CD Rates October 2023: Navigating the current financial landscape can feel overwhelming, especially when it comes to making smart choices about your savings. Certificates of Deposit (CDs) offer a way to earn predictable interest income, but understanding the factors that influence CD rates is crucial for maximizing your returns.

This guide provides a comprehensive overview of CD rates in October 2023, helping you make informed decisions for your financial future.

The current interest rate environment is dynamic, influenced by the Federal Reserve’s monetary policy, inflation, and economic conditions. Banks compete for deposits, offering various CD terms and rates to attract customers. Understanding these factors is key to finding the best CD rates for your needs.

Current CD Rates in October 2023

Certificate of Deposit (CD) rates are constantly changing, making it important to stay informed if you’re considering opening one. In October 2023, CD rates are influenced by various factors, including Federal Reserve policy, inflation, and bank competition. Understanding these factors can help you make informed decisions about your savings.

Current CD Rates

This table provides a snapshot of current CD rates offered by major banks and credit unions in October 2023. It’s important to note that these rates are subject to change and are for informational purposes only.

| Institution Name | CD Term | Interest Rate (APY) | Minimum Deposit | Website |

|---|---|---|---|---|

| Bank of America | 3 Months | 4.50% | $1,000 | https://www.bankofamerica.com |

| Chase | 6 Months | 4.75% | $1,000 | https://www.chase.com |

| Wells Fargo | 1 Year | 5.00% | $1,000 | https://www.wellsfargo.com |

| Capital One | 5 Years | 5.25% | $1,000 | https://www.capitalone.com |

| Ally Bank | 3 Months | 4.60% | $1,000 | https://www.ally.com |

| Discover Bank | 6 Months | 4.85% | $1,000 | https://www.discoverbank.com |

| Citibank | 1 Year | 5.10% | $1,000 | https://www.citibank.com |

Data Source: Bankrate.com, Bank websites (October 2023)

Ready to drive a new car? The Best Car Lease Deals October 2023 list is your go-to resource for finding amazing deals.

Factors Influencing CD Rates

Several factors influence CD rates, and understanding these factors can help you make informed decisions about your savings.

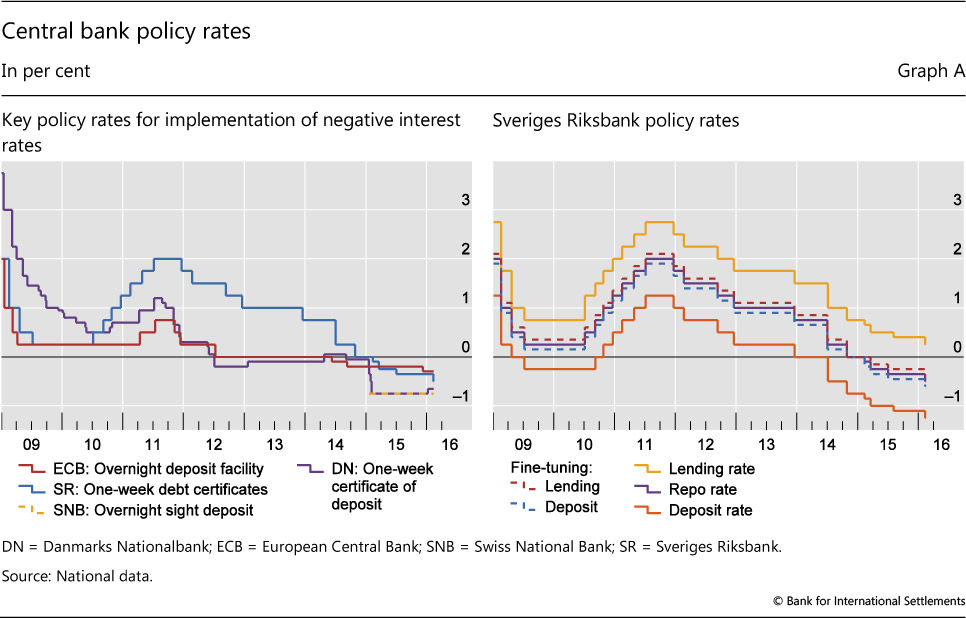

Federal Reserve Interest Rate Policy

The Federal Reserve (Fed) sets the federal funds rate, which is the target interest rate for overnight lending between banks. This rate influences other interest rates in the economy, including CD rates. The Fed’s current policy involves raising interest rates to combat inflation.

When the Fed raises rates, it generally becomes more expensive for banks to borrow money, which can lead to higher CD rates.

Inflation

Inflation is a general increase in the prices of goods and services over time. When inflation is high, banks may offer higher CD rates to attract savers and compensate for the eroding purchasing power of their money. Currently, inflation remains elevated, though it has begun to moderate.

Bank Competition

Competition among banks can drive changes in CD rates. When banks are competing for deposits, they may offer higher rates to attract customers.

Economic Outlook

The overall economic outlook can also influence CD rates. If the economy is expected to grow, banks may be more willing to offer higher rates to attract deposits. However, if the economic outlook is uncertain, banks may be more cautious about offering higher rates.

