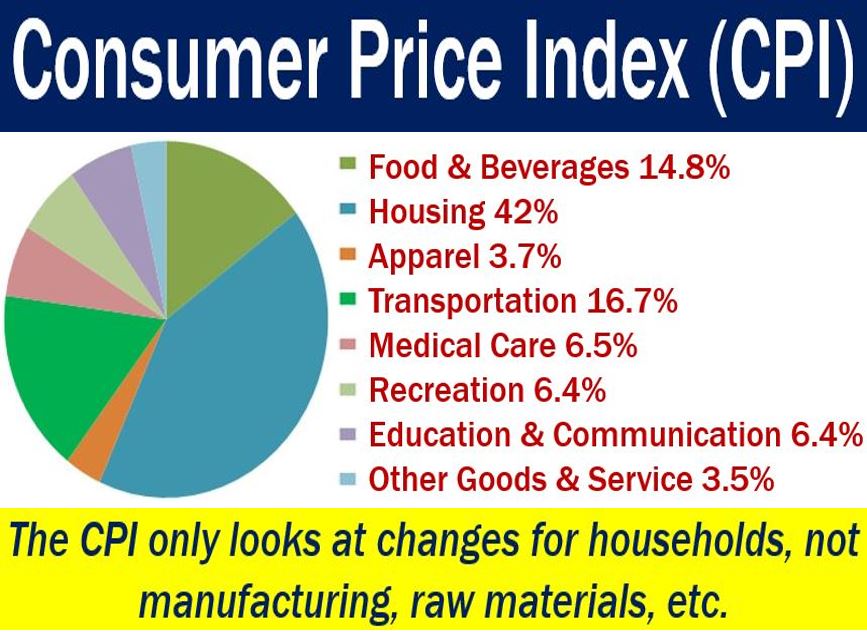

Defining CPI and its Components

The CPI is a weighted average of prices for a basket of consumer goods and services, such as food, housing, transportation, healthcare, and entertainment. The weights assigned to each item reflect its relative importance in the overall consumer budget. The CPI is calculated by comparing the cost of the basket in a given period to its cost in a base period, usually a year.

Check CPI and the Changing Consumer Landscape in November 2024 to inspect complete evaluations and testimonials from users.

- Food and Beverages:This category includes prices for groceries, restaurant meals, and alcoholic beverages.

- Housing:This category encompasses rent, mortgage payments, property taxes, and utilities.

- Transportation:This category includes prices for gasoline, new and used vehicles, and public transportation.

- Healthcare:This category covers medical services, prescription drugs, and health insurance premiums.

- Apparel:This category includes prices for clothing, footwear, and accessories.

- Recreation:This category includes prices for entertainment, travel, and hobbies.

- Education and Communication:This category covers tuition fees, books, internet services, and phone bills.

- Other Goods and Services:This category includes a wide range of items, such as personal care products, tobacco, and financial services.

The Relationship Between Political Uncertainty and Inflation

Political uncertainty can significantly impact inflation by influencing consumer confidence and spending patterns. When political events create uncertainty, consumers may become hesitant to spend money, leading to a decrease in demand and potentially lower inflation. Conversely, political events that increase confidence and optimism can lead to higher demand and potentially higher inflation.

Understand how the union of CPI and the Minimum Wage in November 2024: Is it Enough? can improve efficiency and productivity.

How Political Events Can Impact Consumer Confidence and Spending Patterns

- Policy Uncertainty:Changes in government policies, such as tax reforms, trade agreements, or regulations, can create uncertainty about future economic conditions and impact consumer spending decisions.

- Political Instability:Political unrest, elections, or changes in leadership can create uncertainty and volatility in the markets, leading to reduced investment and consumer spending.

- Geopolitical Tensions:International conflicts or disputes can disrupt trade flows, increase commodity prices, and create economic uncertainty, impacting inflation.

