Cheap travel insurance for Europe in October 2024 sets the stage for this exploration, guiding you through the world of affordable coverage options. Whether you’re planning a romantic getaway, a family adventure, or a solo backpacking trip, having the right travel insurance can provide peace of mind and protect your finances in case of unexpected events.

This guide delves into the essentials of travel insurance, including the different types of coverage available, factors that influence pricing, and tips for finding budget-friendly plans. We’ll also explore essential travel documents, safety precautions, and specific considerations for traveling to Europe in October.

By the end of this journey, you’ll be equipped with the knowledge and tools to secure affordable travel insurance and embark on your European adventure with confidence.

The Annuity 2000 Mortality Table is a standard table used by insurance companies to calculate annuity payments. Annuity 2000 Mortality Table 2024 This table takes into account factors such as age and gender to determine life expectancy and, in turn, the amount of annuity payments.

Travel Insurance Basics

Before you embark on your European adventure, securing travel insurance is a wise decision. It acts as a safety net, protecting you from unexpected events and financial burdens. Understanding the different types of coverage and choosing the right plan is crucial for peace of mind during your trip.

Types of Travel Insurance Coverage

Travel insurance policies come in various forms, each offering different levels of protection. Common types include:

- Comprehensive Travel Insurance:This provides the most extensive coverage, encompassing medical expenses, trip cancellation, baggage loss, and emergency evacuation. It’s suitable for travelers seeking comprehensive protection.

- Single Trip Insurance:Designed for specific trips, this type covers medical expenses, trip cancellation, and baggage loss, offering essential protection for a single journey.

- Annual Multi-Trip Insurance:Ideal for frequent travelers, this policy provides coverage for multiple trips within a year, offering cost-effectiveness for frequent European excursions.

Essential Coverage Elements

A comprehensive travel insurance policy typically includes essential coverage elements:

- Medical Expenses:Covers medical costs incurred due to illness or injury during your trip, including hospitalization, doctor’s fees, and medication.

- Trip Cancellation:Reimburses you for non-refundable trip expenses if you need to cancel your journey due to covered reasons, such as illness, injury, or unforeseen circumstances.

- Baggage Loss or Damage:Provides compensation for lost or damaged baggage during your travels, ensuring you’re not left stranded without essential belongings.

- Emergency Evacuation:Covers the cost of medical evacuation if you require urgent medical attention and need to be transported back to your home country.

- Personal Liability:Protects you against legal claims arising from accidents or injuries caused to others during your trip.

Determining the Right Level of Coverage

The level of coverage you need depends on your individual travel needs, budget, and risk tolerance. Consider these factors:

- Age and Health:If you’re older or have pre-existing medical conditions, you may need more comprehensive coverage.

- Destination and Activities:High-risk activities like skiing or adventure sports require specialized insurance.

- Trip Duration:Longer trips generally require more coverage.

- Budget:Compare different policies and choose one that fits your budget without compromising essential coverage.

Factors Affecting Travel Insurance Costs

The cost of travel insurance is influenced by several factors, which insurers consider when determining premiums.

If you’re looking for a quick and easy way to supplement your income, a 500k immediate annuity might be a good option for you. 500k Immediate Annuity These annuities provide a guaranteed stream of income payments for a set period of time, making them a reliable source of financial security.

Age and Health

Older travelers generally pay higher premiums due to increased risk of health issues. Pre-existing medical conditions can also significantly impact insurance costs, as insurers assess the potential for claims related to these conditions.

Variable annuities are a type of annuity that allows you to invest your premium in a variety of sub-accounts, similar to a mutual fund. Variable Annuity Overview 2024 This can provide the potential for higher returns, but it also comes with a higher level of investment risk.

Destination and Trip Duration

Travel to high-risk destinations, such as countries with unstable political situations or high crime rates, may result in higher premiums. Similarly, longer trips typically require more coverage and therefore cost more.

Immediate annuities provide a stream of income payments that begin immediately after you purchase the annuity. Immediate Annuity Payout Options These annuities can be a good option for people who need a guaranteed source of income right away.

Activities

Engaging in high-risk activities, such as skiing, scuba diving, or adventure sports, can significantly increase insurance costs. Insurers factor in the potential for injuries and medical expenses associated with these activities.

Pricing Strategies of Insurance Providers

Different travel insurance providers employ various pricing strategies. Some focus on offering budget-friendly plans with basic coverage, while others prioritize comprehensive protection at a higher cost. It’s essential to compare quotes from multiple providers to find the best value for your needs.

