Calculating Annuity Present Value 2024 is a fundamental concept in financial planning that helps individuals and businesses make informed decisions about investments, loans, and retirement planning. It involves determining the current value of a series of future payments, taking into account the time value of money.

An annuity with a 5-year payout provides a fixed stream of income for a set period. This article, Annuity 5 Year Payout 2024 , explains the benefits and drawbacks of this type of annuity.

This process involves discounting future cash flows to their present value, considering factors such as interest rates, the number of periods, and the payment amount. Understanding how to calculate annuity present value empowers individuals to make sound financial choices that align with their long-term goals.

Understanding Annuity Present Value: Calculating Annuity Present Value 2024

Annuity present value (PV) is a fundamental concept in finance that helps us understand the current worth of a stream of future payments. It’s a crucial tool for financial planning, investment analysis, and making informed decisions about long-term financial commitments.

A deferred annuity allows you to postpone receiving payments. This article, Annuity Is Deferred 2024 , can help you understand the basics of deferred annuities.

The core idea behind annuity present value is the time value of money. This principle acknowledges that money available today is worth more than the same amount of money received in the future. This is because money can be invested and grow over time, generating interest or returns.

Discounting future cash flows to their present value accounts for this time value.

Annuity can be used as a retirement income solution. This article, Annuity Is Pension Plan 2024 , explores the role of annuities in retirement planning.

Examples of Annuity Present Value Application

- Retirement Planning:Determining the present value of your future retirement income stream helps you understand how much you need to save today to achieve your desired retirement lifestyle.

- Loan Calculations:Calculating the present value of loan payments allows you to compare different loan options and choose the most cost-effective one.

- Investment Analysis:When evaluating investment opportunities, comparing the present value of future cash flows helps determine the most profitable investment.

Formula and Variables

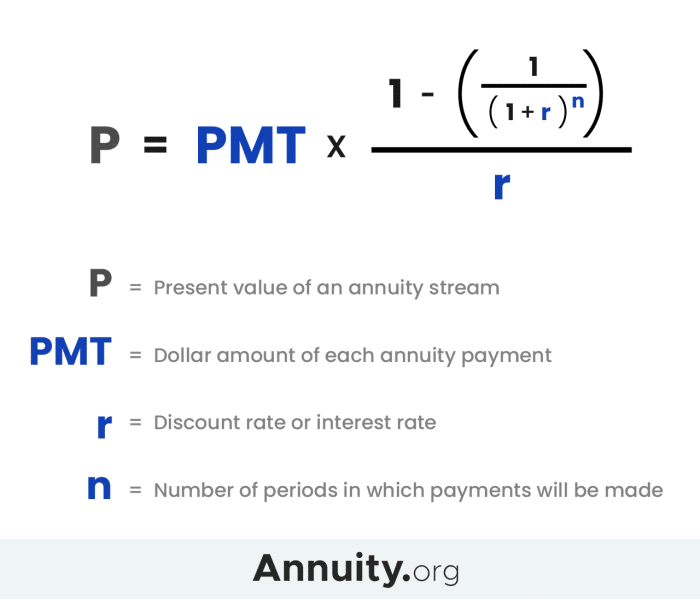

The formula for calculating annuity present value is as follows:

PV = PMT

- [1

- (1 + r)^-n] / r

Where:

- PV(Present Value): The current value of the future cash flows.

- PMT(Payment Amount): The amount of each periodic payment.

- r(Interest Rate): The discount rate used to reflect the time value of money. This rate represents the expected return on investment or the cost of borrowing.

- n(Number of Periods): The total number of payments in the annuity.

The relationship between these variables is crucial. A higher interest rate (r) results in a lower present value (PV), as future cash flows are discounted more heavily. Similarly, a longer period (n) also leads to a lower present value, as the discounting effect over time is more significant.

Annuity Health Westmont Il is a specific provider of annuities in Illinois. This article, Annuity Health Westmont Il 2024 , provides information about their services.

Increasing the payment amount (PMT) naturally increases the present value.

Methods of Calculation

Annuity present value can be calculated using various methods:

Traditional Method: Financial Calculator

Financial calculators are specifically designed for financial calculations, including annuity present value. These calculators have dedicated keys for inputting the variables (PMT, r, n) and a function to calculate the present value (PV).

When winning the lottery, you have the option of taking a lump sum or an annuity. This article, Annuity Or Lump Sum Lottery 2024 , helps you weigh the pros and cons of each choice.

