Chase Trip Delay Insurance 2024 offers a lifeline for travelers facing unexpected disruptions to their travel plans. Whether it’s a delayed flight, a missed connection, or a baggage delay, this insurance can provide financial protection and peace of mind. Imagine yourself eagerly anticipating your dream vacation, only to be met with a sudden flight delay, leaving you stranded and uncertain about your next steps.

Chase Trip Delay Insurance steps in, offering a safety net to help you navigate these challenges and minimize the impact on your trip.

This insurance covers a range of travel disruptions, providing reimbursement for expenses like meals, accommodation, and transportation. It also offers assistance with rebooking flights and finding alternative travel arrangements. By understanding the coverage details, premium costs, and claims process, you can make an informed decision about whether Chase Trip Delay Insurance is right for you.

Chase Trip Delay Insurance Overview

Chase Trip Delay Insurance provides financial protection in case your travel plans are disrupted due to unforeseen circumstances. This insurance offers coverage for various trip delays, helping you manage unexpected expenses and inconveniences.

Covered Trip Delays

This insurance covers delays caused by a range of events, including:

- Weather-related delays:Severe weather conditions, such as storms, blizzards, or fog, can significantly disrupt travel plans. Chase Trip Delay Insurance covers delays resulting from such weather events.

- Mechanical issues:Unexpected mechanical problems with your mode of transportation, such as aircraft or train malfunctions, can lead to delays. This insurance provides coverage for delays caused by these issues.

- Unexpected events:Unforeseen events like strikes, natural disasters, or political unrest can also disrupt travel plans. Chase Trip Delay Insurance covers delays arising from such events.

Eligibility Criteria

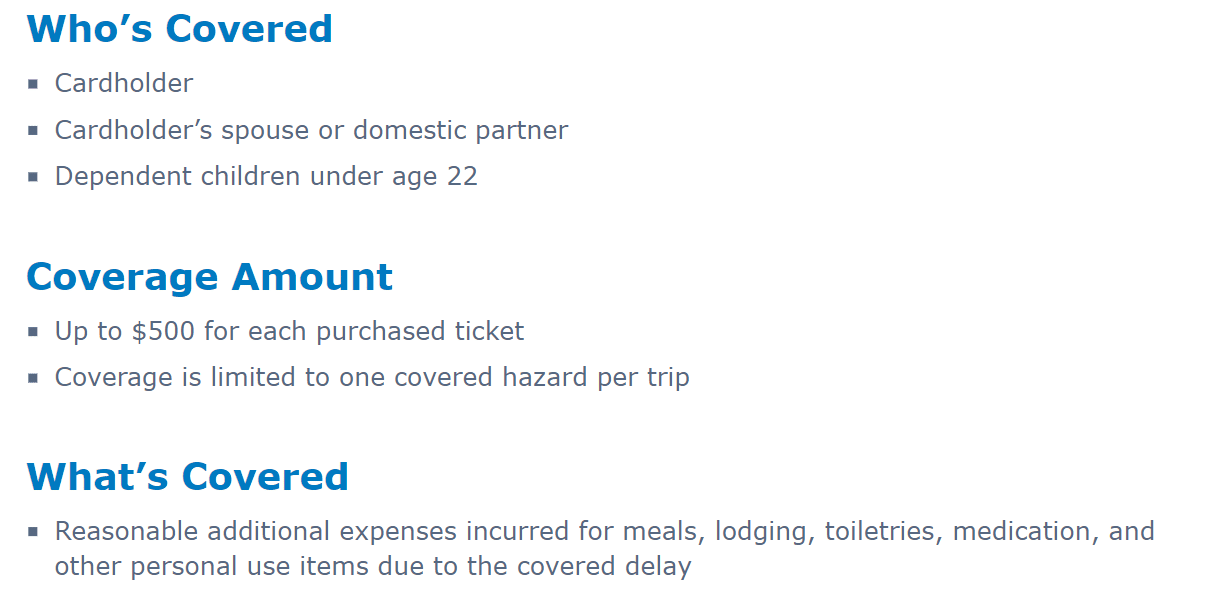

To be eligible for Chase Trip Delay Insurance, you must meet the following criteria:

- Purchase of a Chase travel product:The insurance is typically offered as an add-on to Chase travel products like credit cards or travel packages.

