CPI and Demographic Changes Leading to November 2024: Economic Implications is a crucial topic that examines the complex interplay between consumer price index fluctuations and evolving demographic trends. This analysis delves into the historical and projected impact of these factors on economic growth, consumer behavior, and social stability, providing a comprehensive understanding of their interconnectedness.

The paper investigates how shifts in population demographics, such as aging populations and urbanization, influence consumer spending patterns and ultimately affect the CPI. Furthermore, it explores the role of global supply chains, commodity prices, and government policies in shaping CPI fluctuations, highlighting the multifaceted nature of this economic indicator.

Do not overlook explore the latest data about CPI and Housing Affordability in November 2024.

The study also sheds light on the political and social implications of CPI changes, analyzing their potential impact on public opinion, social unrest, and economic inequality.

This analysis aims to provide valuable insights into the forces driving CPI changes in the lead-up to November 2024, offering a framework for understanding the potential economic implications of these trends. By examining the historical data, demographic projections, and economic indicators, the paper develops a model for forecasting CPI trends and provides a detailed analysis of the potential impact of key factors on the economy.

Understanding CPI and its Impact

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It is a widely used gauge of inflation, which represents a sustained increase in the general price level of goods and services in an economy.

The CPI plays a significant role in understanding the purchasing power of consumers, the health of the economy, and the effectiveness of monetary policy.

In this topic, you find that CPI and Social Inequality in November 2024 is very useful.

How CPI Changes Affect Economic Growth and Consumer Behavior

Changes in the CPI can have a substantial impact on economic growth and consumer behavior. When inflation is high, consumers tend to reduce their spending as the purchasing power of their money diminishes. This can lead to a decline in consumer demand, slowing down economic growth.

On the other hand, when inflation is low or even negative (deflation), consumers may be encouraged to spend more, leading to increased economic activity.

In this topic, you find that CPI and Consumer Confidence in November 2024 is very useful.

- High inflation can erode consumer confidence, leading to a decrease in spending and investment.

- Low inflation can boost consumer confidence and encourage spending, driving economic growth.

- Inflation can also affect interest rates, as lenders demand higher returns to compensate for the erosion of their purchasing power.

