CPI and Housing Affordability in November 2024 takes center stage, offering a snapshot of the delicate balance between inflation and the ability to own a home. As the Consumer Price Index (CPI) reflects the cost of living, it plays a crucial role in understanding the pressures on housing affordability, particularly in light of rising interest rates and the ever-changing economic landscape.

Obtain access to How to Use November 2024 CPI Data for Personal Finance Decisions to private resources that are additional.

This analysis delves into the intricacies of the CPI, its components, and its impact on housing affordability. We explore the current state of housing affordability in the United States, examining key indicators like median home prices, mortgage rates, and household income.

Find out further about the benefits of How the November 2024 CPI Affects Your Daily Life that can provide significant benefits.

By dissecting the factors that influence housing affordability, including economic conditions, government policies, and demographic trends, we aim to shed light on the challenges and potential implications for both consumers and the broader economy.

Consumer Price Index and Housing Affordability in November 2024: CPI And Housing Affordability In November 2024

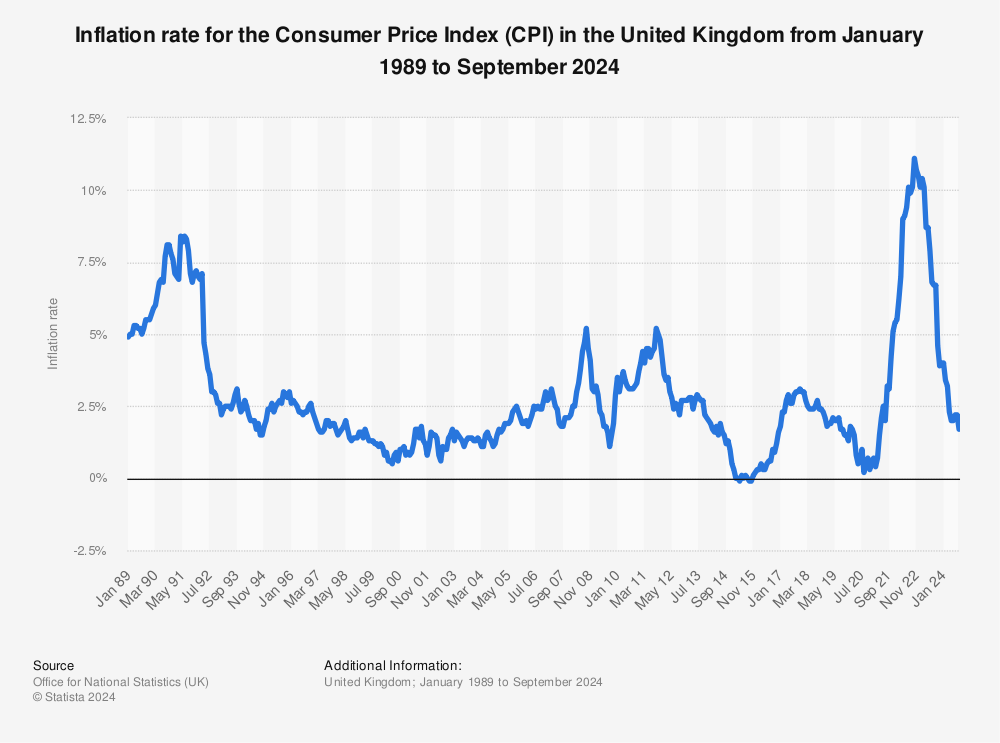

The Consumer Price Index (CPI) is a crucial economic indicator that tracks changes in the prices of goods and services consumed by households. It plays a significant role in gauging inflation, which can have a substantial impact on housing affordability.

This article will delve into the CPI and its relationship with housing affordability, focusing specifically on the situation in November 2024.

CPI Overview

The CPI is a weighted average of prices for a basket of consumer goods and services, representing a typical urban consumer’s spending pattern. It provides a measure of the overall inflation rate, indicating how much prices have changed over time.

Do not overlook the opportunity to discover more about the subject of The Impact of Technology on the November 2024 CPI.

A higher CPI signifies higher inflation, which can erode purchasing power and impact various aspects of the economy, including housing affordability.