Understanding CD Rates

Certificates of Deposit (CDs) are a popular savings option that can help you grow your money over time. CDs offer a fixed interest rate for a set period, allowing you to lock in a specific return on your investment. This makes them a good choice for those who want predictable interest income and are comfortable with limited access to their funds.

What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is a type of savings account that requires you to deposit a certain amount of money for a fixed period of time. In exchange for locking in your money, you earn a higher interest rate than you would with a regular savings account.

CDs are a good option for those who want to grow their savings with a predictable return and are comfortable with limited access to their funds.

Get behind the wheel of your dream car with the Best Lease Deals October 2023. Don’t miss out on these amazing opportunities!

Key Features of CDs

CDs come with several key features that distinguish them from other savings accounts:

- Fixed Interest Rate:When you open a CD, you agree to a fixed interest rate for the term of the CD. This means that the interest rate will not change during the term, regardless of market fluctuations. The interest rate is typically determined by the current market conditions and the term of the CD.

Longer terms usually come with higher interest rates.

- Maturity Date:The maturity date is the date on which your CD matures and you can withdraw your principal and accrued interest. You can choose the term of your CD, which can range from a few months to several years.

- Early Withdrawal Penalties:If you withdraw your funds before the maturity date, you may be subject to early withdrawal penalties. These penalties can vary depending on the financial institution and the term of the CD. The penalty is typically a percentage of the interest earned on the CD.

- Minimum Deposit Requirements:Most CDs have minimum deposit requirements. The minimum deposit amount can vary depending on the financial institution and the term of the CD.

CD Rates vs. Other Interest Rates

CD rates are typically higher than savings account rates but lower than money market rates. Understanding the differences between these rates can help you choose the best option for your needs:

- Savings Account Rates:Savings accounts offer lower interest rates than CDs, but they provide greater flexibility. You can withdraw your money at any time without penalty. However, the interest rates on savings accounts are typically variable, meaning they can fluctuate based on market conditions.

- Money Market Rates:Money market accounts offer higher interest rates than savings accounts and CDs, but they also come with more risk. Money market rates can fluctuate based on market conditions, and there is a risk that you could lose money if the market declines.

Money market accounts also typically have higher minimum deposit requirements than savings accounts and CDs.

Annual Percentage Yield (APY)

APY stands for Annual Percentage Yield and represents the actual rate of return you can expect on your investment, taking into account compounding interest.

- What is APY?APY is a measure of the annual rate of return on an investment, taking into account the effect of compounding interest. This means that the interest earned on your investment is added to the principal, and then interest is calculated on the new, larger principal.

- Importance of APY in CD Rates:APY is important when comparing different CD options because it allows you to see the true return on your investment, taking into account the effect of compounding interest. A higher APY means you will earn more interest over time.

- Calculating APY:APY is calculated using the following formula:

APY = (1 + (Interest Rate / Number of Compounding Periods)) ^ (Number of Compounding Periods)- 1

If you’re looking for a safe and secure way to save, consider exploring the Best CD Rates October 2023 to find the best options for your financial goals.

For example, if a CD has a stated interest rate of 2% and interest is compounded monthly, the APY would be calculated as follows:

APY = (1 + (0.02 / 12)) ^ 12- 1 = 0.0202 or 2.02%

It’s important to stay on top of your financial obligations. The When Are Taxes Due In October 2023 article can help you stay organized.

Pros and Cons of Investing in CDs

Investing in CDs offers both advantages and disadvantages. Here’s a breakdown of the pros and cons to help you make an informed decision:

- Pros:

- Guaranteed Returns:CDs offer guaranteed returns for the term of the CD, which provides peace of mind and predictable interest income.

- Predictable Interest Income:The fixed interest rate on a CD means you know exactly how much interest you will earn each year.

- Potential for Higher Returns than Savings Accounts:CDs typically offer higher interest rates than savings accounts, allowing you to grow your savings faster.

- Cons:

- Limited Liquidity:CDs have limited liquidity because you cannot withdraw your funds before the maturity date without incurring penalties.

- Potential for Lower Returns Compared to Other Investments:While CDs offer guaranteed returns, they may not always keep up with inflation or provide returns as high as other investments, such as stocks or bonds.

- Risk of Inflation Eroding Returns:Inflation can erode the purchasing power of your investment over time, even if you earn interest on your CD.

3. Factors Affecting CD Rates

Certificate of Deposit (CD) rates are influenced by a complex interplay of factors, including economic conditions, monetary policy, and market forces. Understanding these factors is crucial for investors seeking to maximize their returns on CDs.

Interest Rate Environment

The Federal Reserve’s monetary policy plays a significant role in shaping CD rates. The federal funds rate, the target rate at which banks lend reserves to each other overnight, serves as a benchmark for other interest rates, including CD rates.

When the Federal Reserve raises the federal funds rate, banks typically increase their CD rates to attract deposits and maintain profitability. Conversely, a decrease in the federal funds rate often leads to lower CD rates.Beyond the federal funds rate, changes in the overall interest rate environment, including bond yields and money market rates, also influence CD rates.