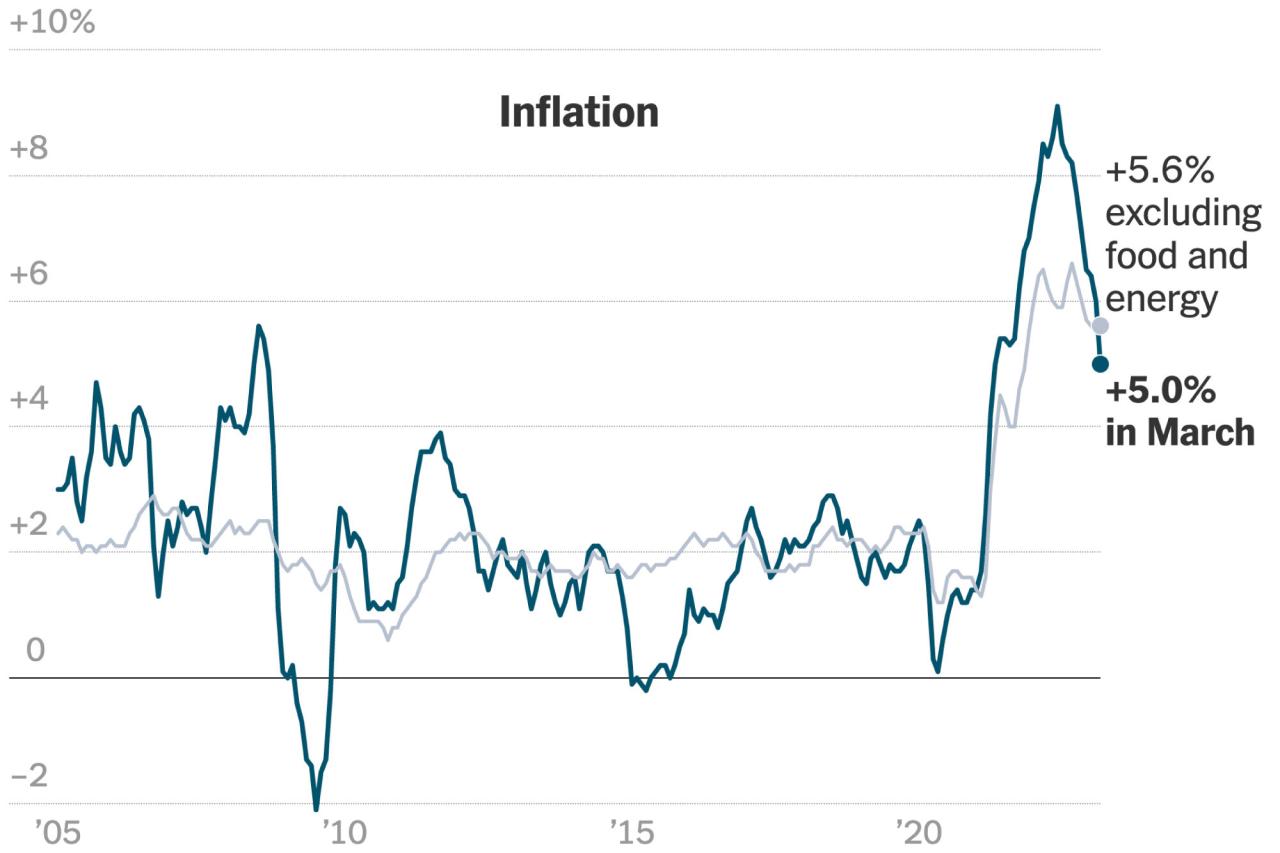

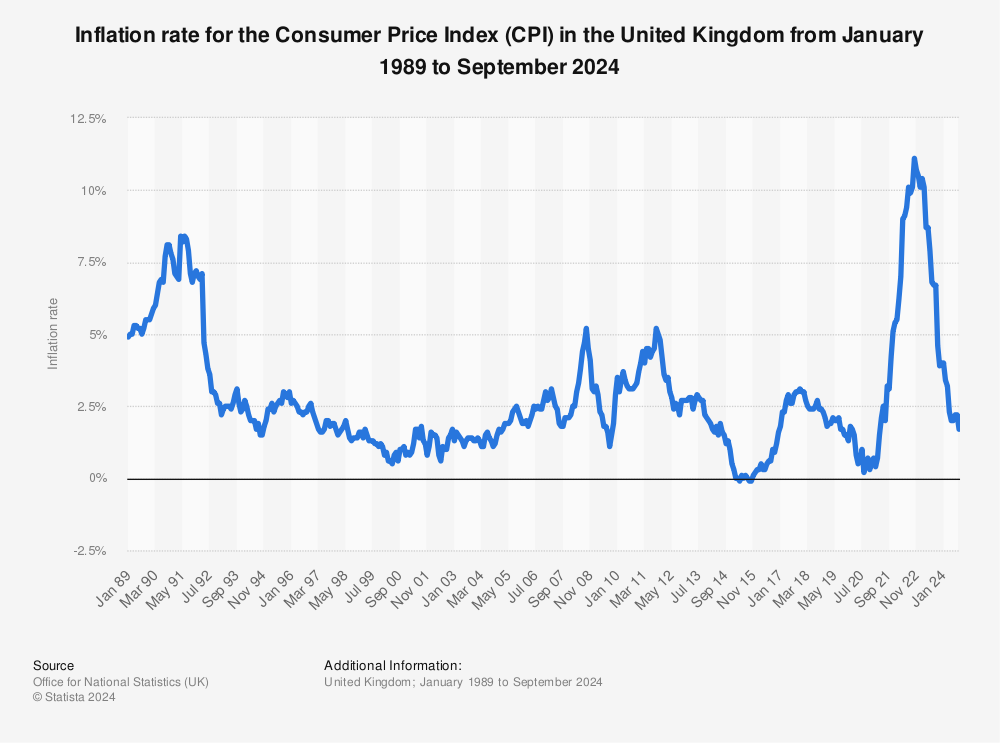

Historical Trends in CPI Data and their Correlation with Demographic Shifts

Historical data on CPI trends reveal a complex interplay between economic factors and demographic changes. For instance, periods of rapid population growth often coincide with higher inflation rates, as increased demand for goods and services puts upward pressure on prices.

