Calculating Annuity Present Values 2024: A Guide delves into the crucial concept of understanding the current worth of a stream of future payments. This guide will illuminate the process of calculating annuity present values, a fundamental tool in financial planning, investment analysis, and various other financial decisions.

Calculating an annuity involves determining the present value of future payments, taking into account factors like interest rates and the duration of payments. Learn more about how to calculate annuities and make informed decisions about your retirement income.

Annuity present value calculations are essential for making informed financial decisions, especially when dealing with investments, loans, or retirement planning. By understanding the present value of future cash flows, individuals and businesses can evaluate the true worth of financial instruments and make sound decisions.

Annuities are primarily used to provide a guaranteed stream of income during retirement. Learn more about the different types of annuities and how they can help you secure your financial future.

Understanding Annuity Present Value

Annuity present value (PV) is the current worth of a series of future payments, discounted to reflect the time value of money. In simpler terms, it’s the amount of money you would need to invest today to receive a stream of future payments at a specific interest rate.

Annuity income is generally considered taxable income in the United States. Learn more about the taxability of annuity income and make informed decisions about your financial future.

This concept is crucial in financial planning, as it helps us make informed decisions about investments, loans, and other financial commitments.

Looking to calculate loan payments in Excel? You can easily calculate annuity loan payments in Excel 2024 using the PMT function. Learn more about how to calculate annuity loan payments in Excel and take control of your finances.

Significance of Annuity Present Value in Financial Planning

Calculating annuity present value allows us to compare different investment options, loan offers, and financial strategies. By understanding the present value of future payments, we can make more informed choices that align with our financial goals. This concept is particularly important for:

- Investment decisions:Knowing the present value of future returns from investments helps us choose the most profitable options.

- Loan analysis:Understanding the present value of loan payments helps us compare different loan offers and choose the most cost-effective option.

- Retirement planning:Calculating the present value of future retirement income allows us to determine how much we need to save to achieve our desired retirement lifestyle.

Real-World Examples of Annuity Present Value Calculations

- Mortgage payments:When applying for a mortgage, the lender calculates the present value of your future monthly payments to determine the maximum loan amount you can afford.

- Retirement savings:You can use annuity present value calculations to determine how much you need to save each month to reach your retirement savings goals.

- Insurance premiums:Insurance companies use annuity present value to calculate the premiums for life insurance policies, considering the present value of future death benefits.

Factors Influencing Annuity Present Value

Several factors determine the present value of an annuity. These factors are interconnected and influence the overall value of the future payments. Understanding these factors is essential for making accurate calculations and informed financial decisions.

Annuities can be structured for a fixed term or for life, depending on your needs and preferences. Learn more about the different annuity terms and choose the option that best suits your financial goals.

Key Factors Affecting Annuity Present Value

- Interest rate:The interest rate used for discounting future payments is a key factor in determining present value. Higher interest rates result in a lower present value, as the time value of money increases. Conversely, lower interest rates lead to a higher present value.

- Payment amount:The amount of each payment in the annuity directly impacts the present value. Larger payments will result in a higher present value, while smaller payments will lead to a lower present value.

- Time period:The duration of the annuity, or the number of payments, also affects the present value. Longer annuity periods generally lead to lower present values, as the discounting effect of time value of money is more pronounced over longer periods.

Impact of Interest Rates on Annuity Present Value

The relationship between interest rates and annuity present value is inverse. As interest rates rise, the present value of an annuity decreases, and vice versa. This is because higher interest rates imply that money invested today can earn a higher return in the future.

An annuity is a financial product that provides a regular stream of income. Learn more about the meaning of annuity in Tamil and how it can help you secure your financial future.

As a result, the present value of future payments is discounted more heavily, leading to a lower present value.

Fixed annuities offer guaranteed interest rates and payments, providing a sense of security for your retirement income. Learn more about fixed annuities and how they can help you achieve your financial goals.

Relationship Between Time Period and Annuity Present Value

The present value of an annuity is generally lower for longer time periods. This is due to the compounding effect of the time value of money. The longer the time period, the more the future payments are discounted, leading to a lower present value.