Historical Analysis of CPI and Political Uncertainty

Analyzing historical data on CPI and political uncertainty in the United States can provide insights into their relationship and the impact of political events on inflation.

Historical Data on CPI and Political Uncertainty in the United States

Historical data on CPI and political uncertainty in the United States can be found in various sources, including the Bureau of Labor Statistics (BLS) for CPI data and the Economic Policy Uncertainty Index (EPU) for political uncertainty data. Analyzing this data can reveal patterns and trends in the relationship between CPI and political uncertainty.

Periods of High Political Uncertainty and Their Impact on Inflation

Several historical periods in the United States have been marked by high political uncertainty, including the Vietnam War, the Watergate scandal, and the 2008 financial crisis. These periods often coincided with significant fluctuations in CPI, suggesting a strong relationship between political uncertainty and inflation.

Obtain recommendations related to CPI and Globalization in November 2024: Impact on Wages that can assist you today.

- The Vietnam War (1950s-1970s):The Vietnam War led to significant political and economic uncertainty, contributing to high inflation in the 1970s.

- The Watergate Scandal (1972-1974):The Watergate scandal, involving President Richard Nixon, created political instability and contributed to rising inflation.

- The 2008 Financial Crisis:The 2008 financial crisis, triggered by the housing market collapse, led to a sharp decline in consumer confidence and spending, contributing to deflationary pressures.

Comparing the Relationship Between CPI and Political Uncertainty Across Different Economic Periods

Comparing the relationship between CPI and political uncertainty across different economic periods can reveal how this relationship has evolved over time. For example, the impact of political uncertainty on inflation may be more pronounced during periods of economic expansion or contraction.

- Periods of Economic Expansion:During periods of economic expansion, consumer confidence is typically high, and political uncertainty may have a less significant impact on inflation.

- Periods of Economic Contraction:During periods of economic contraction, consumer confidence is typically low, and political uncertainty may have a more significant impact on inflation.

Factors Influencing CPI in November 2024: CPI And Political Uncertainty: Forecasting Inflation In November 2024

Forecasting CPI in November 2024 requires considering various factors that could influence inflation, including the 2024 US Presidential Election, economic policies, global events, and technological advancements.

The Potential Impact of the 2024 US Presidential Election on CPI

The 2024 US Presidential Election is likely to have a significant impact on CPI, as different candidates may propose different economic policies that could affect inflation. For example, a candidate who favors fiscal stimulus might lead to higher inflation, while a candidate who focuses on fiscal restraint might lead to lower inflation.

The Role of Economic Policies, Global Events, and Supply Chain Disruptions on Inflation

Economic policies, global events, and supply chain disruptions can all play a significant role in shaping inflation. For example, monetary policy decisions by the Federal Reserve can impact interest rates and the availability of credit, influencing consumer spending and inflation.

- Monetary Policy:The Federal Reserve’s monetary policy decisions, such as interest rate adjustments, can influence the availability of credit and consumer spending, ultimately impacting inflation.

- Fiscal Policy:Government spending and tax policies can also impact inflation. For example, increased government spending can lead to higher demand and potentially higher inflation.

- Global Events:Global events, such as wars, natural disasters, or trade disputes, can disrupt supply chains, increase commodity prices, and contribute to inflation.

- Supply Chain Disruptions:Disruptions to global supply chains, such as those caused by the COVID-19 pandemic, can lead to shortages of goods and services, contributing to higher prices and inflation.

The Potential Impact of Technological Advancements and Automation on CPI

Technological advancements and automation can have both positive and negative impacts on CPI. While technological advancements can lead to lower production costs and potentially lower prices, automation can also lead to job displacement and reduced consumer demand, potentially impacting inflation.

Forecasting CPI in November 2024

Forecasting CPI in November 2024 requires considering historical data, current trends, and the potential impact of future events. A model can be developed to predict CPI based on these factors.

