Calculating Annuity Rate Of Return 2024 is crucial for individuals and investors looking to understand the potential returns on their annuity investments. Annuities are financial products that provide a stream of regular payments, often used for retirement planning or income generation.

Tax laws and regulations can vary from country to country. Is Annuity Income Taxable In India 2024 can provide information on the tax implications of annuity income in India.

This guide will delve into the methods for calculating annuity rate of return, analyzing the factors that influence it, and exploring the potential for growth in 2024.

While an annuity can be a valuable tool for retirement planning, it’s important to understand its potential drawbacks. An Annuity Is Sometimes Called The Flip Side Of 2024 a lump-sum investment, as it involves a trade-off between guaranteed income and potential growth.

Understanding the rate of return on an annuity is essential for making informed financial decisions. It helps investors gauge the potential growth of their investment and compare different annuity options. By analyzing the current market trends and economic conditions, we can gain insights into the potential for annuity rates to increase or decrease in the coming year.

When you’re considering an annuity, it’s important to understand how the payout will be calculated. An Calculating Annuity Payout 2024 tool can help you determine the amount you’ll receive each year, ensuring you’re making informed financial decisions.

This knowledge empowers investors to make strategic choices that align with their financial goals.

Understanding Annuity Rate of Return

An annuity is a financial product that provides a stream of regular payments over a set period of time. The annuity rate of return, also known as the yield, is the annual percentage return that an investor can expect to earn on their annuity investment.

This rate of return is crucial for individuals and investors to understand, as it helps them evaluate the profitability of their annuity investment and compare it to other investment options.

Government agencies often provide resources for financial planning, including Annuity Calculator Gov 2024 tools. These calculators can help you estimate your potential annuity payouts and make informed decisions about your retirement savings.

Defining Annuity Rate of Return

In simple terms, the annuity rate of return is the annual percentage gain that you earn on your annuity investment. It reflects the growth of your principal investment and the interest or earnings generated by the annuity. The higher the annuity rate of return, the more money you can expect to earn over the life of your annuity.

Significance of Calculating Annuity Rate of Return

- Evaluating Investment Performance:Calculating the annuity rate of return allows you to assess the performance of your annuity investment against other investment options, such as stocks, bonds, or mutual funds. This comparison helps you make informed decisions about your investment portfolio.

- Planning for Retirement:For individuals nearing retirement, the annuity rate of return plays a critical role in determining the amount of income they can expect to receive from their annuity during their retirement years. This information is essential for retirement planning and ensuring financial security.

Calculating the Internal Rate of Return (IRR) for an annuity can be a complex process, but it’s crucial for understanding the true profitability of an investment. You can use an IRR Calculator Annuity 2024 to simplify this process and get a clear picture of your potential returns.

- Making Informed Investment Decisions:Understanding the annuity rate of return helps investors make informed decisions about the type of annuity to choose, the investment period, and the amount of money to invest. This knowledge empowers investors to select annuities that align with their financial goals and risk tolerance.

If you’ve won the lottery, you might be faced with the decision of taking a lump sum or receiving payments over time. Calculating Lottery Annuity Payments 2024 can help you determine the best option for your financial goals.

Factors Influencing Annuity Rate of Return

- Interest Rates:Interest rates are a primary factor influencing the annuity rate of return. Higher interest rates generally lead to higher annuity rates, as the insurer can earn more on its investments. Conversely, lower interest rates may result in lower annuity rates.

Annuity payments are often designed to provide a consistent income stream during retirement. An Annuity Is Primarily Used To Provide 2024 a reliable source of income to help you maintain your lifestyle in your later years.

- Inflation:Inflation erodes the purchasing power of money over time. The impact of inflation on the annuity rate of return is crucial to consider, as it affects the real value of the annuity payments received. A higher inflation rate may lead to a lower real rate of return, even if the nominal rate remains the same.

Annuity products can be used in various financial situations, including retirement planning, estate planning, and even funding college expenses. Annuity Is Used In 2024 for a wide range of financial goals.

- Investment Fees and Expenses:Investment fees and expenses associated with the annuity can significantly impact the overall rate of return. Higher fees and expenses can eat into the returns earned on the investment, reducing the net rate of return for the investor.

Methods for Calculating Annuity Rate of Return

Several methods can be used to calculate the annuity rate of return, each with its own advantages and disadvantages. Understanding these methods helps investors choose the most appropriate approach for their specific situation.