Finding Cheap Travel Insurance Options

Finding affordable travel insurance for your European trip in October 2024 doesn’t have to be a daunting task. Several reputable providers offer budget-friendly plans that cater to various travel needs.

Annuity funds are considered unrestricted funds in 2024, meaning they can be used for any purpose. Annuity Fund Is Unrestricted Fund 2024 This flexibility makes them a popular choice for retirement planning, as you can use the funds to cover a variety of expenses, such as healthcare, travel, or even unexpected emergencies.

Comparison of Travel Insurance Providers

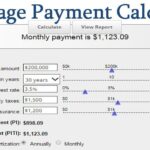

Here’s a table comparing key features, coverage limits, and prices of different insurance plans from reputable providers. Remember to consider your specific needs and budget when choosing a plan.

| Provider | Coverage Limits | Key Features | Price (Approximate) |

|---|---|---|---|

| World Nomads | $100,000 medical expenses, $1,000 baggage loss | Comprehensive coverage, 24/7 emergency assistance | $50

The taxability of annuity payments in India can vary depending on the type of annuity and the terms of the policy. Is Annuity Taxable In India 2024 It’s crucial to consult with a tax advisor to understand the tax implications of your annuity payments.

|

| SafetyWing | $50,000 medical expenses, $1,000 baggage loss | Budget-friendly option, global coverage | $35

The taxability of annuity payments from an LIC policy can vary depending on the specific terms of the policy. Is Annuity From Lic Taxable 2024 It’s important to consult with a financial advisor to determine how your annuity payments will be taxed.

|

| InsureMyTrip | Various coverage options, customizable plans | Wide range of plans, price comparison tool | $40

|

| Allianz Travel | $100,000 medical expenses, $1,500 baggage loss | Reputable provider, comprehensive coverage | $60

|

Tips for Saving on Travel Insurance

Securing affordable travel insurance doesn’t mean compromising on essential coverage. By employing smart strategies, you can find cost-effective plans without sacrificing peace of mind.

Compare Quotes

Obtain quotes from multiple travel insurance providers to compare prices, coverage limits, and policy terms. Online comparison websites can streamline this process.

Purchase Insurance Early

Purchasing travel insurance early, ideally when booking your trip, can often lead to lower premiums. Insurers typically offer discounts for early bookings.

If your annuity is out of surrender, it means that you can no longer withdraw the funds without incurring a penalty. My Annuity Is Out Of Surrender 2024 This is often the case after a certain period of time has passed, so it’s important to understand the terms of your annuity contract.

Consider Bundled Packages

Some travel insurance providers offer bundled packages that include coverage for medical expenses, trip cancellation, baggage loss, and other essential elements at a discounted rate.

Credit Card Travel Insurance

If you have a credit card that offers travel insurance, consider utilizing it for your trip. This can provide basic coverage, potentially saving you the cost of a separate insurance policy. However, it’s crucial to carefully review the terms and conditions of your credit card’s insurance coverage to ensure it meets your needs.

There are annuity calculators available that don’t require you to provide personal details. Annuity Calculator No Personal Details 2024 These calculators can help you estimate your potential annuity payments without sharing sensitive information.

Maximize the Value of Your Policy

To maximize the value of your travel insurance policy, ensure you understand its coverage limits, exclusions, and claim procedures. Keep all relevant documentation, such as receipts and medical records, in case you need to file a claim.

Variable annuities offer the potential for higher returns than fixed annuities, but they also come with a higher level of investment risk. Variable Annuity Investment Risk 2024 It’s important to carefully consider your risk tolerance before investing in a variable annuity.

Essential Travel Documents and Precautions

Before you set off on your European adventure, ensure you have the necessary travel documents and take essential precautions to ensure a safe and enjoyable trip.

Travel Document Checklist, Cheap travel insurance for Europe in October 2024

Gather these essential documents before you travel:

- Passport:Ensure your passport is valid for at least six months beyond your intended stay in Europe. Check visa requirements for specific countries.

- Visas:Some countries require visas for non-EU citizens. Apply for the necessary visas well in advance of your trip.

- Travel Insurance Policy:Carry a copy of your travel insurance policy and contact information for your insurer.

- Flight Itinerary:Keep a copy of your flight itinerary, including booking confirmation and boarding passes.

- Accommodation Reservations:Have confirmation of your hotel or other accommodation bookings.

- Health Records:Carry a copy of your medical records, including vaccination history and any pre-existing conditions.

- Emergency Contact Information:Keep a list of emergency contact numbers, including family, friends, and your embassy or consulate.

