Calculating The Annuity Factor 2024 is a crucial aspect of financial planning, particularly when dealing with investments, loans, and retirement savings. Annuity factors are mathematical tools that help us determine the present value of a stream of future payments, making them essential for making informed financial decisions.

This guide will delve into the concept of annuity factors, explaining their significance and exploring various applications in financial calculations. We’ll cover the formula for calculating annuity factors, provide practical examples, and discuss factors that influence their values.

Understanding Annuity Factors

Annuity factors are essential tools in finance that help us understand the value of a stream of equal payments over a specific period. They are particularly useful for calculating present and future values of annuities, which are a series of regular payments made over time.

Understanding annuity factors is crucial for various financial applications, including loan calculations, retirement planning, and investment analysis.

Concept of Annuity Factors, Calculating The Annuity Factor 2024

An annuity factor is a mathematical representation of the present value of a series of equal payments, assuming a specific interest rate and time period. It essentially converts a stream of future payments into a single equivalent value at the present time.

If you’re looking for information on what happens to an annuity when there’s no beneficiary, you can find details on the Annuity No Beneficiary 2024 page. This page explains the process and potential outcomes, which can vary depending on the specific annuity contract and state regulations.

This factor allows us to compare different investment or loan options by standardizing their values to a common point in time.

The Annuity Method 2024 page explores the various methods used for calculating annuity payments. Understanding these methods can help you make informed decisions about choosing the right annuity for your needs.

Significance of Annuity Factors

Annuity factors are significant in financial calculations because they simplify the process of valuing annuities. By using these factors, we can quickly determine the present value or future value of an annuity without manually calculating each individual payment and its time value.

For those considering a $400,000 annuity, the Annuity 400k 2024 page can provide valuable information. This page discusses the potential benefits and considerations for investing this specific amount in an annuity.

This efficiency is crucial for making informed financial decisions, especially when dealing with complex financial instruments.

Types of Annuity Factors

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity is often used in lease agreements and rent payments.

Calculating Annuity Factors

Calculating annuity factors involves determining the present value of a series of equal payments. The formula for calculating annuity factors depends on whether the annuity is an ordinary annuity or an annuity due.

The Calculate Annuity Hp12c 2024 page provides guidance on how to use the HP-12C financial calculator for annuity calculations. This page explains the various functions and formulas you can use to calculate annuity payments, present values, and other relevant data.

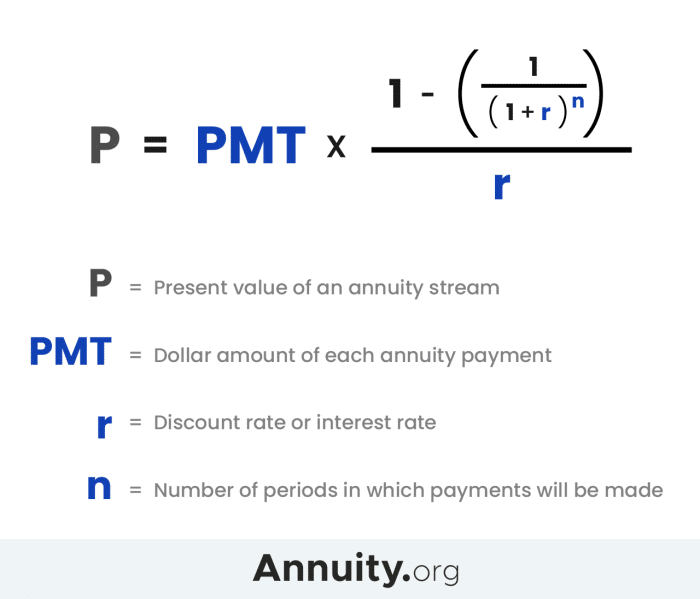

Formula for Calculating Annuity Factors

Ordinary Annuity:

Calculating the present value of an annuity is an important step in financial planning. The Pv Calculator Annuity 2024 page provides a tool for determining the present value of your annuity, which can help you make informed investment decisions.