Conversely, periods of demographic decline or stagnation may be associated with lower inflation, as reduced demand dampens price pressures.

In this topic, you find that Weighting Differences Between CPI and PCE in November 2024 is very useful.

Analyzing historical CPI data in conjunction with demographic trends can provide valuable insights into the underlying drivers of inflation and its potential impact on future economic growth.

Demographic Changes and their Influence on CPI

Demographic changes, such as aging populations, changing family structures, and urbanization, can significantly influence consumer spending patterns and, consequently, the CPI. Understanding these trends is crucial for forecasting future inflation and its impact on the economy.

Impact of Aging Populations, Changing Family Structures, and Urbanization on Consumer Spending

- Aging Populations:As populations age, consumer spending patterns shift towards healthcare, retirement services, and leisure activities. This can lead to increased demand for specific goods and services, potentially impacting the CPI.

- Changing Family Structures:The rise of single-person households and dual-income families has altered spending patterns, impacting demand for housing, transportation, and consumer durables. This can influence the CPI by shifting the relative importance of different goods and services in the basket.

- Urbanization:As more people move to urban areas, demand for housing, transportation, and entertainment services increases. This can contribute to higher inflation rates in urban areas compared to rural regions.

Comparison of the Impact of Demographic Trends on Different Sectors of the Economy

The impact of demographic trends on CPI can vary across different sectors of the economy. For example, the aging population may lead to increased demand for healthcare services, while urbanization may boost demand for housing and transportation services. Analyzing these sectoral impacts is essential for understanding the overall influence of demographic changes on the CPI.

Economic Factors Driving CPI Fluctuations

Economic factors, such as global supply chains, commodity prices, government policies, and interest rate changes, play a significant role in driving CPI fluctuations. Understanding these factors is crucial for predicting future inflation trends and their impact on the economy.

Role of Global Supply Chains and Commodity Prices in CPI Fluctuations, CPI and Demographic Changes Leading to November 2024

Global supply chains and commodity prices can have a substantial impact on the CPI. Disruptions to global supply chains, such as those caused by natural disasters, political instability, or pandemics, can lead to shortages of goods and services, driving up prices.

Similarly, fluctuations in commodity prices, such as oil and food, can directly impact the CPI, as these commodities are essential inputs for many goods and services.

Impact of Government Policies on CPI

Government policies, such as interest rate changes and fiscal stimulus, can also influence CPI. For example, raising interest rates can slow down economic growth and reduce inflation, while fiscal stimulus measures, such as tax cuts or increased government spending, can boost demand and potentially lead to higher inflation.

Do not overlook explore the latest data about Step-by-Step Guide to CPI Calculation for November 2024.

