CPI and Lifestyle Choices in November 2024: Making Adjustments is a crucial topic as inflation continues to impact our daily lives. This article delves into the intricate relationship between the Consumer Price Index (CPI) and our lifestyle choices, exploring how rising prices influence our spending habits and financial well-being.

We’ll examine the factors driving CPI fluctuations, identify key lifestyle choices affected by inflation, and provide practical strategies for adapting to these economic challenges.

From understanding the historical trends of CPI to navigating the impact of inflation on discretionary spending, we’ll cover a range of aspects. This article will guide you through the process of adjusting your lifestyle choices in response to CPI, offering valuable insights into managing finances effectively and building financial resilience in an uncertain economic environment.

You also can understand valuable knowledge by exploring CPI and Globalization Leading to November 2024.

Understanding CPI and Its Impact

The Consumer Price Index (CPI) is a vital economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It provides a comprehensive snapshot of inflation, reflecting the purchasing power of the dollar over time.

Understanding CPI is crucial for individuals and policymakers alike, as it influences everything from personal financial planning to monetary policy decisions.

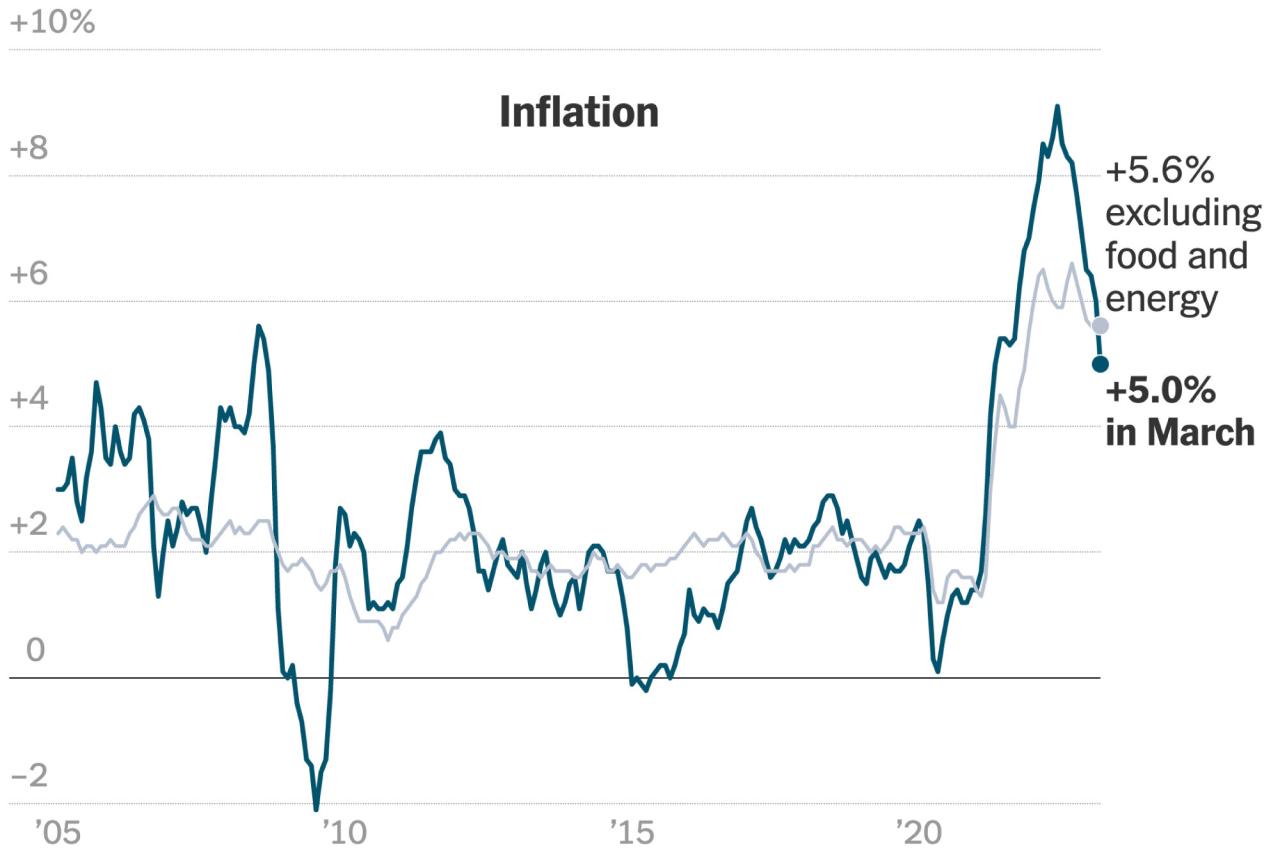

Historical Trends and Recent Developments

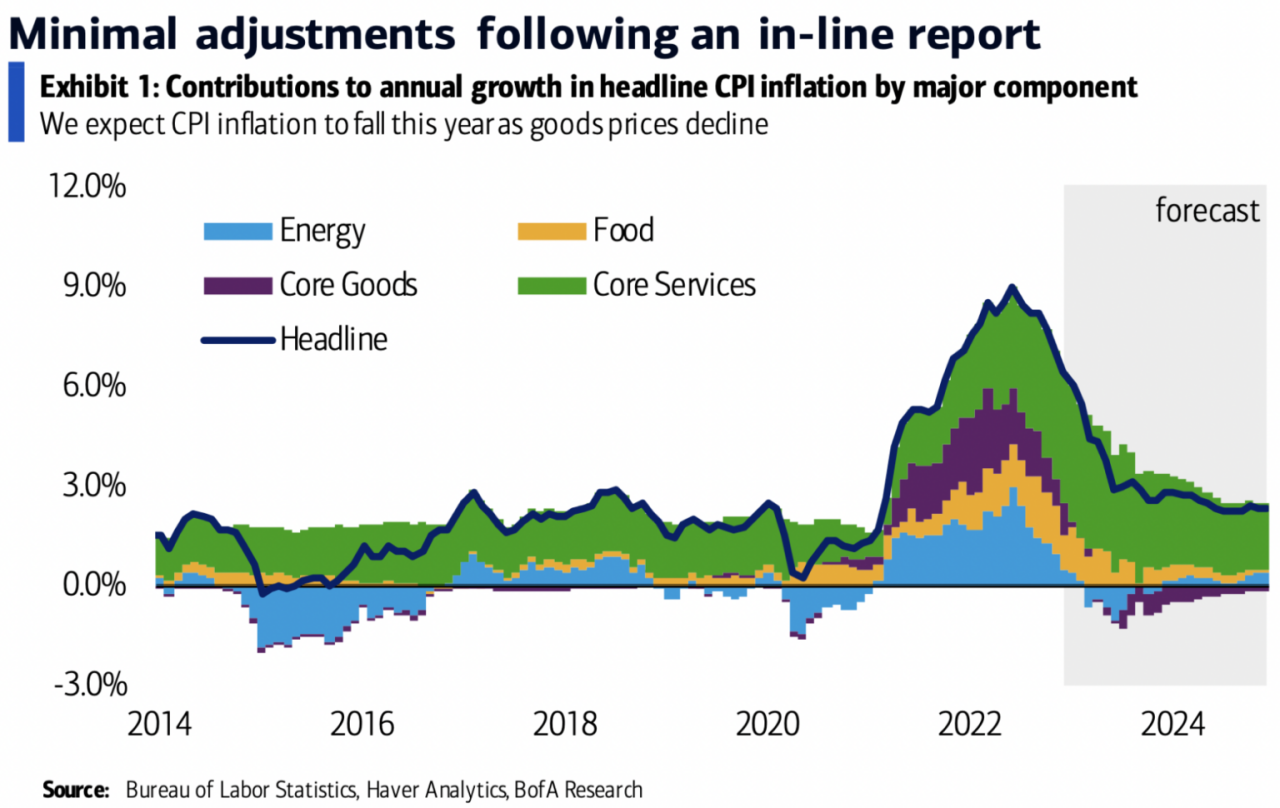

The CPI has experienced periods of both stability and volatility throughout history. In recent years, the CPI has shown a trend of gradual increases, driven by factors such as supply chain disruptions, rising energy prices, and global events like the COVID-19 pandemic.

