Can I contribute more than the Roth IRA limit in 2024? This question often arises as individuals strive to maximize their retirement savings. The Roth IRA offers tax-free withdrawals in retirement, making it a popular choice for many. However, exceeding the annual contribution limit can lead to penalties and tax implications.

This article delves into the intricacies of Roth IRA contributions, exploring the limits, consequences, and alternative retirement savings options.

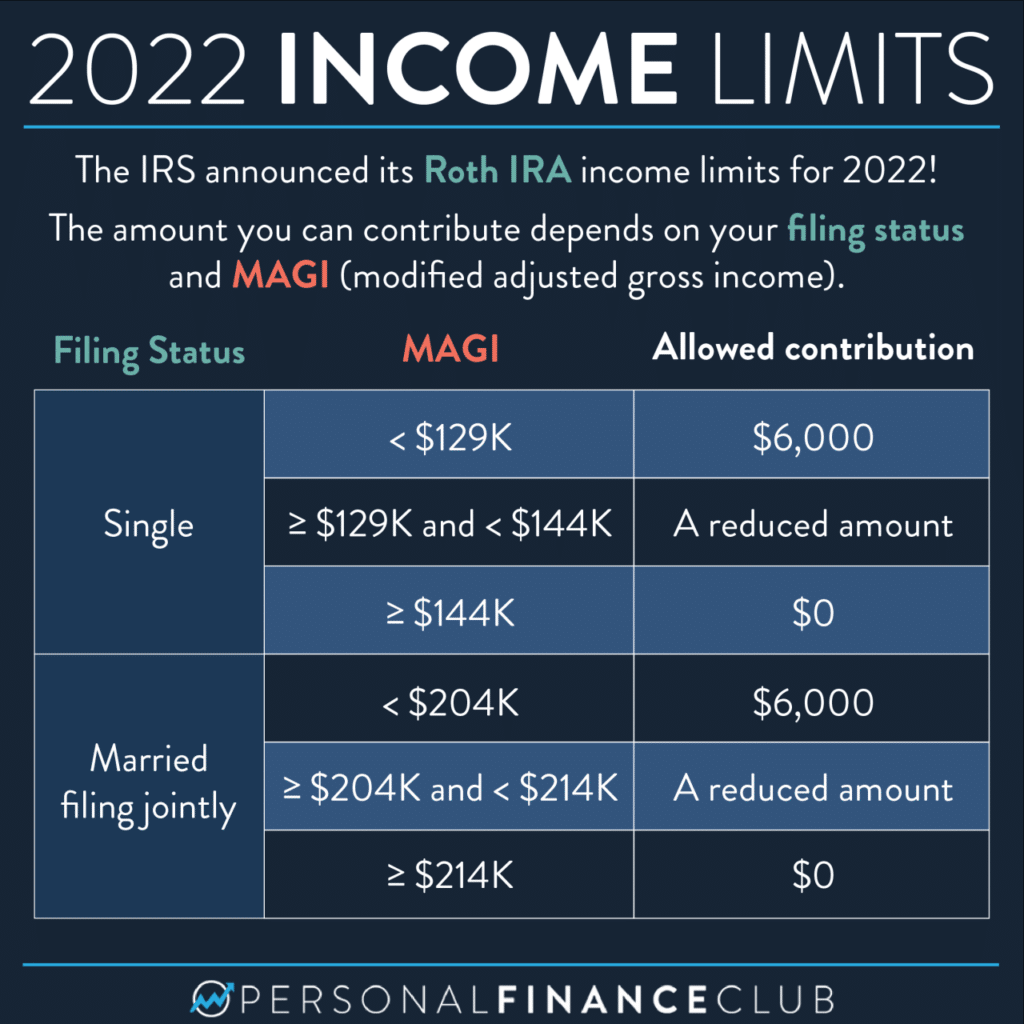

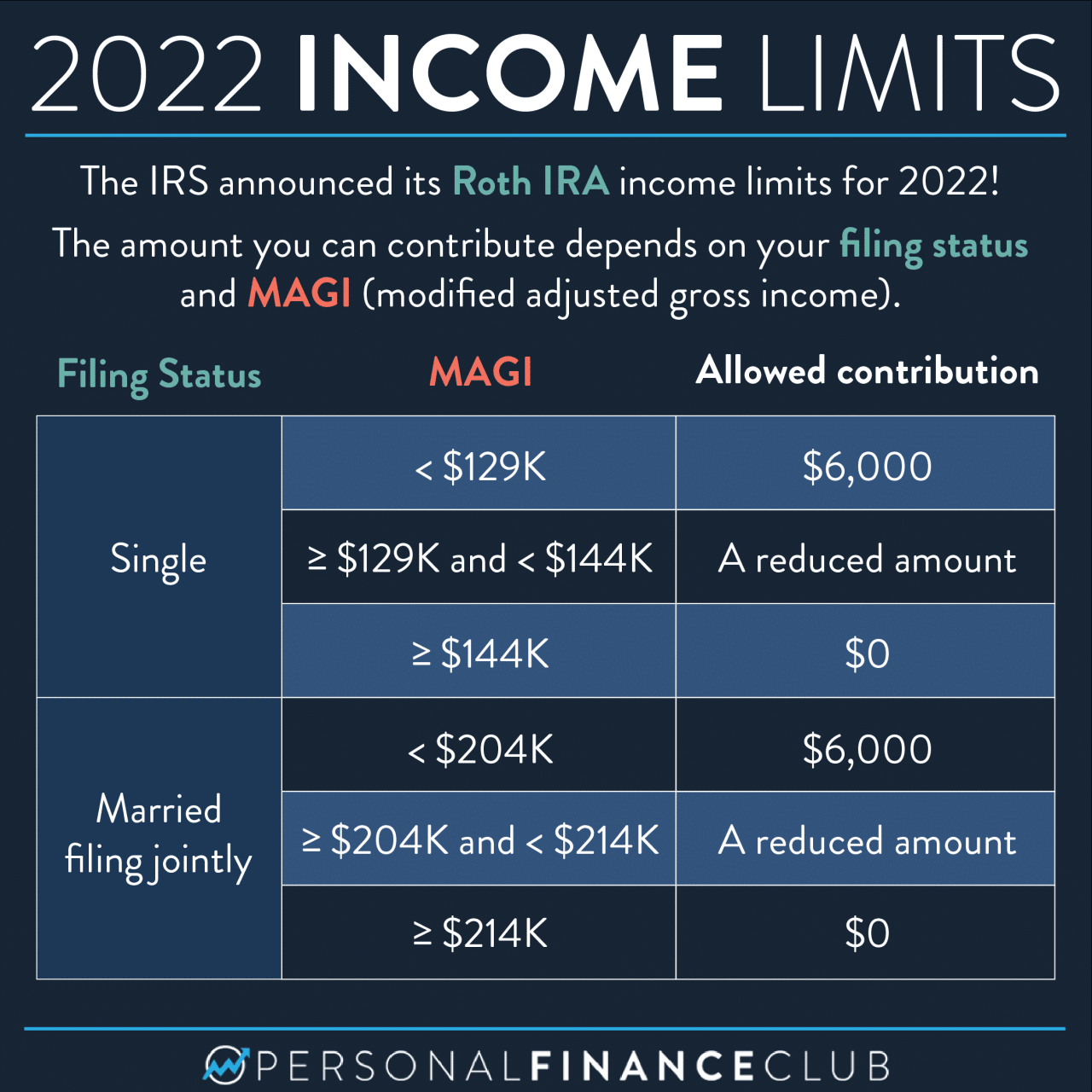

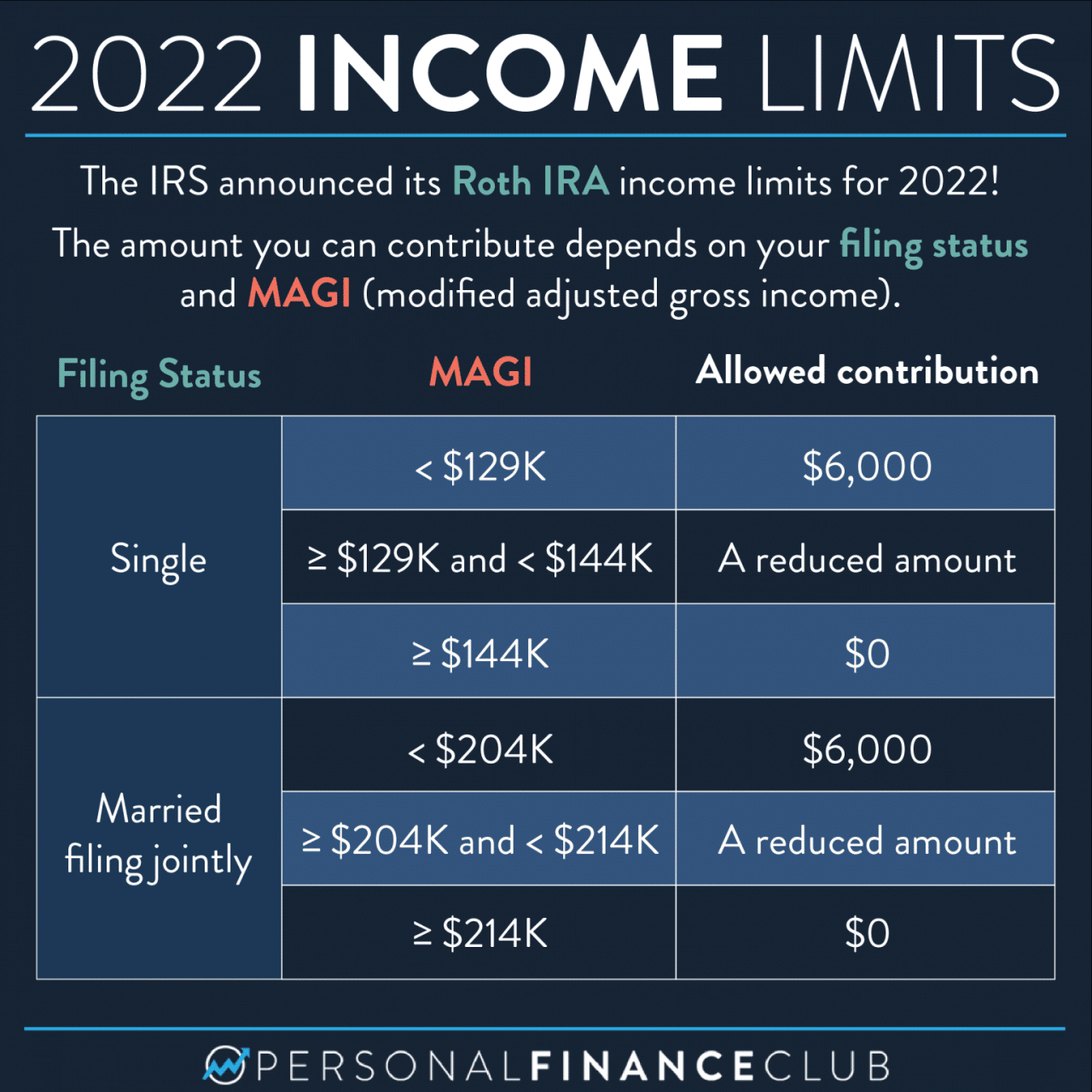

Understanding the Roth IRA contribution limit for 2024 is crucial for avoiding penalties. This limit applies to individuals and couples, and exceeding it can result in hefty penalties. Furthermore, we’ll discuss the tax implications of excess contributions, including the potential for penalties and how to correct them.

