Calculating Lottery Annuity Payments 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Winning the lottery is a dream for many, but navigating the complexities of annuity payments can be daunting.

It can be frustrating to find your annuity is out of surrender. This article explains what that means and what options you may have.

This guide explores the intricacies of lottery annuities, providing insights into how these payments work, the factors that influence their structure, and the financial considerations that come with them. From understanding the basic concepts of annuities to navigating the tax implications and exploring alternative investment options, this comprehensive guide will empower you to make informed decisions about your lottery winnings.

If you’re thinking about using your 401k to purchase an annuity, you might want to read this article on annuities and 401ks in 2024 to get a better understanding of the potential benefits and drawbacks.

Whether you’re a seasoned investor or a first-time lottery winner, understanding lottery annuities is crucial. This guide will equip you with the knowledge you need to make the most of your winnings and ensure a secure financial future. We’ll delve into the details of annuity payment structures, explore the tax implications, and provide practical tips for financial planning with annuity payments.

You can use an annuity calculator to estimate your future income based on your life expectancy. This article provides a guide to using annuity calculators and their benefits.

By the end of this guide, you’ll have a clear understanding of the various aspects of lottery annuities and be well-equipped to make informed decisions about your winnings.

Lottery Annuity Basics: Calculating Lottery Annuity Payments 2024

Winning the lottery is a life-changing event, but how you choose to receive your winnings can significantly impact your financial future. One common option is to receive your winnings in the form of an annuity, which is a series of regular payments over a set period of time.

Many annuities offer a guaranteed period of payments. This article discusses 5-year guaranteed annuities and their potential benefits.

This article will delve into the intricacies of lottery annuity payments, exploring their structure, tax implications, and financial planning considerations.

When it comes to retirement planning, you might be considering an annuity or drawdown. This article helps you compare and contrast these two options to make the best decision for your needs.

Understanding Lottery Annuities, Calculating Lottery Annuity Payments 2024

A lottery annuity payment is a structured payout of lottery winnings spread out over a specified number of years. Instead of receiving a lump sum, winners opt for a series of regular payments, often annually, over a predetermined duration. This approach offers a steady stream of income, potentially easing the burden of managing a large sum of money and mitigating the risk of financial mismanagement.

Lump Sum vs. Annuity

The decision between a lump sum payout and an annuity is a crucial one, heavily influenced by individual financial circumstances and risk tolerance. A lump sum payout offers immediate access to the entire winnings, allowing for greater flexibility in investment and spending.

However, it also comes with the responsibility of managing a significant sum of money, potentially leading to unwise investments or impulsive spending.

You might be wondering if you can still work while receiving an annuity. This article explores the relationship between working and receiving annuity payments.

- Lump Sum Payout:Immediate access to the full winnings, offering flexibility but demanding responsible financial management.

- Annuity:Regular payments over time, providing a steady income stream and potentially reducing financial strain, but limiting immediate access to the full winnings.

Annuity Payment Examples

Imagine winning a lottery jackpot of $100 million. You have the option of receiving the entire amount as a lump sum or opting for an annuity. If you choose the annuity, you might receive annual payments of $5 million for 20 years.

This provides a consistent income stream but restricts your immediate access to the full amount.

Annuity Payment Structure

Lottery annuity payments typically follow a structured schedule, ensuring regular income for the recipient. The specific payment structure can vary depending on the lottery and the chosen payout period. However, the general principles remain consistent.

To better understand annuities, you might want to review a definition of annuities and how they work. This article helps clear up any confusion.

Payment Schedule

Lottery annuities usually involve annual payments, although some lotteries offer more frequent payments, such as semi-annual or quarterly. The duration of the payment period is determined by the lottery and can range from 20 to 30 years or even longer.

Each payment is typically adjusted for inflation, ensuring that the purchasing power of the payments remains relatively consistent over time.

