Cheap Mortgages 2024: Navigating the Market for Affordable Homeownership The dream of homeownership is within reach, even in a dynamic market with fluctuating interest rates. This guide provides insights into the current mortgage landscape, exploring strategies to secure affordable loan options in 2024.

Building your dream home? You’ll need a construction loan. Learn more about Home Construction Loans 2024 to get started.

From understanding the factors influencing interest rates to exploring innovative mortgage solutions, we’ll empower you to make informed decisions and navigate the homebuying process with confidence.

Not all borrowers fit the traditional mortgage mold. If you’re looking for a non-QM lender, see Non Qm Mortgage Lenders 2024 for more information.

This guide will delve into the intricacies of the mortgage market in 2024, analyzing the current interest rate environment and the factors that shape it. We’ll discuss the various mortgage types available, including fixed-rate, adjustable-rate, and government-backed loans, and provide a comprehensive list of lenders offering competitive rates and terms.

Wondering what credit score you need to buy a house? Check out Lowest Credit Score To Buy A House 2024 for the latest information.

Additionally, we’ll explore strategies for securing a lower interest rate, such as improving your credit score, increasing your down payment, and shopping around for lenders.

Working with a home loan broker can be a huge help during the mortgage process. See Home Loan Broker 2024 for more information on how a broker can help you.

Understanding the Current Mortgage Landscape in 2024: Cheap Mortgages 2024

Navigating the mortgage market in 2024 requires a keen understanding of the current landscape, including interest rate trends, influencing factors, and the diverse mortgage options available.

A chattel mortgage is a type of loan secured by personal property. Learn more at Chattel Mortgage 2024 if you’re interested in this type of loan.

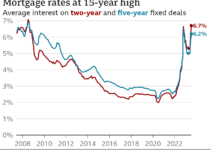

Interest Rate Trends and Fluctuations

Mortgage interest rates are expected to remain volatile in 2024, influenced by a complex interplay of economic indicators. The Federal Reserve’s monetary policy, inflation levels, and overall economic growth will play a significant role in shaping interest rate movements.

Want to tap into your home’s equity? Learn more about Fha Cash Out Refinance 2024 and see if it’s right for you.

Factors Influencing Mortgage Rates

- Inflation:High inflation often leads to higher interest rates as lenders seek to protect their returns against rising prices.

- Economic Growth:Strong economic growth can push interest rates upward as investors demand higher returns on their investments.

- Federal Reserve Policy:The Federal Reserve’s actions, such as raising or lowering interest rates, directly impact mortgage rates.

Mortgage Types: A Comparative Analysis

In 2024, borrowers have a range of mortgage options to choose from, each with its own advantages and drawbacks.

Looking to invest in commercial real estate? Check out Commercial Property Mortgage 2024 for information on commercial mortgages.

- Fixed-Rate Mortgages:Offer predictable monthly payments with a fixed interest rate for the entire loan term. These mortgages provide stability and security, especially in times of rising interest rates.

- Adjustable-Rate Mortgages (ARMs):Feature an initial fixed interest rate that adjusts periodically based on market conditions. ARMs can offer lower initial rates but carry the risk of higher payments if interest rates rise.

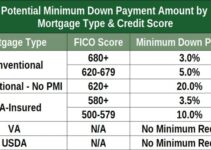

- Government-Backed Loans:Backed by federal agencies such as FHA, VA, or USDA, these loans often offer lower down payment requirements and more lenient credit standards, making homeownership more accessible.

Identifying Affordable Mortgage Options for 2024

Securing an affordable mortgage in 2024 requires a strategic approach, encompassing lender selection, rate negotiation, and exploring loan programs tailored to individual financial situations.

Getting a mortgage in 2024? It’s a good idea to check out Home Mortgage Rates 2024 to see what rates are currently available. You might be surprised at what you find!

Mortgage Lenders Offering Competitive Rates and Terms

Numerous mortgage lenders compete for borrowers’ business in 2024, offering a diverse range of rates and terms.

ARM mortgages can offer flexibility, but it’s important to understand how they work. See Arm Mortgage 2024 for more information.

- Online Lenders:Offer streamlined digital processes and potentially lower rates. Examples include Rocket Mortgage, LendingTree, and Better.com.

- Traditional Banks and Credit Unions:Provide personalized service and may offer competitive rates, particularly for existing customers.

- Mortgage Brokers:Act as intermediaries, connecting borrowers with multiple lenders and helping them find the best deals.

Strategies for Securing a Lower Interest Rate

- Improve Credit Score:A higher credit score translates into better loan terms and lower interest rates.

- Increase Down Payment:A larger down payment can reduce the loan amount and potentially lower interest rates.

- Shop Around for Lenders:Comparing offers from multiple lenders ensures you secure the most competitive rate.

Loan Programs for First-Time Homebuyers and Specific Financial Situations

Various loan programs cater to the unique needs of first-time homebuyers and borrowers with specific financial situations.

- FHA Loans:Offer lower down payment requirements and more lenient credit standards, making homeownership more accessible to first-time buyers and those with lower credit scores.

- VA Loans:Available to eligible veterans, active-duty military personnel, and surviving spouses, VA loans offer no down payment requirements and competitive interest rates.

- USDA Loans:Designed for rural homebuyers, USDA loans provide affordable financing options with low down payment requirements and interest rates.

Exploring Innovative Mortgage Solutions in 2024

The mortgage industry is continuously evolving, with emerging technologies and trends shaping the market in 2024. These innovations aim to streamline the mortgage process, provide personalized solutions, and enhance borrower experiences.

