CPI and PCE: What Investors Need to Know in November 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are two crucial measures of inflation in the United States.

Understanding how these indicators are calculated and how they impact the economy is essential for investors seeking to navigate the ever-changing landscape of financial markets.

Notice CPI and the Sharing Economy in November 2024 for recommendations and other broad suggestions.

As we approach November 2024, the economic climate and inflation expectations are at the forefront of investors’ minds. This article delves into the intricacies of CPI and PCE, providing insights into their historical context, current trends, and potential implications for investors.

We will explore how inflation impacts different asset classes, analyze key economic indicators, and examine the role of the Federal Reserve in managing inflation.

CPI and PCE: Key Inflation Indicators

Understanding inflation is crucial for investors, as it significantly impacts the value of investments and the overall economy. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are two primary measures used to track inflation in the United States.

These indices provide valuable insights into the cost of living and help gauge the effectiveness of monetary policy.

Significance of CPI and PCE

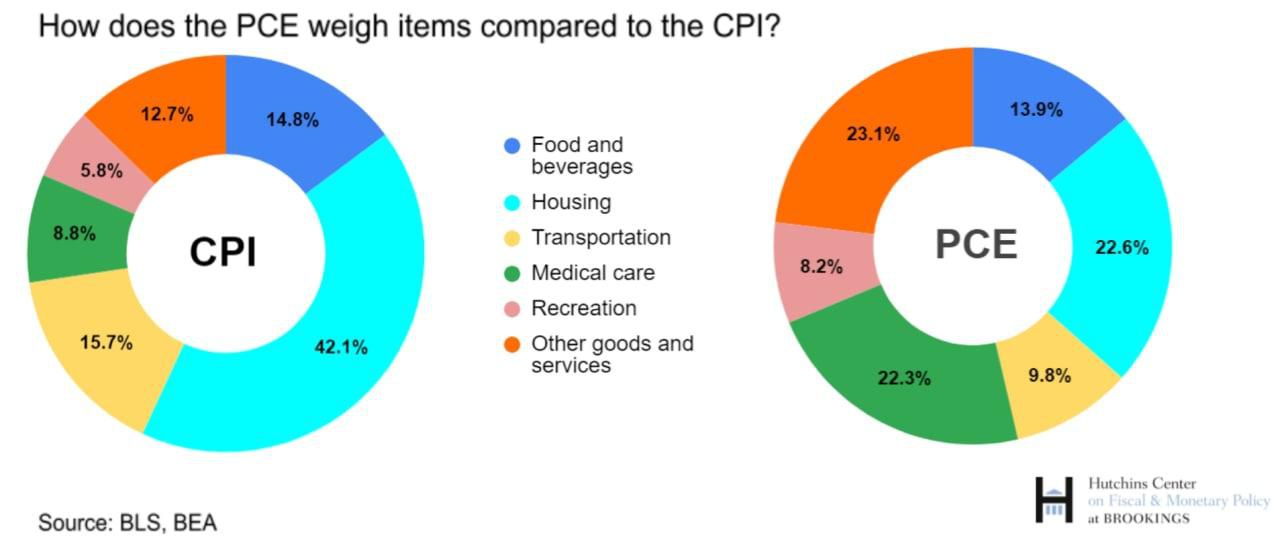

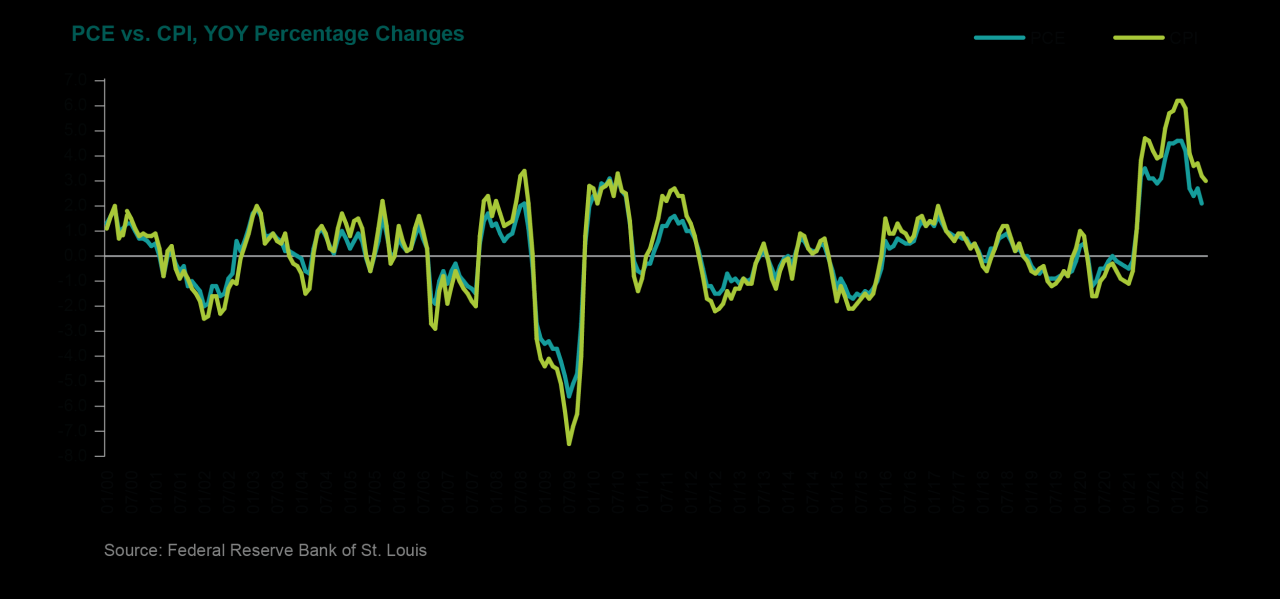

Both CPI and PCE are important inflation indicators, but they differ in their methodologies and what they measure. The CPI tracks the average change in prices paid by urban consumers for a basket of goods and services, while the PCE measures price changes for personal consumption expenditures, which includes spending by households and non-profit institutions serving households.

The PCE is considered a broader measure of inflation, as it includes a wider range of goods and services, including those not included in the CPI, such as healthcare and education.

Methodology Comparison

The CPI uses a fixed basket of goods and services, meaning the composition of the basket remains constant over time. This approach can lead to biases, as consumer spending patterns change. The PCE, on the other hand, uses a chain-weighted approach, which adjusts the basket’s composition based on consumer spending patterns.

This method is considered more accurate in reflecting current consumption patterns and can better capture changes in inflation.

Expand your understanding about How the November 2024 CPI Affects Your Daily Life with the sources we offer.