For instance, rising bond yields may incentivize banks to offer higher CD rates to compete with the returns available in the bond market.

Inflation

Inflation, the rate at which prices for goods and services increase, directly impacts CD rates. When inflation is high, investors demand higher returns on their investments to compensate for the erosion of purchasing power. Banks respond by offering higher CD rates to attract deposits and maintain their competitiveness.

Conversely, during periods of low inflation, CD rates tend to be lower as investors are less concerned about the loss of purchasing power.

Economic Conditions

Economic growth, unemployment rates, and consumer confidence all influence CD rates. During periods of strong economic growth, banks may offer higher CD rates to attract deposits from businesses and individuals with surplus funds. Conversely, during economic downturns, banks may lower CD rates to reduce their borrowing costs and preserve capital.

Bank Competition

Competition among banks for deposits is a key factor driving CD rates. Banks use CD rates as a tool to attract new customers and retain existing ones. When competition is intense, banks may offer higher CD rates to differentiate themselves and entice depositors.

However, during periods of reduced competition, banks may lower CD rates to maintain profitability.

CD Term Length

The term length of a CD is directly related to its interest rate. Longer-term CDs typically offer higher interest rates because banks can lock in deposits for a longer period, reducing their risk and allowing them to invest in longer-term assets.

Conversely, shorter-term CDs often have lower interest rates as they provide banks with less certainty about future funding needs.

Minimum Deposit Requirements

Banks often set minimum deposit requirements for CDs to manage their risk and profitability. Higher minimum deposit requirements may allow banks to offer higher interest rates because they can earn more interest on the larger deposits. However, this can also limit the accessibility of CDs for investors with smaller savings.

Choosing the Right CD

Choosing the right Certificate of Deposit (CD) involves considering various factors that align with your financial goals and risk tolerance. This decision is crucial as CDs offer a fixed interest rate for a specific period, locking in your investment for the duration of the term.

Term Length

The term length of a CD is the period for which your money is locked in, and it directly impacts the interest rate you earn. Longer terms typically come with higher interest rates, as banks can invest your money for a longer period.

However, if you need access to your funds before the term ends, you may face penalties.

- Short-Term CDs:These CDs typically have terms ranging from a few months to a year. They offer lower interest rates but provide more flexibility if you need to access your funds quickly.

- Long-Term CDs:These CDs have terms of several years, often five or more. They offer higher interest rates but come with less flexibility. If you withdraw funds early, you could face substantial penalties.

Interest Rate

The interest rate is the percentage return you earn on your CD investment. It’s crucial to compare interest rates from different institutions and choose the one offering the highest rate for the desired term. Interest rates fluctuate based on market conditions and the bank’s risk appetite.

- APY (Annual Percentage Yield):This represents the annual interest rate earned on a CD, taking compounding into account. A higher APY indicates a better return on your investment.

- Fixed Interest Rate:This rate remains constant throughout the CD’s term, providing certainty about your earnings.

Minimum Deposit

The minimum deposit requirement is the amount you need to invest in a CD. This amount can vary significantly between institutions and CD types. While some CDs have low minimums, others require substantial deposits.

- High Minimum Deposits:These CDs often offer higher interest rates to attract larger investments.

- Low Minimum Deposits:These CDs are more accessible to individuals with smaller investment amounts, but they may have lower interest rates.

Penalties for Early Withdrawal

CDs typically impose penalties if you withdraw your funds before the term ends. These penalties can vary depending on the institution and the CD’s terms. Understanding the penalty structure is essential before investing in a CD, as it can significantly impact your returns.

- Interest Rate Penalty:This penalty involves forfeiting a portion of the accrued interest.

- Early Withdrawal Fee:This fee is a fixed amount charged for withdrawing funds early.

FDIC Insurance

The Federal Deposit Insurance Corporation (FDIC) insures deposits in banks and savings associations up to $250,000 per depositor, per insured bank. This means that if the bank fails, your CD investment is protected up to this limit.

- FDIC-Insured CDs:These CDs provide peace of mind, knowing that your investment is protected by the government.

- Non-FDIC-Insured CDs:These CDs may offer higher interest rates but lack the FDIC’s safety net.

Comparing and Selecting CDs

When comparing CDs from different institutions, consider the following factors:

- Interest Rate:Choose the CD with the highest APY for the desired term.

- Term Length:Select a term that aligns with your financial goals and risk tolerance.

- Minimum Deposit:Ensure the minimum deposit requirement is within your budget.

- Early Withdrawal Penalties:Understand the penalties for withdrawing funds early and their potential impact on your returns.

- FDIC Insurance:Choose an FDIC-insured CD to protect your investment.

CD Rates vs. Other Investment Options: CD Rates October 2023

Choosing the right investment strategy depends on your financial goals, risk tolerance, and time horizon. While CDs offer guaranteed returns and principal protection, other investment options might be more suitable for your needs. Here’s a comparison of CD rates to other popular investment avenues, highlighting their respective pros and cons.

