Cheapest Mortgage Rates: Securing the best mortgage rate can significantly impact your homeownership journey, saving you thousands of dollars over the life of your loan. Navigating the complex world of mortgage rates can feel overwhelming, but understanding the key factors that influence rates and employing effective strategies can help you find the most affordable option.

Finding the Best Loan Companies can be overwhelming. Compare rates, terms, and customer reviews to find the best fit for your needs.

This guide delves into the intricacies of mortgage rates, providing a comprehensive overview of the factors that impact them, strategies for securing the lowest rates, and essential tips for navigating the mortgage application process.

An Unsecured Personal Loan can offer flexibility for various needs, from medical expenses to unexpected repairs, without requiring collateral.

Understanding Mortgage Rates

A mortgage rate is the interest rate you pay on your mortgage loan. It’s a crucial factor in determining your monthly mortgage payments and the overall cost of your home purchase. Understanding mortgage rates is essential for making informed financial decisions.

When you need money quickly, Fast Cash Loans can provide a fast and convenient solution, though it’s important to be aware of the potential higher interest rates.

Factors Influencing Mortgage Rates

Several factors influence mortgage rates, including:

- The Federal Reserve’s monetary policy:The Federal Reserve sets interest rates that influence the overall cost of borrowing money, including mortgage rates.

- Inflation:When inflation rises, lenders tend to increase interest rates to compensate for the decreasing value of money.

- Economic conditions:The overall health of the economy can impact mortgage rates. When the economy is strong, rates may be lower, and vice versa.

- Demand for mortgages:If there’s a high demand for mortgages, rates may rise as lenders compete for borrowers.

Fixed vs. Adjustable-Rate Mortgages

Mortgages come in two primary types: fixed-rate and adjustable-rate mortgages.

Ready to apply for a personal loan? Apply For Personal Loan online for a quick and convenient process.

- Fixed-rate mortgages (FRMs):The interest rate remains constant throughout the loan term, providing predictable monthly payments.

- Adjustable-rate mortgages (ARMs):The interest rate fluctuates based on a benchmark index, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). This can lead to unpredictable monthly payments.

Components of a Mortgage Rate

A mortgage rate consists of several components:

- Base rate:This is the starting point for the mortgage rate, determined by market conditions and lender policies.

- Margin:This is the lender’s profit margin, added to the base rate.

- Loan origination fees:These are charges for processing and administering the mortgage loan.

- Discount points:These are optional fees paid upfront to lower the interest rate.

Finding the Cheapest Mortgage Rates

Securing the lowest possible mortgage rate is a key goal for most homebuyers. Here are some strategies to find the best deals:

Shop Around for Lenders

Don’t settle for the first mortgage offer you receive. Contact multiple lenders, including banks, credit unions, and online mortgage providers, to compare rates and terms.

The government offers programs like Studentaid Gov Debt Relief to help alleviate the burden of student loan debt.

Use a Mortgage Broker, Cheapest Mortgage Rates

A mortgage broker acts as an intermediary, connecting you with various lenders and helping you navigate the mortgage process. Brokers can access a wider range of loan options and may be able to negotiate better rates on your behalf.

Traditional Bank Loans can be a reliable option for larger purchases or projects, offering competitive rates and personalized terms.

Improve Your Credit Score

Lenders typically offer lower interest rates to borrowers with good credit scores. Before applying for a mortgage, take steps to improve your credit score, such as paying bills on time, reducing credit card balances, and avoiding new credit applications.

Active military personnel and veterans have access to special loan programs, including Military Loans , offering competitive rates and flexible terms.

Negotiate with Lenders

Once you’ve received mortgage quotes, don’t be afraid to negotiate with lenders. Highlight your strong financial position and ask for a lower rate or better terms.

Need a new car? Car finance options can help you secure the vehicle you need without breaking the bank.