Finally, we’ll explore alternative retirement savings options that might be more suitable for individuals who wish to contribute more than the Roth IRA limit.

Understanding the Roth IRA Contribution Limit

The Roth IRA is a popular retirement savings vehicle that offers tax-free withdrawals in retirement. To encourage contributions, the IRS sets an annual contribution limit for Roth IRAs. This limit applies to all Roth IRA contributions, regardless of the number of Roth IRAs you have.

Understanding this limit is crucial to ensure you maximize your contributions while avoiding potential penalties.

The Roth IRA Contribution Limit for 2024

The IRS sets the annual contribution limit for Roth IRAs. For 2024, the maximum amount you can contribute to a Roth IRA is $7,500. If you are 50 or older, you can contribute an additional $1,500as a catch-up contribution, bringing the total limit to $9,000.

It’s important to stay informed about the 401k contribution limit for 2024. Find out the 401k contribution limit for 2024 so you can make the most of your retirement savings.

Consequences of Exceeding the Contribution Limit

Exceeding the Roth IRA contribution limit can lead to penalties. The IRS considers excess contributions as a taxable distribution. This means you will be taxed on the excess contribution amount, and you may also face a 6% penalty on the excess contribution.

The W9 form is used to provide your tax information to payees. Learn how to fill out the W9 Form for October 2024 to ensure you’re providing the correct information.

Situations Where Exceeding the Limit Might Occur

There are a few situations where you might inadvertently exceed the Roth IRA contribution limit:

- Contributing to multiple Roth IRAs:If you have multiple Roth IRAs, make sure you track your contributions to each account to avoid exceeding the overall limit.

