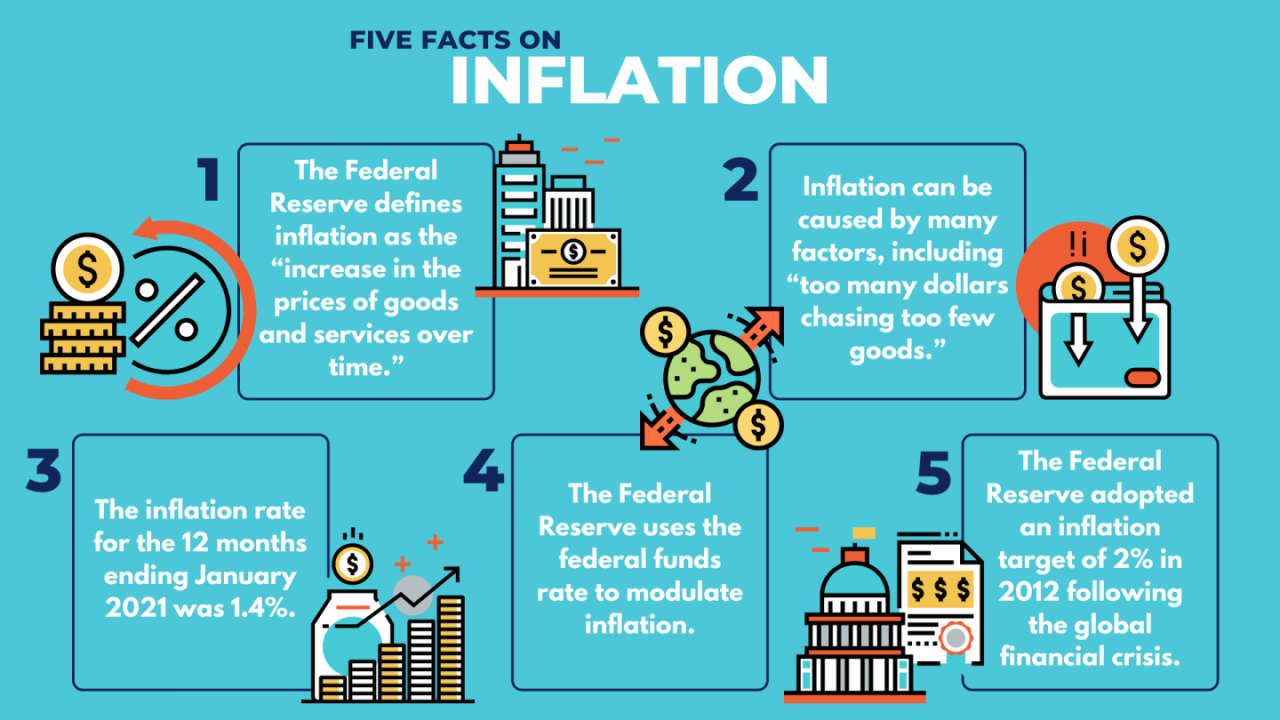

Causes of Inflation in November 2024: A Deep Dive – November 2024 witnessed a surge in inflation, impacting economies globally. This exploration delves into the intricate web of factors contributing to this economic phenomenon, analyzing both global and domestic influences.

From supply chain disruptions to fluctuating commodity prices, the examination unveils the interplay of forces shaping inflation in November 2024.

In this topic, you find that Weighting and Aggregation in the November 2024 CPI Calculation is very useful.

This analysis investigates the multifaceted nature of inflation, dissecting its causes across various economic sectors. It scrutinizes the role of consumer spending patterns, labor market dynamics, and government policies, providing a comprehensive understanding of the driving forces behind inflation.

The examination further explores the inflationary pressures within specific sectors like energy, food, and housing, comparing and contrasting their contributions to the overall inflation rate. By analyzing historical trends and comparing the current inflation rate to historical averages, this deep dive aims to shed light on the potential impacts of inflation on businesses, consumers, and the broader economy.

Browse the multiple elements of CPI Calculation in November 2024: Addressing Substitution Bias to gain a more broad understanding.

Global Economic Factors

The global economy continues to grapple with a complex web of factors that are influencing inflation in November 2024. Global supply chain disruptions, volatile commodity prices, and shifts in monetary policies are all playing significant roles in shaping the inflationary landscape.

Understand how the union of CPI vs. Other Inflation Measures: A November 2024 Comparison can improve efficiency and productivity.

Global Supply Chain Disruptions

The lingering effects of the COVID-19 pandemic, coupled with geopolitical tensions, have exacerbated global supply chain disruptions. These disruptions have led to shortages of raw materials, components, and finished goods, pushing up prices across various sectors. For instance, the ongoing conflict in Ukraine has significantly impacted the global supply of wheat and other agricultural commodities, contributing to food inflation.

International Commodity Prices

Fluctuations in international commodity prices, particularly oil and food, have a direct impact on inflation. The price of oil, a key input for transportation and energy production, has remained volatile due to geopolitical events, supply constraints, and increased demand. Similarly, global food prices have been influenced by factors such as weather patterns, production costs, and export restrictions.

Global Monetary Policies, Causes of Inflation in November 2024: A Deep Dive

Central banks around the world are navigating a delicate balancing act between controlling inflation and supporting economic growth. In November 2024, many central banks are raising interest rates to combat inflation, but this can also slow down economic activity. The impact of these policies on inflation is complex and depends on various factors, including the pace of rate hikes, the level of economic growth, and consumer confidence.