Developing a Model to Forecast CPI in November 2024

A model to forecast CPI in November 2024 can be developed using various statistical techniques, such as time series analysis, regression analysis, or machine learning. The model should consider historical CPI data, current economic conditions, and potential future events, such as the 2024 US Presidential Election and global economic trends.

The Potential Range of CPI Values and the Factors Driving the Forecast

The potential range of CPI values in November 2024 will depend on the specific factors influencing inflation, such as economic policies, global events, and technological advancements. For example, if the Federal Reserve continues to raise interest rates to combat inflation, CPI might remain relatively stable or even decline.

Discover how CPI and Stock Valuations in November 2024: Finding Opportunities has transformed methods in this topic.

However, if there are significant disruptions to global supply chains or a surge in consumer demand, CPI might increase.

Discover the crucial elements that make Accuracy and Reliability of the November 2024 CPI Data the top choice.

Analyzing the Potential Risks and Uncertainties Associated with the CPI Forecast

Forecasting CPI involves inherent risks and uncertainties. For example, unexpected global events, such as wars or natural disasters, could significantly impact inflation and make it difficult to accurately predict CPI. Similarly, changes in government policies or consumer behavior could also influence inflation and affect the accuracy of the forecast.

Check what professionals state about CPI and the Evolution of the US Economy Leading to November 2024 and its benefits for the industry.

Implications of CPI Forecast for the Economy

The CPI forecast for November 2024 has significant implications for the economy, including potential impacts on interest rates, economic growth, and consumer spending.

The Potential Impact of CPI on Interest Rates, Economic Growth, and Consumer Spending, CPI and Political Uncertainty: Forecasting Inflation in November 2024

If CPI is expected to rise significantly in November 2024, the Federal Reserve might increase interest rates to control inflation. This could lead to higher borrowing costs for businesses and consumers, potentially slowing down economic growth and reducing consumer spending.

Conversely, if CPI is expected to remain relatively stable or decline, the Federal Reserve might maintain or even lower interest rates, stimulating economic growth and encouraging consumer spending.

Analyzing the Implications of the CPI Forecast for Businesses and Investors

Businesses and investors need to consider the implications of the CPI forecast for their operations and investment decisions. For example, businesses might need to adjust their pricing strategies to account for potential changes in inflation. Investors might need to consider the potential impact of inflation on their portfolio returns and make adjustments to their investment strategies.

Exploring the Potential Policy Responses to the Projected CPI Levels

Government policymakers might need to consider policy responses to address the projected CPI levels. For example, if CPI is expected to rise significantly, policymakers might consider measures to control inflation, such as increasing taxes or reducing government spending. Conversely, if CPI is expected to remain relatively stable or decline, policymakers might consider measures to stimulate economic growth, such as tax cuts or increased government spending.

Concluding Remarks

As the 2024 US Presidential Election approaches, the interplay between political uncertainty and inflation takes center stage. By analyzing historical data, current trends, and potential economic factors, this report provides a comprehensive assessment of the CPI forecast for November 2024.

The analysis highlights the importance of considering political events, economic policies, and global developments when forecasting inflation. Understanding these dynamics is crucial for businesses, investors, and policymakers in navigating the complex economic landscape and making informed decisions in the face of uncertainty.

Questions Often Asked

What are the key components of the CPI?

The CPI measures changes in the price of a basket of goods and services commonly consumed by urban households. These components include food, energy, housing, transportation, healthcare, and recreation.

How can political events impact consumer confidence?

Political events, such as elections or policy changes, can create uncertainty and affect consumer confidence. This can lead to changes in spending patterns, as consumers may delay major purchases or adjust their spending habits based on perceived economic risks.

What are some potential risks associated with the CPI forecast?

The CPI forecast is subject to inherent uncertainties, including unforeseen global events, changes in government policies, and unpredictable shifts in consumer behavior. These factors can influence the accuracy of the forecast and introduce potential risks.

Remember to click CPI and Housing Affordability in November 2024 to understand more comprehensive aspects of the CPI and Housing Affordability in November 2024 topic.