High-Yield Savings Accounts

High-yield savings accounts (HYSA) are FDIC-insured accounts that offer higher interest rates than traditional savings accounts. They provide a safe and accessible way to save money while earning a decent return.

- Pros:

- FDIC insured, guaranteeing the safety of your principal up to $250,000 per depositor, per insured bank.

- Highly liquid, allowing you to withdraw your funds easily.

- Generally offer higher interest rates than traditional savings accounts.

- Cons:

- Interest rates are typically lower than CD rates.

- Interest rates can fluctuate, potentially decreasing your returns.

Money Market Accounts

Money market accounts (MMAs) are similar to savings accounts but offer slightly higher interest rates and more flexibility. They often allow you to write checks and make debit card purchases.

- Pros:

- FDIC insured, protecting your principal up to $250,000 per depositor, per insured bank.

- Offer higher interest rates than savings accounts but generally lower than CDs.

- Provide check-writing privileges and debit card access.

- Cons:

- Interest rates can fluctuate, potentially decreasing your returns.

- May have higher minimum balance requirements than savings accounts.

Bonds

Bonds are debt securities representing loans made by investors to borrowers, such as companies or governments. They offer fixed interest payments and a return of principal at maturity.

Maximize your spending power with the right credit card. Check out the Best Credit Cards October 2023 for top picks.

- Pros:

- Generally offer higher returns than savings accounts and CDs.

- Can provide diversification to your investment portfolio.

- Some bonds are considered relatively low-risk, particularly government bonds.

- Cons:

- Bond prices can fluctuate, potentially decreasing your returns.

- Interest rates are fixed, so you may earn less than current market rates.

- Bonds are less liquid than savings accounts and CDs.

Stocks

Stocks represent ownership in a company. They offer the potential for higher returns than bonds or CDs but also carry greater risk.

- Pros:

- Potential for higher returns than other investment options.

- Can provide significant growth potential over the long term.

- Offer the opportunity to participate in the growth of a company.

- Cons:

- Carry higher risk than other investment options, including the potential for losses.

- Can be volatile, with prices fluctuating significantly.

- Require more active management and research.

CD Rate Trends

CD rates have been on the rise in recent months, reflecting the Federal Reserve’s efforts to combat inflation by raising interest rates. This upward trend has provided opportunities for savers to earn higher returns on their deposits. However, it’s important to understand the factors that could influence future rate movements and how they might impact your investment decisions.

Recent CD Rate Trends

Recent CD rate trends have been influenced by several factors, including the Federal Reserve’s monetary policy, inflation, and overall economic conditions. In the past year, CD rates have seen a significant increase, driven by the Federal Reserve’s aggressive rate hikes.

This upward trend has been beneficial for savers seeking higher returns on their deposits. However, it’s important to note that CD rates can fluctuate based on market conditions and economic factors.

Factors Influencing Future CD Rates

Several factors could influence CD rates in the coming months.

- Federal Reserve’s Monetary Policy:The Federal Reserve’s decisions regarding interest rates will continue to be a major driver of CD rate movements. If the Fed continues to raise interest rates to combat inflation, CD rates are likely to follow suit. However, if the Fed pauses or even reverses its rate hike cycle, CD rates could stabilize or even decline.

- Inflation:Inflation is a key factor influencing CD rates. When inflation is high, savers demand higher returns to compensate for the erosion of their purchasing power. This can lead to increased competition among banks and credit unions, resulting in higher CD rates.

As inflation cools down, CD rates might stabilize or even decline.

- Economic Growth:Economic growth can impact CD rates indirectly. When the economy is strong, banks and credit unions are more likely to lend money, which can lead to higher demand for deposits and potentially higher CD rates. Conversely, during periods of economic slowdown, CD rates might decline as banks become more cautious about lending.

- Competition:Competition among financial institutions plays a significant role in CD rates. Banks and credit unions compete for deposits, offering higher rates to attract savers. Increased competition can lead to higher CD rates, while reduced competition might result in lower rates.

Tracking CD Rate Changes

Staying informed about CD rate changes is crucial for making informed investment decisions. Several resources can help you track CD rate trends:

- Bankrate:Bankrate provides a comprehensive overview of current CD rates offered by various financial institutions across the country. It also offers tools to compare rates and find the best deals.

- NerdWallet:NerdWallet offers a similar service to Bankrate, providing information on CD rates, comparison tools, and insights into the CD market.

- FDIC:The Federal Deposit Insurance Corporation (FDIC) website provides information on CD rates offered by FDIC-insured banks and credit unions. It also offers tools to search for banks and credit unions in your area.

7. CD Rate Strategies

Certificates of Deposit (CDs) are a popular savings option that offers fixed interest rates for a set period. The interest rate, known as the CD rate, plays a crucial role in maximizing returns. By understanding various CD rate strategies, you can optimize your earnings and achieve your financial goals.

Laddered CDs

Laddered CDs involve investing in a series of CDs with staggered maturity dates. This strategy helps to mitigate interest rate risk and provides a steady stream of income.For example, you could invest in four CDs with maturity dates of one, two, three, and four years, respectively.