Historical CPI Trends

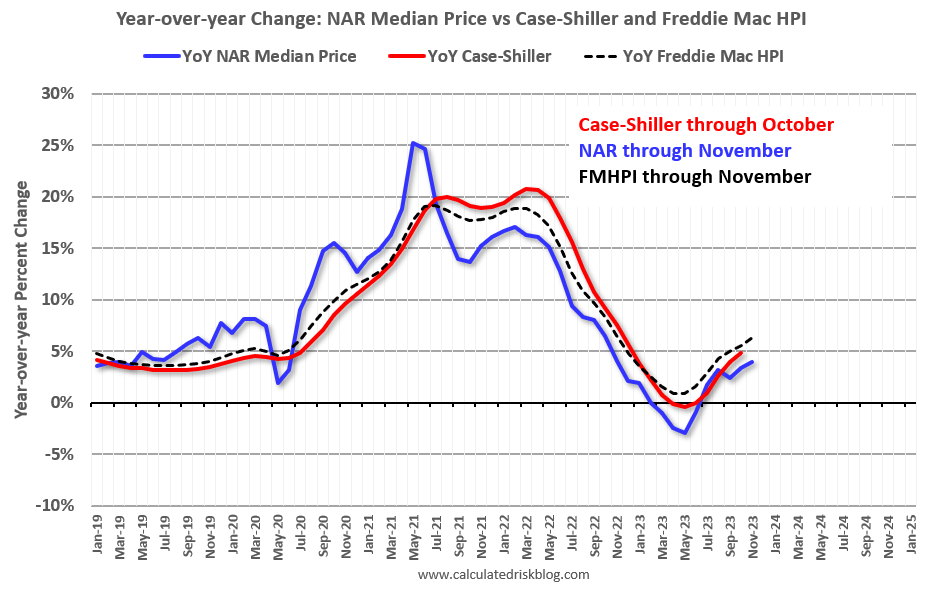

Over the past five years, the CPI in the United States has exhibited a mixed trend. Following a period of relatively low inflation, the CPI began to rise in 2022, primarily driven by supply chain disruptions and increased demand following the COVID-19 pandemic.

Finish your research with information from The Role of the CPI in Economic Policy in November 2024.

While inflation has shown signs of moderating in recent months, it remains elevated compared to historical averages.

Do not overlook the opportunity to discover more about the subject of Decoding the November 2024 CPI: Key Terms and Concepts.

Components of the CPI

The CPI is comprised of various components, each representing a different category of consumer spending. Housing is one of the most significant components of the CPI, accounting for a substantial portion of the overall index. This reflects the importance of housing costs in household budgets.

Housing Affordability

Housing affordability refers to the ability of households to purchase or rent housing without experiencing undue financial strain. Key indicators of housing affordability include median home prices, mortgage rates, and household income. When housing costs rise faster than incomes, affordability decreases, making it challenging for individuals and families to find suitable and affordable housing.

Find out about how CPI and the Global Economy in November 2024 can deliver the best answers for your issues.

Current State of Housing Affordability

The current state of housing affordability in the United States is characterized by high home prices and rising mortgage rates. While the pace of price increases has slowed in recent months, home prices remain significantly higher than they were a few years ago.

Further details about CPI vs. Other Inflation Measures: A November 2024 Comparison is accessible to provide you additional insights.

Additionally, the Federal Reserve’s efforts to combat inflation have led to higher interest rates, making mortgage payments more expensive.

CPI and Housing Affordability in November 2024

The CPI in November 2024 is expected to show a moderate increase, reflecting continued price pressures in various sectors. While the impact of inflation on housing affordability is complex, the rising CPI is likely to further strain housing affordability in November 2024.

The combination of higher home prices and mortgage rates is making it increasingly difficult for many households to enter or remain in the housing market.

When investigating detailed guidance, check out CPI November 2024: A Beginner’s Guide to Understanding Inflation now.

Factors Influencing Housing Affordability

Numerous factors influence housing affordability, including economic conditions, government policies, and demographic trends. Economic growth, employment levels, and interest rates all play a role in shaping housing affordability. Government policies, such as tax incentives for homeownership and regulations governing housing construction, can also have a significant impact.

Additionally, demographic factors, such as population growth and household formation, can influence demand for housing and, consequently, affordability.

Potential Implications

The CPI and housing affordability trends in November 2024 have the potential to impact the economy in various ways. Rising housing costs can reduce consumer spending, as households allocate a larger portion of their income to housing expenses. This can lead to slower economic growth.

Do not overlook explore the latest data about CPI and the Changing Consumer Landscape in November 2024.

Additionally, a decline in housing affordability can dampen activity in the housing market, impacting construction and related industries.

Final Wrap-Up

The interplay between the CPI and housing affordability in November 2024 paints a complex picture. While rising inflation and interest rates pose significant challenges, understanding the underlying factors and potential implications is crucial for navigating this dynamic landscape. By examining the data, analyzing trends, and exploring policy responses, we can gain valuable insights into the future of housing affordability and its impact on the economy.

FAQ Compilation

What are the major components of the CPI?

The CPI includes various components such as food, energy, housing, transportation, medical care, and recreation. Housing is typically the largest component, representing a significant portion of the overall index.

How does the Federal Reserve influence housing affordability?

The Federal Reserve’s monetary policy, including setting interest rates, directly impacts mortgage rates and thus, housing affordability. Higher interest rates make borrowing more expensive, reducing purchasing power for homes.

What are some potential policy responses to address housing affordability challenges?

Obtain a comprehensive document about the application of Common Misconceptions about the CPI in November 2024 that is effective.

Policy responses can include measures like increasing housing supply, providing tax incentives for homeownership, and expanding access to affordable housing programs.