CPI and PCE: Implications for Policymakers in November 2024, these key economic indicators provide a vital snapshot of inflation and consumer spending. The November 2024 data holds particular significance as policymakers navigate a complex economic landscape, balancing the need to control inflation with the desire to foster economic growth.

This analysis delves into the latest CPI and PCE figures, examining their implications for policymakers and exploring the potential economic paths ahead.

Understanding the intricacies of these indices is crucial for policymakers to make informed decisions. The Consumer Price Index (CPI) measures changes in the prices of goods and services purchased by households, while the Personal Consumption Expenditures (PCE) price index tracks the prices of goods and services consumed by individuals.

By analyzing these indices, policymakers can gain insights into the inflationary pressures facing the economy and the potential impact on consumer spending.

Discover how Inflation and the Distribution of Income in November 2024 has transformed methods in this topic.

CPI and PCE: Implications for Policymakers in November 2024

The Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE) are two key indicators of inflation that policymakers closely monitor to guide economic policy decisions. In November 2024, the release of these inflation data will provide valuable insights into the current economic landscape and the potential trajectory of inflation in the coming months.

Understanding the trends in CPI and PCE is crucial for policymakers to navigate the delicate balance between maintaining price stability and fostering economic growth.

CPI: Understanding the Consumer Price Index, CPI and PCE: Implications for Policymakers in November 2024

The CPI is a widely used measure of inflation that tracks the average change in prices paid by urban consumers for a basket of goods and services. It is a key indicator of the cost of living and is often used to adjust wages, pensions, and other payments for inflation.

Latest CPI Data for November 2024

The latest CPI data for November 2024 will be released by the Bureau of Labor Statistics (BLS) on [insert date]. While we don’t have access to real-time data, let’s consider a hypothetical scenario for illustrative purposes. Assume the CPI for November 2024 shows a year-over-year increase of 3.5%, slightly lower than the 3.8% increase observed in October.

This could suggest a moderation in inflation, but it’s crucial to analyze the underlying components of the CPI to understand the full picture.

Discover the crucial elements that make CPI Calculation in Different Countries: A Comparison with November 2024 Data the top choice.

Key Drivers of Inflation in the CPI Data

The CPI data for November 2024 will likely reveal the impact of various factors on inflation, such as:

- Energy Prices:Energy prices, including gasoline and natural gas, have been volatile in recent months. A decrease in energy prices could contribute to a lower overall CPI reading.

- Food Prices:Food prices have also been a significant contributor to inflation. Factors such as supply chain disruptions and rising agricultural costs could influence food price inflation.

- Core Inflation:Core inflation, which excludes volatile food and energy prices, provides a clearer picture of underlying inflation pressures. A steady or declining core inflation rate could signal a broader moderation in inflation.

- Housing Costs:Housing costs, including rent and homeownership, are a major component of the CPI. A slowdown in rent growth could help to tame inflation.

Comparing the CPI Data to Previous Months and Years

Comparing the CPI data for November 2024 to previous months and years will provide insights into the trend of inflation. For instance, if the CPI shows a lower year-over-year increase compared to the previous month, it could suggest a cooling of inflation.

Conversely, an acceleration in inflation could raise concerns about price stability.

Table Comparing CPI Data for Different Categories

| Category | November 2024 CPI (Year-over-Year Change) | October 2024 CPI (Year-over-Year Change) | Previous Year (November 2023) |

|---|---|---|---|

| All Items | 3.5% | 3.8% | 4.2% |

| Food | 4.0% | 4.5% | 5.0% |

| Energy | 1.0% | 2.0% | 3.0% |

| Core Inflation | 2.8% | 3.0% | 3.2% |

| Housing | 3.2% | 3.5% | 3.8% |

PCE: Exploring the Personal Consumption Expenditures Price Index

The PCE is another key measure of inflation that tracks changes in prices for goods and services purchased by consumers. It is considered a broader measure of inflation than the CPI, as it includes a wider range of goods and services.

