Can I contribute to a Roth IRA if I make over the income limit in 2024? This question arises for many individuals seeking to maximize their retirement savings. While Roth IRAs offer tax-free withdrawals in retirement, income limits can restrict eligibility.

Understanding these limitations is crucial for making informed financial decisions. The 2024 contribution limit for Roth IRAs remains at $6,500 for individuals and $13,000 for couples, but exceeding certain income thresholds can significantly impact your ability to contribute.

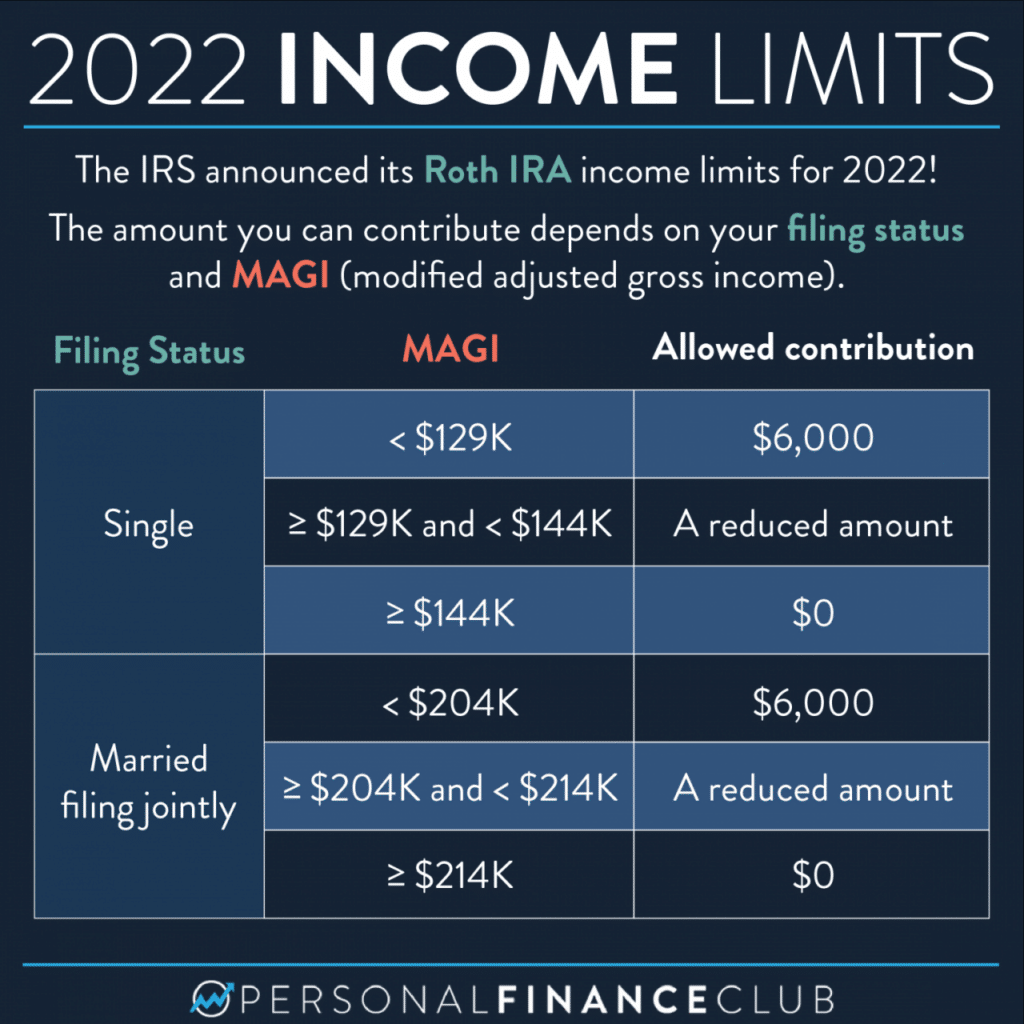

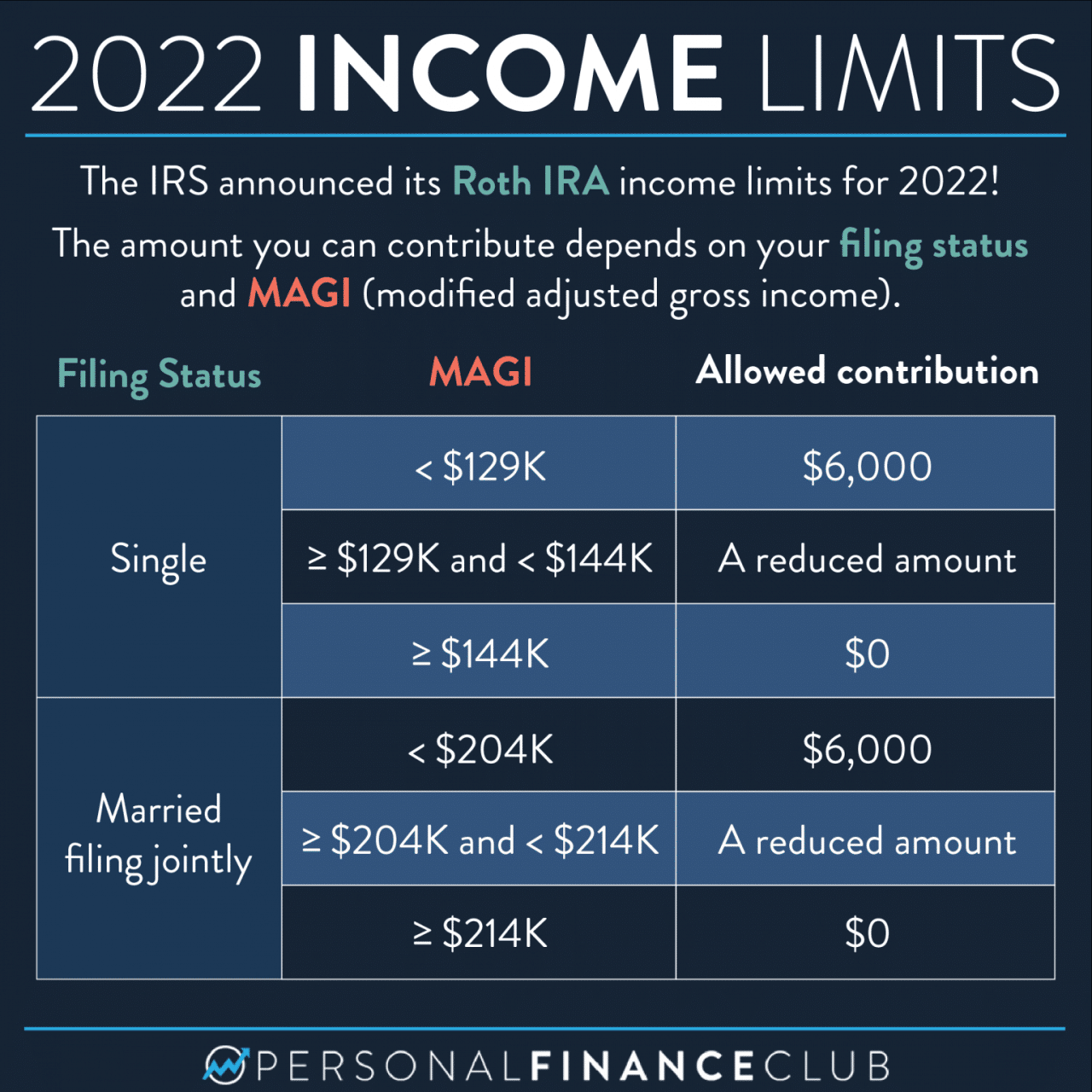

The modified adjusted gross income (MAGI) determines your eligibility. For 2024, single filers with a MAGI exceeding $153,000 and married couples filing jointly with a MAGI over $228,000 are ineligible for Roth IRA contributions. Those falling within the phase-out range may only contribute a portion of the maximum amount.