Methods for Calculating Annuity Present Value

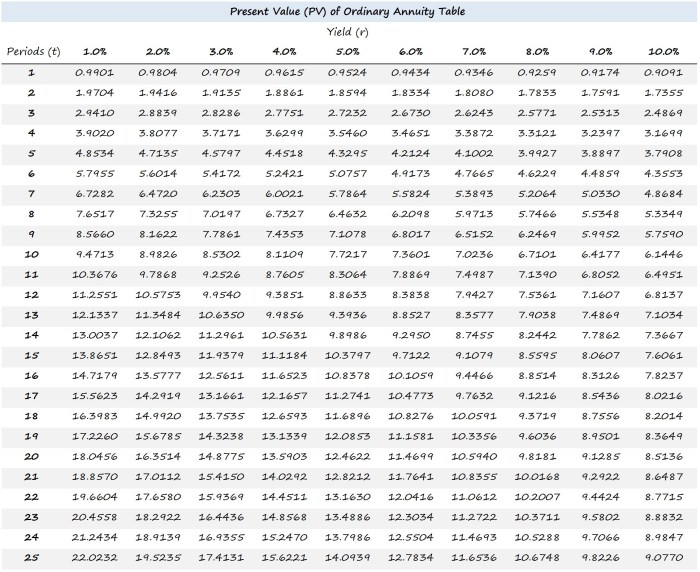

Calculating annuity present value involves discounting future payments to their present worth. There are various methods for calculating annuity present value, including manual calculations, financial calculators, and spreadsheet software.

Formula for Calculating Annuity Present Value

PV = PMT- [1 – (1 + r)^-n] / r

Excel can be a helpful tool for calculating and managing annuity payments. Learn more about using Excel for annuity calculations and make the most of your financial planning.

Where:

- PV = Present value of the annuity

- PMT = Payment amount per period

- r = Interest rate per period

- n = Number of periods

Step-by-Step Guide to Manual Calculation

- Determine the payment amount (PMT):Identify the amount of each payment in the annuity.

- Determine the interest rate (r):Find the interest rate per period, usually expressed as a decimal.

- Determine the number of periods (n):Identify the total number of payments in the annuity.

- Calculate the present value factor:Use the formula [1

(1 + r)^-n] / r to calculate the present value factor.

- Multiply the payment amount by the present value factor:Multiply the payment amount (PMT) by the present value factor to arrive at the present value (PV) of the annuity.

Using Financial Calculators and Spreadsheet Software

Financial calculators and spreadsheet software provide convenient tools for calculating annuity present value. These tools automate the calculations, eliminating the need for manual calculations. Simply input the necessary variables (payment amount, interest rate, and number of periods) into the calculator or spreadsheet function, and the software will calculate the present value.

An annuity is a life insurance product that provides a guaranteed stream of income for a set period or for life. Learn more about how annuities work and how they can help you achieve your financial goals.

Annuity Present Value in Different Scenarios: Calculating Annuity Present Values 2024

Annuity present value calculations can be applied to various financial scenarios, including ordinary annuities, annuities due, loan amortization, and investment planning.

The taxability of annuity income in India can vary depending on factors like the type of annuity and the source of the income. Learn more about the taxability of annuity income in India and plan your finances accordingly.

Ordinary Annuities vs. Annuities Due

An ordinary annuityinvolves payments made at the end of each period, while an annuity dueinvolves payments made at the beginning of each period. The calculation of present value differs slightly between these two types of annuities.

An annuity of 80,000 can provide a monthly income stream, but the exact amount will depend on the type of annuity and the interest rate. Learn more about how to calculate annuity payments and make informed decisions about your retirement income.

- Ordinary annuity:The formula used for calculating the present value of an ordinary annuity is the same as the general formula mentioned earlier.

- Annuity due:The present value of an annuity due is calculated by multiplying the present value of an ordinary annuity by (1 + r), where r is the interest rate per period.