Internal Rate of Return (IRR) Method

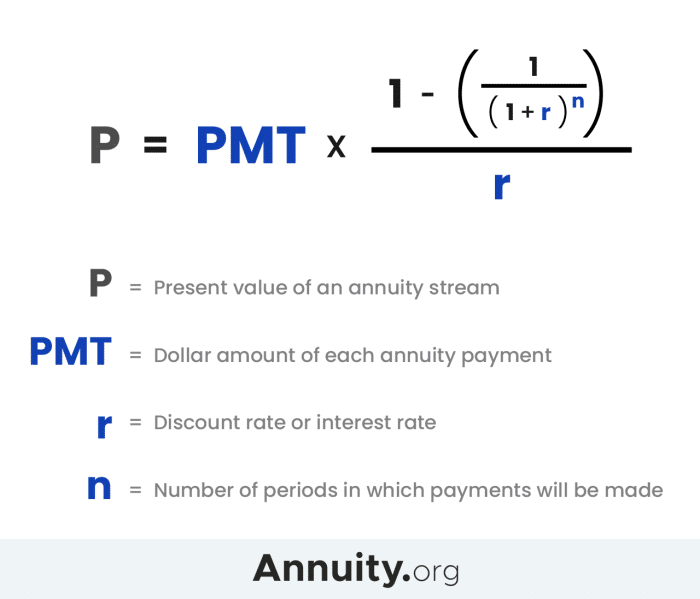

The Internal Rate of Return (IRR) method is a widely used technique for calculating the annuity rate of return. It involves finding the discount rate that makes the present value of the annuity’s future payments equal to the initial investment.

The IRR represents the annualized effective rate of return on the annuity.

- Determine the Initial Investment:Identify the amount of money you initially invested in the annuity.

- Estimate the Future Payments:Project the amount of regular payments you expect to receive from the annuity over its term.

- Use a Financial Calculator or Spreadsheet:Input the initial investment, future payments, and the annuity term into a financial calculator or spreadsheet program. The IRR function will calculate the discount rate that equates the present value of the future payments to the initial investment.

- Interpret the Result:The calculated IRR represents the annuity rate of return. A higher IRR indicates a more favorable investment, while a lower IRR suggests a less attractive return.

Time Value of Money (TVM) Concept, Calculating Annuity Rate Of Return 2024

The Time Value of Money (TVM) concept is fundamental to calculating the annuity rate of return. TVM recognizes that money received today is worth more than the same amount of money received in the future due to its potential to earn interest or grow over time.

When calculating the annuity rate of return, the TVM concept is used to discount future payments to their present value, allowing for a more accurate assessment of the investment’s profitability.

Comparison of Different Methods

Besides the IRR method, other methods for calculating the annuity rate of return include:

- Discount Rate Method:This method uses a predetermined discount rate to calculate the present value of the annuity’s future payments. The discount rate can be based on market interest rates, the risk-free rate of return, or other relevant factors.

- Yield to Maturity (YTM) Method:This method is typically used for fixed-income securities like bonds. It calculates the annual rate of return an investor can expect to earn if they hold the bond until maturity. While not directly applicable to all annuities, it can provide a benchmark for comparison.

The choice of method depends on the specific annuity type, the investor’s financial goals, and the available information. It’s often beneficial to consult with a financial advisor to determine the most appropriate method for your individual circumstances.

Factors Affecting Annuity Rate of Return

Several factors can influence the annuity rate of return, impacting the profitability of the investment. Understanding these factors helps investors make informed decisions and potentially maximize their returns.

Interest Rates

Interest rates play a significant role in determining the annuity rate of return. When interest rates rise, insurers can earn more on their investments, leading to higher annuity rates. Conversely, when interest rates fall, annuity rates tend to decrease.

When you’re considering retirement planning, you may have to decide between an annuity or a lump sum. Annuity Or Lump Sum 2024 can help you understand the pros and cons of each option and make an informed decision for your financial future.

Therefore, investors should monitor interest rate trends and consider their impact on annuity rates.

The age of 70 1/2 is often a significant milestone for retirement planning. Annuity 70 1/2 2024 can provide valuable insights into how annuities can play a role in your retirement income strategy at this age.

Inflation

Inflation erodes the purchasing power of money, reducing the real value of annuity payments over time. While the nominal annuity rate of return may remain the same, the real rate of return, which accounts for inflation, can be significantly lower.

Whether your annuity qualifies for certain tax benefits can depend on various factors. It’s important to understand the tax implications of your annuity. Annuity Is Qualified 2024 can help you determine if your annuity qualifies for any tax advantages.

Investors should factor in inflation when evaluating the annuity rate of return, ensuring that the payments they receive will maintain their purchasing power over time.

Investment Fees and Expenses

Investment fees and expenses associated with the annuity can significantly impact the overall rate of return. These fees can include administrative charges, management fees, and surrender charges. Higher fees and expenses can eat into the returns earned on the investment, reducing the net rate of return for the investor.

It’s essential to carefully review the fee structure of any annuity before investing to understand the potential impact on your returns.

Annuity options can be available within your 401k plan. Annuity 401k 2024 can help you understand the potential benefits of incorporating an annuity into your retirement savings strategy.

Annuity Rate of Return in 2024

Predicting annuity rates in 2024 is challenging, as they are influenced by a complex interplay of economic factors. However, analyzing current market trends and economic conditions can provide insights into potential scenarios for annuity rates.