Exceeding the limits can lead to penalties or tax implications, making it essential to carefully consider your options.

Roth IRA Contribution Limits in 2024: Can I Contribute To A Roth IRA If I Make Over The Income Limit In 2024

The Roth IRA is a popular retirement savings option that offers tax-free withdrawals in retirement. However, there are income limits that can affect your eligibility to contribute to a Roth IRA. Here’s a breakdown of the Roth IRA contribution limits and income thresholds for 2024.

Moving can be a big expense, and the IRS offers a mileage deduction to help offset some of the costs. The October 2024 mileage rate for moving expenses is set at a specific rate per mile, so make sure you’re aware of the current rate before filing your taxes.

Maximum Contribution Limit

The maximum contribution limit for Roth IRAs in 2024 is $6,500 for individuals under age 50 and $7,500 for individuals age 50 and over.

If you’re married, you might be wondering about the specific contribution limits for your situation. The Roth IRA contribution limits for 2024 for married couples can be found on the IRS website, but you can also find a breakdown of the limits on our site.

Modified Adjusted Gross Income (MAGI) Thresholds

Your eligibility to contribute to a Roth IRA is based on your modified adjusted gross income (MAGI). If your MAGI exceeds certain thresholds, you may be limited in your ability to contribute to a Roth IRA, or you may not be able to contribute at all.

If you’re looking to maximize your retirement savings, it’s important to stay up-to-date on the latest contribution limits. For 2024, the 2024 401k contribution limits for all ages are set to increase, offering you the chance to stash away more money for your future.

Phase-Out Range for Roth IRA Contributions

For 2024, the phase-out range for Roth IRA contributions is as follows:

Single filers

For those over 50, there’s an additional contribution limit known as catch-up contributions. The how much can I contribute to my 401k in 2024 with catch-up contributions can help you accelerate your retirement savings.

The phase-out range for single filers is between $153,000 and $168,000.

Exceeding the contribution limit for a Roth IRA can lead to penalties. It’s crucial to be aware of the what happens if I exceed the Roth IRA contribution limit in 2024 to avoid any unwanted financial consequences.

Married filing jointly

When filing your taxes as married filing separately, it’s crucial to know the standard deduction for married filing separately in 2024. This amount can be deducted from your taxable income, potentially reducing your tax liability.

The phase-out range for married couples filing jointly is between $228,000 and $243,000.

If you use your vehicle for business purposes, you can deduct a certain amount of your mileage expenses. The October 2024 mileage rate for business use is set at a specific rate per mile, which can help you reduce your tax liability.

Head of household

The Roth IRA contribution limits for 2024 are set at a specific amount, which can vary depending on your age and filing status. It’s important to stay informed about these limits to make sure you’re maximizing your contributions.

The phase-out range for head of household filers is between $204,000 and $219,000.

Impact of Exceeding Income Limits

If your Modified Adjusted Gross Income (MAGI) exceeds the income limits for Roth IRA contributions in 2024, you will face certain consequences. The income limits for Roth IRA contributions are based on your filing status. For example, in 2024, if you are single and your MAGI is $153,000 or higher, you cannot contribute to a Roth IRA.

Contribution Validity

Contributions made above the income limit are not considered valid and may be subject to penalties. The Internal Revenue Service (IRS) may require you to withdraw the excess contribution, along with any earnings on the excess contribution, by the tax filing deadline for the year following the year of the excess contribution.

Potential Penalties and Tax Implications, Can I contribute to a Roth IRA if I make over the income limit in 2024

If you exceed the income limits for Roth IRA contributions, you may face penalties. The IRS may impose a 6% penalty on the excess contribution each year that the excess contribution remains in the Roth IRA. Additionally, the earnings on the excess contribution may be taxed as ordinary income.

The tax system can be complex, but understanding understanding tax brackets for 2024 is a key step in navigating it effectively. Each bracket represents a different tax rate, and knowing which bracket you fall into helps you determine your tax liability.