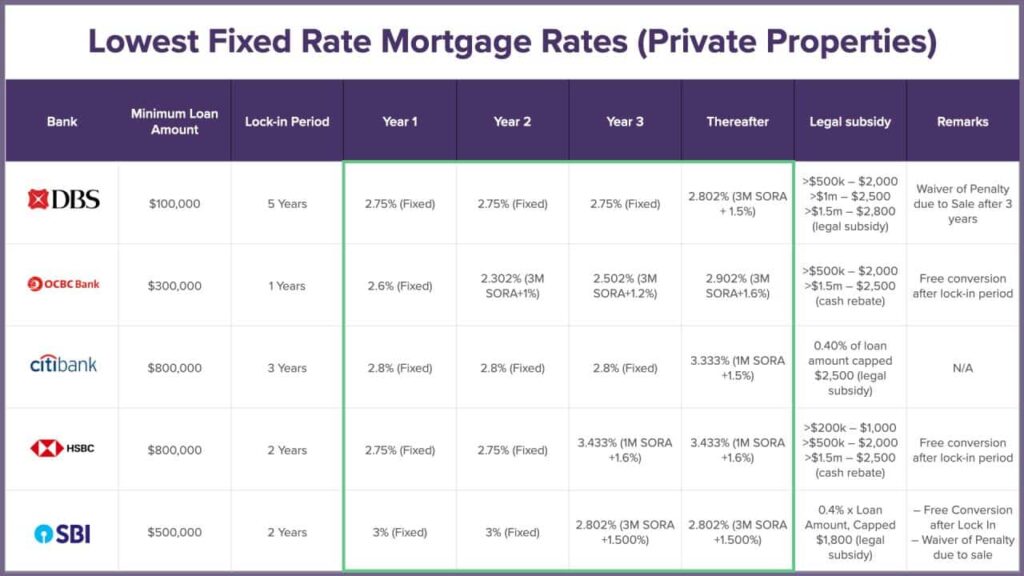

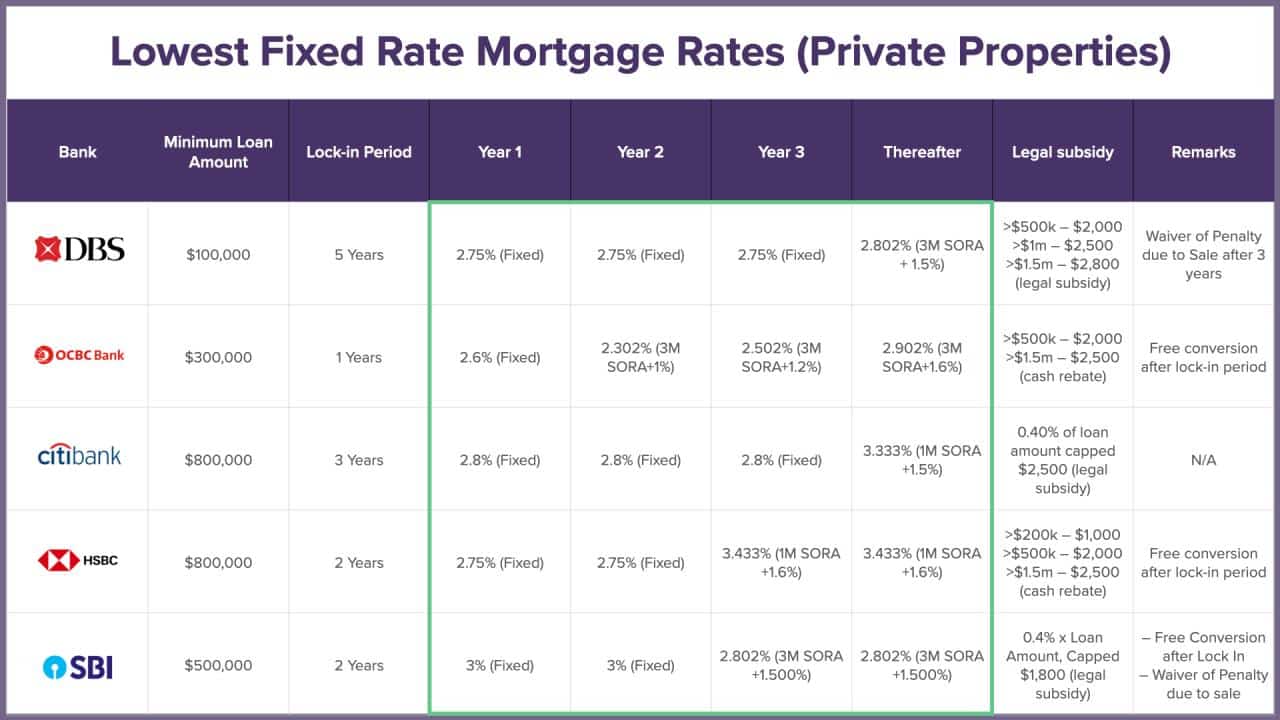

Consider a Fixed-Rate Mortgage

While ARMs may offer lower initial interest rates, fixed-rate mortgages provide greater stability and predictability. If you prefer a consistent monthly payment, a fixed-rate mortgage is a good option.