The year 2023 witnessed a significant surge in inflation, with the CPI experiencing its highest annual increase in decades. This surge was largely attributed to supply chain bottlenecks, rising energy costs, and strong consumer demand.

Factors Influencing CPI Fluctuations

- Supply Chain Disruptions:Global supply chain disruptions, often triggered by events like natural disasters, geopolitical tensions, or pandemics, can lead to shortages of goods and services, pushing prices upward.

- Energy Prices:Fluctuations in energy prices, particularly oil and gas, have a significant impact on the CPI. Increases in energy prices often ripple through the economy, raising transportation costs and impacting the prices of other goods and services.

- Global Events:Global events, such as wars, political instability, and natural disasters, can create economic uncertainty and volatility, influencing inflation and the CPI.

Lifestyle Choices and Their Relationship with CPI

CPI changes directly impact various aspects of our daily lives, particularly our lifestyle choices. As inflation rises, the cost of goods and services increases, forcing individuals to adjust their spending habits and priorities.

You also can investigate more thoroughly about CPI and Education Expenses in November 2024 to enhance your awareness in the field of CPI and Education Expenses in November 2024.

Impact on Discretionary Spending

Rising inflation disproportionately affects discretionary spending, which encompasses non-essential goods and services such as travel, dining, and entertainment. As the purchasing power of the dollar diminishes, individuals may find themselves cutting back on these activities to manage their budgets. This can lead to a decline in consumer demand for non-essential goods and services, potentially impacting businesses in these sectors.

Affordability of Essential Goods and Services

The affordability of essential goods and services, such as housing, healthcare, and transportation, is significantly impacted by CPI changes. Individuals with lower incomes are often more vulnerable to inflation, as a larger portion of their income is dedicated to essential expenses.

Obtain direct knowledge about the efficiency of Which is a Better Measure of Inflation in November 2024: CPI or PCE? through case studies.

For example, rising housing costs can make it challenging for lower-income families to afford adequate housing, potentially leading to increased homelessness or overcrowding.

Strategies for Adjusting Lifestyle Choices in Response to CPI

In a high-inflation environment, it is crucial to adapt spending habits and make informed financial decisions to maintain financial stability. Several strategies can help individuals navigate the challenges of rising prices.

Adjusting Spending Habits, CPI and Lifestyle Choices in November 2024: Making Adjustments

- Prioritize Essential Expenses:Focus on essential expenses such as housing, food, healthcare, and transportation, while minimizing discretionary spending.

- Reduce Discretionary Spending:Explore ways to reduce spending on non-essential items, such as dining out, entertainment, and travel. Consider alternative activities like cooking at home, enjoying free events, or exploring local attractions.

- Shop Around for Deals:Compare prices across different retailers and take advantage of discounts, coupons, and promotions to save money on groceries, household goods, and other necessities.

Budgeting and Financial Planning

Creating a realistic budget and sticking to it is essential during periods of inflation. A budget can help track income and expenses, identify areas for savings, and ensure that essential needs are met. It is also important to prioritize saving and building an emergency fund to cushion against unexpected expenses.

Obtain access to The Role of Monetary Policy in Controlling Inflation in November 2024 to private resources that are additional.