- Age requirements:There may be age restrictions for eligibility. Check the specific policy terms and conditions for details.

- Trip duration:The insurance may have a minimum or maximum trip duration requirement. Refer to the policy for specific details.

2. Coverage Details

Chase Trip Delay Insurance provides financial protection for unexpected travel disruptions. This insurance covers a range of travel inconveniences, offering reimbursement for expenses incurred due to delays or cancellations. However, certain situations are excluded from coverage.

Coverage Limits and Exclusions

This section Artikels the maximum reimbursement amounts for various travel disruptions and the specific situations that are not covered by the insurance.

Maximum Reimbursement Amounts

The following table summarizes the maximum reimbursement amounts for different types of travel disruptions:

| Type of Disruption | Maximum Reimbursement |

|---|---|

| Delayed Flights | $500 per person |

| Missed Connections | $500 per person |

| Baggage Delays | $500 per person |

Exclusions

Chase Trip Delay Insurance does not cover all travel disruptions. The following situations are specifically excluded from coverage:

- Delays caused by weather conditions, such as storms or fog.

- Delays caused by mechanical issues with the aircraft.

- Delays caused by security threats or government restrictions.

- Delays caused by strikes or labor disputes.

- Delays caused by personal reasons, such as missing a flight due to oversleeping.

Qualifying Situations

To be eligible for reimbursement under Chase Trip Delay Insurance, certain criteria must be met. The following scenarios qualify for coverage:

- Flight delays exceeding a specific time limit, typically 6 hours or more.

- Missed connections due to a previous flight delay.

- Baggage delays exceeding a specific time limit, typically 24 hours or more.

Maximum Reimbursement for Delayed Flights

Chase Trip Delay Insurance offers a maximum reimbursement of $500 per person for delayed flights. This reimbursement covers expenses such as meals, lodging, and transportation incurred due to the delay. The maximum reimbursement is capped at a specific number of days or hours of delay, which varies depending on the policy.

Premium and Cost Considerations

The cost of Chase Trip Delay Insurance is determined by several factors, including your trip’s duration, destination, and the level of coverage you choose. Understanding these factors will help you make an informed decision about whether this insurance is right for you and how much it will cost.

Factors Influencing Premium Rates

The premium for Chase Trip Delay Insurance is influenced by several factors.

- Trip Duration:Longer trips generally have higher premiums than shorter trips. This is because the risk of delays increases with the length of your trip.

- Destination:The destination of your trip can also impact the premium. Destinations with a higher risk of delays, such as those with unpredictable weather patterns or frequent flight disruptions, may have higher premiums.

- Coverage Level:The level of coverage you choose will also affect the premium. Higher levels of coverage, such as those that include coverage for lost luggage or medical expenses, will typically cost more.

- Age and Health:Your age and health can also play a role in the premium. For example, individuals with pre-existing medical conditions may face higher premiums.

- Travel History:Your travel history, including past claims, can also influence the premium. Individuals with a history of filing claims may face higher premiums.

Obtaining Quotes and Comparing Premiums

You can obtain quotes for Chase Trip Delay Insurance online or by calling Chase directly. When requesting a quote, be sure to provide accurate information about your trip, including your departure and arrival dates, destination, and the number of travelers.

You can compare premium rates from different insurance providers to find the best value for your needs. Be sure to compare coverage levels and benefits carefully before making a decision.