Loan Amortization and Investment Planning

Annuity present value calculations are essential in loan amortization. Lenders use these calculations to determine the present value of future loan payments, which helps them set the loan principal and interest rate. In investment planning, annuity present value calculations are used to evaluate the present value of future cash flows from investments, helping investors make informed decisions about their investment portfolios.

Annuity joint and survivor options are designed to provide income for both spouses, even after one passes away. Learn more about annuity joint and survivor options and ensure financial security for your loved ones.

Retirement Planning and Real Estate Investments

Annuity present value calculations are frequently used in retirement planning to determine the present value of future retirement income. This information helps individuals understand how much they need to save to achieve their desired retirement lifestyle. In real estate investments, annuity present value calculations can be used to evaluate the present value of future rental income, helping investors determine the profitability of real estate investments.

Practical Applications of Annuity Present Value

Annuity present value calculations have numerous practical applications in various financial situations. Here are some examples of how these calculations can be used in real-world scenarios.

Evaluating a Loan Offer

Imagine you are considering a loan offer for a new car. The lender offers you a loan of $20,000 with a 5% interest rate and a 5-year term. Using annuity present value calculations, you can determine the present value of the future loan payments.

This will help you compare this loan offer with other options and make an informed decision about whether the loan is affordable and financially advantageous.

An annuity of 600,000 can provide a significant stream of income, but the amount of monthly payments will depend on factors like the annuity type and interest rates. Learn more about annuities and how they can work for you.

Comparing Annuity Options, Calculating Annuity Present Values 2024

| Annuity Option | Interest Rate | Time Period (Years) | Payment Amount | Present Value |

|---|---|---|---|---|

| Option A | 3% | 10 | $1,000 | $8,530 |

| Option B | 4% | 10 | $1,000 | $7,722 |

| Option C | 5% | 10 | $1,000 | $6,940 |

This table illustrates how changes in interest rates and time periods affect the present value of an annuity. Option A, with the lowest interest rate, has the highest present value. As the interest rate increases, the present value decreases, as seen in Options B and C.

Annuities and pensions are both retirement income options, but they have distinct characteristics. Learn more about the differences between annuities and pensions and make an informed decision about your retirement income strategy.

This highlights the importance of considering interest rates and time periods when evaluating different annuity options.

Determining Mortgage Affordability

- Determine your desired mortgage amount:Identify the maximum amount you are comfortable borrowing for a mortgage.

- Research current mortgage interest rates:Gather information on current mortgage interest rates from various lenders.

- Determine the mortgage term:Choose the desired mortgage term, typically 15 or 30 years.

- Calculate the monthly mortgage payment:Use a mortgage calculator or annuity present value formula to calculate the monthly mortgage payment based on the desired mortgage amount, interest rate, and term.

- Compare the monthly payment to your budget:Assess whether the calculated monthly mortgage payment fits comfortably within your budget, considering other expenses and income.

By following these steps, you can use annuity present value calculations to determine the affordability of a mortgage and make an informed decision about whether you can comfortably afford the monthly payments.

Final Summary

Mastering the concept of annuity present value empowers individuals and businesses to make informed financial decisions. By understanding the present value of future cash flows, we gain valuable insights into the true worth of financial instruments and can make sound decisions that align with our financial goals.

Annuity income can be guaranteed for a set period or for life, depending on the type of annuity you choose. Learn more about whether annuity income is guaranteed and choose the option that best suits your needs.

This guide has provided a comprehensive overview of annuity present value calculations, equipping readers with the knowledge and tools necessary to navigate the complex world of finance with confidence.

Questions Often Asked

What are the limitations of annuity present value calculations?

Annuity present value calculations rely on assumptions about future interest rates and cash flows. Changes in these factors can significantly impact the calculated present value. Additionally, these calculations do not account for inflation or other economic uncertainties.

How do I choose the appropriate discount rate for annuity present value calculations?

The discount rate should reflect the risk associated with the annuity. Factors to consider include the time value of money, inflation, and the opportunity cost of investing the funds elsewhere. Consult with a financial advisor for guidance on selecting an appropriate discount rate.