BMO, a well-known financial institution, offers annuity products and tools to help you plan for your retirement. Annuity Calculator Bmo 2024 can be a helpful resource for exploring your annuity options.

Current Market Trends and Economic Conditions

As of 2024, the global economy faces several challenges, including high inflation, rising interest rates, and geopolitical uncertainties. These factors can impact the annuity rate of return in various ways. For example, high inflation may lead to higher interest rates, potentially benefiting annuity rates.

However, economic uncertainty and volatility can also create market instability, making it difficult to predict annuity rate trends with certainty.

Potential Scenarios for Annuity Rate of Return in 2024

- Scenario 1: Moderate Economic Growth and Stable Interest Rates:If the economy experiences moderate growth and interest rates remain relatively stable, annuity rates may see modest increases. This scenario suggests that insurers can continue to earn decent returns on their investments, leading to more favorable annuity rates for investors.

- Scenario 2: High Inflation and Rising Interest Rates:In a scenario where inflation remains high and interest rates continue to rise, annuity rates could experience more significant increases. This scenario reflects a more favorable environment for insurers, as they can earn higher returns on their investments, potentially translating into higher annuity payouts for investors.

- Scenario 3: Economic Recession and Falling Interest Rates:If the economy enters a recession and interest rates fall, annuity rates may decline. This scenario reflects a less favorable environment for insurers, as they may face challenges in generating returns on their investments, leading to lower annuity rates for investors.

Recommendations for Maximizing Annuity Rate of Return in 2024

Investors seeking to maximize their annuity rate of return in 2024 should consider the following recommendations:

- Shop Around:Compare annuity rates offered by different insurers to find the most favorable terms and conditions. This comparison can help you identify annuities with higher rates of return and lower fees.

- Consider Fixed Annuities:Fixed annuities offer a guaranteed rate of return for a specific period. While the rates may be lower than variable annuities, they provide greater certainty and protection against market volatility.

- Minimize Fees and Expenses:Carefully review the fee structure of any annuity before investing. Choose annuities with lower fees and expenses to maximize your net rate of return.

- Consult with a Financial Advisor:Seek professional advice from a qualified financial advisor to understand the different types of annuities, their features, and their suitability for your individual financial goals and risk tolerance.

Practical Examples of Calculating Annuity Rate of Return: Calculating Annuity Rate Of Return 2024

To illustrate the calculation of annuity rate of return, let’s consider a hypothetical scenario.

Hypothetical Scenario

Suppose an individual invests $100,000 in an immediate annuity that promises to pay $5,000 per year for 25 years. To calculate the annuity rate of return, we can use the IRR method.

Calculating Annuity Rate of Return using the IRR Method

Using a financial calculator or spreadsheet program, we can input the following information:

- Initial Investment: $100,000

- Annual Payment: $5,000

- Annuity Term: 25 years

The IRR function will calculate the discount rate that equates the present value of the future payments to the initial investment. In this hypothetical scenario, the IRR is approximately 3.8%. This means that the annuity is expected to provide an annualized rate of return of 3.8% over the 25-year period.

Impact of Investment Period and Interest Rates

| Investment Period (Years) | Interest Rate (%) | Annuity Rate of Return (%) |

|---|---|---|

| 10 | 4.0 | 4.5 |

| 15 | 4.5 | 5.2 |

| 20 | 5.0 | 5.8 |

| 25 | 5.5 | 6.4 |

The table above shows the impact of different investment periods and interest rates on the annuity rate of return. As the investment period increases, the annuity rate of return generally tends to increase. Similarly, higher interest rates lead to higher annuity rates of return.

An Annuity Certain Is An Example Of 2024 of a type of annuity where the payments are guaranteed for a specific period, regardless of the annuitant’s lifespan. This provides a sense of security and predictability for financial planning.

These factors highlight the importance of considering the investment period and prevailing interest rates when evaluating annuity investment options.

Concluding Remarks

By understanding the intricacies of calculating annuity rate of return and considering the factors that influence it, investors can navigate the complexities of the financial market and make informed decisions. The insights provided in this guide equip investors with the knowledge to maximize their potential returns and achieve their financial aspirations.

As we move forward into 2024, staying informed about market trends and economic conditions will be crucial for maximizing the potential of annuity investments.

FAQ Section

What are the different types of annuities?

Annuities come in various forms, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features and risk profiles, so it’s important to understand the differences before choosing an annuity.

How do taxes affect annuity payments?

Omni Calculator offers a variety of financial tools, including an Omni Calculator Annuity 2024. This calculator can help you compare different annuity options and determine the best fit for your individual needs.

The tax implications of annuity payments vary depending on the type of annuity and the individual’s tax situation. It’s essential to consult with a tax professional to understand the tax consequences of your specific annuity investment.

Are annuities a good investment for everyone?

Annuities can be a valuable investment for some individuals, but they may not be suitable for everyone. It’s crucial to carefully consider your financial goals, risk tolerance, and investment horizon before deciding if an annuity is right for you.