Chase Car Loans offer a comprehensive range of financing options for new and used vehicles. Whether you’re seeking a low interest rate, flexible repayment terms, or convenient online tools, Chase provides a tailored approach to help you secure the car of your dreams.

Need to find a personal loan provider in your area? Personal Loans Near Me can help you locate local lenders offering personal loan options.

From understanding eligibility requirements to exploring loan terms and comparing rates, this guide delves into the essential aspects of Chase car loans. We’ll also cover the application process, payment options, and additional features that make Chase a popular choice for car financing.

Choosing the right mortgage company is a crucial step in the home buying process. Mortgage Companies offer a range of loan options and services, so it’s important to compare and choose the best fit for your needs.

Chase Car Loan Overview

Chase Bank is a leading financial institution offering a range of financial products, including car loans. Chase car loans are designed to help individuals finance the purchase of new or used vehicles. These loans are known for their competitive interest rates, flexible repayment options, and convenient application process.

Credit unions are often a good option for loans, as they tend to offer competitive rates and personalized service. Credit Union Loans can be a great alternative to traditional banks.

Types of Car Loans

Chase offers two main types of car loans:

- New Car Loans:These loans are specifically designed for financing the purchase of brand-new vehicles directly from a dealership.

- Used Car Loans:These loans are intended for financing the purchase of pre-owned vehicles from a dealership or private seller.

Eligibility Criteria

To be eligible for a Chase car loan, borrowers generally need to meet the following criteria:

- Credit Score:Chase typically requires a minimum credit score, which varies depending on the loan terms and borrower’s financial profile.

- Income:Borrowers need to demonstrate a stable income source to meet the loan’s monthly payments.

- Debt-to-Income Ratio (DTI):Chase evaluates the borrower’s DTI, which is the percentage of their monthly income allocated to debt payments. A lower DTI generally improves loan approval chances.

- Down Payment:Chase may require a down payment for car loans, especially for used vehicles. The down payment amount can influence the loan terms and interest rate.

Interest Rates and Loan Terms: Chase Car Loan

Chase car loan interest rates are influenced by several factors, including the borrower’s credit score, loan amount, loan term, and the type of vehicle being financed.

Securing the best possible home loan rate is essential. Best Home Loan Rates can vary depending on the lender, your credit score, and the current market conditions.

Interest Rates

Chase car loan interest rates typically range from around 2.49% to 18.99% APR (Annual Percentage Rate). The specific rate offered to a borrower depends on their individual creditworthiness and the loan terms.

Need to find a financial institution near you? Finance Companies Near Me can help you locate local lenders offering a variety of financial services.

Loan Terms

Chase car loans typically offer flexible repayment terms, allowing borrowers to choose a loan duration that aligns with their budget and financial goals. Common loan terms range from 24 months to 84 months.

Getting pre-approved for an auto loan can be a smart move. Auto Loan Pre Approval gives you a better idea of what you can afford and helps you negotiate a better price for your next vehicle.

- Loan Amounts:Chase car loans are available for a range of loan amounts, depending on the vehicle’s price and the borrower’s financial capacity.

- Repayment Periods:Borrowers can choose a repayment period that suits their budget, typically ranging from a few years to several years.

- Grace Periods:Chase may offer a grace period for the first payment, allowing borrowers some time to settle into their new car loan.

Application Process

Applying for a Chase car loan is a straightforward process that can be completed online or in person.

Keeping an eye on Freddie Mac Mortgage Rates can help you determine the best time to lock in a rate for your home loan.

Online Application

To apply online, borrowers can visit Chase’s website and complete a car loan application form. This process typically involves providing personal information, financial details, and information about the desired vehicle.

CashUSA is a popular platform that connects borrowers with lenders. Cashusa offers a variety of loan options, including personal loans, payday loans, and installment loans.

In-Person Application

Borrowers can also apply for a Chase car loan in person by visiting a local Chase branch. This option allows for face-to-face interaction with a Chase representative who can assist with the application process.

Wondering if you qualify for a personal loan? Personal Loan Eligibility depends on factors like your credit score, income, and debt-to-income ratio.

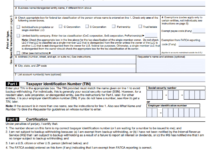

Required Documentation

When applying for a Chase car loan, borrowers will typically need to provide the following documentation:

- Proof of Identity:A valid driver’s license or passport.

- Social Security Number:To verify identity and credit history.