- Making a late contribution:If you make a contribution for a previous year after the deadline, you might exceed the limit for that year.

- Failing to account for catch-up contributions:If you are 50 or older, make sure you are aware of the additional catch-up contribution limit and do not exceed it.

Alternative Retirement Savings Options

If you’ve reached the Roth IRA contribution limit for 2024 and are still looking to save for retirement, there are other options available to you. These options vary in terms of contribution limits, tax benefits, and eligibility requirements, so it’s important to carefully consider each one before making a decision.

Married couples have a higher IRA contribution limit than single individuals. Check out the IRA contribution limits for married couples in 2024 to maximize your retirement savings.

Traditional IRA

A Traditional IRA is another retirement savings account that offers tax benefits. Unlike a Roth IRA, contributions to a Traditional IRA are tax-deductible, meaning you can deduct your contributions from your taxable income in the year you make them. However, you’ll have to pay taxes on your withdrawals in retirement.

Small business owners face unique tax implications. Learn about the 2024 tax implications for small business owners to ensure you’re compliant and taking advantage of available deductions and credits.

- Contribution Limit:$6,500 in 2024 (or $7,500 if you’re 50 or older).

- Tax Benefits:Tax-deductible contributions, but withdrawals are taxed in retirement.

- Pros:Tax-deductible contributions can reduce your current tax liability. May be a better option for those who expect to be in a lower tax bracket in retirement.

- Cons:Withdrawals are taxed in retirement. You may need to pay taxes on your distributions if you’re in a higher tax bracket in retirement than you were when you made your contributions.

401(k)

A 401(k) is a retirement savings plan offered by your employer. You can contribute pre-tax dollars to your 401(k) and your contributions will grow tax-deferred. Your employer may also offer a matching contribution, which is free money that can help you save for retirement faster.

- Contribution Limit:$22,500 in 2024 (or $30,000 if you’re 50 or older).

- Tax Benefits:Tax-deferred growth and withdrawals. Some employers offer matching contributions.

- Pros:Tax-deferred growth and withdrawals can help you save more for retirement. Employer matching contributions can boost your savings.

- Cons:Your employer may not offer a matching contribution. You may be limited in your investment choices. You may have to pay taxes on your withdrawals in retirement.

403(b)

A 403(b) is a retirement savings plan offered by certain non-profit organizations, such as schools, hospitals, and religious organizations. Similar to a 401(k), contributions to a 403(b) are tax-deferred, and you may be eligible for employer matching contributions.

It’s always good to know the IRA contribution limits for the future. Check out the IRA contribution limits for 2024 and beyond to plan your retirement savings.

- Contribution Limit:$22,500 in 2024 (or $30,000 if you’re 50 or older).

- Tax Benefits:Tax-deferred growth and withdrawals. Some employers offer matching contributions.

- Pros:Tax-deferred growth and withdrawals can help you save more for retirement. Employer matching contributions can boost your savings.

- Cons:Your employer may not offer a matching contribution. You may be limited in your investment choices. You may have to pay taxes on your withdrawals in retirement.

Solo 401(k)

A Solo 401(k) is a retirement savings plan designed for self-employed individuals and small business owners. It combines features of both a traditional 401(k) and a SEP IRA, allowing you to make both employee and employer contributions.

If you drive your vehicle for business purposes, you can deduct the cost of mileage. Find out the October 2024 mileage rate for business use to make sure you’re claiming the correct amount.

- Contribution Limit:$66,000 in 2024 (or $73,500 if you’re 50 or older).

- Tax Benefits:Tax-deferred growth and withdrawals. Contributions are tax-deductible.

- Pros:Higher contribution limits than traditional IRAs. Tax-deductible contributions can reduce your current tax liability.

- Cons:May be more complex to set up and manage than other retirement savings plans. You may need to pay taxes on your withdrawals in retirement.

SEP IRA

A SEP IRA is a retirement savings plan for self-employed individuals and small business owners. It allows you to contribute a percentage of your net adjusted self-employment income.

Freelancers have until October 2024 to file their taxes, but if you need more time, you can request an extension. Learn more about the tax extension deadline for freelancers. This gives you extra time to gather all your necessary documents and ensure you’re taking advantage of all the deductions and credits available to you.

- Contribution Limit:25% of your net adjusted self-employment income, up to $66,000 in 2024.