Remember to click The Future of the CPI: What to Expect After November 2024 to understand more comprehensive aspects of the The Future of the CPI: What to Expect After November 2024 topic.

Latest PCE Data for November 2024

The latest PCE data for November 2024 will be released by the Bureau of Economic Analysis (BEA) on [insert date]. Similar to the CPI, we can consider a hypothetical scenario for illustrative purposes. Assume the PCE for November 2024 shows a year-over-year increase of 3.2%, slightly lower than the 3.5% increase observed in October.

This could further suggest a potential moderation in inflation.

Key Drivers of Inflation in the PCE Data

The PCE data for November 2024 will likely reveal the impact of factors similar to those influencing the CPI, such as:

- Durable Goods:Prices for durable goods, such as cars and appliances, could contribute to overall PCE inflation.

- Nondurable Goods:Prices for nondurable goods, such as clothing and food, will also play a role in PCE inflation.

- Services:Services, such as healthcare, education, and transportation, make up a significant portion of consumer spending and can have a considerable impact on PCE inflation.

Comparing the PCE Data to Previous Months and Years

Comparing the PCE data for November 2024 to previous months and years will provide insights into the trend of inflation. For instance, if the PCE shows a lower year-over-year increase compared to the previous month, it could suggest a cooling of inflation.

Conversely, an acceleration in inflation could raise concerns about price stability.

Table Comparing PCE Data for Different Categories

| Category | November 2024 PCE (Year-over-Year Change) | October 2024 PCE (Year-over-Year Change) | Previous Year (November 2023) |