Factors Influencing Payment Amount

The amount of each annuity payment is determined by several factors, including the total jackpot amount, the chosen payment period, and the prevailing interest rates. Lotteries typically calculate the annuity payments based on a discounted present value formula, taking into account the time value of money.

There are different types of annuities, and the 72t annuity is one that allows you to withdraw funds before age 59 1/2 without penalty. It’s a good idea to understand the rules and regulations before you decide if it’s right for you.

This means that the initial payments are larger than subsequent payments, reflecting the potential for interest earnings over time.

- Total Jackpot Amount:The larger the jackpot, the larger the individual annuity payments will be.

- Payment Period:Longer payment periods generally result in smaller individual payments, as the total winnings are spread out over a longer time.

- Interest Rates:The prevailing interest rates at the time of the lottery drawing can influence the annuity payment amount, as lotteries typically base their calculations on a specific interest rate.

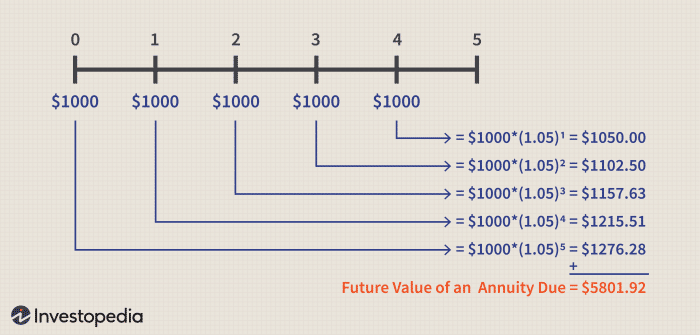

Interest Accumulation

While lottery annuities are not traditional investments, they do involve a degree of interest accumulation. The lottery organization invests the lump sum winnings and uses the interest earned to fund the annuity payments. This means that the initial annuity payments are larger than subsequent payments, as the interest earned on the invested funds gradually decreases over time.

One of the key features of annuities is their indefinite duration. This article delves into the concept of indefinite duration and its implications for annuity holders.

Tax Implications of Annuity Payments

Lottery winnings, including annuity payments, are subject to taxation in most jurisdictions. Understanding the tax implications of annuity payments is crucial for effective financial planning.

Tax Treatment of Annuity Payments

Annuity payments are typically treated as ordinary income for tax purposes. This means that they are taxed at the recipient’s ordinary income tax rate, which can vary depending on their income level and filing status. It’s important to note that the tax rate may be subject to change over time, so it’s advisable to consult with a tax professional for current information and guidance.

Potential Tax Deductions

While annuity payments are generally taxed as ordinary income, there may be some potential tax deductions available to recipients. For example, if a portion of the annuity payment represents interest earned on the invested funds, that portion may be eligible for a deduction.

An annuity is known for providing a steady stream of income. This article explores the concept of guaranteed income and its importance for retirement planning.

However, it’s essential to consult with a tax professional to determine eligibility and specific deductions.

If you’re wondering if annuities are a good idea in 2024, you might want to check out this article on why annuities might be bad in 2024. It’s important to weigh the pros and cons before making any decisions.

Tax Calculation Examples

Let’s consider an example. If an annuity recipient receives an annual payment of $5 million and their ordinary income tax rate is 30%, they would owe $1.5 million in taxes on that payment. However, if a portion of the payment represents interest earned, that portion may be eligible for a deduction, reducing the overall tax liability.

The annuity exclusion ratio is an important factor to consider when calculating your tax liability. This article explains the ratio and its impact on your tax obligations.

Financial Planning with Annuity Payments

Receiving a lottery annuity requires careful financial planning to ensure long-term financial security and achieve desired financial goals.

Importance of Financial Planning

Proper financial planning is essential for lottery annuity recipients to maximize the benefits of their winnings and avoid potential financial pitfalls. This includes creating a comprehensive budget, setting realistic financial goals, and developing an investment strategy that aligns with their risk tolerance and time horizon.