Make sure you don’t miss the October Extension Tax Deadline 2023. It’s a valuable opportunity to file your taxes without penalties.

This creates a ladder with a consistent flow of maturing CDs. When one CD matures, you reinvest the principal and interest into a new CD with a longer maturity date.Laddered CDs offer a degree of flexibility, as you can adjust your investment strategy based on changing market conditions.

However, they may not offer the highest potential returns compared to other strategies.

Bump-Up CDs

Bump-Up CDs allow you to increase the interest rate on your CD under certain conditions, typically when market interest rates rise. This strategy can potentially enhance your returns if interest rates increase during the CD term.For instance, a bump-up CD might offer an initial interest rate of 3%.

Find the perfect credit card for your needs with the Best Credit Cards October 2023 list. Enjoy the benefits of rewards, cashback, and more!

If market rates rise to 4% within a specified period, you can request a bump-up to increase your interest rate to 4%.Bump-up CDs can be advantageous in a rising interest rate environment, but they may not offer the same flexibility as other strategies.

CD Rollovers

CD rollovers involve automatically reinvesting the principal and interest of a maturing CD into a new CD with the same or a different term. This strategy simplifies your investment management and ensures that your funds remain invested.For instance, you might invest in a one-year CD.

When it matures, the principal and interest are automatically rolled over into a new one-year CD. This process can continue indefinitely, creating a consistent investment strategy.CD rollovers offer simplicity and convenience, but they may not provide the same potential for maximizing returns as other strategies.

Comparison of Strategies

| Strategy | Description | Benefits | Risks | Suitability |

|---|---|---|---|---|

| Laddered CDs | Investing in a series of CDs with staggered maturity dates | Mitigates interest rate risk, provides a steady stream of income | May not offer the highest potential returns | Suitable for investors seeking a balance between risk and return |

| Bump-Up CDs | Allows for interest rate increases under certain conditions | Potential for higher returns in a rising interest rate environment | Limited rate increases, may not offer the same flexibility as other strategies | Suitable for investors who believe interest rates will rise |

| CD Rollovers | Automatic reinvestment of maturing CDs | Simplicity and convenience | May not provide the same potential for maximizing returns | Suitable for investors seeking a low-maintenance investment strategy |

Impact of CD Rates on Personal Finance

CD rates play a significant role in personal financial planning, influencing savings goals, investment strategies, and retirement planning. Understanding how CD rates work and how they interact with other financial factors can help you make informed decisions about incorporating them into your overall financial plan.

Savings Goals

CD rates directly impact the effectiveness of CDs for achieving both short-term and long-term savings goals.

- Short-Term Goals: CDs can be a reliable tool for achieving short-term goals like building an emergency fund or saving for a down payment. The fixed interest rate provides a predictable return, allowing you to estimate how long it will take to reach your goal.

For instance, if you need to save $5,000 for an emergency fund and a CD offers a 4% annual interest rate, you can calculate the time it takes to reach your goal.

- Long-Term Goals: While CDs can be part of a long-term savings strategy, their fixed rates may not keep pace with inflation, potentially diminishing the real value of your savings over time. For long-term goals like retirement or a child’s education, CDs may not be the most suitable option compared to other investments with higher growth potential.

- Specific Examples: Let’s consider two examples. If you aim to save $20,000 for a down payment on a house within five years and a CD offers a 3% annual interest rate, you’ll need to contribute significantly to reach your goal. However, if you invest in a diversified portfolio of stocks and bonds with a projected average annual return of 7%, you could potentially reach your goal faster.

Investment Strategies

CD rates are a factor in determining the role of CDs in your investment strategy, especially for risk-averse investors.

- Risk Tolerance: For investors with a low risk tolerance, CDs offer a secure and predictable return. They are less volatile than stocks or bonds, providing peace of mind for those seeking to preserve capital.

- Diversification: CDs can be used to diversify a portfolio by providing a stable component alongside riskier investments like stocks. This can help mitigate overall portfolio risk and provide a balanced approach to investment.

- Inflation: Inflation erodes the purchasing power of your savings. While CDs offer a fixed interest rate, it may not keep pace with inflation, resulting in a lower real return. For instance, if a CD earns a 3% interest rate and inflation is 4%, the real return is -1%, meaning your purchasing power is declining.

Retirement Planning

CDs can play a role in retirement planning by providing a reliable stream of income and offering tax advantages.

- Retirement Income: CDs can be used to generate a steady income stream during retirement. By investing in CDs with varying maturity dates, you can create a CD ladder that provides regular interest payments.

- Tax Advantages: Interest earned from CDs is generally taxed as ordinary income. However, if you hold CDs within a tax-advantaged retirement account like an IRA or 401(k), the interest earned may grow tax-deferred.

- Inflation Protection: CDs do not offer significant protection against inflation. As inflation rises, the real value of your CD principal may decrease. To mitigate this risk, consider diversifying your retirement portfolio with investments that have the potential to outpace inflation, such as stocks or real estate.