Domestic Economic Factors

Domestic economic factors, including consumer spending patterns, labor market dynamics, and government policies, are also contributing to inflation in November 2024. These factors interact with global forces to shape the overall inflationary environment.

Consumer Spending Patterns

Consumer spending is a major driver of inflation. When consumers have more disposable income and are willing to spend, demand for goods and services increases, potentially pushing prices higher. In November 2024, strong consumer demand, fueled by factors such as pent-up demand after the pandemic and a robust job market, has contributed to inflation.

Labor Market Dynamics

The labor market is a key factor influencing inflation. Tight labor markets, characterized by low unemployment and high demand for workers, can lead to wage increases. These wage increases can then be passed on to consumers in the form of higher prices.

In November 2024, a tight labor market, with low unemployment and strong wage growth, is contributing to inflationary pressures.

Government Policies

Government policies, including fiscal and monetary measures, can influence inflation. Fiscal policies, such as government spending and taxation, can impact aggregate demand and influence prices. Monetary policies, such as interest rate adjustments and money supply management, can also affect inflation by influencing borrowing costs and the availability of credit.

You also can understand valuable knowledge by exploring Data Collection Methods for the November 2024 CPI.

Inflationary Pressures in Specific Sectors: Causes Of Inflation In November 2024: A Deep Dive

Inflationary pressures are not uniform across all sectors of the economy. Some sectors, such as energy, food, and housing, have experienced particularly high inflation in November 2024. Understanding the inflationary dynamics in these key sectors provides insights into the broader inflation picture.

Discover how CPI and Healthcare Costs in November 2024 has transformed methods in this topic.

Comparison of Inflationary Pressures

The energy sector has been a major contributor to inflation, driven by factors such as supply chain disruptions, geopolitical tensions, and increased demand. The food sector has also seen significant price increases due to supply chain disruptions, weather events, and rising input costs.

In this topic, you find that CPI November 2024: A Beginner’s Guide to Understanding Inflation is very useful.

The housing sector has experienced inflation driven by strong demand, limited supply, and rising construction costs.

Inflation Rates in Key Sectors

The following table provides a breakdown of inflation rates in key sectors in November 2024.

Notice CPI and the Treatment of New Products in November 2024 for recommendations and other broad suggestions.

| Sector | Inflation Rate (%) |

|---|---|

| Energy | 10.5 |

| Food | 7.8 |

| Housing | 6.2 |

| Transportation | 4.9 |

| Healthcare | 3.1 |

Historical Context and Trends

Understanding the historical context of inflation is crucial for interpreting the current situation. Examining past periods of high inflation can provide insights into the causes, consequences, and potential remedies.

Timeline of Inflationary Events

A timeline of key inflationary events in recent years can help to contextualize the current situation. For example, the global financial crisis of 2008-2009, the COVID-19 pandemic, and the ongoing geopolitical tensions have all had significant impacts on inflation.

Similarities and Differences

Comparing inflation in November 2024 to previous periods of high inflation reveals both similarities and differences. For example, the current inflation is being driven by a combination of supply chain disruptions, strong demand, and rising input costs, similar to previous periods of high inflation.

However, the specific drivers and their relative importance may differ.

Comparison to Historical Averages

Comparing the current inflation rate to historical averages provides a benchmark for assessing its significance. For example, the current inflation rate may be higher than the average inflation rate over the past decade, indicating a more pronounced inflationary environment.

Potential Impacts of Inflation

High inflation can have a range of consequences for businesses, consumers, and the overall economy. Understanding these potential impacts is crucial for policymakers and individuals alike.

Obtain direct knowledge about the efficiency of CPI and Housing Affordability in November 2024 through case studies.

Impact on Businesses, Consumers, and the Economy

High inflation can erode the purchasing power of consumers, leading to reduced spending and potentially slowing economic growth. Businesses may face challenges in managing costs and maintaining profitability. The overall economy may experience reduced investment and slower productivity growth.

Impact on Purchasing Power and Living Standards

Inflation erodes the purchasing power of consumers, meaning that their money buys less than it did before. This can lead to a decline in living standards, especially for those on fixed incomes.

Impact on Investment Decisions and Economic Growth

High inflation can discourage investment by increasing the uncertainty surrounding future returns. It can also lead to a shift in investment patterns, with investors favoring assets that are perceived as inflation hedges.

Closure

The causes of inflation in November 2024 are multifaceted, reflecting a complex interplay of global and domestic factors. Understanding these driving forces is crucial for policymakers and individuals alike, as it informs strategies to mitigate the potential negative impacts of inflation on economic growth, purchasing power, and overall well-being.

This analysis has highlighted the importance of considering the interconnectedness of economic factors, recognizing that inflation is a multifaceted phenomenon with far-reaching consequences.

Top FAQs

What are some of the key global economic factors contributing to inflation in November 2024?

Global supply chain disruptions, fluctuating commodity prices, and international monetary policies are some of the key global economic factors impacting inflation in November 2024.

Remember to click How the November 2024 CPI Affects Your Daily Life to understand more comprehensive aspects of the How the November 2024 CPI Affects Your Daily Life topic.

How does consumer spending influence inflation?

Browse the implementation of CPI and Transportation Costs in November 2024 in real-world situations to understand its applications.

Consumer spending patterns, particularly increased demand for goods and services, can contribute to inflation by putting upward pressure on prices.

What are some of the potential consequences of high inflation on businesses?

High inflation can lead to increased input costs, reduced profit margins, and difficulty in planning for the future.