Obtaining Travel Documents

Contact your local passport office or embassy to apply for a passport or visa. Allow ample time for processing, as these documents can take several weeks to obtain.

An annuity 401k plan allows you to invest your retirement savings in an annuity contract. Annuity 401k Plan 2024 This can provide a guaranteed stream of income in retirement, which can be a valuable source of financial security.

Travel Safety Precautions

Follow these safety tips to ensure a secure trip:

- Health Precautions:Consult your doctor about necessary vaccinations and travel health advisories. Pack a small first-aid kit with essential medications.

- Security Measures:Be aware of your surroundings and avoid displaying valuables. Keep your passport and other important documents safe.

- Cultural Sensitivity:Respect local customs and traditions. Dress modestly when visiting religious sites or cultural attractions.

- Emergency Contacts:Keep emergency contact information readily available. Register your travel plans with your embassy or consulate.

October Travel Considerations for Europe

October is a fantastic time to visit Europe, offering pleasant weather and fewer crowds compared to peak summer season. Here’s a glimpse into October travel considerations for Europe.

Calculating annuity cash flows in Excel can be a useful way to model your annuity payments and project your future income. Calculating Annuity Cash Flows Excel 2024 Excel’s powerful formulas and functions can help you create accurate and detailed cash flow projections.

Weather Conditions

October weather in Europe varies across regions. While some areas may experience cooler temperatures and occasional rain, others enjoy mild and sunny days. It’s a good idea to check specific weather forecasts for your destinations.

Determining the required annuity amount over a 12-year period depends on your individual financial goals and needs. What Annuity Is Required Over 12 Years 2024 It’s best to consult with a financial advisor to determine the appropriate annuity amount for your situation.

Seasonal Events

October is a month of vibrant festivals and events in Europe. From Oktoberfest in Germany to Halloween celebrations across the continent, there’s something for everyone.

Popular Destinations and Activities

October offers a great opportunity to explore popular destinations without the summer crowds. Consider visiting:

- Paris:Stroll along the Seine, visit iconic landmarks, and enjoy the city’s vibrant atmosphere.

- Rome:Discover ancient ruins, explore charming neighborhoods, and savor delicious Italian cuisine.

- Barcelona:Admire Antoni Gaudí’s architectural masterpieces, relax on the beach, and enjoy the city’s vibrant nightlife.

- Amsterdam:Explore picturesque canals, visit world-class museums, and enjoy the city’s relaxed atmosphere.

Budget-Friendly Travel Tips

October is a great time to find budget-friendly deals on flights and accommodations. Consider these tips:

- Book Flights and Accommodation in Advance:Secure your travel arrangements early to take advantage of lower prices.

- Travel During the Off-Season:Visit destinations outside peak tourist season to enjoy lower prices and fewer crowds.

- Consider Alternative Accommodation:Explore options like hostels, apartments, or guesthouses to save on accommodation costs.

- Embrace Local Cuisine:Enjoy delicious and affordable meals at local restaurants and markets.

- Utilize Public Transportation:Explore destinations using efficient and cost-effective public transportation systems.

Summary

Navigating the world of travel insurance can feel overwhelming, but with a little research and planning, you can find affordable options that meet your specific needs. By understanding the different types of coverage, factors affecting pricing, and tips for saving, you can ensure a smooth and worry-free trip.

Annuity 3 is a type of annuity that provides a guaranteed stream of income payments for a specific period of time. Annuity 3 2024 These annuities can be a valuable tool for retirement planning, as they provide a predictable source of income that can help you cover your living expenses.

Remember to prioritize essential travel documents, safety precautions, and consider the unique aspects of traveling to Europe in October. With a little preparation, you can enjoy your European adventure knowing you’re protected and ready to embrace all that this incredible continent has to offer.

FAQ Summary: Cheap Travel Insurance For Europe In October 2024

What are the most common reasons people need to use travel insurance?

Common reasons include medical emergencies, flight delays or cancellations, lost or stolen luggage, and unexpected trip interruptions.

Calculating Powerball annuity payments can be a complex process, as it involves factoring in interest rates and inflation. Calculating Powerball Annuity Payments 2024 However, understanding how these payments are calculated can help you make informed decisions about your winnings.

Is travel insurance really necessary for a trip to Europe?

While not mandatory, travel insurance is highly recommended for trips to Europe, especially if you’re traveling outside your home country. It provides financial protection against unexpected events that could leave you with significant expenses.

What should I look for when comparing travel insurance plans?

Consider factors like coverage limits, deductibles, pre-existing conditions, and exclusions. Also, read reviews and compare quotes from reputable providers.