It’s important to understand how annuities are treated under the Income Tax Act. This article sheds light on the tax implications of annuities in 2024.

Financial Goals

Lottery annuity payments can provide the financial means to achieve a wide range of financial goals, including:

- Debt Consolidation:Use the annuity payments to pay off high-interest debts, such as credit card debt or student loans.

- Investment:Invest a portion of the payments in a diversified portfolio of assets, such as stocks, bonds, and real estate, to grow wealth over time.

- Home Purchase:Use the annuity payments to purchase a dream home or upgrade to a larger residence.

- Education:Fund children’s education or pursue further education or training.

- Charitable Giving:Support favorite charities or philanthropic causes.

- Retirement Planning:Secure a comfortable retirement by investing in retirement accounts or purchasing an annuity to provide a steady income stream in later years.

Risk Management and Maximizing Returns

While lottery annuities offer a steady income stream, it’s important to manage risk and maximize returns on these payments. This includes:

- Diversification:Avoid putting all your eggs in one basket. Diversify your investments across different asset classes to reduce risk and potentially enhance returns.

- Professional Advice:Seek guidance from financial advisors and tax professionals to develop a comprehensive financial plan and make informed investment decisions.

- Long-Term Perspective:Resist the temptation to spend all your winnings immediately. Think long-term and develop a plan to ensure financial security for yourself and future generations.

Alternatives to Lottery Annuities

While lottery annuities offer a structured approach to receiving winnings, they are not the only option. Lottery winners have alternative investment options that can potentially provide greater flexibility and control over their finances.

To get a better idea of how annuities work in practice, you can look at examples of different annuity scenarios and see how they might apply to your situation.

Alternative Investment Options

Some alternative investment options for lottery winners include:

- Direct Investments:Invest directly in stocks, bonds, real estate, or other assets, allowing for greater control over investment decisions.

- Mutual Funds and Exchange-Traded Funds (ETFs):Diversify investments across a wide range of assets through mutual funds or ETFs, offering professional management and lower investment minimums.

- Private Equity and Venture Capital:Invest in private companies or emerging technologies for potentially higher returns, but also higher risk.

- Real Estate:Purchase rental properties or invest in commercial real estate for potential income and appreciation.

- Business Ventures:Start or invest in a business, leveraging the lottery winnings to create a new revenue stream.

Pros and Cons of Different Strategies

Each investment strategy has its own set of pros and cons, including potential returns, risk levels, and liquidity. It’s important to carefully consider your financial goals, risk tolerance, and time horizon when choosing an investment strategy.

Potential Risks and Rewards

Alternative investment options offer the potential for higher returns than traditional investments, but they also come with increased risk. It’s essential to understand the potential risks and rewards associated with each investment option before making a decision.

Outcome Summary

Winning the lottery can be a life-changing event, but it’s important to remember that it’s just the beginning of a new journey. Understanding lottery annuities and making informed financial decisions is essential to maximizing your winnings and securing a bright future.

This guide has provided you with a comprehensive overview of lottery annuities, covering everything from the basics to advanced financial planning strategies. Armed with this knowledge, you can confidently navigate the complexities of lottery annuities and make the most of your newfound wealth.

It’s a common misconception that annuities are a form of lottery. This article clears up the confusion and provides a better understanding of how annuities work.

User Queries

What is the difference between a lump sum payout and an annuity?

A lump sum payout provides you with the entire lottery prize amount at once, while an annuity distributes the winnings in equal annual installments over a specified period.

How are lottery annuity payments taxed?

Lottery annuity payments are typically taxed as ordinary income. You will receive a 1099-R form from the lottery provider, which reports the amount of the payment and the amount withheld for taxes.

What are some alternative investment options for lottery winners?

Some alternatives include investing in stocks, bonds, real estate, or starting your own business. It’s important to consult with a financial advisor to determine the best investment options for your specific circumstances.