Spreadsheet Programs: Excel

Spreadsheet programs like Microsoft Excel offer built-in functions for calculating annuity present value. The “PV” function in Excel allows you to input the variables and obtain the present value with ease.

If you’re looking for annuity rates in the UK, this article, Annuity Rates Uk 2024 , can provide you with current rates and information.

Online Calculators

Numerous online calculators are available that simplify the process of calculating annuity present value. These calculators are generally user-friendly and require minimal input. However, they may have limitations in terms of customization or advanced features.

Annuity 4 is a type of annuity that offers specific benefits. Read this article, Annuity 4 2024 , to learn more about this type of annuity.

Factors Influencing Annuity Present Value

Several factors significantly impact the present value of an annuity:

Interest Rates

Higher interest rates lead to a lower present value. This is because future cash flows are discounted more heavily at higher rates, making them worth less today.

Understanding the basis of your annuity is crucial for tax purposes. Check out this article, Annuity Basis Is 2024 , to learn how to determine your annuity basis.

Number of Periods, Calculating Annuity Present Value 2024

As the number of periods increases, the present value decreases. This is due to the cumulative effect of discounting over time. The longer the annuity lasts, the less each future payment is worth today.

If you’re living in the UK, you may be wondering about the tax treatment of annuities. This article, Is Annuity Income Taxable In Uk 2024 , can help you understand the tax implications of annuities in the UK.

Payment Amount

A higher payment amount results in a higher present value. This is intuitive, as a larger payment stream naturally has a greater present value.

Want to learn more about annuities in general? This article, Annuity General 2024 , provides a comprehensive overview of annuities.

Applications of Annuity Present Value

Annuity present value is widely applied in various financial scenarios:

Retirement Planning

Retirement planning involves determining the present value of future retirement income streams to understand how much you need to save today. This allows you to create a comprehensive retirement plan and ensure financial security during your retirement years.

When it comes to single-life annuities, you may be curious about the tax implications. Read this article, Is A Single Life Annuity Taxable 2024 , to learn more about how these annuities are taxed.

Loan Calculations

When taking out a loan, calculating the present value of loan payments helps compare different loan options. This allows you to choose the loan with the lowest present value, minimizing the overall cost of borrowing.

Investment Analysis

Annuity present value is crucial in investment analysis. By comparing the present value of different investment opportunities, investors can make informed decisions about where to allocate their capital. This allows them to maximize their returns and achieve their financial goals.

Looking for annuity quotes in Canada? Check out this article, Annuity Quotes Canada 2024 , for information on Canadian annuity providers and rates.

Comparing Annuity Options

When presented with multiple annuity options, comparing their present values is essential. This allows you to choose the annuity that provides the highest present value, maximizing the value of your investment.

Practical Considerations

When working with annuity present value, several practical considerations are important:

Time Value of Money

The time value of money is a fundamental concept that underlies annuity present value calculations. It’s crucial to understand that money today is worth more than money in the future due to its potential to grow through investment.

A single-sum annuity involves a lump sum payment that is then converted into a stream of income. This article, Annuity Is A Single Sum 2024 , provides information on this type of annuity.

Inflation

Inflation erodes the purchasing power of money over time. When calculating annuity present value, it’s important to consider inflation to ensure the present value accurately reflects the future value of the payments.

Estimating Future Cash Flows and Interest Rates

Accurate estimation of future cash flows and interest rates is essential for calculating annuity present value. This requires careful analysis and consideration of various factors, including historical trends, market conditions, and personal financial goals.

Wondering how much annuity you can get for $100,000 in 2024? Check out this article, How Much Annuity For 100 000 2024 , to learn more about annuity options and rates.

Last Point

By mastering the concept of annuity present value, individuals can navigate the complexities of financial planning with greater confidence. Whether evaluating investment opportunities, planning for retirement, or managing debt, understanding the present value of future cash flows is essential for making informed and strategic decisions.

FAQs

What are the benefits of understanding annuity present value?

Understanding annuity present value allows you to compare different financial options, make informed investment decisions, and plan for your future financial security.

How does inflation affect annuity present value calculations?

Inflation erodes the purchasing power of future payments, reducing their present value. It’s crucial to consider inflation when calculating annuity present value to obtain a realistic estimate.

Are there any online tools for calculating annuity present value?

If you’re receiving annuity payments, you might be wondering about the tax implications. This article, Annuity 1099 2024 , can help you understand how annuities are reported on your taxes.

Yes, numerous online calculators are available to help you calculate annuity present value. However, it’s important to choose reliable sources and understand the limitations of such tools.