- Proof of Income:Recent pay stubs or tax returns.

- Proof of Residence:A utility bill or bank statement.

- Vehicle Information:Details about the vehicle being financed, including the year, make, model, and VIN (Vehicle Identification Number).

Tips for Loan Approval

- Improve Credit Score:A higher credit score can increase the chances of loan approval and secure a lower interest rate.

- Maintain a Low DTI:A lower DTI demonstrates financial responsibility and increases the likelihood of loan approval.

- Provide Accurate Information:Ensure all information provided in the application is accurate and complete to avoid delays or rejection.

- Shop Around:Compare loan offers from multiple lenders to find the most competitive terms and interest rates.

Loan Repayment and Payment Options

Chase car loans offer various convenient payment options to manage loan repayments efficiently.

If you’re looking to buy a used car, understanding Used Car Interest Rates is crucial. Rates can vary depending on the lender and your credit score, so it’s important to shop around.

Payment Options

- Online Payments:Borrowers can make payments online through Chase’s website or mobile banking app.

- Mobile Payments:Payments can be made through Chase’s mobile banking app, offering a convenient way to manage loan repayments on the go.

- Mail Payments:Payments can be mailed to the address provided on the loan statement.

- Automatic Payments:Borrowers can set up automatic payments from their Chase bank account to ensure timely repayments.

Late or Missed Payments

Late or missed payments can have several consequences, including:

- Late Fees:Chase may charge late fees for payments received after the due date.

- Negative Impact on Credit Score:Late payments can negatively affect the borrower’s credit score, making it harder to obtain future loans or credit.

- Potential Loan Default:If multiple payments are missed, Chase may consider the loan to be in default, leading to potential legal action.

Managing Loan Payments

- Set Reminders:Use calendar reminders or online tools to ensure timely payments.

- Budgeting:Create a budget that allocates funds for the monthly car loan payment.

- Automatic Payments:Consider setting up automatic payments to avoid missing deadlines.

- Contact Chase:If facing financial difficulties, contact Chase customer service to explore options for payment assistance.

Additional Features and Benefits

Chase car loans come with several additional features and benefits that enhance the borrowing experience.

Looking for a lender that specializes in helping people with less-than-perfect credit? Plain Green Loans is a non-profit organization that provides affordable loan options for those with limited credit history.

Loan Prepayment Options

Chase allows borrowers to prepay their car loan without any penalties. Prepayments can help reduce the total interest paid over the loan term and shorten the repayment period.

Looking to buy a home? Rocket Mortgage Com is a popular choice for online mortgage applications, known for its streamlined process and user-friendly platform.

Car Insurance Discounts, Chase Car Loan

Chase may offer car insurance discounts to borrowers who purchase their insurance through Chase partners. These discounts can help save money on car insurance premiums.

Online Resources

Chase provides several online resources to help borrowers manage their car loans effectively.

Need some extra cash? Personal Loan Bank offers various loan options to help you cover unexpected expenses or achieve your financial goals.

- Car Loan Calculators:These calculators allow borrowers to estimate their monthly payments and total loan cost based on different loan terms and interest rates.

- Online Account Access:Borrowers can access their loan account information online, including payment history, outstanding balance, and loan terms.

- Customer Service:Chase offers dedicated customer service representatives to answer questions and provide assistance with car loan-related inquiries.

Concluding Remarks

Securing a car loan can be a significant financial decision. By understanding the ins and outs of Chase car loans, you can make an informed choice that aligns with your financial goals. Whether you’re a first-time buyer or looking to refinance an existing loan, Chase provides a comprehensive platform to navigate the car financing process with confidence.

Popular Questions

What is the minimum credit score required for a Chase car loan?

While Chase doesn’t publicly disclose a minimum credit score requirement, a good credit score (generally 670 or above) will significantly increase your chances of approval and secure a lower interest rate.

How can I calculate my monthly car loan payment?

Financing your education can be daunting, but it doesn’t have to be. College Loans offer various options to help you achieve your academic goals without financial stress.

Chase offers a convenient online car loan calculator on their website. You can input the loan amount, interest rate, and loan term to estimate your monthly payments.

What are the benefits of prepaying my Chase car loan?

Prepaying your loan can save you money on interest charges and help you pay off your loan faster. Chase allows for early payments without any penalties.

A Fixed Rate Mortgage provides peace of mind, as your monthly payments will remain the same for the entire loan term, regardless of interest rate fluctuations.