Hypothetical Budget Plan

Here is a hypothetical budget plan demonstrating how to allocate resources effectively during periods of inflation:

| Category | Percentage of Income |

|---|---|

| Housing | 30% |

| Food | 15% |

| Transportation | 10% |

| Healthcare | 5% |

| Savings | 15% |

| Debt Repayment | 10% |

| Discretionary Spending | 5% |

This budget plan prioritizes essential expenses, allocates a significant portion to savings and debt repayment, and allows for a small amount of discretionary spending. It is important to adjust this plan based on individual circumstances and financial goals.

Understand how the union of CPI and the Digital Economy in November 2024 can improve efficiency and productivity.

The Role of Technology in Managing Lifestyle Choices

Technology plays a crucial role in helping individuals manage their finances effectively in a high-inflation environment. Numerous apps and online platforms provide tools for budgeting, tracking expenses, and finding deals.

Budgeting and Expense Tracking Apps

Budgeting apps, such as Mint, Personal Capital, and YNAB (You Need a Budget), allow users to track income and expenses, create budgets, and set financial goals. These apps can help individuals identify areas where they can cut back on spending and make more informed financial decisions.

You also will receive the benefits of visiting Weighting and Aggregation in the November 2024 CPI Calculation today.

Deal-Finding Platforms

Online platforms like Groupon, LivingSocial, and RetailMeNot offer deals and discounts on various goods and services. These platforms can help consumers save money on everyday purchases, from groceries to entertainment.

Finish your research with information from Long-Term CPI Projections and Their Implications for November 2024.

Impact of Digitalization on Consumer Behavior

Digitalization has significantly impacted consumer behavior and shopping habits. Online shopping has become increasingly popular, offering convenience and access to a wider range of products. Consumers are also increasingly relying on online reviews and social media recommendations to make purchasing decisions.

Long-Term Implications of CPI and Lifestyle Choices

High inflation can have significant long-term implications for individual financial well-being and economic stability. Understanding these implications is crucial for making informed financial decisions and building financial resilience.

Impact on Financial Well-being

Persistent high inflation can erode the purchasing power of savings and investments, making it challenging to maintain a comfortable standard of living. It can also lead to increased debt levels, as individuals struggle to keep up with rising expenses.

Discover more by delving into November 2024 CPI: A Turning Point for Interest Rates? further.

Importance of Financial Literacy and Planning

Financial literacy and responsible financial planning are essential in navigating economic uncertainty. Individuals need to understand the basics of budgeting, saving, investing, and managing debt to make informed financial decisions and protect their financial well-being.

You also can understand valuable knowledge by exploring CPI as a Measure of Inflation in November 2024.

Building Financial Resilience

Building financial resilience involves taking proactive steps to prepare for future economic challenges. This includes diversifying income sources, building an emergency fund, and investing wisely to protect and grow wealth. It also entails being adaptable and willing to adjust spending habits and financial plans as needed.

Final Review: CPI And Lifestyle Choices In November 2024: Making Adjustments

Navigating the complexities of CPI and its impact on lifestyle choices requires a proactive approach. By understanding the forces driving inflation, adapting our spending habits, and leveraging technology for financial management, we can navigate the challenges of a high-inflation environment.

Check Supply-Side Shocks and Inflation in November 2024 to inspect complete evaluations and testimonials from users.

Embracing financial literacy and responsible planning is crucial for building long-term financial stability and ensuring our well-being in the face of economic uncertainty. This article has provided a framework for making informed decisions and adjusting our lifestyles to thrive in the current economic climate.

FAQ Insights

What are some examples of essential goods and services whose prices are significantly affected by CPI?

Essential goods and services like housing, healthcare, transportation, and food are particularly affected by CPI changes. As inflation rises, the cost of these necessities increases, putting pressure on household budgets.

How can technology help me manage my finances more effectively during periods of inflation?

Numerous mobile apps and online platforms can assist with budgeting, tracking expenses, finding deals, and even investing. These tools empower consumers to make informed financial decisions and stay on top of their finances.