Example Premium Levels

The following table shows examples of premium levels for Chase Trip Delay Insurance, based on different trip durations and destinations:

| Trip Duration | Destination | Premium Level |

|---|---|---|

| 5 Days | New York City | $50

Looking for apartments in a specific area? Apartments For Rent 33186 2024: Your Guide to Finding the Perfect Place can help you find the perfect apartment in the 33186 zip code. From cozy studios to spacious multi-bedroom apartments, you’ll find a variety of options to choose from.

|

| 10 Days | Paris, France | $100

|

| 14 Days | Tokyo, Japan | $150

|

Note:These are just examples and actual premium levels may vary depending on the specific factors mentioned above.

Claims Process

Understanding the claims process is crucial for ensuring a smooth experience if you need to file a claim for trip delay insurance. It’s essential to be familiar with the steps involved, the required documentation, and the typical processing time.

Claim Filing Procedure

Filing a claim for trip delay insurance usually involves the following steps:

- Contact the insurance provider:As soon as you become aware of a covered delay, reach out to your insurance provider. This can typically be done through their website, phone, or email.

- Provide initial details:Be prepared to provide basic information about your trip, including your policy details, the nature of the delay, and the extent of the delay.

- Submit required documentation:Depending on the specific circumstances, you may need to provide supporting documentation, such as:

- Airline or transportation confirmation with details of the delay.

- Receipts for any additional expenses incurred due to the delay.

- Proof of identity and residency.

- Review and processing:The insurance provider will review your claim and the supporting documentation. This process can take several days or weeks depending on the complexity of the claim and the amount of information required.

- Claim approval or denial:Once the review is complete, you will be notified of the outcome. If approved, you will receive the benefits Artikeld in your policy. If denied, you will be provided with an explanation for the denial.

Claim Processing Time

The time it takes to process a trip delay insurance claim can vary depending on factors such as the complexity of the claim, the amount of documentation required, and the insurance provider’s workload. However, you can typically expect a response within a few weeks.

Claim Payment Procedures

If your claim is approved, the insurance provider will typically pay the benefits directly to you. The payment method may vary depending on the provider, but it is usually made through a check, direct deposit, or online transfer.

Comparison with Other Travel Insurance Options

Choosing the right travel insurance plan can be challenging, as numerous options exist with varying coverage and costs. Comparing Chase Trip Delay Insurance with other providers helps you make an informed decision.

Finding the right apartment can be a stressful process, but it doesn’t have to be. 3 Bedroom Apartments For Rent Near Me 2024: Finding Your Perfect Home can help you find your ideal 3-bedroom apartment in your area, taking the hassle out of your search.

Key Differences in Coverage

Understanding the specific coverage offered by different providers is crucial for choosing the right plan. While Chase Trip Delay Insurance focuses on trip delay protection, other providers offer broader coverage, including medical expenses, baggage loss, and cancellation.

- Medical Expenses:Many travel insurance plans include medical expenses coverage, covering medical emergencies while traveling. Chase Trip Delay Insurance typically does not include this benefit.

- Baggage Loss:Several providers offer baggage loss coverage, reimbursing you for lost or stolen luggage. Chase Trip Delay Insurance might not cover baggage loss.

- Trip Cancellation:Some plans cover trip cancellation due to unforeseen circumstances, such as illness or a natural disaster. While Chase Trip Delay Insurance focuses on delays, it might not cover cancellations.

Premium Costs and Considerations

Premium costs for travel insurance vary based on factors like destination, trip duration, age, and coverage level. While Chase Trip Delay Insurance may be relatively affordable due to its focused coverage, broader plans from other providers might have higher premiums.

Finding a comfortable and spacious apartment can be a challenge, especially in bustling cities like Brooklyn. If you’re looking for a 3-bedroom apartment, 3 Bedroom Apartments For Rent Brooklyn 2024: Your Guide to Finding the Perfect Home can help you navigate the process and find the ideal place to call home.

Claims Procedures

Claims procedures differ between providers. Understanding the process, including required documentation and timelines, is essential. While Chase Trip Delay Insurance has its own claims process, other providers may have varying procedures.