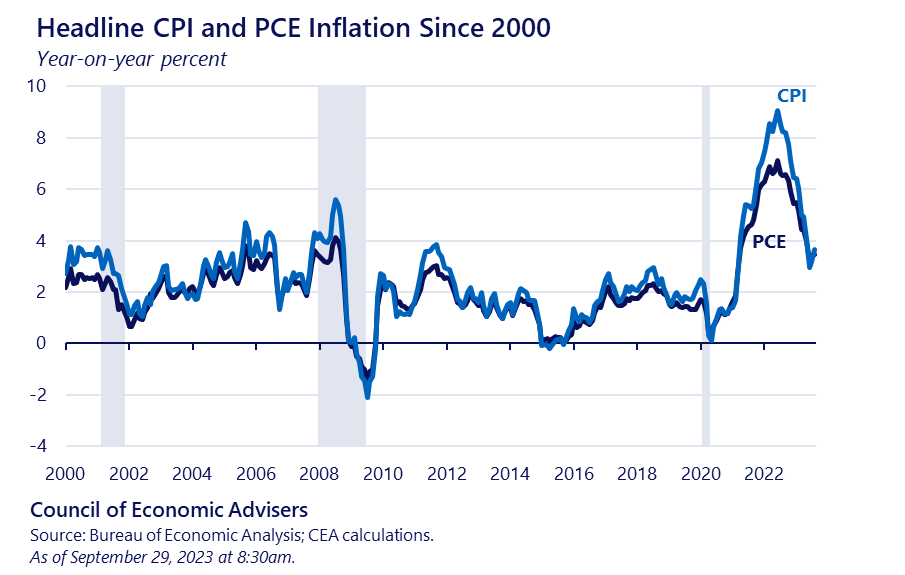

Historical Context of Inflation

The United States has experienced periods of high inflation, particularly in the 1970s and early 1980s. During these times, inflation reached double-digit levels, eroding purchasing power and causing economic instability. The Federal Reserve’s aggressive monetary policy, including raising interest rates, helped to curb inflation in the 1980s.

Since then, inflation has remained relatively low and stable, with the exception of recent spikes due to factors such as supply chain disruptions and increased energy prices.

Discover how Deflation: Causes and Effects in November 2024 (if applicable) has transformed methods in this topic.

November 2024: Economic Landscape and Inflation Expectations

As of November 2024, the US economy is showing signs of resilience. While the Federal Reserve has successfully curbed inflation, there are still uncertainties surrounding the future path of economic growth. Investors are closely watching key economic indicators to gauge the strength of the economy and potential risks to inflation.

Current Economic Landscape

- The unemployment rate remains low, indicating a strong labor market. This suggests that consumers have healthy spending power, potentially contributing to inflation.

- GDP growth has been relatively steady, although there are concerns about a potential slowdown in the coming months.

- Interest rates have increased in response to inflation, potentially slowing economic activity and impacting consumer spending.

Inflation Expectations, CPI and PCE: What Investors Need to Know in November 2024

Economists are closely watching the November 2024 CPI and PCE data for clues about the future trajectory of inflation. While the consensus forecast suggests that inflation will remain below the Federal Reserve’s 2% target, there is a range of possibilities depending on factors such as energy prices and supply chain disruptions.

Do not overlook explore the latest data about The Psychology of Inflation in November 2024.

A significant increase in inflation could lead to further interest rate hikes, while a decline in inflation could provide the Federal Reserve with more flexibility in monetary policy.

Discover the crucial elements that make CPI Calculation in November 2024: Addressing Substitution Bias the top choice.

Impact of Inflation on Investors

Inflation can have a significant impact on different asset classes and investment strategies. Understanding how inflation affects investment returns is crucial for making informed investment decisions.

Impact on Asset Classes

- Stocks:Inflation can erode the value of stocks, particularly those in sectors sensitive to rising input costs, such as manufacturing and consumer goods. However, companies with pricing power and strong earnings growth may be able to offset inflation’s impact.

- Bonds:Inflation erodes the value of bonds, as fixed interest payments lose purchasing power. Investors typically prefer short-term bonds during periods of high inflation, as they can be rolled over at higher interest rates.

- Real Estate:Real estate can be a hedge against inflation, as property values tend to rise with inflation. However, rising interest rates can make it more expensive to finance real estate purchases, potentially dampening demand.

Impact on Consumer Spending and Business Investment

High inflation can reduce consumer spending, as purchasing power declines. This can lead to a slowdown in economic growth and a decrease in business investment. However, businesses may also increase prices to offset rising costs, which can further fuel inflation.

Mitigating Inflation Risks

Investors can adjust their portfolios to mitigate inflation risks. This may involve investing in assets that are expected to outperform during periods of inflation, such as commodities, real estate, and stocks with pricing power. Diversifying across asset classes and adjusting portfolio allocation based on inflation expectations can help reduce risk and protect investment returns.