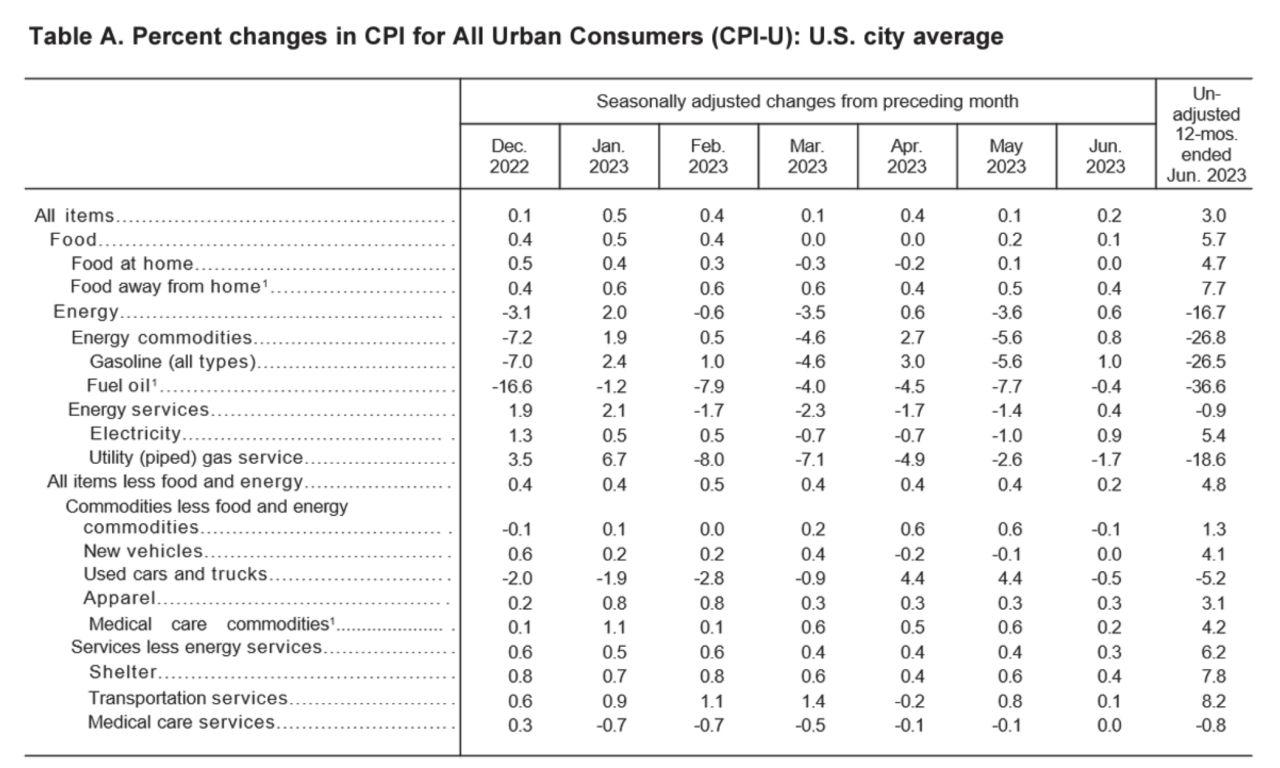

Table Summarizing Key Economic Indicators Influencing CPI

| Economic Indicator | Potential Impact on CPI |

|---|---|

| Interest Rates | Higher interest rates can reduce inflation by slowing down economic growth and reducing borrowing costs. |

| Exchange Rates | A weaker currency can lead to higher inflation as imported goods become more expensive. |

| Government Spending | Increased government spending can boost demand and potentially lead to higher inflation. |

| Oil Prices | Fluctuations in oil prices can directly impact the CPI, as oil is a key input for many goods and services. |

| Food Prices | Changes in food prices, influenced by factors such as weather and global demand, can significantly impact the CPI. |

Political and Social Implications of CPI Changes

Changes in the CPI can have significant political and social implications, influencing political discourse, public opinion, and social unrest. Understanding these implications is crucial for policymakers and citizens alike.

Do not overlook explore the latest data about The Relationship Between CPI and Inflation Expectations in November 2024.

Influence of CPI Changes on Political Discourse and Public Opinion

High inflation can be a major political issue, as it can erode consumer confidence and lead to dissatisfaction with the government’s economic policies. Political parties may use inflation as a campaign issue, highlighting the government’s perceived failures in controlling prices.

In this topic, you find that CPI and Education Expenses in November 2024 is very useful.

Conversely, low inflation can be seen as a sign of economic stability and may benefit the incumbent government.