Planning for your retirement? An annuity can provide a steady stream of income during your golden years. Annuity Estimator 2024: Planning Your Retirement Income is a valuable tool that can help you estimate your potential annuity payments and make informed decisions about your financial future.

Comparison Table

The following table provides a comparison of key features and benefits of different travel insurance options:

| Provider | Trip Delay Coverage | Medical Expenses | Baggage Loss | Trip Cancellation | Premium Cost |

|---|---|---|---|---|---|

| Chase Trip Delay Insurance | Yes | No | No | No | Low |

| Travel Guard | Yes | Yes | Yes | Yes | High |

| World Nomads | Yes | Yes | Yes | Yes | Medium |

| Allianz Global Assistance | Yes | Yes | Yes | Yes | High |

6. Real-Life Examples

Chase Trip Delay Insurance can be a lifesaver in unexpected travel situations. Here are some real-life examples showcasing how the insurance helped travelers navigate challenging circumstances and minimize the impact on their journeys.

Family Vacation Delayed by Bad Weather

A family of four was excited to embark on their dream vacation to Europe. Their flight from New York to Paris was scheduled to depart on a sunny Friday morning. However, a sudden snowstorm hit the East Coast, causing widespread flight cancellations and delays.

Whether you’re searching for a cozy 2-bedroom apartment or a spacious 3-bedroom home, finding the perfect place can be a daunting task. 2 Bedroom Apartments For Rent Brooklyn 2024: Your Guide to Finding the Perfect Home can help you find the right apartment in Brooklyn, making your search a little easier.

Their flight was delayed for 24 hours, leaving the family stranded at the airport.

- The family was initially disappointed and frustrated about the delay, worried about missing out on precious vacation time.

- Fortunately, they had purchased Chase Trip Delay Insurance, which provided coverage for expenses incurred due to flight delays. The insurance covered the cost of meals, accommodation, and other incidental expenses incurred during the delay.

- The claims process was straightforward, and the insurance company promptly reimbursed the family for their expenses.

- Although the delay was inconvenient, the family was relieved that the insurance eased their financial burden and allowed them to focus on enjoying their trip. They were able to make the most of their vacation, exploring Paris and its surrounding areas.

Business Trip Disrupted by Mechanical Issues

A business executive was traveling to London for an important client meeting. His flight was cancelled due to a mechanical issue with the aircraft. The executive was worried about missing the meeting, which could have significant consequences for his business.

- The executive was initially stressed about the cancellation, fearing the impact on his business and the potential loss of revenue.

- Fortunately, he had Chase Trip Delay Insurance, which covered the cost of rebooking flights and accommodations.

- The insurance company helped him find an alternative flight and secure a hotel room in London. He was able to attend the meeting and salvage the business opportunity.

- The insurance company’s prompt assistance and coverage for travel expenses allowed the executive to minimize the disruption to his business trip and maintain his professional commitments.

Traveler Stranded in a Foreign Country

A solo traveler was stranded in Bangkok, Thailand, due to a delayed flight caused by a technical malfunction. The traveler was unfamiliar with the city and felt overwhelmed by the situation.

- The traveler was initially scared and worried about being stuck in a foreign country, unsure of how to navigate the situation.

- Chase Trip Delay Insurance provided emergency assistance, including access to a 24/7 hotline for support and guidance.

- The insurance company helped the traveler find safe accommodation and provided translation services to communicate with local authorities.

- The traveler felt reassured and safe knowing they had the support of the insurance company. The insurance company’s assistance eased the traveler’s anxiety and helped them feel more secure in an unfamiliar environment.

Traveler’s Unexpected Expenses Covered

A traveler’s flight from Chicago to Los Angeles was delayed for several hours due to bad weather. The delay resulted in unexpected expenses for meals, transportation, and overnight accommodation.

- The traveler was initially disappointed about the delay and worried about the added costs.

- Chase Trip Delay Insurance covered the traveler’s expenses, including $50 for meals, $20 for transportation, and $100 for overnight accommodation.