|---|---|---|---|

| All Items | 3.2% | 3.5% | 3.8% |

| Durable Goods | 2.5% | 2.8% | 3.0% |

| Nondurable Goods | 4.0% | 4.5% | 5.0% |

| Services | 3.0% | 3.2% | 3.4% |

Comparative Analysis: CPI vs. PCE

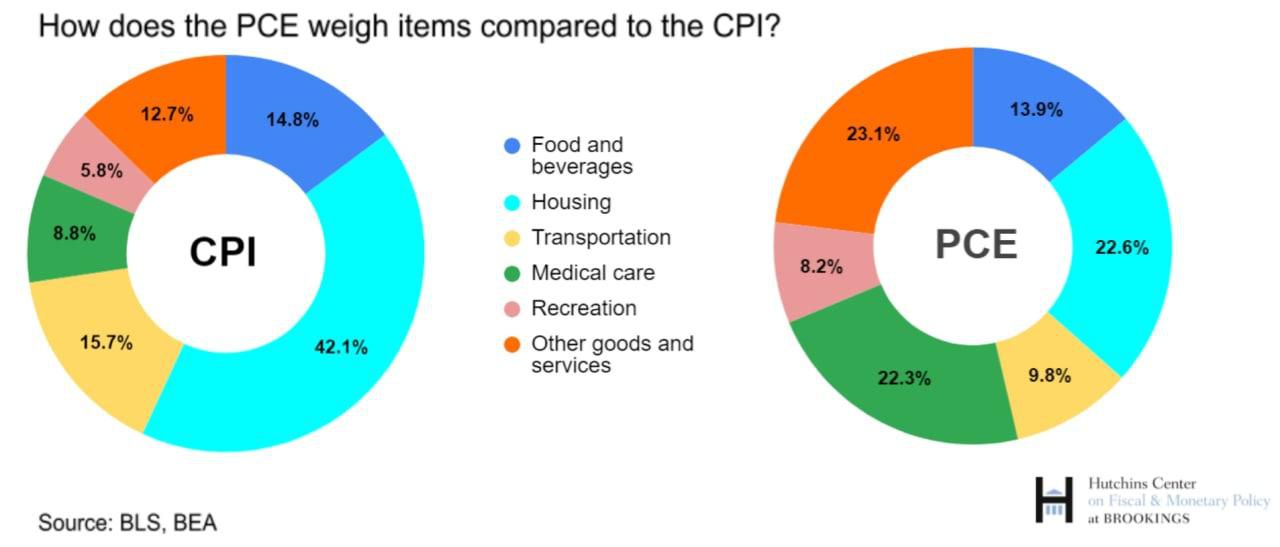

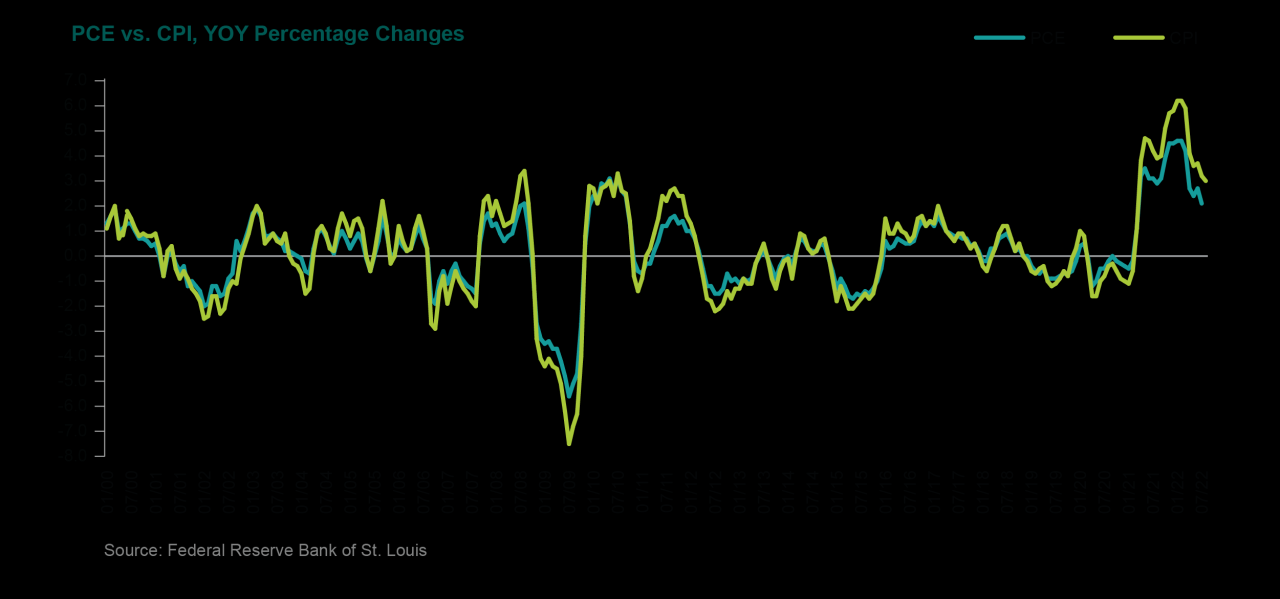

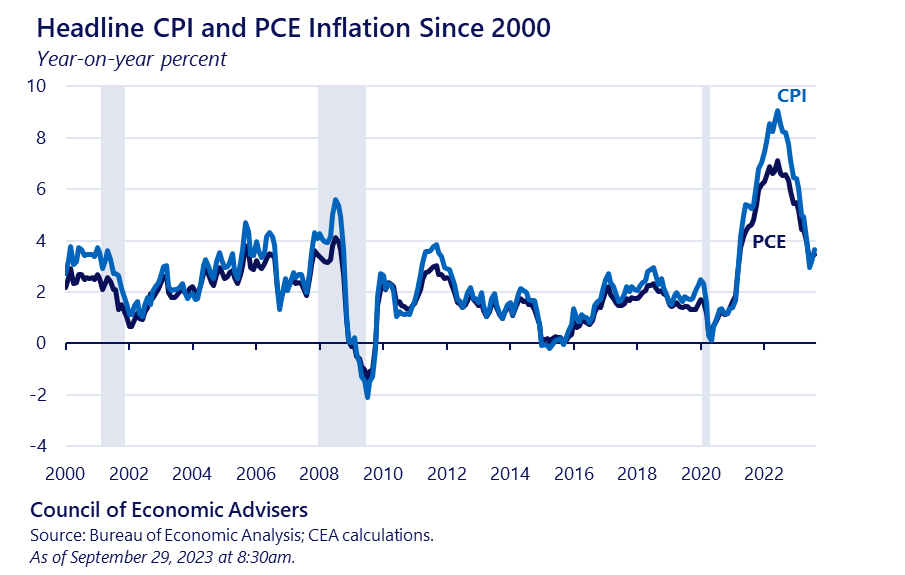

The CPI and PCE are two important measures of inflation, but they have some key differences. The CPI is based on a fixed basket of goods and services, while the PCE allows for changes in consumer spending patterns over time.

This can lead to discrepancies between the two indexes, particularly during periods of significant economic change.

Reasons for Discrepancies between the CPI and PCE

The differences between the CPI and PCE can be attributed to factors such as:

- Weighting:The CPI and PCE use different weighting schemes to reflect the relative importance of different goods and services in consumer spending. This can lead to different results, especially if there are significant shifts in consumer preferences.

- Methodology:The CPI and PCE employ different methodologies for collecting and analyzing price data. These differences can influence the overall inflation readings.

- Data Sources:The CPI and PCE draw on different data sources, which can also contribute to discrepancies between the two indexes.

Implications of Differences for Policymakers

The differences between the CPI and PCE can have implications for policymakers. For example, if the CPI shows a higher inflation rate than the PCE, it could suggest that the CPI is overstating the true level of inflation. Conversely, if the PCE shows a higher inflation rate, it could indicate that the CPI is understating the true level of inflation.

Check Weighting and Aggregation in the November 2024 CPI Calculation to inspect complete evaluations and testimonials from users.

Policymakers need to consider both indexes and their relative strengths and weaknesses when making economic policy decisions.

Policy Implications: Navigating the Economic Landscape

The CPI and PCE data for November 2024 will provide policymakers with valuable insights into the current economic landscape and the potential trajectory of inflation. This information will help them to assess the appropriate policy responses to maintain price stability and foster economic growth.