Tips for Incorporating CDs into a Financial Plan

Incorporating CDs into your financial plan requires careful consideration of your goals, risk tolerance, and investment horizon.

- CD Ladder: A CD ladder involves investing in CDs with varying maturity dates, typically staggered in one-year increments. This strategy helps mitigate interest rate risk by allowing you to reinvest maturing CDs at potentially higher rates while maintaining some liquidity.

- Matching CD Rates with Financial Goals: When selecting CDs, choose terms and rates that align with your specific financial goals. For short-term goals, consider shorter-term CDs with lower interest rates. For longer-term goals, you might opt for longer-term CDs with higher interest rates.

- Diversification and Allocation: Diversify your investments by allocating a portion of your savings to CDs and other investment options. The specific allocation will depend on your risk tolerance, time horizon, and financial goals.

Factors to Consider When Choosing CDs

Choosing the right CD involves evaluating several factors, including interest rates, terms, penalties, and minimum deposits.

Thinking about getting a new car? October is a great time to find deals, and the Best Car Lease Deals October 2023 list might just have the perfect option for you.

| Factor | Description |

|---|---|

| Interest Rate | The annual percentage yield (APY) you earn on your CD deposit. Higher APYs generally come with longer terms. |

| Term | The length of time you commit your money to the CD, ranging from a few months to several years. |

| Penalties | Fees charged for early withdrawal of funds from the CD. |

| Minimum Deposit | The minimum amount required to open a CD. |

Strategies for Maximizing CD Returns

Maximizing your CD returns requires exploring strategies like CD laddering, early withdrawal strategies, and other techniques.

- CD Laddering: A CD ladder allows you to reinvest maturing CDs at potentially higher rates, potentially boosting your overall returns.

- Early Withdrawal Strategies: Some banks may offer early withdrawal options with reduced penalties. Explore these options if you need access to your funds before maturity.

Risks and Limitations of CDs

While CDs offer security and predictable returns, they also come with certain risks and limitations.

If you’re wondering about the Irs Tax Deadline October 2023 , you’re not alone! Many people are curious about the deadlines for filing their taxes.

- Interest Rate Risk: If interest rates rise after you’ve locked in a CD rate, you may miss out on higher returns.

- Inflation Risk: Inflation can erode the purchasing power of your CD principal, especially over longer terms.

- Liquidity Constraints: CDs have a fixed term, and early withdrawal penalties can reduce your returns.

Alternative Investment Options

CDs are not the only option for saving and investing. Other alternatives include high-yield savings accounts, money market accounts, and bonds.

- High-Yield Savings Accounts (HYSA): HYSAs offer higher interest rates than traditional savings accounts, but they are still FDIC-insured and provide greater liquidity than CDs.

- Money Market Accounts (MMAs): MMAs offer variable interest rates and allow limited check-writing privileges, providing a balance between liquidity and potential returns.

- Bonds: Bonds are debt securities that offer a fixed interest rate and a maturity date. They can provide a higher return than CDs but carry more risk.

CD Rates and the Economy

CD rates, like other financial instruments, are deeply intertwined with the overall health of the economy. They serve as a reflection of economic conditions and investor sentiment, and their fluctuations can have ripple effects throughout the financial markets.

The Geico Layoffs October 2023 are a reminder of the changing landscape in the business world. It’s important to stay informed about current events.

Relationship Between CD Rates and Economic Health

CD rates are influenced by various economic factors, including inflation, interest rates set by the Federal Reserve, and the overall economic outlook. When the economy is strong and inflation is low, banks can afford to offer lower CD rates, as they are confident in their ability to generate returns from lending out deposits.

Conversely, when economic uncertainty prevails and inflation rises, banks tend to offer higher CD rates to attract depositors and compensate for the erosion of purchasing power.

CD Rates as a Reflection of Investor Confidence and Economic Growth

CD rates can serve as a barometer of investor confidence and economic growth. Higher CD rates often signal that investors are hesitant about the future of the economy and are seeking a safe haven for their funds. Conversely, lower CD rates can indicate a more optimistic outlook, as investors are willing to accept lower returns for the potential for higher growth.

Impact of CD Rate Movements on Financial Markets

Fluctuations in CD rates can impact the financial markets in several ways. For example, a rise in CD rates can lead to increased competition for deposits, potentially putting downward pressure on lending rates. This can have implications for businesses seeking loans and consumers looking for mortgages.

Additionally, changes in CD rates can influence the attractiveness of other investment options, such as stocks and bonds, leading to shifts in investor preferences.

CD Rates and Financial Institutions

CD rates play a crucial role in attracting deposits for financial institutions, impacting their profitability and lending capacity. They serve as a vital tool for banks and credit unions to compete for customer funds in a dynamic market.

The Role of CD Rates in Attracting Deposits

Financial institutions rely on deposits from customers to fund their operations and make loans. Higher CD rates make deposits more attractive to customers, as they offer a higher return on their savings. By offering competitive CD rates, institutions can entice individuals and businesses to deposit their money with them, increasing their deposit base.