- Tax Benefits:Tax-deductible contributions, but withdrawals are taxed in retirement.

- Pros:Simple to set up and manage. Contributions are tax-deductible.

- Cons:Lower contribution limits than Solo 401(k)s. You may need to pay taxes on your withdrawals in retirement.

Defined Benefit Plan

A defined benefit plan is a type of pension plan that provides a guaranteed monthly income in retirement, based on your years of service and salary. This type of plan is typically offered by larger employers.

If you’re contributing to a 401k, you’ll want to know the contribution limits for 2024. Check out the 401k contribution limit for 2024 to make sure you’re maximizing your retirement savings.

- Contribution Limit:Varies depending on the plan.

- Tax Benefits:Contributions are tax-deductible, and benefits are taxed in retirement.

- Pros:Provides a guaranteed monthly income in retirement. Can be a good option for those who want to ensure they have a steady income in retirement.

- Cons:Not offered by all employers. Benefits may be lower than you expect if your employer goes out of business.

Strategies for Maximizing Retirement Savings

Maximizing your retirement savings is crucial for ensuring a comfortable and secure future. A well-designed plan can help you reach your financial goals and achieve peace of mind.

If you’re working with government agencies, you’ll need to fill out a W9 form. Learn more about the W9 Form for October 2024 for government agencies to ensure you’re providing the correct information.

Retirement Savings Plan Design

Designing a retirement savings plan involves a systematic approach to ensure you maximize contributions within the limits and achieve your financial goals. This includes identifying your retirement needs, establishing a timeline, and selecting appropriate savings vehicles.

Looking to save for retirement in a Roth 401k? The contribution limits for Roth 401ks are different from traditional 401ks. Find out the 401k contribution limits for Roth 401ks in 2024 to make sure you’re staying within the guidelines.

- Identify Your Retirement Needs:Determine your desired lifestyle, housing costs, healthcare expenses, and other financial needs during retirement. This helps you estimate the amount of savings required.

- Establish a Timeline:Set a realistic timeline for retirement and consider factors such as your age, current savings, and expected income.

- Select Appropriate Savings Vehicles:Choose a combination of retirement accounts that align with your financial situation, risk tolerance, and tax preferences.

Optimizing Contributions Across Different Accounts

Optimizing contributions across different accounts involves strategically allocating your savings to maximize tax benefits and potential growth.

Wondering how much you might owe in taxes this year? A tax calculator can help you estimate your tax liability. Use this tax calculator to see the latest tax brackets and figure out your potential tax burden. This can help you plan your finances and make informed decisions about your tax strategy.

- Maximize Employer Matching:If your employer offers a 401(k) plan with matching contributions, take full advantage of this opportunity. It’s free money, and it significantly boosts your savings.

- Utilize Roth IRA Contributions:Roth IRAs offer tax-free withdrawals in retirement, making them a valuable option for those who anticipate being in a higher tax bracket later in life.

- Consider Traditional IRA Contributions:Traditional IRAs allow for pre-tax contributions, reducing your current tax burden. However, withdrawals in retirement are taxable.

- Explore Other Retirement Savings Options:Beyond traditional and Roth IRAs, consider options like Solo 401(k)s, SEP IRAs, and SIMPLE IRAs, which offer unique advantages depending on your self-employment status or small business ownership.

Diversification in Retirement Savings

Diversification is a key strategy for managing risk and maximizing returns in retirement savings. It involves spreading your investments across different asset classes, such as stocks, bonds, and real estate.

- Invest in Stocks:Stocks offer the potential for higher returns over the long term, but they also carry higher risk.

- Include Bonds:Bonds provide more stability and income than stocks, but their returns are typically lower.

- Consider Real Estate:Real estate can offer diversification and potential for appreciation, but it also involves higher liquidity risk.

“Diversification is key to mitigating risk and maximizing returns in retirement savings.”

Tax Implications of Excess Contributions: Can I Contribute More Than The Roth IRA Limit In 2024

Exceeding the Roth IRA contribution limit can lead to tax penalties and complications. Understanding these implications is crucial for ensuring you maximize your retirement savings without facing unwanted financial consequences.

Tax deductions and credits can help you save money on your taxes. Use this tax calculator to explore deductions and credits you might be eligible for and maximize your tax savings.