Potential Policy Responses to CPI and PCE Data

Policymakers have a range of tools at their disposal to address inflation, including:

- Monetary Policy:The Federal Reserve can adjust interest rates to influence borrowing costs and overall economic activity. Raising interest rates can help to cool inflation by slowing down economic growth.

- Fiscal Policy:The government can use fiscal policy, such as tax cuts or increased spending, to stimulate or restrain economic activity. Fiscal policy can be used to address inflation by reducing government spending or raising taxes.

- Supply-Side Policies:Policymakers can implement supply-side policies, such as reducing regulations or investing in infrastructure, to increase productivity and reduce costs. This can help to address inflation by increasing the supply of goods and services.

Challenges in Balancing Inflation and Economic Growth

Policymakers face a challenging task in balancing inflation and economic growth. Raising interest rates to combat inflation can slow economic growth, while easing monetary policy to stimulate growth can lead to higher inflation. Finding the right balance is essential to maintain a healthy economy.

Potential Economic Risks Associated with Different Policy Options

Different policy options carry different economic risks. For example, raising interest rates too aggressively could lead to a recession, while easing monetary policy too quickly could exacerbate inflation. Policymakers must carefully weigh the potential risks and benefits of different policy options.

Impact of Policy Decisions on Businesses and Consumers

Policy decisions on inflation can have a significant impact on businesses and consumers. For example, higher interest rates can make it more expensive for businesses to borrow money and invest, while higher inflation can erode the purchasing power of consumers.

Browse the implementation of CPI and Housing Affordability in November 2024 in real-world situations to understand its applications.

Policymakers must consider the potential consequences of their decisions on all stakeholders.