Annuity Factor = (1 – (1 + r)^-n) / r

Annuity Due:

Annuity Factor = (1 – (1 + r)^-n) / r – (1 + r)

For those approaching retirement age, the Annuity 65 2024 page can provide valuable insights. This page focuses on annuities specifically for individuals turning 65 in 2024, discussing potential benefits and considerations for this age group.

Where:

- r = Interest rate per period

- n = Number of periods

Step-by-Step Guide to Calculating Annuity Factors Manually

- Determine the interest rate per period (r):This is the annual interest rate divided by the number of periods per year. For example, if the annual interest rate is 5% and payments are made monthly, the interest rate per period would be 5% / 12 = 0.4167%.

- Determine the number of periods (n):This is the total number of payments in the annuity. For example, if payments are made monthly for 5 years, the number of periods would be 5 years

12 months/year = 60.

- Plug the values of r and n into the appropriate annuity factor formula:Use the formula for ordinary annuity if payments are made at the end of each period, and the formula for annuity due if payments are made at the beginning of each period.

- Calculate the annuity factor:Solve the equation to find the annuity factor.

Calculating Annuity Factors Using Financial Calculators or Spreadsheets

Financial calculators and spreadsheets have built-in functions that can quickly calculate annuity factors. These tools eliminate the need for manual calculations, making the process more efficient and less prone to errors. To use these tools, you need to input the interest rate, number of periods, and type of annuity (ordinary or due).

Applications of Annuity Factors

Annuity factors have numerous applications in finance, helping us understand and manage various financial situations. Some key applications include:

Calculating Loan Payments

Annuity factors are used to calculate the regular payments required to repay a loan over a specific period. By using the loan amount, interest rate, and loan term, we can determine the monthly or other periodic payment using the annuity factor.

The Annuity M 2024 page is a great resource for understanding the “M” type of annuity. This type of annuity is often used for specific financial goals and can be a valuable tool for retirement planning.

This allows borrowers to understand their financial obligations and lenders to assess the feasibility of loan applications.

When it comes to annuity funds, understanding how they’re managed is important. The Annuity Fund Is Unrestricted Fund 2024 page delves into the nature of these funds, explaining how they operate and what factors can influence their growth.

Determining Retirement Savings

Annuity factors are essential for retirement planning. They help us calculate the amount of money needed to accumulate in retirement savings accounts to generate a desired income stream during retirement. By using the estimated annual income needed in retirement, the expected interest rate, and the number of years in retirement, we can determine the necessary savings amount.

The Annuity Jackpot 2024 page delves into the concept of winning a large annuity payout. It explores the potential implications and how to manage such a significant financial windfall.

Other Financial Applications

- Investment Analysis:Annuity factors are used to evaluate the present value of future cash flows from investments, allowing investors to compare different investment opportunities.

- Lease Payments:Annuity factors are used to calculate lease payments, ensuring that the present value of lease payments equals the fair market value of the leased asset.

- Insurance Premiums:Annuity factors are used to calculate insurance premiums, considering the present value of future payouts in case of an insured event.

Factors Affecting Annuity Factors

Several factors can influence annuity factors, affecting the present value of a stream of payments. Understanding these factors is crucial for accurate financial calculations.

If you’re wondering how much income an annuity can generate, the How Much Will An Annuity Pay Calculator 2024 page can provide an estimate. This calculator allows you to input different factors, such as the amount you invest and the interest rate, to see potential payout amounts.

Impact of Interest Rates

Interest rates have a direct impact on annuity factors. As interest rates increase, the present value of future payments decreases. This is because higher interest rates imply that money invested today will grow faster, making future payments less valuable in today’s terms.