Impact of Inflation on Social Unrest and Economic Inequality

High inflation can exacerbate social unrest and economic inequality. As prices rise, low-income households may struggle to afford basic necessities, leading to increased poverty and hardship. This can create social tensions and fuel political instability. Furthermore, inflation can benefit those with assets, such as property owners, while harming those with fixed incomes, such as retirees.

Influence of CPI Fluctuations on Consumer Confidence and Spending Habits

Fluctuations in the CPI can significantly impact consumer confidence and spending habits. High inflation can erode consumer confidence, leading to a decrease in spending and investment. Conversely, low inflation can boost consumer confidence and encourage spending, driving economic growth. Understanding how CPI changes affect consumer sentiment is crucial for businesses and policymakers alike.

Forecasting CPI Trends for November 2024: CPI And Demographic Changes Leading To November 2024

Forecasting CPI trends for November 2024 requires a comprehensive analysis of historical data, demographic projections, and economic indicators. By combining these elements, we can develop a model for predicting future inflation and its impact on the economy.

Model for Forecasting CPI Trends

A model for forecasting CPI trends could incorporate the following factors:

- Historical CPI data:Analyzing past trends in CPI can provide insights into the cyclical nature of inflation and its relationship with economic growth.

- Demographic projections:Understanding future demographic changes, such as aging populations, changing family structures, and urbanization, can help predict shifts in consumer spending patterns.

- Economic indicators:Tracking key economic indicators, such as interest rates, exchange rates, government spending, and commodity prices, can provide insights into potential drivers of inflation.

Table Summarizing Key Factors Driving CPI Changes in the Lead-up to November 2024

| Factor | Potential Impact on CPI |

|---|---|

| Aging Population | Increased demand for healthcare and retirement services could lead to higher inflation in these sectors. |

| Urbanization | Higher demand for housing, transportation, and entertainment services in urban areas could contribute to higher inflation. |

| Global Supply Chain Disruptions | Disruptions to global supply chains could lead to shortages and price increases for goods and services. |

| Commodity Price Fluctuations | Fluctuations in commodity prices, such as oil and food, can directly impact the CPI. |

| Government Policies | Monetary policy changes, such as interest rate adjustments, and fiscal policies, such as government spending, can influence inflation. |

Analysis of the Potential Impact of These Factors on CPI and its Implications for the Economy

The combination of these factors could potentially lead to a range of CPI outcomes in the lead-up to November 2024. For example, if global supply chains remain disrupted and commodity prices continue to rise, inflation could be higher than expected.

Conversely, if interest rates are raised aggressively and economic growth slows down, inflation could be lower than anticipated.

In this topic, you find that Inflation Targeting and the CPI in November 2024 is very useful.

Understanding the potential impact of these factors on CPI is crucial for businesses, investors, and policymakers, as it can inform decisions regarding pricing, investment strategies, and economic policies.

End of Discussion

In conclusion, CPI and Demographic Changes Leading to November 2024 present a dynamic and interconnected landscape that demands careful analysis and proactive strategies. Understanding the interplay between these factors is essential for navigating the complex economic challenges ahead. By recognizing the potential impact of demographic shifts, economic indicators, and political factors on CPI, policymakers, businesses, and individuals can make informed decisions to mitigate risks and capitalize on opportunities.

In this topic, you find that The Impact of Technology on the November 2024 CPI is very useful.

As we approach November 2024, the insights gleaned from this analysis will be instrumental in shaping economic policies, consumer behavior, and social stability, ultimately contributing to a more sustainable and equitable future.

Do not overlook explore the latest data about CPI and Healthcare Costs in November 2024.

FAQ Guide

What are the key demographic trends that could impact CPI?

Aging populations, changing family structures, and urbanization are significant demographic trends that can influence consumer spending patterns and thus impact CPI.

How can government policies affect CPI?

Government policies, such as interest rate changes and fiscal stimulus, can have a significant impact on CPI by influencing inflation, economic growth, and consumer confidence.

What are the potential social implications of inflation?

Inflation can lead to social unrest and economic inequality by eroding purchasing power, particularly for low-income households, and exacerbating existing disparities.