Factors Affecting Mortgage Rates

Your individual financial circumstances significantly impact your mortgage rate. Here are some key factors lenders consider:

Credit Score

Your credit score is a crucial factor in determining your mortgage rate. Borrowers with higher credit scores typically qualify for lower interest rates. A credit score of 740 or above is generally considered excellent and can lead to the most favorable rates.

Looking for a convenient way to borrow money? Online Loans offer a streamlined application process and quick approval times.

Debt-to-Income Ratio (DTI)

Your DTI is calculated by dividing your monthly debt payments (including your mortgage) by your gross monthly income. Lenders prefer a DTI of 43% or lower. A higher DTI may result in a higher interest rate or even a loan denial.

A Fixed Rate Heloc can offer peace of mind by providing a predictable interest rate, protecting you from fluctuations in the market.

Loan Terms

The term of your mortgage, typically 15 or 30 years, also affects the interest rate. Longer loan terms generally have lower interest rates but result in higher overall interest payments.

If you’re looking to tap into your home equity, a Best Heloc can provide you with the funds you need for home improvements, debt consolidation, or other expenses.

Down Payment

The amount of your down payment can influence your mortgage rate. A larger down payment typically leads to a lower interest rate, as it reduces the lender’s risk.

Keeping an eye on interest rates today is crucial for making smart financial decisions, especially when considering loans or investments.

Strategies for Lowering Mortgage Rates

While you can’t always control external factors like the overall market interest rate, you can take steps to improve your financial profile and increase your chances of securing a lower mortgage rate.

Improve Your Credit Score

Here are some strategies to improve your credit score:

- Pay bills on time:Late payments can significantly damage your credit score. Set up reminders or use automatic payments to ensure timely payments.

- Reduce credit card balances:High credit card balances can negatively impact your credit utilization ratio, which is a factor in your credit score. Aim to keep your credit utilization ratio below 30%.

- Avoid opening new credit accounts:Each new credit application can slightly lower your credit score. Only apply for new credit when necessary.

Reduce Your Debt-to-Income Ratio

Here are some ways to reduce your DTI:

- Pay down high-interest debt:Prioritize paying off debts with high interest rates, such as credit cards or personal loans.

- Consolidate debt:Consider consolidating multiple debts into a single loan with a lower interest rate.

- Increase income:Explore ways to increase your income, such as taking on a side hustle or asking for a raise.

Increase Your Down Payment

Here are some strategies for increasing your down payment:

- Save diligently:Set a budget and commit to saving regularly for your down payment.

- Consider a down payment assistance program:Some government and non-profit organizations offer down payment assistance programs to eligible borrowers.

- Sell assets:If you have valuable assets, such as a car or jewelry, you may consider selling them to increase your down payment.

Final Summary: Cheapest Mortgage Rates

By understanding the factors that influence mortgage rates, employing effective strategies for lowering them, and carefully navigating the mortgage application process, you can secure a loan that aligns with your financial goals and paves the way for a successful homeownership experience.

Buying your first home is a significant milestone. First Time Home Buyer Loans are designed to make the process easier and more affordable.

Remember, securing the cheapest mortgage rate is not just about finding the lowest number, but also about choosing a loan that fits your individual needs and financial circumstances.

A Heloc can be a great way to access your home equity, allowing you to borrow against your home’s value for various needs.

FAQ Summary

What is a mortgage rate?

Looking to invest in your rural community? A Rural Development Loan can help you achieve your goals, whether it’s expanding your farm, starting a business, or improving your home.

A mortgage rate is the interest rate you pay on your home loan, expressed as a percentage of the loan amount. It determines how much interest you will accrue over the life of the loan.

How often do mortgage rates change?

Mortgage rates fluctuate daily based on various factors, including economic conditions, inflation, and Federal Reserve policy.

What is a good mortgage rate?

A “good” mortgage rate is relative to the current market conditions. Generally, a lower rate is better, but it’s essential to consider the overall loan terms and your financial situation.

How can I lock in a mortgage rate?

You can lock in a mortgage rate for a specific period to secure a fixed rate and avoid fluctuations. Locking in a rate typically involves paying a fee, and the length of the lock period varies.