Impact of CD Rates on a Bank’s Profitability and Lending Capacity

CD rates directly affect a bank’s profitability. When CD rates rise, the cost of funds for the bank increases, reducing its profit margin. However, higher CD rates can also lead to an increase in deposits, allowing the bank to lend more money and generate higher revenue through interest income on loans.

This creates a delicate balance for banks, as they must carefully consider the trade-off between attracting deposits and maintaining profitability.

Competitive Landscape for CD Products

The CD market is highly competitive, with various financial institutions vying for customer deposits. To stand out, banks and credit unions offer a range of CD products with different terms, rates, and features. Some institutions may specialize in offering high-yield CDs to attract savers seeking higher returns, while others may focus on offering CDs with flexible terms or penalty-free withdrawals.

The competitive landscape constantly evolves, as institutions adjust their CD rates and product offerings to stay ahead of the curve.

CD Rates and Inflation

Inflation can significantly impact the attractiveness of CD investments. While CDs offer a fixed interest rate, the purchasing power of that interest can be eroded by rising prices. Understanding the relationship between inflation and CD rates is crucial for making informed investment decisions.

Impact of Inflation on CD Rates

Inflation directly affects the attractiveness of CD investments by reducing the real return on your investment. As inflation rises, the purchasing power of your interest earnings diminishes. In essence, your money buys less over time, making the fixed interest rate on a CD less appealing.

Historical Relationship Between Inflation and CD Rates

Historically, CD rates have tended to rise in response to higher inflation. This is because lenders need to offer higher rates to compensate for the declining purchasing power of their money. However, the relationship between inflation and CD rates is not always straightforward.

There are instances where CD rates may lag behind inflation, particularly during periods of economic uncertainty.

Impact of Inflation on Short-Term and Long-Term CDs

Inflation can have a more significant impact on the purchasing power of long-term CD investments. This is because the longer the term of the CD, the greater the potential for inflation to erode the value of your interest earnings. For example, a 5-year CD with a fixed interest rate of 3% might not provide a positive real return if inflation averages 4% over that period.

Looking for a way to boost your income this fall? Check out the Jepi Dividend October 2023 for potential investment opportunities.

Calculating Real Return on CD Investments

To determine the real return on a CD investment, you need to subtract the inflation rate from the nominal interest rate. For example, if a CD offers a 3% interest rate and inflation is 2%, the real return is 1%.

Staying organized with your finances is crucial. The Taxes Due October article provides valuable information to keep you on track.

This means that the purchasing power of your investment is only increasing by 1% per year.

Real Return = Nominal Interest Rate

Looking for the best deals on new car leases? The October 2023 Lease Deals article can help you find the perfect vehicle at a great price.

Inflation Rate

Hypothetical Scenario Illustrating Inflation Impact

Imagine you invest $10,000 in a 5-year CD with a 3% interest rate. If inflation averages 2% over that period, your investment will grow to approximately $11,592.74 at the end of the 5 years. However, due to inflation, the purchasing power of that $11,592.74 will be equivalent to approximately $10,773.33 in today’s dollars.

This means you will have experienced a real return of approximately 0.77% per year.

Strategies for Managing Inflation Risk, CD Rates October 2023

Investing in CDs during periods of high inflation can be challenging. However, several strategies can potentially mitigate the impact of inflation on your CD investments.

Laddering CDs

Laddering CDs involves investing in CDs with varying maturity dates. This strategy helps diversify your investment and reduces the risk of locking in a low interest rate for a long period. For example, you could invest in a 1-year CD, a 2-year CD, a 3-year CD, and so on.

This way, a portion of your investment will mature each year, allowing you to reinvest at current market rates.

Don’t miss out on the IRS October Deadline 2023 for tax extensions. It’s a great opportunity to get your finances in order.

Investing in Inflation-Adjusted CDs

Inflation-adjusted CDs, also known as TIPS (Treasury Inflation-Protected Securities), offer interest rates that adjust with inflation. This means that the principal value of the CD increases with inflation, protecting your investment from purchasing power erosion. However, TIPS typically have lower interest rates than traditional CDs, and their returns are not guaranteed.

Advantages and Disadvantages of Inflation-Hedging Strategies

Laddering CDs

- Advantages:Diversification, flexibility, and potential to reinvest at higher rates.

- Disadvantages:Requires more time and effort to manage, potential for lower overall returns compared to longer-term CDs.

Inflation-Adjusted CDs

- Advantages:Protects against inflation, provides a guaranteed return on principal.

- Disadvantages:Lower interest rates than traditional CDs, potential for lower overall returns, limited availability.

Key Factors to Consider When Investing in CDs During Inflation

| Factor | Description |

|---|---|

| Inflation Rate | The current and projected inflation rate will significantly influence the attractiveness of CD investments. |

| CD Interest Rate | The interest rate offered on the CD should be high enough to compensate for inflation. |

| Maturity Date | Consider the maturity date of the CD in relation to your investment goals and inflation projections. |

| Inflation-Hedging Strategies | Explore options such as laddering or investing in inflation-adjusted CDs to mitigate inflation risk. |

CD Rates and Interest Rate Risk

Interest rate risk is a crucial factor to consider when investing in CDs. While CDs offer the security of fixed interest rates, they also expose investors to the risk of potential losses if interest rates rise. This article will delve into the concept of interest rate risk, its impact on CD investments, and strategies to mitigate this risk.