The penalty for exceeding the Roth IRA income limits can be significant, and it is important to understand the rules and avoid making excess contributions.

Understanding the tax brackets for married filing separately in 2024 is essential for accurately calculating your tax obligations. The tax brackets determine the percentage of your income that will be taxed at each level.

Tax Implications for Excess Contributions

Excess contributions to a Roth IRA are considered non-deductible contributions. This means that the excess contributions are not tax-deductible in the year they are made. However, the earnings on the excess contributions are taxed as ordinary income when they are withdrawn.

Retirement planning is a key part of financial security, and knowing the IRA contribution limits for 2024 by age can help you make informed decisions about your savings. These limits vary depending on your age, so make sure you’re aware of the limits that apply to you.

For example, if you contribute $6,500 to a Roth IRA in 2024, but your MAGI exceeds the income limit, the IRS may require you to withdraw the $6,500 contribution, along with any earnings on the contribution, by the tax filing deadline for 2025. The earnings on the excess contribution would be taxed as ordinary income in 2025.

If you need more time to file your taxes, you can request an extension. The deadline for filing an extension in October 2024 is typically on the 15th, but it’s always a good idea to double-check the specific date.

You can find information on how to file for an extension on my taxes in October 2024 on the IRS website.

Alternative Options for Saving

If you exceed the income limits for Roth IRA contributions, you still have several other options for saving for retirement. These alternative retirement accounts offer varying levels of tax benefits and flexibility, allowing you to choose the best fit for your individual circumstances.

Self-employed individuals have unique contribution options for their retirement savings. The 401k contribution limits for 2024 for self-employed are designed to help self-employed individuals build a strong retirement nest egg.

Traditional IRAs

Traditional IRAs are similar to Roth IRAs but offer pre-tax contributions. This means you deduct your contributions from your taxable income, reducing your tax liability in the present. However, you will be taxed on withdrawals during retirement.

Features and Benefits

- Tax-deductible contributions:Reduces your current tax burden.

- Potential for tax-free growth:Earnings grow tax-deferred.

- Flexible contribution options:Allows for both traditional and Roth contributions.

- No income limitations:You can contribute to a traditional IRA regardless of your income.

Comparison with Roth IRAs

While Roth IRAs offer tax-free withdrawals in retirement, traditional IRAs provide tax deductions on contributions, making them a better option for those who expect to be in a lower tax bracket in retirement.

401(k)s

(k)s are employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax salary to a retirement account. Employers may also offer matching contributions, essentially free money for retirement savings.

Features and Benefits

- Tax-deductible contributions:Reduces your current tax burden.

- Potential for tax-free growth:Earnings grow tax-deferred.

- Employer matching contributions:Increases your retirement savings significantly.

- Potential for higher contribution limits:401(k) plans often have higher contribution limits than IRAs.

Comparison with Traditional IRAs

(k)s offer employer matching contributions, which is a significant advantage. However, traditional IRAs provide more flexibility in investment options and may be a better choice for those who are self-employed or have limited access to employer-sponsored retirement plans.

For those who want to contribute to their 401k after taxes, it’s important to understand the limits. The how much can I contribute to my 401k in 2024 after taxes is a question that many individuals have, and the answer depends on your specific situation.

Other Retirement Accounts

Beyond traditional IRAs and 401(k)s, several other retirement savings options exist. These include:

- SEP IRA:Designed for self-employed individuals and small business owners.

- SIMPLE IRA:Available to small businesses with 100 or fewer employees.

- Solo 401(k):Combines features of a 401(k) and a SEP IRA, suitable for self-employed individuals and small business owners.

Contribution Limits and Income Restrictions

| Retirement Account | Contribution Limit (2024) | Income Restrictions |

|---|---|---|

| Traditional IRA | $7,500 | None |

| Roth IRA | $7,500 | $153,000 (single filers), $228,000 (married filing jointly) |

| 401(k) | $30,000 | None |

| SEP IRA | 25% of net self-employment income | None |

| SIMPLE IRA | $16,000 | None |

| Solo 401(k) | $75,000 (employee contribution) | None |

Strategies for Future Contributions

Don’t let the current income limits deter you from maximizing your retirement savings. You can still work towards contributing to a Roth IRA in the future. There are several strategies you can consider to position yourself for future contributions.