Need to determine the current value of an annuity? The Annuity Value Calculator 2024 page offers a convenient tool for this. You can input details like the annuity’s initial investment and interest rate to calculate its current worth.

Conversely, lower interest rates lead to higher annuity factors, as future payments are worth more in today’s terms.

Relationship Between Time Period and Annuity Factors

The time period over which payments are made also affects annuity factors. As the time period increases, the annuity factor decreases. This is because the further into the future the payments are made, the less valuable they become in today’s terms.

Calculating the exclusion ratio of an annuity is crucial for tax purposes. The Calculate Annuity Exclusion Ratio 2024 page provides guidance on how to determine this ratio, ensuring you understand the tax implications of your annuity payments.

The longer the time period, the greater the impact of time value of money, leading to a lower present value.

Looking for a lighthearted take on annuities? The Annuity Jokes 2024 page offers a collection of humorous anecdotes related to annuities. It’s a fun way to learn about these financial products in a relaxed setting.

Different Payment Frequencies

The frequency of payments also influences annuity factors. More frequent payments, such as monthly payments, lead to lower annuity factors compared to less frequent payments, such as annual payments. This is because more frequent payments allow for more compounding of interest, leading to a lower present value of the payment stream.

Annuity Factor Tables

Annuity factor tables are valuable tools that provide pre-calculated annuity factors for different interest rates and time periods. These tables simplify the process of determining annuity factors, eliminating the need for manual calculations.

Annuity payments can be a steady source of income, but understanding how they work is crucial. To learn more about the series of payments involved, you can visit the Annuity Is A Series Of 2024 page. This page will give you a clear understanding of how annuity payments are structured and calculated.

Annuity Factor Table

| Interest Rate | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years |

|---|---|---|---|---|---|

| 1% | 0.9901 | 1.9704 | 2.9410 | 3.9020 | 4.8534 |

| 2% | 0.9804 | 1.9416 | 2.8839 | 3.8077 | 4.7135 |

| 3% | 0.9709 | 1.9135 | 2.8286 | 3.7171 | 4.5797 |

| 4% | 0.9615 | 1.8861 | 2.7751 | 3.6299 | 4.4518 |

| 5% | 0.9524 | 1.8594 | 2.7232 | 3.5460 | 4.3295 |

Advantages and Disadvantages of Using Annuity Factor Tables

- Advantages:

- Convenience: Annuity factor tables provide readily available factors for various interest rates and time periods.

- Efficiency: They eliminate the need for manual calculations, saving time and effort.

- Disadvantages:

- Limited Scope: Tables may not cover all interest rates and time periods, requiring interpolation or alternative methods.

- Accuracy: Rounding errors may occur in table values, potentially affecting the accuracy of calculations.

Interpreting and Utilizing Annuity Factor Tables

To interpret and utilize annuity factor tables, locate the intersection of the desired interest rate and time period. The corresponding value represents the annuity factor. For example, if the interest rate is 3% and the time period is 4 years, the annuity factor is 2.7751.

This factor can then be used to calculate the present value or future value of an annuity.

Want to calculate how much an annuity could potentially pay out? The Annuity Calculator Bmo 2024 page provides a helpful tool for this purpose. It allows you to input various factors, such as the amount you invest and your desired payout frequency, to estimate potential returns.

Last Point: Calculating The Annuity Factor 2024

Understanding annuity factors empowers individuals and businesses to make informed financial decisions. By grasping the concepts and methods presented in this guide, you can navigate complex financial scenarios with greater confidence. Whether you’re planning for retirement, taking out a loan, or investing your savings, the knowledge of annuity factors provides valuable insights into the long-term implications of your financial choices.

General Inquiries

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do interest rates affect annuity factors?

Higher interest rates generally result in lower annuity factors, as the future payments are discounted more heavily.

What are the advantages and disadvantages of using annuity factor tables?

Annuity factor tables offer quick and easy access to pre-calculated factors, but they may not be available for all interest rates and time periods.