- The traveler submitted a claim with the insurance company, providing receipts for their expenses. The insurance company promptly reimbursed the traveler for the covered expenses.

- The traveler was satisfied with the insurance company’s efficient claims process and the reimbursement for their unexpected expenses. The insurance helped minimize the financial impact of the delay and made the traveler feel more secure during their trip.

Advantages and Disadvantages

Chase Trip Delay Insurance can provide peace of mind and financial protection in the event of unexpected travel disruptions. However, it’s crucial to carefully weigh the benefits and drawbacks before making a purchase decision.

Advantages of Purchasing Chase Trip Delay Insurance

- Financial Coverage for Unexpected Delays:Chase Trip Delay Insurance can reimburse you for expenses incurred due to covered travel delays, such as missed flights, hotel accommodations, and meals. This can help mitigate financial losses and reduce the stress associated with travel disruptions.

- Protection Against Unforeseen Circumstances:Travel delays can arise from various unforeseen events, including weather conditions, mechanical issues, and even political instability. Trip delay insurance offers coverage for these unpredictable circumstances, providing financial support when you need it most.

- Peace of Mind and Reduced Stress:Knowing that you have insurance coverage for travel delays can provide peace of mind and reduce stress during your trip. You can focus on enjoying your vacation without worrying about the financial impact of unexpected disruptions.

Disadvantages and Limitations of Chase Trip Delay Insurance, Chase Trip Delay Insurance 2024

- Limited Coverage:Chase Trip Delay Insurance may not cover all types of travel delays or expenses. It’s essential to review the policy details carefully to understand the specific coverage limitations and exclusions.

- Premium Costs:Purchasing trip delay insurance involves an additional cost. The premium amount may vary depending on factors such as the destination, duration of the trip, and the level of coverage you choose. It’s important to consider whether the cost is justifiable based on your individual travel needs and risk tolerance.

- Claim Process:Filing a claim for trip delay insurance can be a time-consuming and bureaucratic process. You may need to provide supporting documentation, such as flight confirmation, receipts, and medical records, to support your claim.

Travel Insurance vs. Self-Insurance

- Travel Insurance:Provides comprehensive coverage for various travel-related risks, including trip cancellation, medical emergencies, and lost luggage. It offers financial protection and peace of mind, but comes with a premium cost.

- Self-Insurance:Relies on personal savings and credit cards for travel expenses. It can be cost-effective but exposes you to significant financial risks in the event of unexpected travel disruptions.

Wrap-Up

In a world where travel plans can be unpredictable, Chase Trip Delay Insurance provides a valuable layer of protection. By understanding the coverage details, premium costs, and claims process, you can make an informed decision about whether this insurance is right for you.

With Chase Trip Delay Insurance, you can embark on your travels with greater confidence, knowing that you have a safety net in place to help you navigate unexpected disruptions and minimize their impact on your trip.

Expert Answers: Chase Trip Delay Insurance 2024

What types of travel disruptions are covered by Chase Trip Delay Insurance?

Chase Trip Delay Insurance typically covers disruptions like flight delays, missed connections, and baggage delays. Specific coverage details and exclusions can vary depending on the policy.

How much does Chase Trip Delay Insurance cost?

The cost of Chase Trip Delay Insurance varies depending on factors such as trip duration, destination, and coverage levels. You can obtain quotes and compare premium rates online or by contacting Chase directly.

What is the claims process for Chase Trip Delay Insurance?

To file a claim, you’ll need to provide supporting documentation, such as flight confirmation, receipts, and a detailed explanation of the disruption. Chase provides specific instructions on their website and through customer service.

Can I purchase Chase Trip Delay Insurance after I’ve already booked my trip?

Generally, you can purchase Chase Trip Delay Insurance after booking your trip, but there may be a time limit. It’s best to check with Chase for their specific policies.

What are the benefits of purchasing Chase Trip Delay Insurance?

Benefits include financial protection against unexpected travel disruptions, peace of mind, and assistance with rebooking flights and finding alternative travel arrangements.