Analyzing CPI and PCE Data: What to Look For

To understand the implications of CPI and PCE data for investors, it’s important to analyze the key components of these indices and identify potential drivers of inflation.

Key Components of CPI and PCE

- Energy:Energy prices are a significant component of both CPI and PCE. Fluctuations in oil prices can have a major impact on overall inflation.

- Food:Food prices are also a significant contributor to inflation. Factors such as weather patterns, supply chain disruptions, and global demand can affect food prices.

- Housing:Housing costs, including rent and home prices, are a major component of both CPI and PCE. Rising housing costs can significantly impact inflation.

- Healthcare:Healthcare costs are a significant component of PCE but not CPI. Rising healthcare costs can contribute to overall inflation.

Potential Drivers of Inflation

Several factors can contribute to inflation in November 2024, including:

- Supply Chain Disruptions:Ongoing supply chain disruptions could continue to put upward pressure on prices for goods and services.

- Labor Shortages:Tight labor markets can lead to wage increases, which can be passed on to consumers in the form of higher prices.

- Geopolitical Events:Geopolitical events, such as wars or sanctions, can disrupt global supply chains and lead to higher energy prices.

Impact of Specific Components

The impact of specific components on inflation can vary depending on the economic environment. For example, a rise in energy prices could have a more significant impact on inflation during periods of high demand for energy, while a rise in food prices could have a greater impact during periods of food shortages.

Remember to click Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 to understand more comprehensive aspects of the Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 topic.

Implications for Monetary Policy and Interest Rates: CPI And PCE: What Investors Need To Know In November 2024

The Federal Reserve closely monitors CPI and PCE data to guide its monetary policy decisions. The November 2024 inflation data will provide important insights into the Fed’s likely course of action regarding interest rates.

Discover how The Future of CPI Calculation After November 2024 has transformed methods in this topic.

Federal Reserve’s Use of Inflation Data

The Federal Reserve aims to maintain a stable inflation rate of 2%. If inflation rises above this target, the Fed may raise interest rates to cool the economy and curb inflation. Conversely, if inflation falls below the target, the Fed may lower interest rates to stimulate economic growth.

Implications for Interest Rates

If the November 2024 inflation data shows a significant increase in inflation, the Federal Reserve may feel pressure to raise interest rates further. This could lead to higher borrowing costs for businesses and consumers, potentially slowing economic growth.

Fed’s Likely Course of Action

The Fed’s likely course of action will depend on the overall economic landscape and the trajectory of inflation. If inflation remains elevated, the Fed may continue to raise interest rates to bring it under control. However, if inflation shows signs of easing, the Fed may be more cautious in its approach, potentially pausing or even reversing interest rate hikes.

Last Word

In conclusion, CPI and PCE are vital indicators that provide investors with valuable insights into the health of the economy and the trajectory of inflation. By understanding the nuances of these measures and their potential impact on asset classes and monetary policy, investors can make informed decisions to protect and grow their portfolios.

Find out further about the benefits of Data Collection Methods for the November 2024 CPI that can provide significant benefits.

The economic landscape is constantly evolving, and staying abreast of inflation trends is crucial for long-term financial success.

Further details about Decoding the November 2024 CPI: Key Terms and Concepts is accessible to provide you additional insights.

Top FAQs

What is the difference between CPI and PCE?

CPI measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. PCE measures the prices of goods and services purchased by households and non-profit institutions serving households.

Do not overlook explore the latest data about Inflation and Asset Prices in November 2024.

How often are CPI and PCE data released?

Both CPI and PCE data are released monthly by the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA), respectively.

What are the main components of CPI and PCE?

CPI and PCE include various components, such as food, energy, housing, transportation, healthcare, and recreation. The specific components and their weighting may vary slightly between the two indices.

How can investors adjust their portfolios to mitigate inflation risks?

Investors can consider strategies such as investing in inflation-protected securities, real estate, or commodities. They can also adjust their asset allocation to favor sectors that tend to perform well during inflationary periods.