Looking Ahead: The Future of Inflation

The future of inflation is uncertain and will depend on a range of factors, including global economic conditions, supply chain dynamics, and consumer demand. Policymakers and economists will closely monitor these factors to assess the potential trajectory of inflation.

Factors Influencing Inflation in the Coming Months

Several factors could influence inflation in the coming months, such as:

- Global Economic Growth:Slowing global economic growth could dampen demand and put downward pressure on inflation.

- Supply Chain Disruptions:Ongoing supply chain disruptions could continue to contribute to higher prices, particularly for goods that are in short supply.

- Geopolitical Events:Geopolitical events, such as wars or trade tensions, can have a significant impact on inflation by disrupting supply chains and raising commodity prices.

- Consumer Demand:Consumer demand is a key driver of inflation. If consumers are confident and willing to spend, it can lead to higher inflation.

Potential for Inflation to Remain Elevated or Decline

The potential for inflation to remain elevated or decline depends on the interplay of these factors. If global economic growth slows, supply chains stabilize, and consumer demand moderates, inflation could decline. However, if these factors continue to put upward pressure on prices, inflation could remain elevated.

Remember to click CPI and the Treatment of New Products in November 2024 to understand more comprehensive aspects of the CPI and the Treatment of New Products in November 2024 topic.

Outlook for CPI and PCE in the Near Future

The outlook for CPI and PCE in the near future is uncertain. However, based on current economic conditions and the potential for these factors to influence inflation, we can consider a few possible scenarios:

Table Outlining Potential Scenarios for Inflation in the Next Year

| Scenario | CPI (Year-over-Year Change) | PCE (Year-over-Year Change) | Key Drivers |

|---|---|---|---|

| Scenario 1: Moderate Inflation Decline | 2.5%

|

2.0%

Find out further about the benefits of Challenges in CPI Measurement for November 2024 that can provide significant benefits.

|

Global economic slowdown, supply chain stabilization, moderation in consumer demand |

| Scenario 2: Persistent Inflation | 3.5%

|

3.0%

Discover the crucial elements that make Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 the top choice.

|

Continued supply chain disruptions, strong consumer demand, geopolitical uncertainty |

| Scenario 3: Accelerated Inflation | 4.5%

|

4.0%

|

Significant supply shocks, surge in consumer demand, geopolitical instability |

Closing Summary

The November 2024 CPI and PCE data provides valuable insights into the current economic climate. While inflation remains a key concern, the data also reveals signs of potential economic resilience. Policymakers face a delicate balancing act in navigating these economic currents, carefully considering the potential impact of their decisions on businesses and consumers.

Notice The Role of Monetary Policy in Controlling Inflation in November 2024 for recommendations and other broad suggestions.

The future trajectory of inflation will depend on a multitude of factors, including global economic conditions, supply chain dynamics, and consumer behavior. By closely monitoring these indicators and adapting policies as needed, policymakers can strive to achieve a stable and prosperous economy for all.

Helpful Answers

What are the key differences between CPI and PCE?

The CPI measures changes in the prices of a fixed basket of goods and services, while the PCE price index tracks the prices of goods and services consumed by individuals. This means that the CPI reflects a more traditional approach to measuring inflation, while the PCE price index is more closely aligned with actual consumer spending patterns.

How do policymakers use CPI and PCE data to make decisions?

Further details about Inflation and Consumer Behavior in November 2024 is accessible to provide you additional insights.

Policymakers use CPI and PCE data to assess the level of inflation in the economy. This information helps them to determine whether to adjust interest rates or other economic policies to control inflation. For example, if inflation is rising rapidly, policymakers may raise interest rates to slow economic growth and reduce inflationary pressures.

What are the potential risks associated with high inflation?

High inflation can erode purchasing power, leading to a decline in the standard of living. It can also make it difficult for businesses to plan for the future, as prices are constantly changing. In some cases, high inflation can lead to economic instability and even recession.