Penalties for Excess Contributions

Penalties for exceeding the Roth IRA contribution limit are applied to the amount exceeding the limit. These penalties are calculated as a 6% excise tax on the excess amount each year until the excess contribution is removed. The penalty applies to the excess contribution plus any earnings on that amount.

If you use your vehicle for business purposes, you can deduct the cost of mileage. Check out the standard mileage rate for October 2024 to see how much you can deduct.

- The penalty is applied annually until the excess contribution is withdrawn.

- The penalty is not applied to the earnings on the excess contribution if the excess contribution is withdrawn within the same year it was made.

“The penalty for excess contributions is 6% of the excess contribution each year until the excess contribution is withdrawn.”

Students may be eligible for a standard deduction. Learn more about the standard deduction for students in 2024 to see if you can benefit from this tax break.

Correcting Excess Contributions

If you realize you have exceeded the Roth IRA contribution limit, you can correct the situation by withdrawing the excess contribution. You have until the tax filing deadline for the year following the year of the excess contribution to withdraw the excess contribution and avoid penalties.

There are some changes and updates to the W9 Form for October 2024. Make sure you’re aware of the W9 Form changes and updates for October 2024 to ensure you’re providing accurate information.

This withdrawal is considered a tax-free return of contribution, meaning it will not be subject to income tax. However, any earnings on the excess contribution will be taxable.

- The excess contribution can be withdrawn before the tax filing deadline for the year following the year of the excess contribution to avoid penalties.

- Any earnings on the excess contribution are taxable when withdrawn.

“You can withdraw the excess contribution and avoid penalties if you do so before the tax filing deadline for the year following the year of the excess contribution.”

Seeking Professional Advice

Navigating retirement savings can be complex, especially when considering options beyond the standard contribution limits. Consulting with a financial advisor can provide valuable insights and guidance to help you make informed decisions about your retirement planning.While seeking professional advice is always a good idea, there are specific situations where it becomes essential.

When to Seek Professional Advice, Can I contribute more than the Roth IRA limit in 2024

A financial advisor can provide tailored advice and strategies to help you achieve your retirement goals. Here are some scenarios where seeking professional advice is particularly beneficial:

- High Income Earners:If your income exceeds the Roth IRA contribution limit, a financial advisor can help you explore alternative retirement savings options, such as a 401(k) or Solo 401(k), and determine the most advantageous approach for your specific circumstances.

- Complex Financial Situations:If you have a complex financial situation, such as multiple sources of income, significant assets, or unique tax considerations, a financial advisor can help you develop a comprehensive retirement plan that addresses all your needs.

- Desire for Personalized Strategies:If you’re looking for personalized retirement savings strategies that go beyond standard advice, a financial advisor can help you identify opportunities to maximize your contributions, optimize your investment portfolio, and minimize tax implications.

- Uncertainty about Retirement Planning:If you’re unsure about your retirement goals, investment options, or the best strategies for achieving financial security, a financial advisor can provide clarity and guidance, helping you develop a well-defined plan.

Finding Qualified Financial Advisors

Several resources can help you find qualified financial advisors who can provide expert advice and support your retirement planning:

- Professional Organizations:Organizations such as the Certified Financial Planner Board of Standards (CFP Board), the National Association of Personal Financial Advisors (NAPFA), and the Financial Planning Association (FPA) offer directories of certified financial planners and advisors.

- Online Platforms:Websites like Advisorpedia and Financial Advisor Finder provide comprehensive listings of financial advisors, allowing you to filter by location, expertise, and other criteria.

- Referrals:Ask friends, family, or colleagues for recommendations of financial advisors they have worked with and found helpful.

Concluding Remarks

Navigating the complexities of retirement savings requires careful planning and consideration. Understanding the Roth IRA contribution limit and its implications is crucial for maximizing your savings while staying compliant. If you’re unsure about your contribution strategies or need personalized advice, consulting a financial advisor is highly recommended.

By understanding your options and seeking expert guidance, you can confidently build a secure financial future.

Popular Questions

What happens if I accidentally exceed the Roth IRA contribution limit?

If you accidentally contribute more than the Roth IRA limit, you have options to correct the excess contribution. You can withdraw the excess contribution before the tax filing deadline for the year, or you can choose to pay a penalty.

Consult a financial advisor for guidance on the best course of action.

Are there any exceptions to the Roth IRA contribution limit?

There are some exceptions to the Roth IRA contribution limit, such as if you are a member of the military serving in a combat zone or if you are a participant in a qualified employer-sponsored retirement plan. Consult the IRS website for more information.