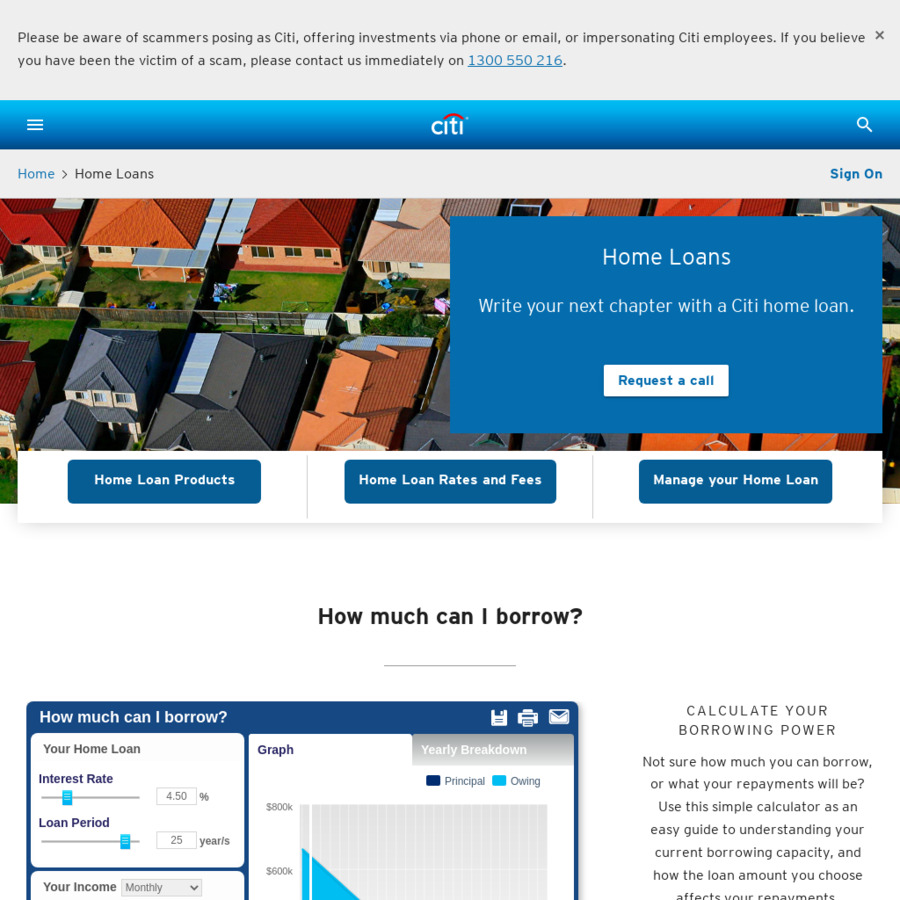

Citi Bank Home Loan 2024 offers a comprehensive suite of mortgage options designed to help you achieve your homeownership goals. Whether you’re a first-time buyer, looking to refinance, or seeking a loan tailored to your unique needs, Citibank provides a range of loan types, competitive rates, and flexible terms to fit your financial situation.

The convenience of applying for a home loan online is appealing to many. Consider exploring online home loan options for a streamlined process.

This guide delves into the intricacies of Citibank’s home loan offerings, exploring their eligibility criteria, loan rates and fees, program features, and customer experience. We’ll also provide valuable tips and strategies to maximize your chances of securing a loan and navigating the homebuying process with confidence.

A home mortgage loan is a big commitment, but it can also be a great way to build equity. If you’re considering this route, check out the latest home mortgage loan options available in 2024.

Last Recap

Securing a home loan can be a complex journey, but with Citibank’s comprehensive offerings and commitment to customer satisfaction, you can navigate the process with ease. By understanding the different loan options, eligibility requirements, and key factors influencing interest rates, you can make informed decisions and find the mortgage that best aligns with your financial goals and aspirations.

Getting pre-approved for a mortgage can give you a better idea of how much you can borrow. Check out Rocket Mortgage’s pre-approval process to see if it’s right for you.

Clarifying Questions: Citi Bank Home Loan 2024

What is the minimum credit score required for a Citibank home loan?

US Bank is another major lender offering home mortgages. If you’re considering them, it’s helpful to understand their home mortgage offerings for 2024.

While specific credit score requirements may vary, a credit score of at least 620 is generally considered favorable for obtaining a competitive interest rate.

A fixed interest rate can provide stability and predictability for your mortgage payments. Take a look at fixed interest rates for 2024 to see if this is the right choice for you.

How do I calculate my debt-to-income ratio?

Mr. Cooper is a well-known mortgage lender, and they offer a variety of loan options. You can explore their services by checking out their mortgage offerings for 2024.

Your debt-to-income ratio (DTI) is calculated by dividing your monthly debt payments by your gross monthly income. A lower DTI typically improves your chances of loan approval.

If you’re looking to invest in real estate, you’ll want to compare investment home loan rates to find the best deal. These rates can fluctuate, so it’s important to stay informed.

What are the closing costs associated with a Citibank home loan?

Navy Federal offers a range of mortgage products, so it’s worth checking out their current mortgage rates if you’re a member. You might find a competitive option.

Closing costs can vary depending on factors such as the loan amount, property location, and lender fees. Citibank provides detailed information about closing costs during the loan application process.

Does Citibank offer any special programs for first-time homebuyers?

Yes, Citibank offers a variety of programs designed to assist first-time homebuyers, including down payment assistance options and educational resources.

Thinking about buying a home in 2024? You might want to explore applying for a home loan to get started. This can help you determine your budget and find the best options for your situation.

Chase is a well-known bank with a strong presence in home lending. They offer a range of options, so it’s worth checking out Chase Home Lending for your mortgage needs.

If you’re eligible for a VA loan, it’s important to stay informed about current VA mortgage rates to find the best deal.

Buying a home for the first time can be exciting but also overwhelming. You can make the process easier by researching best mortgages for first-time buyers in 2024.

Knowing how to calculate your mortgage payment can help you make informed decisions. You can find helpful tools and calculators online to help you with calculating mortgage payments in 2024.

30-year mortgages are a popular choice for many homeowners. It’s helpful to keep track of current 30-year mortgage rates to see how they’re changing.

A no down payment mortgage can be a great option for some buyers, but it’s important to understand the requirements. Learn more about no down payment mortgage options available in 2024.