ARM mortgages can be a good option for some borrowers. Check out 5 1 Arm Rates Today 2024 to see current rates.

Emerging Mortgage Technologies and Trends

- Online Mortgage Applications:Digital platforms allow borrowers to apply for mortgages online, simplifying the process and providing faster approvals.

- Digital Closing Processes:E-signatures and electronic document management accelerate the closing process, making it more efficient and convenient.

- Personalized Loan Recommendations:AI-powered tools analyze borrower data to provide tailored mortgage recommendations, ensuring a more suitable and affordable loan.

The Role of Mortgage Brokers and Financial Advisors

Mortgage brokers and financial advisors play a crucial role in guiding borrowers through the complex mortgage landscape.

Reverse mortgages can be a valuable tool for seniors. To find a reverse mortgage company, visit Reverse Mortgage Companies 2024.

- Mortgage Brokers:Act as intermediaries, connecting borrowers with multiple lenders and helping them find the best deals.

- Financial Advisors:Provide comprehensive financial planning advice, including mortgage strategies, ensuring borrowers make informed decisions aligned with their financial goals.

Pros and Cons of Various Mortgage Solutions

| Mortgage Solution | Pros | Cons |

|---|---|---|

| Fixed-Rate Mortgages | Predictable monthly payments, stability during rising interest rates. | Potentially higher initial rates compared to ARMs. |

| Adjustable-Rate Mortgages (ARMs) | Lower initial rates, potential for lower payments if interest rates fall. | Risk of higher payments if interest rates rise, less predictable monthly payments. |

| Government-Backed Loans (FHA, VA, USDA) | Lower down payment requirements, more lenient credit standards, potentially lower interest rates. | May have additional fees or restrictions. |

Navigating the Homebuying Process in 2024

The homebuying process in 2024 involves a series of steps, each requiring careful planning and execution.

Before you start shopping for a mortgage, it’s a good idea to get prequalified. See Prequalify 2024 for more information on how to get prequalified.

Step-by-Step Guide to the Homebuying Process

- Pre-Approval:Obtain pre-approval from a lender to determine your buying power and strengthen your offer.

- Property Search:Explore available properties, considering factors like location, size, amenities, and neighborhood characteristics.

- Negotiation:Submit an offer and negotiate the purchase price and closing terms with the seller.

- Closing:Finalize the purchase, sign all necessary documents, and receive the keys to your new home.

Essential Tips for Budgeting, Saving, and Managing Finances, Cheap Mortgages 2024

- Create a Realistic Budget:Account for all expenses, including mortgage payments, property taxes, insurance, and maintenance costs.

- Save for a Down Payment:Aim for a substantial down payment to reduce the loan amount and potentially lower interest rates.

- Manage Debt:Pay down existing debts to improve your credit score and increase your borrowing power.

Factors to Consider When Choosing a Home

- Location:Consider proximity to work, schools, shopping, and other amenities.

- Size:Choose a home that meets your current and future needs, considering family size and lifestyle.

- Amenities:Evaluate features like bedrooms, bathrooms, kitchen appliances, and outdoor space.

- Neighborhood Characteristics:Research the neighborhood’s safety, schools, and community amenities.

Addressing Potential Challenges in Securing a Mortgage

While obtaining a mortgage can be a rewarding experience, borrowers may encounter challenges during the application process.

If you’re a veteran, you might qualify for a VA loan. To see current rates for VA loans, visit Current Va Mortgage Rates 2024 and explore your options.

Common Obstacles and Strategies for Overcoming Them

- Credit Issues:A low credit score can hinder loan approval. Consider improving your credit score by paying bills on time, reducing debt, and disputing any errors on your credit report.

- Insufficient Income:Lenders evaluate income to determine your ability to repay the loan. Consider increasing your income or demonstrating stable employment history.

- Debt-to-Income Ratio Concerns:A high debt-to-income ratio can impact loan approval. Reduce your debt load or increase your income to improve your ratio.

Managing Debt, Improving Credit Score, and Preparing for a Successful Mortgage Application

- Create a Debt Management Plan:Prioritize paying down high-interest debts to free up cash flow and improve your credit score.

- Monitor Your Credit Report:Regularly review your credit report for errors and take steps to correct them.

- Gather Necessary Documentation:Prepare all required documents, including pay stubs, tax returns, and bank statements, to expedite the application process.

Summary

Securing a cheap mortgage in 2024 requires a proactive approach and a thorough understanding of the market. By leveraging the information and strategies Artikeld in this guide, you can navigate the homebuying process effectively and achieve your dream of owning a home.

Remember, the key to success lies in careful planning, diligent research, and seeking expert advice when needed.

Essential Questionnaire

What are the current interest rates for mortgages in 2024?

Mortgage interest rates fluctuate daily based on economic factors. It’s best to check with lenders for the most up-to-date information.

How can I improve my credit score to qualify for a better mortgage rate?

Pay bills on time, reduce credit card debt, and avoid opening new credit accounts.

Getting approved for a mortgage can be a bit nerve-wracking. Learn more about the mortgage approval process at Mortgage Approval 2024.

What are some common obstacles borrowers might encounter when applying for a mortgage?

The mortgage market is always changing, so it’s important to stay informed. Check out New Mortgage Rates 2024 to see what’s happening in the market today.

Credit issues, insufficient income, high debt-to-income ratio, and lack of documentation are common obstacles.

What is a good debt-to-income ratio for a mortgage?

Lenders typically prefer a debt-to-income ratio below 43%.