Understanding Interest Rate Risk

Interest rate risk refers to the potential loss in value of an investment due to changes in interest rates. In the context of CDs, this risk arises because when interest rates rise, the fixed rate earned on an existing CD becomes less attractive compared to new CDs being issued at higher rates.Imagine you invest $10,000 in a 1-year CD offering a 3% annual interest rate.

After six months, interest rates rise to 4%. If you were to cash out your CD early, you would receive your principal ($10,000) plus accrued interest (around $150), but you would miss out on the higher interest rate that is now available on new CDs.

This is a simplified illustration of interest rate risk.

Impact of Interest Rate Changes on CD Value

Rising interest rates have a negative impact on the value of existing CDs. When interest rates go up, the fixed rate earned on your CD becomes less appealing, making it less valuable. This is because you could have invested in a new CD with a higher rate, earning more interest.The concept of “opportunity cost” plays a significant role here.

Opportunity cost refers to the potential return you miss out on by choosing one investment over another. In the context of CDs, the opportunity cost is the higher interest rate you could be earning on a new CD if you had not invested in the existing one.For example, if you have a $10,000 CD with a 2% interest rate, and interest rates rise to 3%, your CD is worth less because you are earning 1% less than you could be.

This difference in earnings represents your opportunity cost.

Planning to lease a car? The October 2023 Lease Deals can help you find a great deal on your dream car.

Strategies for Mitigating Interest Rate Risk

- Short-Term CDs: Investing in shorter-term CDs, such as those with maturities of 3 months or 6 months, can help reduce interest rate risk. This is because you can reinvest your money in a new CD at a higher rate when interest rates rise.

However, short-term CDs generally offer lower interest rates than longer-term CDs.

- Laddered CD Strategy: A laddered CD strategy involves investing in CDs with staggered maturities. For example, you could invest in a 1-year CD, a 2-year CD, and a 3-year CD. This strategy helps to reduce interest rate risk by ensuring that a portion of your investment is always maturing and can be reinvested at current rates.

- Variable Rate CDs: Variable rate CDs offer interest rates that adjust with market interest rates. While this can protect you from interest rate risk, it also means that your interest rate can decrease if market rates fall. Variable rate CDs may not be suitable for everyone, as they offer less certainty about future earnings.

- Diversification: Diversifying your investments beyond CDs can help mitigate interest rate risk. This means investing in a mix of assets, such as stocks, bonds, and real estate. Diversification can help reduce your overall exposure to interest rate fluctuations and other market risks.

CD Rates and the Future

Predicting future CD rates is a complex endeavor, as various factors influence their trajectory. However, analyzing historical trends and current economic conditions can provide insights into potential rate movements.

Monetary Policy

The Federal Reserve’s monetary policy plays a crucial role in shaping interest rates. When the Fed raises interest rates, CD rates tend to follow suit, as financial institutions adjust their deposit rates to reflect the higher cost of borrowing. Conversely, interest rate cuts by the Fed can lead to lower CD rates.

Economic Growth

A robust economy generally leads to higher CD rates, as investors demand higher returns for their money. Conversely, a weak economy can result in lower CD rates, as financial institutions may lower rates to attract deposits.

Inflation

Inflation erodes the purchasing power of money, and investors demand higher returns to compensate for this erosion. As inflation rises, CD rates typically increase to reflect the higher cost of living.

Global Events

Global events, such as geopolitical tensions, economic crises, or natural disasters, can significantly impact interest rates and CD rates. These events can lead to uncertainty and volatility in the market, influencing investor behavior and, consequently, CD rates.

Final Thoughts

Making informed decisions about your savings requires careful consideration of CD rates, term lengths, and potential risks. By understanding the factors that influence CD rates and utilizing strategies like laddering or bump-up CDs, you can potentially optimize your returns and reach your financial goals.

Remember to compare options from different institutions, consider your risk tolerance, and stay informed about current market trends to make the best choices for your financial well-being.

Answers to Common Questions

What are the best CD rates currently available?

The best CD rates vary depending on the term length, institution, and minimum deposit requirements. It’s essential to compare rates from multiple banks and credit unions to find the most competitive options.

Are CD rates guaranteed?

While CD rates are fixed for the term of the deposit, they are not guaranteed. Interest rates can fluctuate, and if you withdraw your funds before maturity, you may incur penalties.

What are the risks associated with CDs?

The primary risk associated with CDs is interest rate risk. If interest rates rise after you’ve opened a CD, you may miss out on higher returns. Additionally, CDs offer limited liquidity, meaning you may face penalties for early withdrawal.

How do I choose the right CD term length?

The optimal CD term length depends on your financial goals and risk tolerance. If you need access to your funds in the near future, consider a shorter term. For long-term savings goals, a longer term may offer higher interest rates.