For those who prefer a Roth IRA, you’ll want to check out the Roth IRA contribution limit changes in 2024. These limits are adjusted annually, so it’s a good idea to review them to make sure you’re contributing the maximum amount allowed.

Planning for Future Contributions

One way to potentially qualify for Roth IRA contributions in the future is to reduce your Modified Adjusted Gross Income (MAGI) in subsequent years. This can be achieved through various strategies, including:

- Reduce Your Income:This may involve taking on a lower-paying job, reducing your hours, or taking a temporary leave of absence. However, it’s important to weigh the potential impact on your overall financial situation.

- Increase Deductions and Credits:Explore eligible deductions and credits that can lower your taxable income, ultimately reducing your MAGI. For example, you can consider deductions for homeownership, student loan interest, or charitable contributions.

- Adjust Your Retirement Contributions:While you may be limited in your Roth IRA contributions, you can consider increasing contributions to a traditional IRA or 401(k) plan. This can help lower your taxable income, potentially bringing your MAGI below the Roth IRA income limit in the future.

Actions to Lower MAGI

Here are some specific actions you can take to potentially lower your MAGI and qualify for Roth IRA contributions in the future:

- Contribute to a Traditional IRA:Contributions to a traditional IRA are tax-deductible, which can lower your taxable income and MAGI. However, keep in mind that you’ll need to pay taxes on withdrawals in retirement.

- Maximize 401(k) Contributions:Increasing your contributions to a 401(k) plan can also reduce your taxable income. You can often choose between traditional and Roth 401(k) options, allowing you to tailor your contributions to your financial goals.

- Contribute to a Health Savings Account (HSA):Contributions to an HSA are tax-deductible and withdrawals for qualified medical expenses are tax-free. This can significantly reduce your taxable income and MAGI.

- Utilize Deductions and Credits:Explore various deductions and credits available to you, such as deductions for homeownership, student loan interest, or charitable contributions. The IRS offers a wide range of deductions and credits that can lower your taxable income and potentially reduce your MAGI below the Roth IRA income limit.

- Consider a Roth Conversion:If you have money in a traditional IRA or 401(k), you can consider converting it to a Roth IRA. While you’ll pay taxes on the conversion, it can help you qualify for future Roth IRA contributions.

Note:It’s important to consult with a financial advisor to determine the best strategies for your specific situation. They can help you assess your financial goals, understand the implications of different strategies, and develop a plan to maximize your retirement savings.

Conclusive Thoughts

Navigating Roth IRA income limits requires careful planning and consideration. If you find yourself exceeding the income thresholds, exploring alternative retirement savings options like traditional IRAs or 401(k)s may be advantageous. However, remember that Roth IRAs offer unique tax benefits that make them a desirable option when eligible.

By strategically planning for future contributions, potentially reducing your MAGI in subsequent years, you can maximize your retirement savings and achieve your financial goals.

Key Questions Answered

What happens if I contribute to a Roth IRA but exceed the income limit?

If you contribute to a Roth IRA and later discover you exceeded the income limit, you’ll need to file an amended tax return. You can choose to withdraw the excess contribution to avoid penalties, but this may impact your overall retirement savings strategy.

Are there any other retirement savings options available for those exceeding the Roth IRA income limits?

Yes, there are several other options available, including traditional IRAs, 401(k)s, and employer-sponsored retirement plans. These options may offer different tax benefits and contribution limits, so it’s essential to compare them carefully to find the best fit for your situation.

Can I still contribute to a Roth IRA in the future if I exceed the income limit this year?

Yes, you can still contribute to a Roth IRA in the future if your income falls below the limit. You can also explore strategies to reduce your MAGI in subsequent years, making you eligible for Roth IRA contributions.